CA Vidhan Surana & CA Sunil Maloo have conducted a succinct analysis of the provisions of the Finance Bill 2018 and explained the important amendments that it seeks to incorporate in the Direct Tax law. The authors have also given practical examples to explain the impact of the amendments

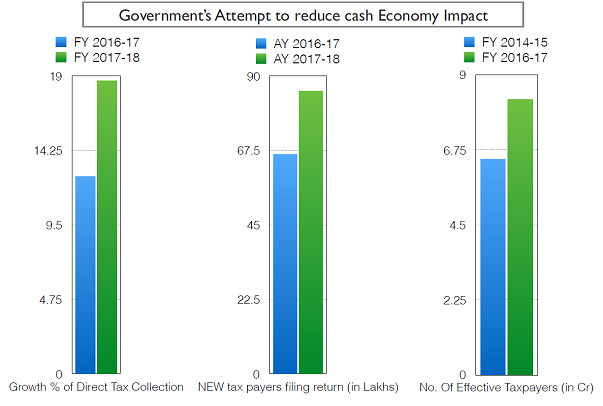

1. Governments Attempt to Reduce Cash Economy – Impact

2. Budget Proposals – Tax Rates

– No Change in Non-Corporate Tax Rates

– Corporate Tax Rates

– In case of domestic company, the rate of income-tax shall be 25% of the total income if the total turnover or gross receipts of the previous year 2016-17 does not exceed ` 250 cores and

in all other cases the rate of Income-tax shall be 30%

– Existing Education Cess and Secondary and Higher Secondary Education Cess at the rate of 2% and 1% respectively shall be replaced by Health and Education Cess at the rate 4% in case of all assesses – No Marginal Relief will be allowed for this new cess.

3. Budget Proposals – For Salaried

– Introduction of Flat Standard Deduction of Rs 40,000

– Earlier Exemption in respect of Transport Allowance (i.e. Rs 1600 per month * 12 months) and reimbursement of medical expenses (upto Rs 15,000/- p.a.) withdrawn

– Transport Allowance in case of differently abled persons remains unchanged

– Net Deduction to Salaried Employees – Rs 5,800/-

Budget Proposals – For Senior Citizens

To care of those who cared for us is one of the highest honours

– Section 80D for Senior Citizen – monetary limit of deduction from ` 30,000/- to ` 50,000/-

– Section 80DDB – Ceiling Limit of Deduction for medical treatment of specified diseases raised to ` 1,00,000/- for both senior citizens and very senior citizens.

– Section 80TTB – (New Section Inserted) – a deduction upto ` 50,000/- in respect of interest income from deposits held by senior citizens

– Section 194A – raise the threshold for deduction of tax at source on interest income for senior citizens from ` 10,000/- to ` 50,000/-.

Budget Proposals – For Business and Profession

Income Computation and Disclosure Standards

1. A writ was filed challenging the constitutional validity of the ICDS notified and the court had struct down certain provisions of the ICDS treating the same to ultra-vires to the Act. Thus, amendments are proposed to clarify the doubts raised on the legitimacy of the notified ICDS as per the recent judicial pronouncement.

2. ICDS provisions provided in the notification are now proposed to be made part of the Statue by the following amendments in the act:

(a) Insertion of new section 36(1)(xviii) – to provide the allowability of marked to market loss or other expected loss as per ICDS;

(b) Insertion of new section 40A(13) – to provide the disallowance of marked to market loss or other expected loss covered in except 36(1)(xviii)

(c) Insertion of a new section 43AA – to provide any gain or loss arising on account of effects of changes in foreign exchange rates in respect of specified foreign currency transactions shall be treated as income or loss, as per the ICDS.

(d) Insertion of a new section 43CB – to provide that profits arising from a construction contract or a contract for providing services shall be determined on the basis of percentage of completion method except for certain service contracts, and that the contract revenue shall include retention money, and contract cost shall not be reduced by incidental interest, dividend and capital gains.

