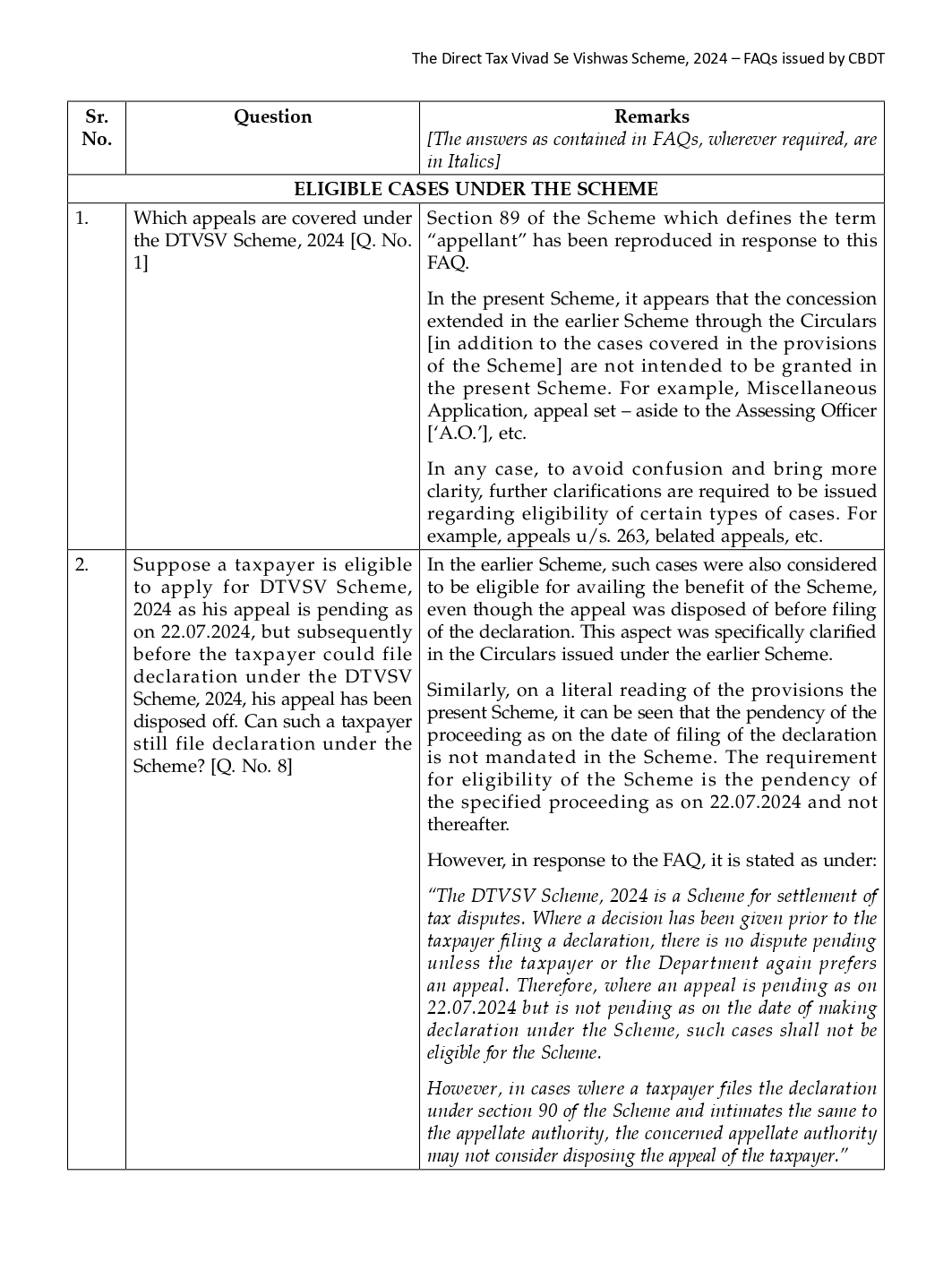

