In this article, the ld. author has covered various unresolved issues w.r.t 10(23C) and 12A. The Article addresses core confusions around filing of Form 10A by 10(23C) approved Institutions and demands remedial action or clarifications for all the issues. Also, an attempt has been made to notice the undue hardship to the Charitable Institutions, which required immediate attention by the Government. Otherwise, a lot of Institutions in India, may lose their income-tax exemption unnecessarily, without any default and may have to face serious trouble and other financial issues. The article is topical and discusses a matter which is of current interest to the professionals/ readers and also for all NGOs i.e., Trust, Society, Section 8 Company who held 10(23C) approval and 12A registration as on 31st May, 2020.

The Government has taken effective and decisive steps towards removing unnecessary burdensome compliances, to ensure ease of carrying out operations. The monotony and inefficiency of existing system is being continually addressed.

In continuation of these steps, the Government introduced amendments which were undoubtedly good,in reaping the benefits of technological advancements, by bringing the process of re-registration of existing Charitable Institutions, on online mode and also in standardising the existing process which was earlier manual.

Along with the introduction of new process of registration, Government through Finance Act 2020, brought amendment by way of insertion of provisos to section 11(7), according to which Charitable Institutions (hereinafter referred to as “Institutions”) can hold either 10(23C) or 12A and not both. The same has created a lot of confusion for the Institutions across the nation.

“It is one of the greatest dilemmas today which is faced by Institutions and professionals, that whether Institution should opt for10(23C) or 12A. This remarkable move is the panacea for all the past practices of inappropriately using exemptions under both sections by switching over.”

Through this article, an attempt has been made to bring the core discussionsover practical unmanageable difficulties and the key challenges arising out of this unexpected clash between 10(23C) and 12A:

Which is a better option? (Section 12A vs 10(23C)

Following are certain points of consideration which one should evaluate in their specific case to make a decision.

| S.No. |

Basis of Difference |

Section 12A |

Section 10(23C) |

|

1. |

Restriction on nature of activity |

The entity can involve in any activity as per the object clause as covered under section 2(15) of income Tax Act 1961. |

The entity cannot involve in any activity other than Medical and Education as the word ‘solely’ is included in section 10(23C) while defining activities. |

|

2. |

Deemed application of income |

Concept of deemed application exists through Form 9A. |

No concept of deemed application – No such form. |

|

3. |

Formalities for accumulation of income |

Form No. 10 in the case of 12A for accumulation of income specifying the purpose. |

No such formalities to be followed. |

|

4. |

Payment to persons specified under section 13(3) |

Restricted. |

Allowed |

|

5. |

Eligibility to file Form CSR-1 and thereby receive CSR Funds |

Eligible if Institution hold 80G. |

Not Eligible. |

|

6. |

Retrospective benefits for previous years on grant of approval/registration subsequently |

Once registration is granted, it will also have retrospective exemption and pending assessment under provision to section 12A(2). |

No Retrospective Tax benefit the tax exemption shall be prospective. |

|

7. |

Provisions related to accreted income |

Provisions of accreted income u/s 115TD are applicable when registration u/s 12A is cancelled. |

Provisions of section 115TD are not applicable if approval u/s 10(23C) is cancelled. |

|

8. |

Parallel approval |

12A shall be inoperative from the date on which the trust or institution has approved under section 10(23C) or is notified under section 10(46). |

Institution which is having 10(23C) can continue to be notified u/s 10(46). |

|

9. |

Activities only within India |

Activities of an Institution registered u/s 12A are restricted to India only. |

Section 10(23C) is silent about the place of activities. |

|

10. |

Exemption of capital gains on reinvestment in capital asset |

Yes |

No |

|

11. |

Consequence if accumulation not spent within 5 years |

Unspent Accumulation taxable in 6thyear |

Loss of Exemption |

As mentioned above, Institutions earlier to 1st June, 2020 could hold both 10(23C) approval and 12A registration, on account of differences between both, as explained above.