(e) Further proposed to amend section 145A of the Act to provide that, for “Profits and gains of business or profession”:-

| the valuation of inventory | lower of actual cost or net realizable value computed as per ICDS |

| the valuation of purchase and sale of goods or services and of inventory | shall be adjusted to include the amount of any tax, duty, cess or fee actually paid or incurred by the assessee to bring the goods or services to the place of its location and condition as on the date of valuation |

| inventory being securities not listed, or listed but not quoted | shall be valued at actual cost as per ICDS |

| inventory being listed securities, | shall be valued at lower of actual cost or net realisable value – on category wise basis |

(f) Insertion of a new section 145B, to propose –

| interest received by an assessee on compensation or on enhanced compensation, shall be taxable on receipt basis |

| the claim for escalation of price in a contract or export incentives shall be deemed to be the income of the previous year in which reasonable certainty of its realisation is achieved. |

| The subsidy or grant or cash assistant deemed to be the income of the previous year in which it is received, if not charged to income tax for any earlier previous year. |

Section 44AE

– Amended for large capacity / size Goods Carriage Vehicles

– in the case of heavy goods vehicle (more than 12MT gross vehicle weight deemed income @ Rs 1,000 per ton of gross vehicle weight or unladen weight, as the case may be, per month or part of a month for each goods vehicle or

– the amount claimed to be actually earned by the assessee

– whichever is higher.

– Conversion of Stock in Trade in Capital Assets

– Earlier section 45(2) covers conversion of Capital Assets into Stock in Trade

– Now the reverse scenario also brought under tax net i.e. conversion of Stock in Trade into Capital Assets

– section 28 amended so as to provide that any profit or gains arising from conversion of inventory into capital asset or its treatment as capital asset shall be charged to tax as business income.

– the fair market value of the inventory on the date of conversion shall be deemed to be the full value of the consideration received

– Consequently corresponding amendments proposed in Section 2(24), 2(42A) & 49

Budget Proposals – Capital Gains

– New regime for taxation of long-term capital gains on sale of equity shares etc.

The return on investment in equity is already quite attractive even without tax exemption. There is therefore a strong case for bringing long term capital gains from listed equities in the tax net

– Section 112A proposed to be inserted and a new proviso to Section 10(38) inserted

– The existing exempt LTCG regime is inherently biased against manufacturing and has encouraged diversion of investment in financial assets. It has also led to significant erosion in the tax base resulting in revenue loss.

– proposed to withdraw the exemption under section 10(38) and to introduce a new section 112A in the Act to provide that long term capital gains arising from transfer of a long term capital asset being an equity share in a company or a unit of an equity oriented fund or a unit of a business trust shall be taxed at 10 per cent. of such capital gains exceeding one lakh rupees

– concession rate of 10% will be subject to following conditions;

– in case of equity shares, STT has been paid on both acquisition and transfer of such capital asset

– in case of unit of equity oriented Mutual Fund, STT has been paid on transfer of such capital asset

– “fair market value” and “equity oriented fund” defined

– long term capital gains will be computed without giving effect of indexation

– cost of acquisitions in respect of the long term capital asset acquired by the assessee before the 01/02/2018 shall be the higher of – actual cost of acquisition or fair market value (i.e. Highest quoted market price on the 31/01/2018)

– No benefit of deduction under chapter-VIA against such capital gain

– Rebate u/s 87A will remain be allowed

Example;

| Sr. No. | Particulars | Scenario – 1 | Scenario – 2 | Scenario – 3 | Scenario – 4 |

| Shares sold after 31/03/2018 | Shares sold upto 31/03/2018 | ||||

| 1 | Date of Purchase of Equity Shares | 01-07-2017 | 01-01-2017 | 01-01-2017 | 01-01-2017 |

| 2 | Date of Sales of Equity Shares | 01-08-2018 | 30-03-2025 | 30-03-2019 | 30-03-2018 |

| 3 | Nature of Capital Gain at the time of sales | LTCG | LTCG | LTCG | LTCG |

| 4 | Cost of Acquisition; | ||||

| a. Actual Cost of Acquisition | 100.00 | 100.00 | 100.00 | 100.00 | |

| b. FMV as on 31-01-2018 | 120.00 | 15.00 | 250.00 | ||

| c. Amount of Sale Consideration | 150.00 | 250.00 | 110.00 | ||

| d. Lower of (b) & (c) | 120.00 | 15.00 | 110.00 | ||

| Cost of Acquisition – Higher of (a) & (d) | 120.00 | 100.00 | 110.00 | 100.00 | |

| 5 | Amount of Sales | 150.00 | 250.00 | 110.00 | 150.00 |

| 6 | Capital Gain Taxable u/s 112A | 30.00 | 150.00 | – | – |

| 7 | Exemption u/s 10(38) | – | – | – | 50.00 |

Taxation of long-term capital gains in the case of Foreign Institutional Investor

– Section 115AD

– Consequent to the proposal for withdrawal of exemption under clause (38) of section 10 of the Act, such long-term capital gain will become taxable in the hands of FIIs also.