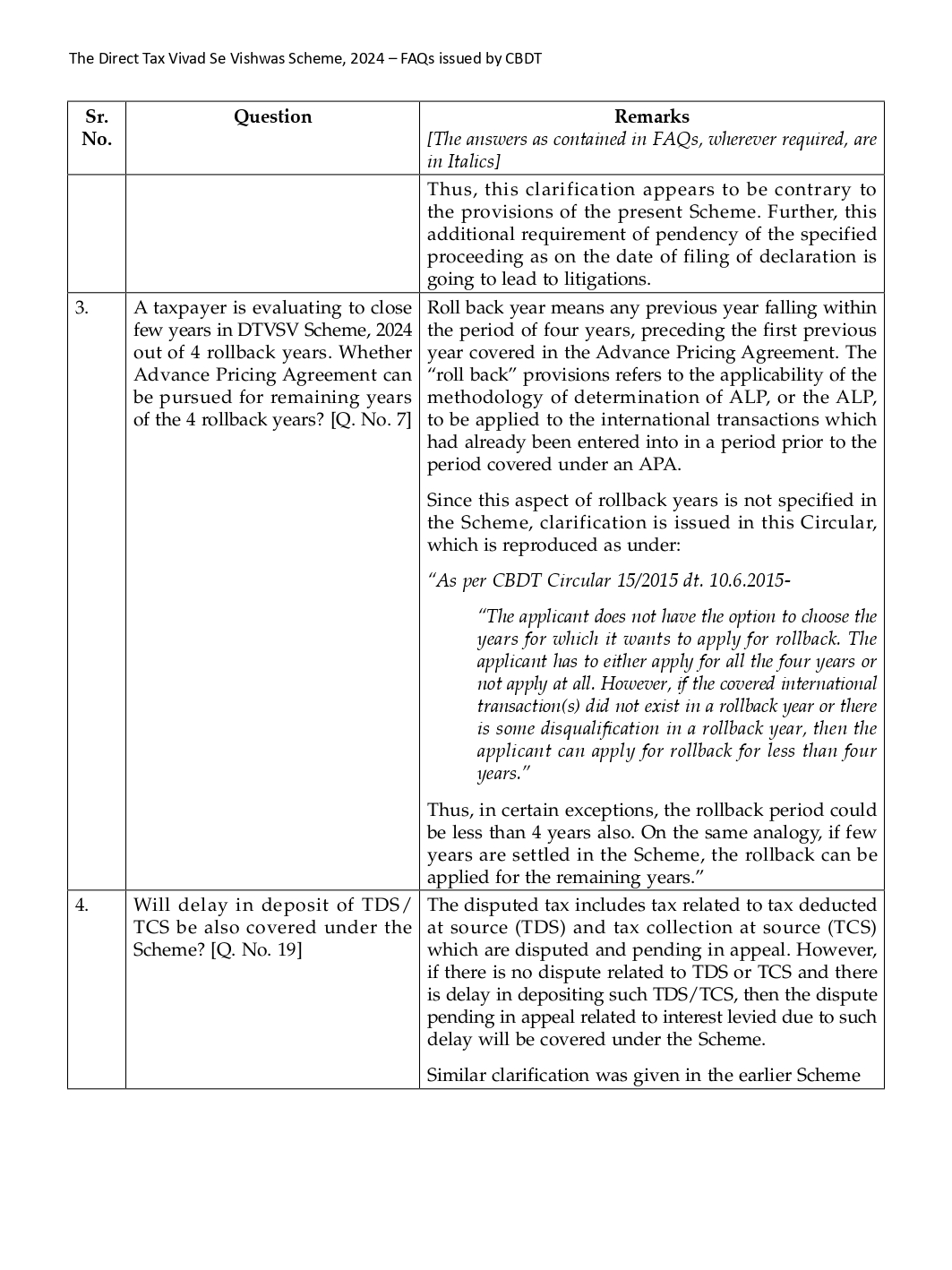