But,

How did they enjoy benefits under both the sections?

The Earlier Scenario

Certain institutions used to enjoy the benefits by switching between both the schemes, as per their situation, to take income-tax exemptions. These Institutions availed benefits on year-on-year wise basis. In many cases, they did not follow a consistent practice, but handpicked the best of both sections as per their choice.

It was due to many reasons, like:

| When was 10(23C) preferred |

When was 12A preferred |

|

|

|

|

|

|

|

Although, it is clearly mentioned in section 10(23C), that institution should exist solely for educational or medical purposes, to avail the benefits, but up till now following instances were possible –

|

Amendment made through Union Budget 2020

All the earlier unconventional practices,have now eventually ended with a big “STOP” sign. Earlier, there was no restriction in the Act for switch overs from section 12A to Sec 10(23C) and vice versa. The amendment has been brought in to curb such practice.

Now the Institutions has to decide once in for all whether to take tax exemption u/s 12 A or u/s 10 (23C). Only one switch over is allowed for ensuring the ease in administration, as stated by the Finance Minister in the Explanatory Memorandum to the Finance Bill 2020, but, unfortunately the option of switch made available in the amendment provisions for F.Y. 2020-21 are not an equal trade-off.

For the sake of brevity with respect to the core issue under consideration, we will discuss only relevant clauses out of 6, which shall only be referred in forthcoming discussions –

|

12A (1) (ac) |

1st proviso to section 10(23C) |

Situations |

Timeline of filing application |

Validity of registration |

Disposal of Application |

Enquiry from Dept. |

Type of Registration / Approval |

Form to be Filed |

|

(i) |

(i) |

Re-Registration/ re-approval of existing Registration |

within three |

5 Years |

3 months |

No |

Regular |

10A |

|

(iv) |

NA |

Where Registration became inoperative due to the first proviso to section 11(7) |

at least six months prior to the commencement of the A.Y. from which the said registration is sought to be madeoperative |

5 Years |

6 months |

Yes |

Regular |

10AB |

|

(vi) |

(vi) |

ProvisionalRegistration/ Approval |

at least one month prior to the commencement of the previous year relevant to the A.Y. from which the said registration is sought. |

3 Years |

1 month |

No |

Provisional |

10A |

With 12A getting inoperative w.e.f. 1st June,2020 Institutions have only one option i.e., to seek re-approval u/s 10(23C), which shall be made available without any enquiry. But if Institution wishes to make 12A operative then Department shall dispose-off the application in six months that too with extensive enquiries.

It defeats the purpose of overall scheme and spirit & intent of these significant amendment brought in the Income-tax law because Institutions should be provided with the option at least once to choose between 12A or 10(23C) for 5 years and only after that, both proviso to 11(7) should have been made applicable. Then only the purpose of this amendment would have served best and neither department nor Institutions, would have faced any critical challenge.