– Such Capital Gain in excess of ` 1,00,000/- taxable u/s 115AD

Rationalization of the provisions of Section 54EC

– The scope of this section now proposed to restricted only to “long-term specified asset” being land or building appurtenant thereto;

– The period of holding (lock in) enhanced from present level of 3 years to proposed 5 years.

Budget Proposals – Income from Other Sources

– Application of Dividend Distribution Tax to Deemed Dividend u/s 2(22)(e)

– Proposed to delete the Explanation to Chapter XII-D occurring after section 115Q of the Act

– Now DDT chargeable u/s 115-O also include dividend u/s 2(22)(e) in the hands of company @ 30% (without gross up)

– Proposed DDT structure –

– Dividend covered u/s 2(22)(a) to 2(22)(d) – DDT @ 15% (with gross up)

– Dividend covered u/s 2(22)(e) – DDT @ 30% (without gross up)

Widening of scope of Accumulated profits for the purposes of Dividend

– To curb abusive arrangements in order to escape liability of paying tax on distributed profits whereby companies with large accumulated profits adopt the amalgamation route to reduce capital and circumvent the provisions of sub-clause (d) of clause (22) of section 2 of the Act.

– Proposed to insert a new Explanation 2A in section 2(22) of the Act to widen the scope of the term ‘accumulated profits’ so as to provide that in the case of an amalgamated company, accumulated profits, whether capitalised or not, or losses as the case may be, shall be increased by the accumulated profits of the amalgamating company, whether capitalized or not, on the date of amalgamation.

Dividend distribution tax on dividend payouts to unit holders in an equity-oriented fund

– Under existing provision Section 115R – any income distributed to a unit holder of equity-oriented funds is not chargeable to tax under the said section

– to providing a level playing field between growth-oriented funds and dividend paying funds, it is proposed to amend the said section to provide that where any income is distributed by a Mutual Fund being, an equity oriented fund, the mutual fund shall be liable to pay additional incometax at the rate of ten per cent on income so distributed

Taxability of compensation in connection to business or employment

– proposed to amend section 28 & Section 56 of the Act

– to provide that any compensation received or receivable, whether revenue or capital, in connection with the termination or the modification of the terms and conditions of any contract relating to its business shall be taxable as business income & relating to employment shall be income from other source.

Rationalisation of provision of section 115BA relating to certain domestic companies

– Special rate incomes under the Act, now proposed to tax @ such special rates only instead of flat 25%

– Amendment proposed with retrospective effect from 01/04/2017

Rationalization of section 43CA, section 50C and section 56.

– It is proposed that No adjustment needs to be made to full value of consideration in based on stamp duty valuation if the variation is within the range of 5% of sales consideration.

– Corresponding amendment in section 43CA, 50C and 56 are made.

Rationalisation of the provisions of section 115BBE

– income referred to in section 68 or section 69 or section 69A or section 69B or section 69C or section 69D at a higher rate of sixty percent

– under the existing provisions, there was a loop hole with respect allowability of expenditure or allowance or set off of any loss against such income which is not disclosed in the Return and added by the AO

– now it is proposed no such deductions shall be allowed against such incomes whether disclosed in return or added by AO in the assessment proceedings.