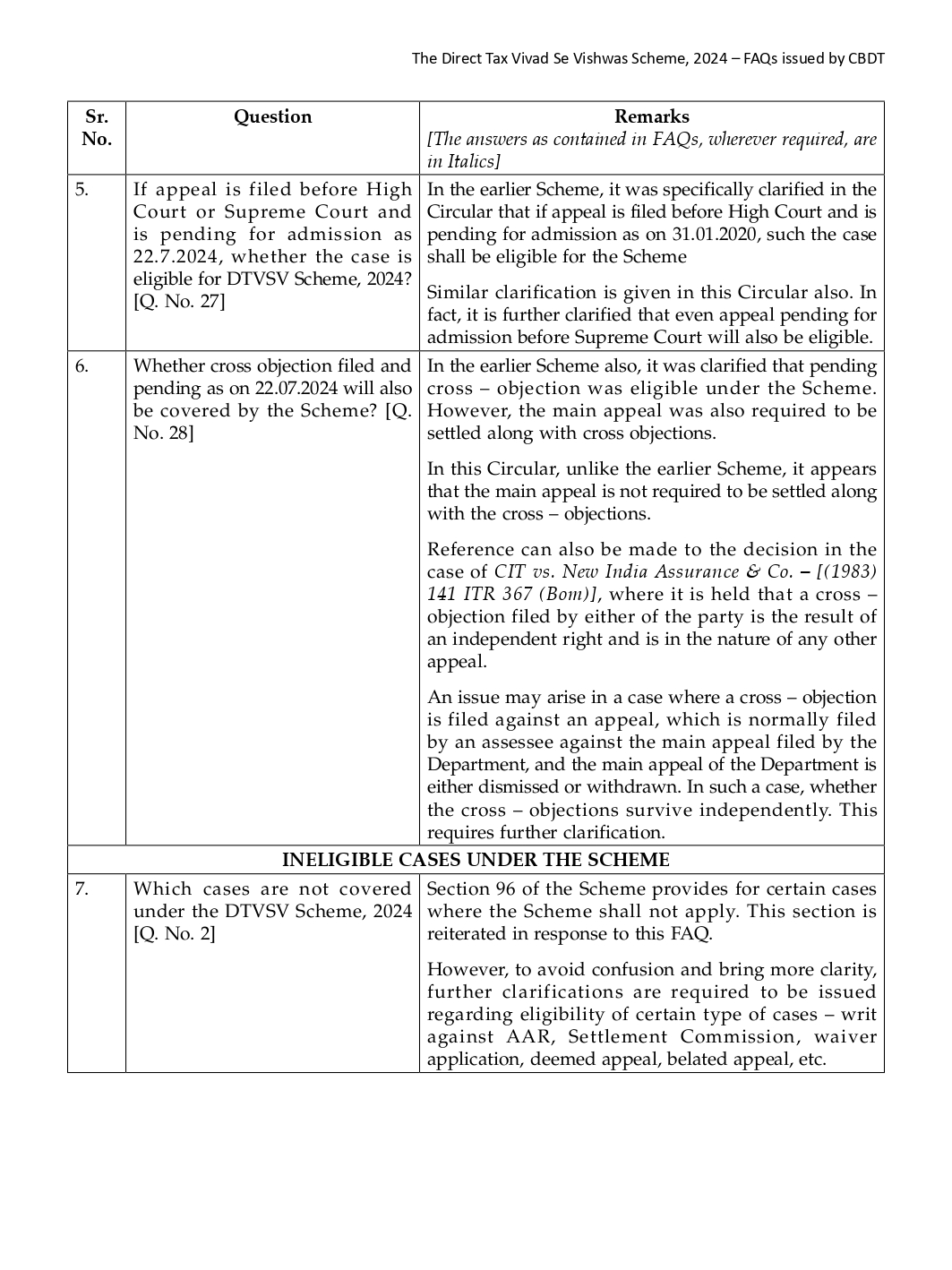