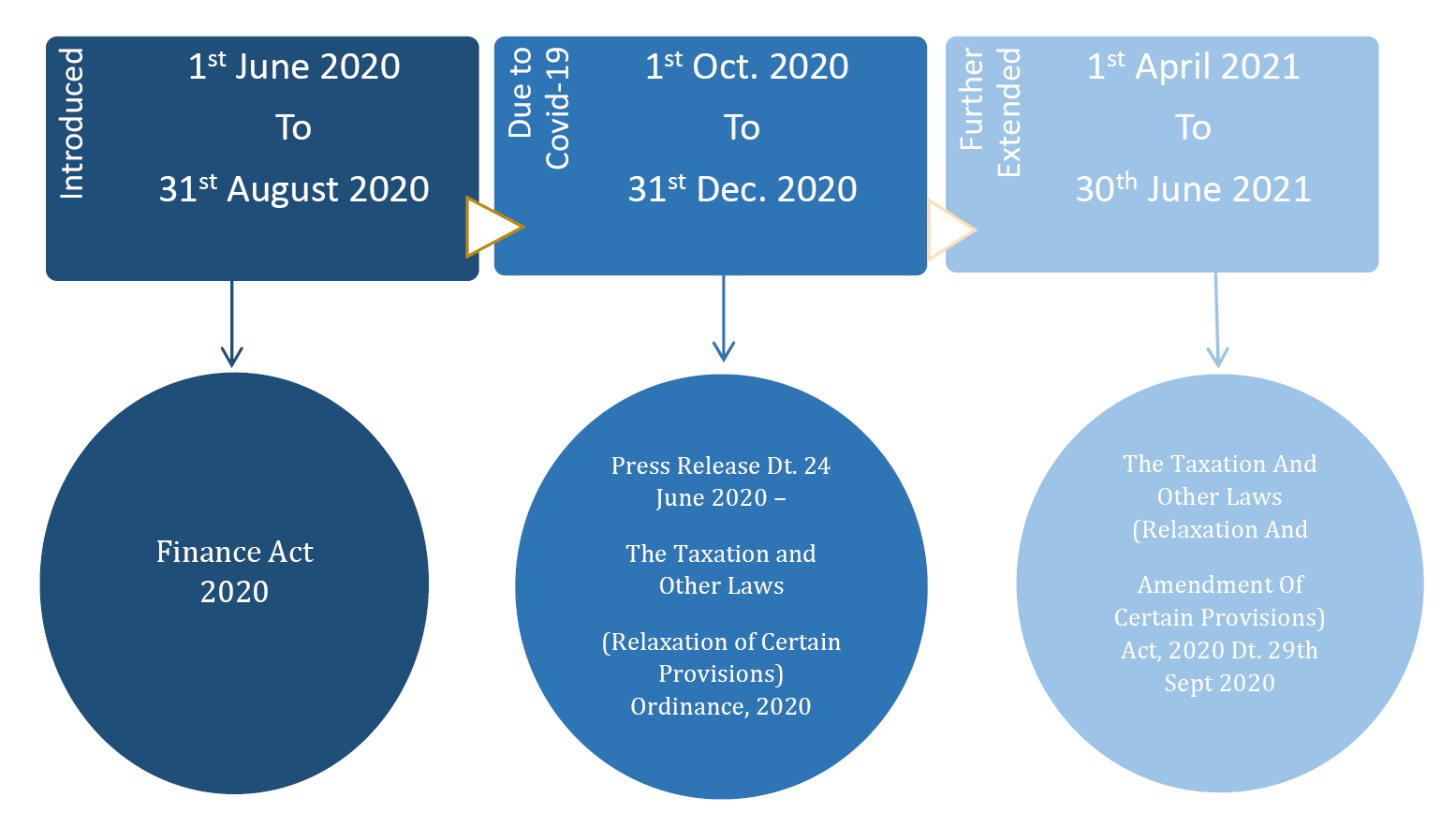

THE UNSYNCED EFFECTIVE DATE

The new process of registration which was also introduced in Finance Act 2020 has already undergone series of postponement upto 1st April, 2021. But the 1st proviso to section 11(7) has never been postponed, resultantly a void has been created due to which Institution could not even apply to make 12A operative from 1st June, 2020 to 31st March, 2021, as no such option was available in the old regime. Following are the details of postponement of amendment w.r.t new process of registration-

It is too ironical, that 12A was made inoperative w.e.f. 1st June, 2020 but there was no way to make 12A operative again until 1st April, 2021 when section 12A(1)(ac)(iv) came into effect, as no such option was available under old law.

Moreover, Income-tax portal is allowing 10(23C) approved institution to apply for re-registration of 12A, which is creating further more doubts and unnecessary confusion.

Form 10AB which is the form required to be filed to make 12A operative again is not available for filing on Income-tax portal up to this date.

Such a myopic approach of lawmakers in deciding the effective date of mentioned proviso will not have practical sustainability in the year of transition.