Budget Proposals – Procedural

Entities to apply for Permanent Account Number in certain cases

– It is proposed to use a PAN as Unique Entity Number (UEN) for non-individual entities which enters into a financial transaction of an amount aggregating 2.50 or more in FY

– In order to link the financial transactions with the natural persons, it is also proposed that the managing director, director, partner, trustee, author, founder, karta, chief executive officer, principal officer or office of such entities shall also apply for PAN

Tax deduction at source and manner of payment in respect of certain exempt entities

– there are no restrictions on payments made in cash by charitable or religious trusts or institutions

– no checks on whether such trusts or institutions follow the provisions of TDS

– it is proposed to insert new explanation to the section 11 for the purposes of determining the application of income under the provisions of sub-section (1) of the said section, the provisions of 40(ia), 40(a), 40(3) & 40(3A) shall, mutatis mutandis, apply

Rationalisation of prima-facie adjustments during processing of return of income

– Sub-clause (vi) of the said clause provides for adjustment in respect of addition of income appearing in Form 26AS or Form 16A or Form 16 which has not been included in computing the total income

– it is proposed to insert a new proviso to the said clause to provide that no adjustment under sub-clause (vi) of the said clause shall be made in respect of any return furnished on or after 01/04/2018

New scheme for scrutiny assessment

– to impart greater transparency and accountability, by eliminating the interface between the AO and the assessee, optimal utilization of the resources, and introduction of team-based assessment

– it is proposed to insert new section 143(3A), 143(3B) and 143(3C) enabling the Central Government to prescribe the aforementioned new scheme for scrutiny assessments, by way of notification

Rationalisation of section 276CC relating to prosecution for failure to furnish return

– The tax limit provided under proviso to said section relax the all person (including companies)

– In order to prevent abuse of the said proviso by shell companies it is proposed to amend the provisions of the said sub-clause so as to provide that the said sub-clause shall not apply in respect of a company

Deductions in respect of certain incomes not to be allowed unless return is filed by the due date

– existing provisions contained in the section 80AC of the Act provide that no deduction would be admissible under section 80IA, 80IAB, 80IB, 80IC, 80ID and 80IE unless the return of income by the assessee is furnished on or before the due date specified under sub-section 139(1)

– it is proposed to extend the scope of section 80AC to provide that the benefit of deduction under the entire class of deductions under the heading C in chapter VIA

– other deduction in Chapter VI-A continue to be allowed.

Aligning the scope of “business connection” with modified PE Rule as per Multilateral Instrument (MLI)

Exiting factual position – in example form – In terms of the DAPE rules in tax treaties, if any person acting on behalf of the non-resident, is habitually authorised to conclude contracts for the non-resident, then such agent would constitute a PE in the source country. However, in many cases, with a view to avoid establishing a permanent establishment (hereafter referred to as ‘PE’) under Article 5(5) of the DTAA, the person acting on the behalf of the non-resident, negotiates the contract but does not conclude the contract.

Review by OECD – The OECD under BEPS Action Plan 7 reviewed the definition of ‘PE’ with a view to preventing avoidance of payment of tax by circumventing the existing PE definition

Update in Multilateral Instrument – Further, with a view to preventing base erosion and profit shifting, the recommendations under BEPS Action Plan 7 have now been included in Article 12 of Multilateral Convention to Implement Tax Treaty Related Measures (herein referred to as ‘MLI’), to which India is also a signatory. Consequently, these provisions will automatically modify India’s bilateral tax treaties covered by MLI, where treaty partner has also opted for Article 12.

Act vs DTAA – beneficial provisions were being applied – However, sub-section (2) of section 90 of the Act provides that the provisions of the domestic law would prevail over corresponding provisions in the DTAAs, to the extent they are beneficial. Since, in the instant situations, the provisions of the domestic law being narrower in scope are more beneficial than the provisions in the DTAAs, as modified by MLI, such wider provisions in the DTAAs are ineffective.

Therefore, now its proposed to amend the provision of section 9 of the Act so as to align them with the provisions in the DTAA as modified by MLI so as to make the provisions in the treaty effective.

Accordingly, clause (i) of sub-section (1) of section 9 is being proposed to be amended to provide that “business connection” shall also include any business activities carried through a person who, acting on behalf of the non-resident, habitually concludes contracts or habitually plays the principal role leading to conclusion of contracts by the non-resident.

