Hon’ble Supreme Court has recently delivered its 100+ pages verdict on 03.10.2024 in the case of UOI v. Rajeev Bansal [2024] 167 taxmann.com 70 / 301 Taxman 238 (SC) which drastically changes the terrain of tax reassessment process and emerges as a turning point in the Indian tax law. This historical ruling raises vital concern regarding the limits of judicial intervention in tax proceedings and exposes a careful mix between principle and pragmatism by inventing the idea of “surviving time”. This ruling deals with the issues concerning the separation of powers in India’s constitutional design by offering a complicated interaction between judicial power, administrative policy and taxpayers rights. i. e. can administrative convenience supersede the accepted standards of statute interpretation?

Hon’ble Supreme Court has recently delivered its 100+ pages verdict on 03.10.2024 in the case of UOI v. Rajeev Bansal [2024] 167 taxmann.com 70 / 301 Taxman 238 (SC)

Hon’ble Supreme Court has recently delivered its 100+ pages verdict on 03.10.2024 in the case of UOI v. Rajeev Bansal [2024] 167 taxmann.com 70 / 301 Taxman 238 (SC) which drastically changes the terrain of tax reassessment process and emerges as a turning point in the Indian tax law. This historical ruling raises vital concern regarding the limits of judicial intervention in tax proceedings and exposes a careful mix between principle and pragmatism by inventing the idea of “surviving time”. This ruling deals with the issues concerning the separation of powers in India’s constitutional design by offering a complicated interaction between judicial power, administrative policy and taxpayers rights. i.e. can administrative convenience supersede the accepted standards of statute interpretation?

2.0 Three main laws- Income Tax act 1961, Taxation & other Laws (Relaxation and Amendment of certain provisions) Act 2020 (popularly known as “TOLA”) and Finance Act 2021-formulate the legal basis behind this case. TOLA enacted as an emergency response to the COVID-19 epidemic, stretches certain tax related compliance deadlines to June, 2021.On the other hand, Finance Act 2021 brought about far reaching modifications to the reassessment regime under the Income Tax Act.

2.1 The core issue involved in this case was “Whether TOLA has any applicability or bearing on the Income Tax law as it stood after new regime of reassessment introduced by Finance Act 2021 to the notices issued u/s 148 during the period from 01.04.2021 to 30.06.2021 in the old regime.i.e. following the procedure as existing pre-amendments brought into force by Finance Act 2021 w.e.f. 01.04.2021? The Revenue had relied upon the procedure narrated in the instruction no.1 of 2022 dt. 11.05.2022. They were challenged before various High Courts and were also quashed. But the Apex Court saved all said notices running into around 90,000 by an order in case of UOI v Ashish Agrawal ( 444 ITR 01) by invoking the special powers vested in them under Article 141 of the Constitution of India. The non-application of the amended new regime on part of the Revenue was considered as a bonafide mistake and interest of the taxpayers were balanced by allowing them all defenses available under the new regime including Sec. 149.

2.3 After hearing the arguments of both the sides, the Apex Court held that the provisions of TOLA will override the provisions of Section 149 of Income Tax Act being a specified Act in light of the non-obstante clause in Sec. 3(1) of TOLA. The Ruling dealt with also the issue relating to the reassessment notices issued u/s 148 of the new regime between July & September 2022 in consequence to the ruling in case of Ashish Agrawal (supra).

2.4 The position of law as held by the Apex Court may be summarized as follows:

a) After 1.04.2021 the Income Tax Act has to be read along with the substituted provisions;

b) TOLA will continue to apply after 01.04.2021 if an action or proceedings specified under the substituted provisions falls for completion between 20.03.202 to 31.03.2021.;

c) Sec 3(1) of TOLA will override the Sec. 149 of I T Act to the extent of relaxing the time limit for issuance of reassessment notice u/s 148.

d) TOLA will extend the time limit for grant of sanction to be accorded by the specified authority u/s 151. The consequence of (b) and (d) above will be that the time limit of three years falling between 20.03.2020 and 31.03.2021 will be extended till 30.06.2021 for granting approval.

e) The directions given in the ruling of Ashish Agrawal (supra) will further time to all those notices which were challenged. i.e. the period of stay till the supply of relevant information & material as directed in this order of Supreme Court and the period of two weeks allowed to those assesses to respond to the notices u/s 148A(b) of the Act.

f) The entire aforesaid period was coined as “surviving period” so that the notices issued beyond this period would become time barred and liable to be quashed.

2.5 It may be noted that in order to interpret the provisions of amended Income Tax Act and TOLA, the Apex Court applied the principles of interpretation like “strict interpretation”, harmonious construction” and “workability” which were considered necessary to arrive at a meaningful result. Therefore, the Court opined that if the limitation as per first proviso to Sec 149(1) of the new regime was allowed the very purpose of the exercise of the powers under Article 142 in the case by Ashish Agrawal would get frustrated. Therefore, the provisions of TOLA would be applicable into the Income Tax Act.