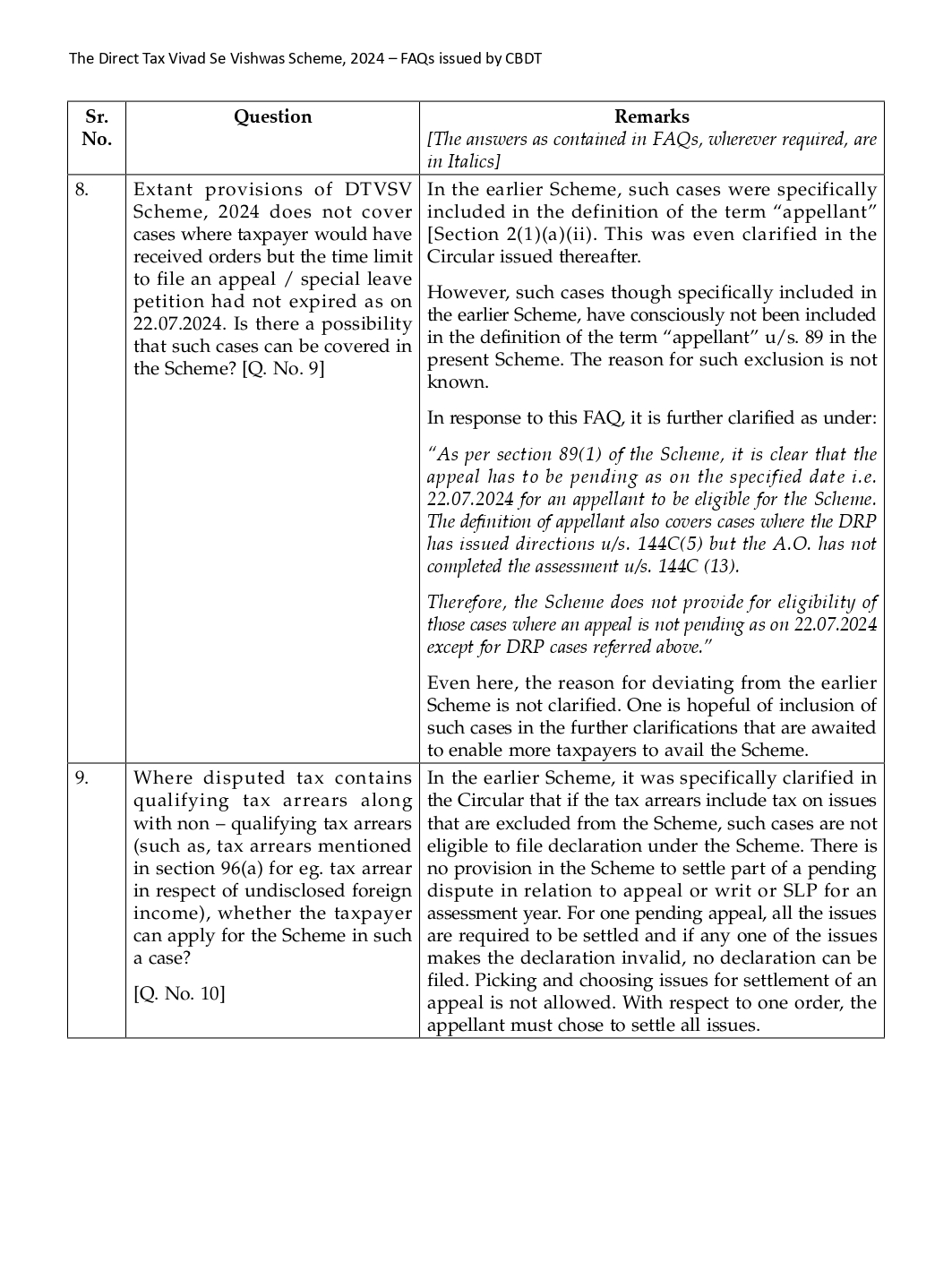

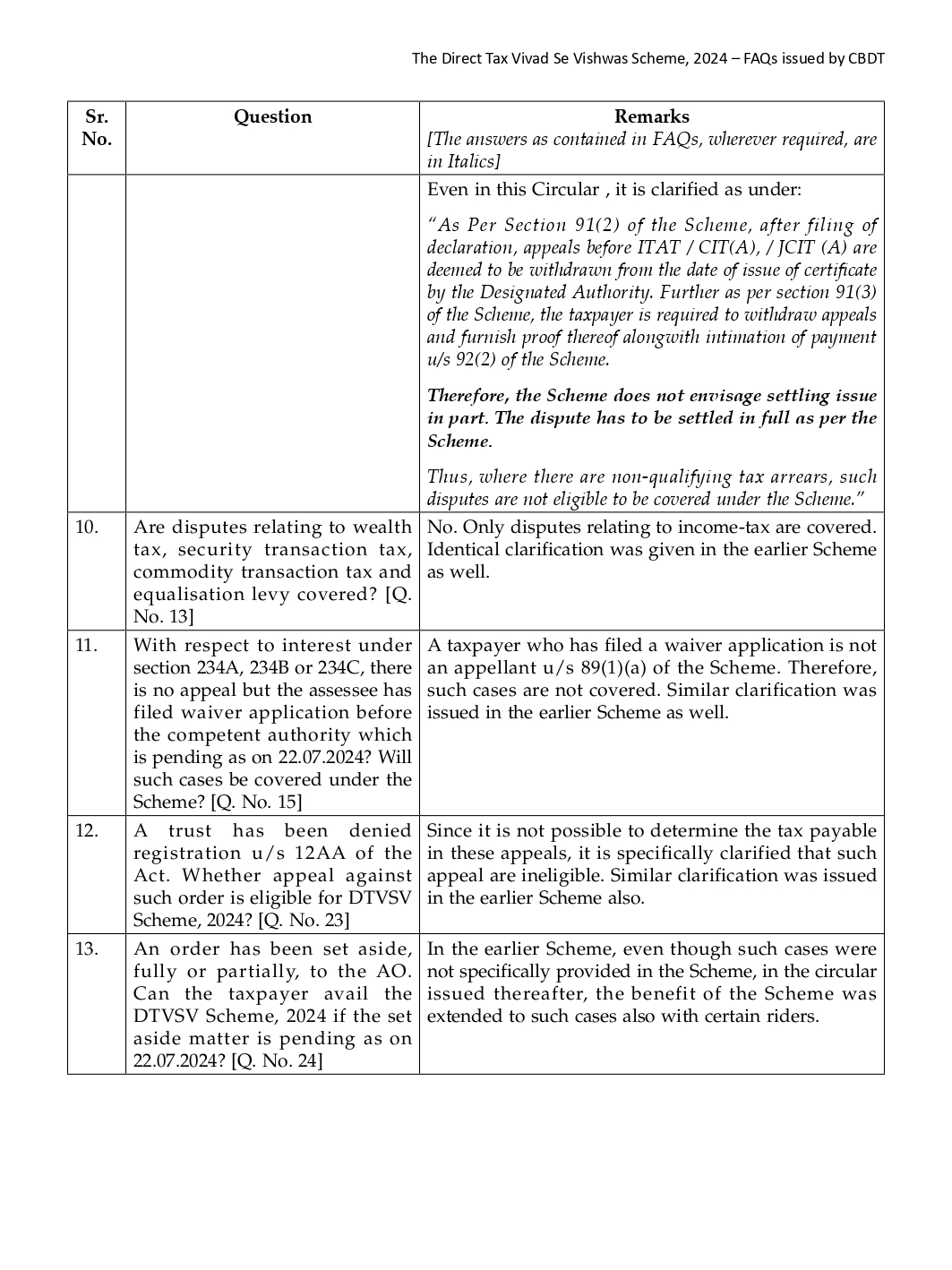