“Business connection” to include “Significant Economic presence” – Physical vs digital presence

“The oranges upon the trees in California are not acquired wealth until they are picked, not even at that stage until they are packed, and not even at that stage until they are transported to the place where demand exists and until they are put where the consumer can use them. These stages, upto the point where wealth reached fruition, may be shared in by different territorial authorities.” (excerpts from a report on double taxation submitted to League of Nations in early 1920s)

In the above illustration, both the residence and source countries claim the right to taxation.

If an enterprise carries on its business in another country through a ‘Permanent Establishment’ situated therin, such other country may also tax the business profits attributable to the ‘Permant Establishment’.

Under these new business models, the non-resident enterprises interact with customers in another country without having any physical presence in that country resulting in avoidance of taxation in the source country. Therefore, the existing nexus rule based on physical presence do not hold good anymore for taxation of business profits in source country. As a result, the rights of the source country to tax business profits that are derived from its economy is unfairly and unreasonably eroded.

For a long time, nexus based on physical presence was used as a proxy to regular economic allegiance of a non-resident. However, with the advancement in information and communication technology in the last few decades, new business models operating remotely through digital medium have emerged. Under these new business models, the non-resident enterprises interact with customers in another country without having any physical presence in that country resulting in avoidance of taxation in the source country. Therefore, the existing nexus rule based on physical presence do not hold good anymore for taxation of business profits in source country. As a result, the rights of the source country to tax business profits that are derived from its economy is unfairly and unreasonably eroded.

The scope of existing provisions of clause (i) of sub-section (1) of section 9 is restrictive as it essentially provides for physical presence-based nexus rule for taxation of business income of the non-resident in India. Explanation 2 to the said section which defines ‘business connection’ is also narrow in its scope since it limits the taxability of certain activities or transactions of non-resident to those carried out through a dependent agent. Therefore, emerging business models such as digitized businesses, which do not require physical presence of itself or any agent in India, is not covered within the scope of clause (i) of sub-section (1) of section 9 of the Act.

In view of the above, it is proposed to amend clause (i) of sub-section (1) of section 9 of the Act to provide that ‘significant economic presence’ in India shall also constitute ‘business connection’. Further, “significant economic presence” for this purpose, shall mean-

(i) any transaction in respect of any goods, services or property carried out by a non-resident in India including provision of download of data or software in India if the aggregate of payments arising from such transaction or transactions during the previous year exceeds the amount as may be prescribed; or

(ii) systematic and continuous soliciting of its business activities or engaging in interaction with such number of users as may be prescribed, in India through digital means.

It is further proposed to provide that only so much of income as is attributable to such transactions or activities shall be deemed to accrue or arise in India. It is further proposed to provide that the transactions or activities shall constitute significant economic presence in India, whether or not the non-resident has a residence or place of business in India or renders services in India.

Penalty for failure to furnish statement of financial transaction or reportable account u/s 285BA

| Existing Provision | Proposed Provision | ||

| Fail to furnish within prescribe time | Fail to furnish statement within time specified in notice | Fail to furnish within prescribe time | Fail to furnish statement within time specified in notice |

| Rs 100/ Day | Rs 500 / Day | Rs 500 / Day | Rs 1000/ Day |

Budget Proposals – Incentives

Deduction in respect of income of Farm Producer Companies

– Farm Producer Companies (FPC), having a total turnover upto ` 100 Crore shall eligible to deductions u/s 80P

Measures to promote start-ups u/s 80-IAC

– Section 80-IAC of the Act, provides that deduction under this section shall be available to an eligible start-up for 3 consecutive AY out of 7 years at the option of the assessee

– In order to improve the effectiveness of the scheme for promoting start ups in India, it is proposed to make following changes

| Particular | Existing Provision | Proposed Provision |

| Eligibility w.r.t. incorporation | on or after 01/04/2016 but before 01/04/2019 | on or after 01/04/2016 but before 01/04/2021 |

| Turnover Requirement | Does not exceed Rs 25 Crores in any PY beginning on or after 01/04/2016 and ending on 31/03/2021 | Does not exceed Rs 25 Crores in any seven PYs commencing from the date of incorporation |

| Eligibility business definition enhanced | Engaged in Innovation, development, deployment or commercialization of new products, processes or services driven by technology or intellectual property | Engaged in innovation, development or improvement of products or processes or services, or a scalable business model with a high potential of employment generation or wealth creation |

Measures to promote International Financial Services Centre (IFSC)

– Transactions of transfer by NR on recognised stock exchange located in IFSC shall not be regarded as transfer if consideration payable in foreign currency

– bond or Global Depository Receipt, as referred to in sub-section (1) of section 115AC; or

rupee denominated bond of an Indian company; or

derivative.