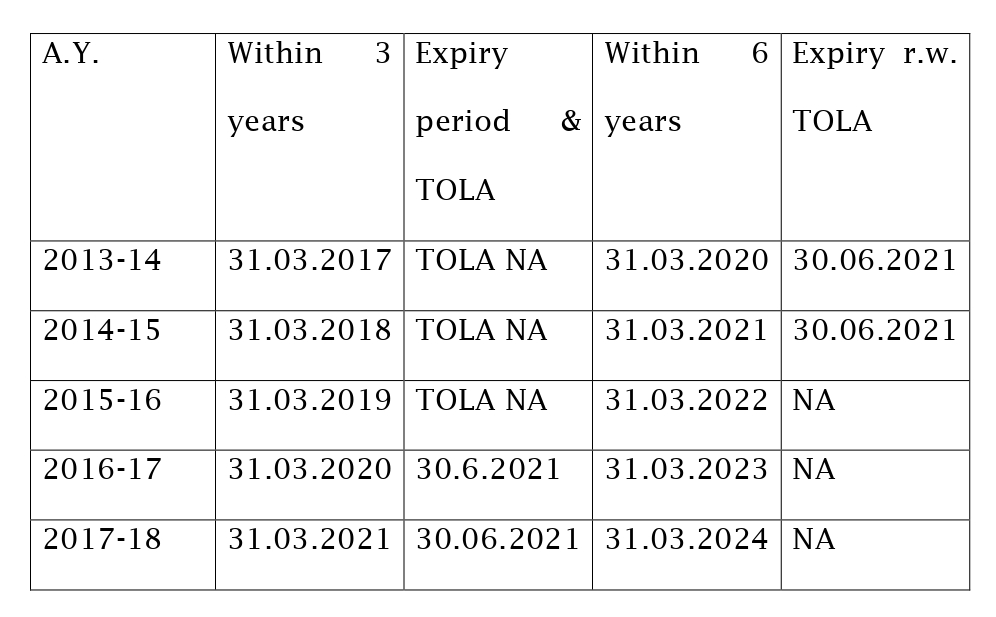

2.6 So far as the issue relating to the validity of sanction/approval by the specified authority u/s 151 is concerned, it may be noted that the new regime specified a new set of authorities. The Court held that TOLA applied to the sanctions u/s 151 also and therefore, the authority who was empowered to grant sanction during 31.03.2020 to 31.03.2021 can grant sanction till June, 2021 although literally speaking three years might have expired from the end of the relevant assessment year. The Court explained with the example of A.Y. 2017-18. It stated that the time period of three years from the end of A.Y. 2017-18 has expired on 31.03.2021 which fell between TOLA period of 30.3.2020 to 31.03.2021. Therefore, the authority empowered to grant sanction as on 31.03.2021 as per Sec 151(i) of the new law could grant approval till 30.06.2021.

2.7 Now, dealing with the contention of the Revenue relying upon Third proviso to sec 149(1) the Court held that the decision of Ashish Agrawal was an order of a Court so that it amounted to virtual stay of all such notice of reassessment till the date of order i.e. 04.05.2022 and the same will have to be excluded in counting the period of limitation.

2.8 In case of Ashish Agrawal the Court had directed to supply information & material within 30 days from 04.05.2022 and the assessee was allowed two weeks’ time to respond to such fresh notices. Thus the Court held that the period till supply of information to the assesses and time of two weeks allowed to him to respond his notice by AO will have to be excluded in arriving at the period of time barring u/s 149.

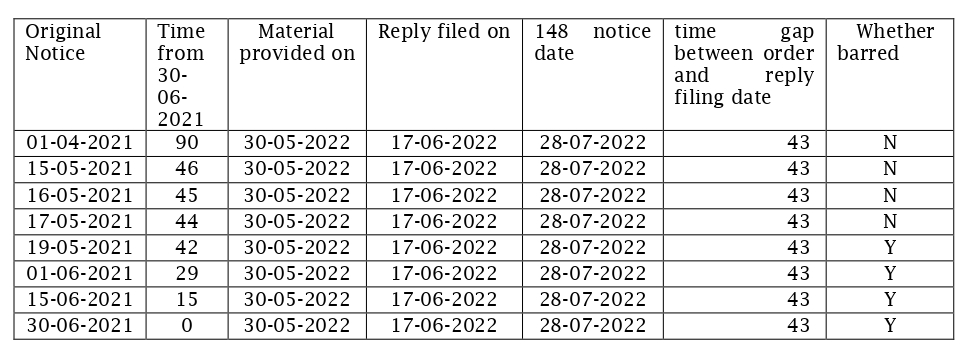

2.9 It will be useful to reproduce the Tabular chart given in the verdict by the Court:

In view of the above discussion, the tax payer will have to ascertain various dates to claim whether the notice is barred by limitation or improper sanction say assessment year concerned, date of original notice, letter after Ashish Agrawal, response date to it, etc. The important question is when the time star ticking?

2.10 The implication of this ruling may be considered in respect of following situations:

a) The matters where the writ filed before High Court has allowed it in past following earlier order of the Court and no further Special civil appeal is filed before Hon’ble Supreme Court.

b) The matters where such writ is pending final disposal and stay is granted or a case where interim order of stay is not granted.

c) The matters where no writ is filed before high Court but no final order is yet to be passed

d) When the notice issued for A.Y. 2015-16 would be invalid as per this Ruling?

e) The time during which the show cause notices were deemed to be stayed is from the date of issuance of the deemed notice between 1 April 2021 and 30 June 2021 till the supply of relevant information and material by the assessing officers to the assesses in terms of the directions issued by this Court in Ashish Agarwal (supra), and the period of two weeks allowed to the assesses to respond to the show cause notices; and

f) The assessing officers were required to issue the reassessment notice under Section 148 of the new regime within the time limit surviving under the Income Tax Act read with TOLA. All notices issued beyond the surviving period are time barred and liable to be set aside”

2.11 The following tabular chart explain the interaction of different time limits:

[Source : Souvenir published on 27th National Convention of AIFTP 2024]

About the Author: Details are awaited

Pdf file of article: Click here to Download

Posted on: December 24th, 2024

Leave a Reply