Author’s Opinion “A transition option should have been provided to the Institutions to opt any one of the two schemes, and only thereafter this amendment should have been made effective. This way Institutions could have got enough opportunity to adopt a suitable practice.”

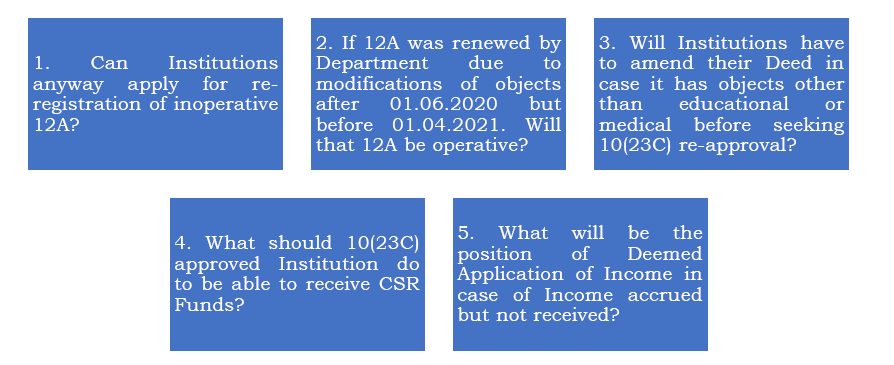

Now, building upon above discussions the following issues arises –

ISSUES

Issue 1.Why was equivalent switch option not made available i.e.,‘re-registration u/s 12A without enquiry’ in the year of transition? Can Institutions anyway go ahead with filing of application for re-registration of 12A u/s 12A(1)(ac)(i) through Form 10A?

Explanation. Single route of ‘enquiry’ is provided by the Government to opt for 12A.If the Institution anyway go ahead with filing of Form 10A u/s 12A(1)(ac)(i) for re-registration of 12A, it should be feared that following mightensue –

- Department can cancel the order and the URN as if it was never granted, at any time in future. (Rule 17A(6)), and

- The benefits availed under section 12A can be withdrawn for such previous years.

Clarification Required- The Govt. should clarify on the steps to be taken by these Institutions and 12A should be allowed for re-registration by revising the effective date of applicability of 1st proviso to section 11(7). The effective date should be delayed to 1st April, 2021, and Institutions should be allowed to file application for re-registration of 12A under section 12A(1)(ac)(i).

Such a law has created an unnecessary hardship for Institutions in the year of transition.

Issue 2.What if already 10(23C) approved Institution holds 12A registration which is granted to it after 01.06.2020 and before 31.03.2021 due to modification of objects?

Can Institution apply for re-registration of 12A in that case?

Explanation. No, this is a procedural lapse where Govt is not be able to cross verify the presence of 10(23C) approval, and surprisingly, they have issued 12A registration between 01.06.2020 and 31.03.2021 to those institution, who are already approved under 10(23C), in cases where they have applied for 12A due to the modifications of the objects. In our opinion, the re-registration for 12A cannot be applied after 01.06.2020 31.03.2021, in this situation.