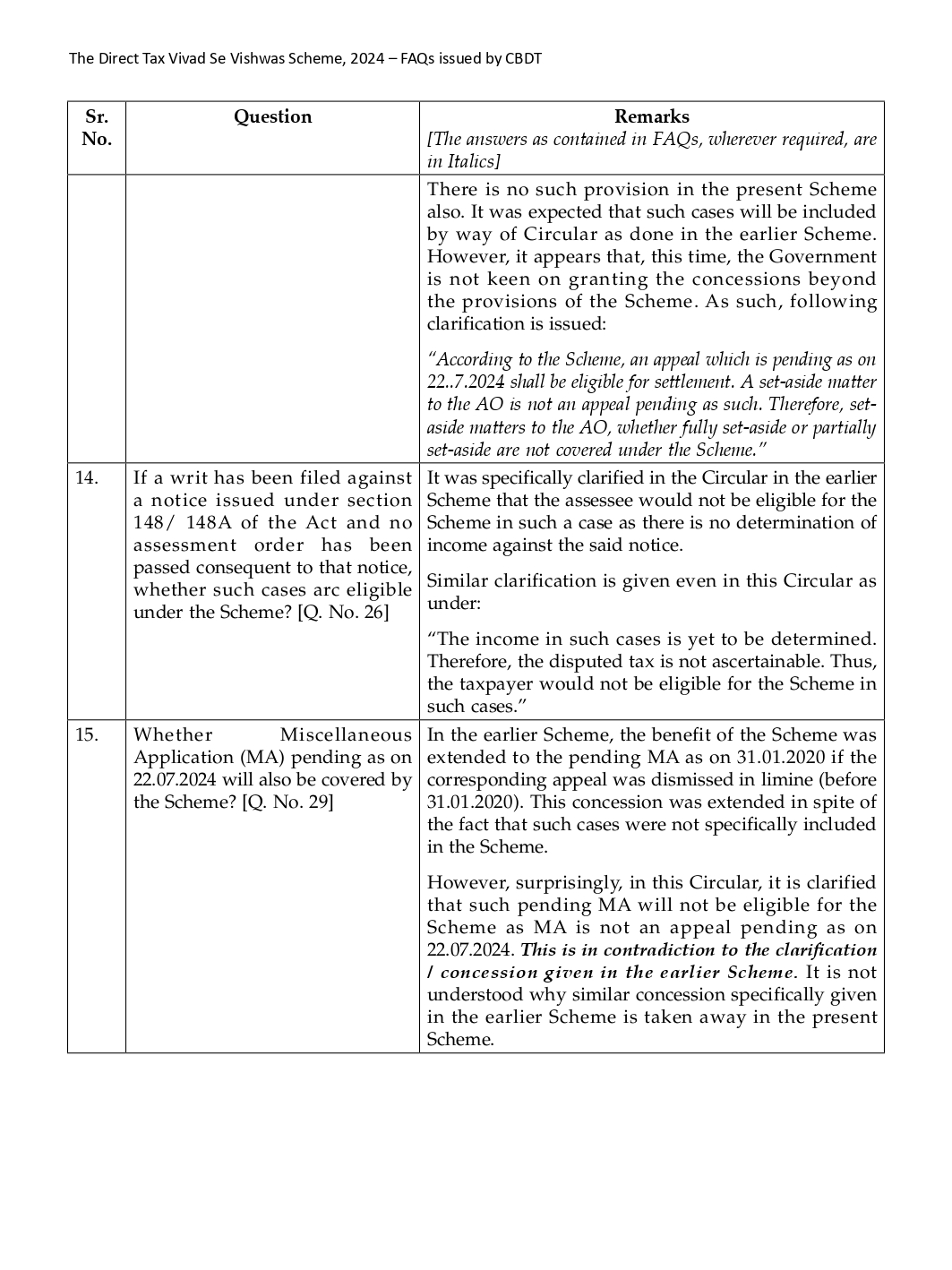