– Section 115JC of the Act provides for alternate minimum tax at the rate of 18.50 % of adjusted total income in the case of a non-corporate person

– It is proposed to reduce the rate to 9% of AMT of unit located in an IFSC

Incentive for employment generation u/s 80JJAA

– minimum period of employment is relaxed to 150 days in the case of apparel industry is proposed to extend this relaxation to footwear and leather industry

– new employee who is employed for less than the minimum period during the first year but continues to remain employed for the minimum period in subsequent year shall also become eligible for deduction u/s 80JJAA in such subsequent assessment year

Tax treatment of transactions in respect of trading in agricultural commodity derivatives

– Section 43(5)

– Under the existing provisions – it was specifically provided that the commodity transactions which are on recognized association and subject to CTT shall not be considered to be speculative transactions.

– However, there was no clarity over the fact with respect to those commodity derivatives which are traded on recognized association but are exempt from CTT.

– Accordingly, now it is proposed that such commodity derivatives trading transactions on recognized association, which are exempt from CTT – shall not be considered as speculative business transaction.

Relief from liability of Minimum Alternate Tax (MAT) – to IBC Companies

– Section 115JB of the Act, provides for a deduction in respect of the amount of loss brought forward or unabsorbed depreciation, whichever is less as per books of account.

– Consequently, where the loss brought forward or unabsorbed depreciation is Nil, no deduction is allowed. This non-deduction is a barrier to rehabilitating companies seeking insolvency resolution.

– Accordingly, it is proposed to amend section 115JB to provide that the aggregate amount of unabsorbed depreciation and loss brought forward (excluding unabsorbed depreciation) shall be allowed to be reduced from the book profit, if a company’s application for corporate insolvency resolution process under the Insolvency and Bankruptcy Code, 2016 has been admitted by the Adjudicating Authority.

Benefit of carry forward and set off of losses – IBC Companies

– It is proposed to relax the rigors of section 79 in case of such companies, whose resolution plan has been approved under the Insolvency and Bankruptcy Code, 2016, after affording a reasonable opportunity of being heard to the jurisdictional Principal Commissioner or Commissioner

Section 140 – Verification by IP for ITR of IBC Companies

– It is also proposed to amend section 140 of the Act so as to provide that during the resolution process under the Insolvency and Bankruptcy Code, 2016, the return shall be verified by an insolvency professional appointed by the Adjudicating Authority under the Insolvency and Bankruptcy Code, 2016.

Extending the benefit of tax-free withdrawal from NPS to non-employee subscribers

– Under the existing provisions of the clause (12A) of section 10 this exemption is not available to non-employee subscribers for NPS Subscription.

– it is proposed to amend clause (12A) of section 10 of the Act to extend the said benefit to all subscribers.

Tax neutral transfers

– Section 47 provides for certain tax neutral transfers, which includes transfer of capital assets between the wholly owned subsidiary company and its holding company.

– However, no corresponding provision was available in statue book in section 56 under the head “Income from Other Source “

– Accordingly, In order to further facilitate the transaction of money or property between a wholly owned subsidiary company and its holding company, it is proposed to amend the section 56 so as to exclude such transfer from its scope.

| Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. Neither the author nor itatonline.org and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission of itatonline.org |

thanks for such type of write up

C A K C AGARWAL< , alld

Good summarily presentation covering all the proposed changes

Very Good Analysis ..

Noticed just one error, pls update the correct figures of 2.50 on requirement of PAN above.

This 2018-2019 union budget proposals mainly concentrating on Tax collections if any body evades or refused he may be dealt with penal actions.In particular some amendments in PMLA – 20002 and companies act U/S 447 certainly penalize the economic and commercial crime.It seems that this govt may notify special courts for trying economic and tax offences soon.

congratulations for the efforts very good consolidation

Minute observation appreciated. Keep it up.

All aspects covered with example.Best analysis in article ever!!

Practice oriented approach