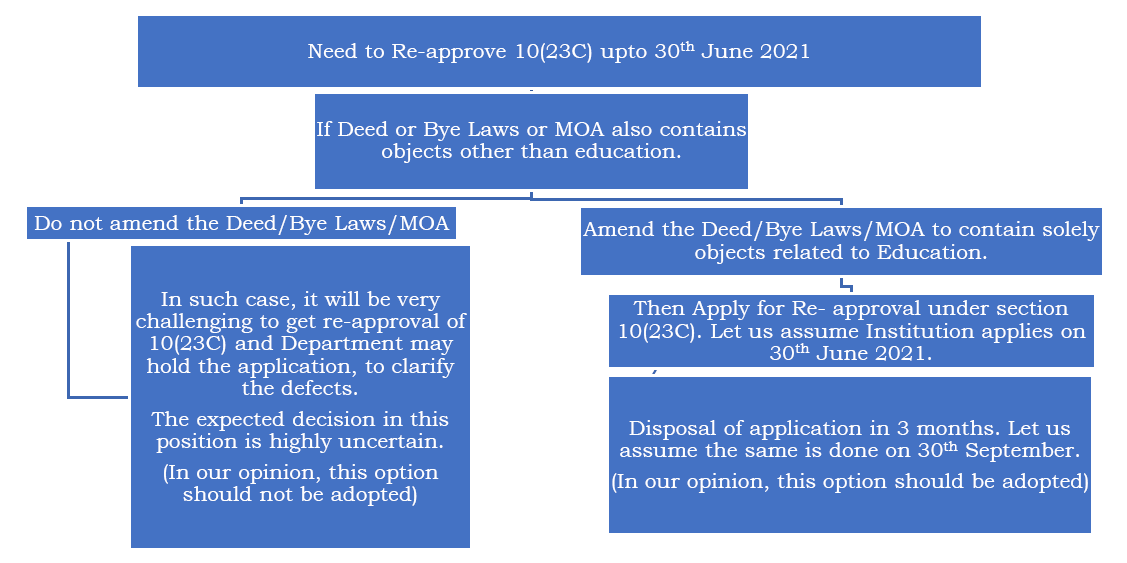

Issue 3. Will Institutions having other objects as well,be granted with re-approval u/s 10(23C)(vi)? Or will they have to amend such objects?

Explanation. If Deeds and Bye Laws contain objects other than education then two situations may arise as explained in the flowchart –

Author’s Opinion “Deed should be amended to contain object clause limited to education only before applying for re-approval under section 10(23C)(vi).”

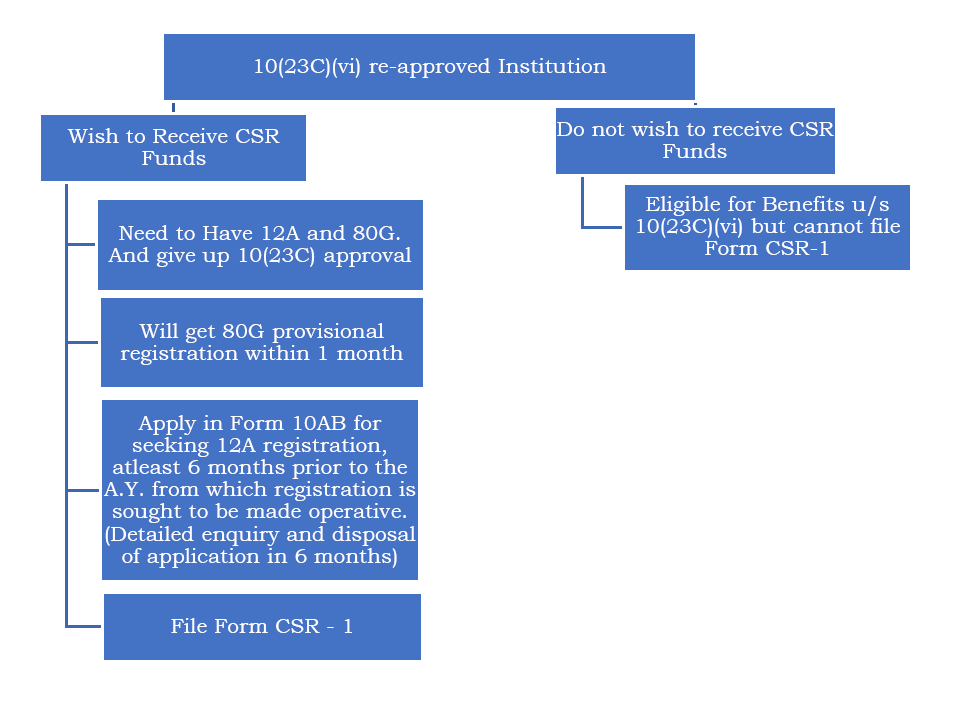

Issue 4. What shall be the course of action for 10(23C)(vi) approved Institutions not holding 80G approval, if it is desirous of obtaining CSR Funds, as right now,Form CSR-1 is required to be filed in order to be listed as one of the CSR eligible Institutions on MCA?