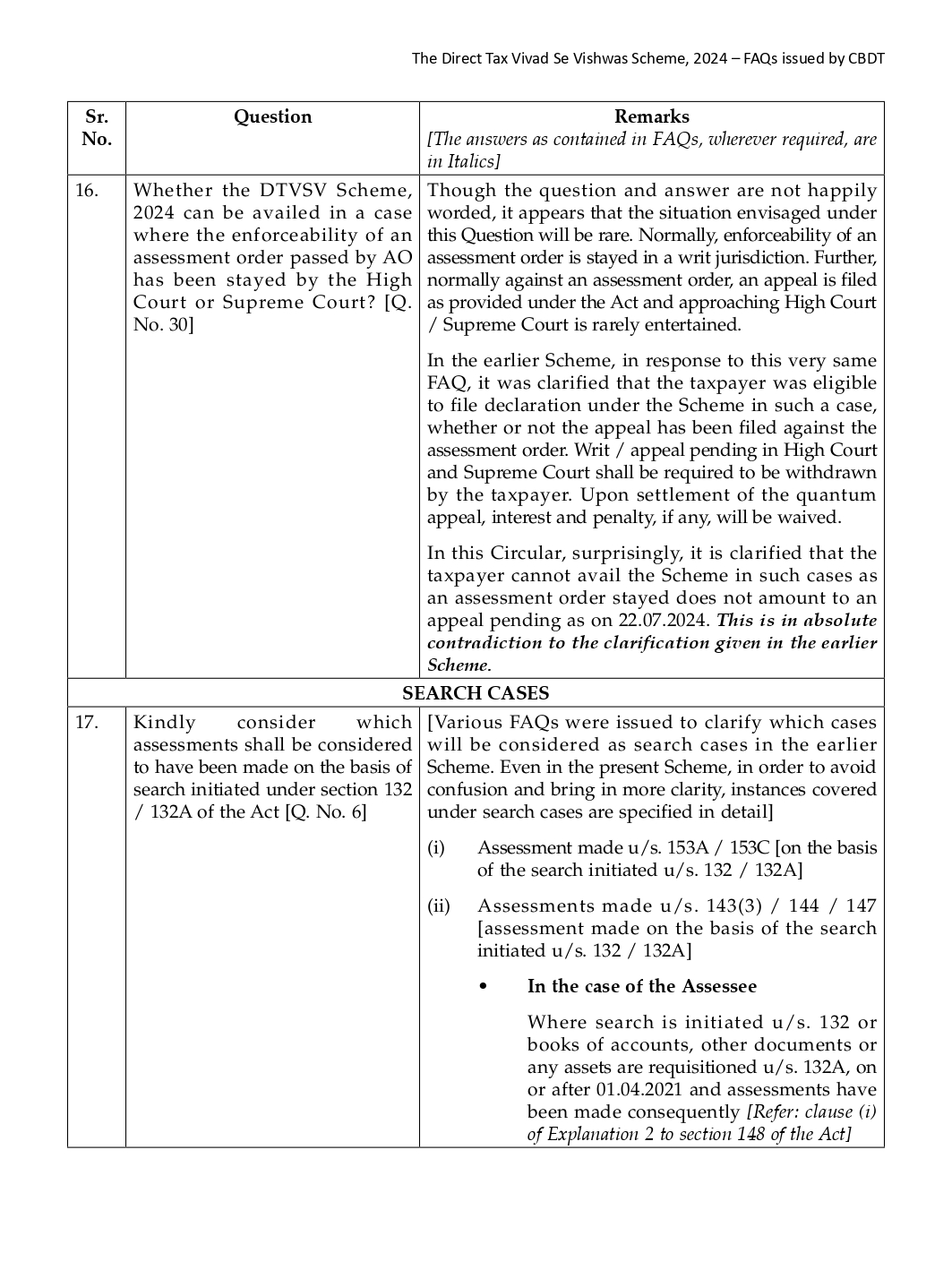

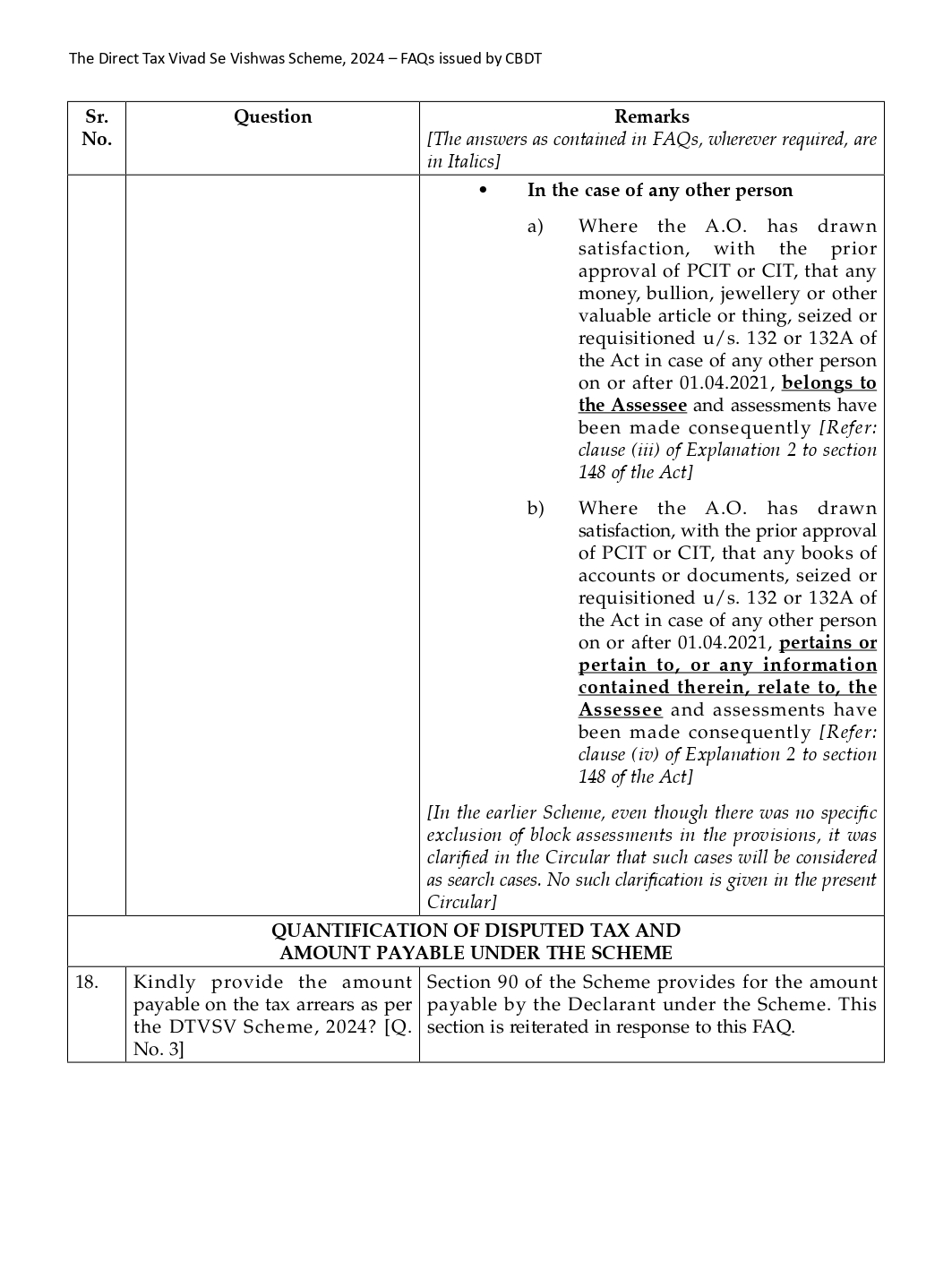