Explanation. CSR-1 can be filed by 12A & 80 G registered Institutions only.

There are 2 possible situations as enumerated in the flowchart below-

Author’s Opinion “Non-eligibility to file Form CSR-1 by 10(23C) approved Institutions is an unintended anomaly which needs to be rectified by the Government. However, till any clarification comes, Institutions need to apply for 12A to file Form CSR-1.”

Issue 5. Due to COVID-19, many Educational Institutions did not receive income, especially fees from students. In that case, can these Institutions file Form 9A to claim exemption on such income as “Deemed Application of Income”?

Explanation. Govt should also harmonise section 10(23C) with section 12A so that common benefits like “Deemed application of income” can be availed, at least for the F.Y. 2020-21.

FAQs

| Questions/Doubts |

Answers |

|

Why can’t Institution drop re-approval of 10(23C) and apply for 12A provisional registration as it is necessary for seeking CSR funds? |

It is not advisable to do so. As re-approval of 10(23C) shall be granted for 5 years without any enquiry. |

|

Can Institution file application of making 12A operative again under section 12A(1)(ac)(iv), or will it have to wait for order granting re-approval under section 10(23C) first? |

In our opinion, Institution can go ahead with filing of application under mentioned section, it does not have to wait for order granting re-approval u/s 10(23C). However,the requisite form 10AB is still not available on income-tax portal till 17.06.2021, whereas proviso to make 12A inoperative applicable from 01.06.2020. |

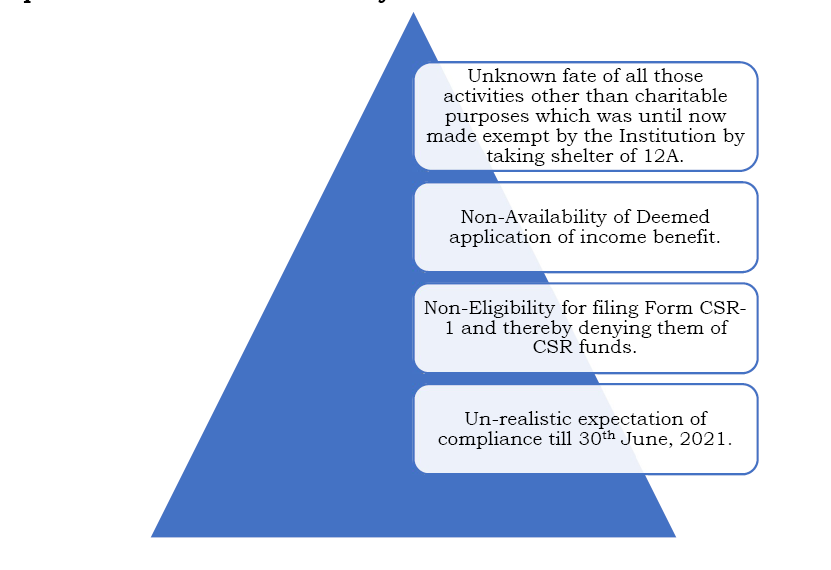

Apart from the above discussed issues following are few of many possible repercussions of midway cancellation of 12A registration.

|

END NOTE – These Institutions being forced in such an unsettling disposition and imposition of unrealistic time limits without clarifications in not only unjust but also an impractical expectation.

|

About the Author: The author is a Partner, Internal Audit, with M/s R Sogani & Associates | Chartered Accountants, situated at C-Scheme, Jaipur, Rajasthan. E-mail: naresh@soganiprofessionals.com

Pdf file of article: Click here to Download

Posted on: June 19th, 2021

Leave a Reply