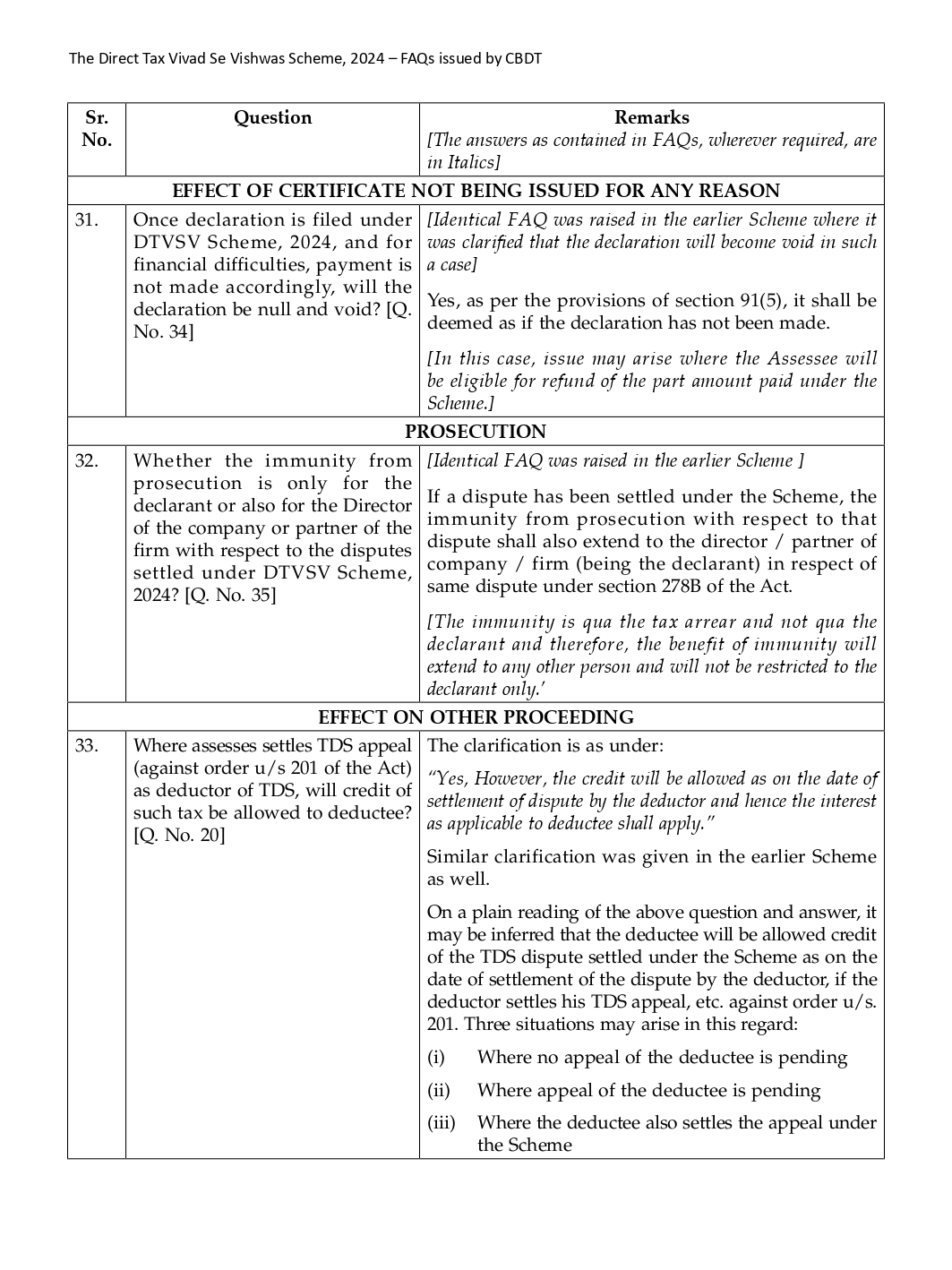

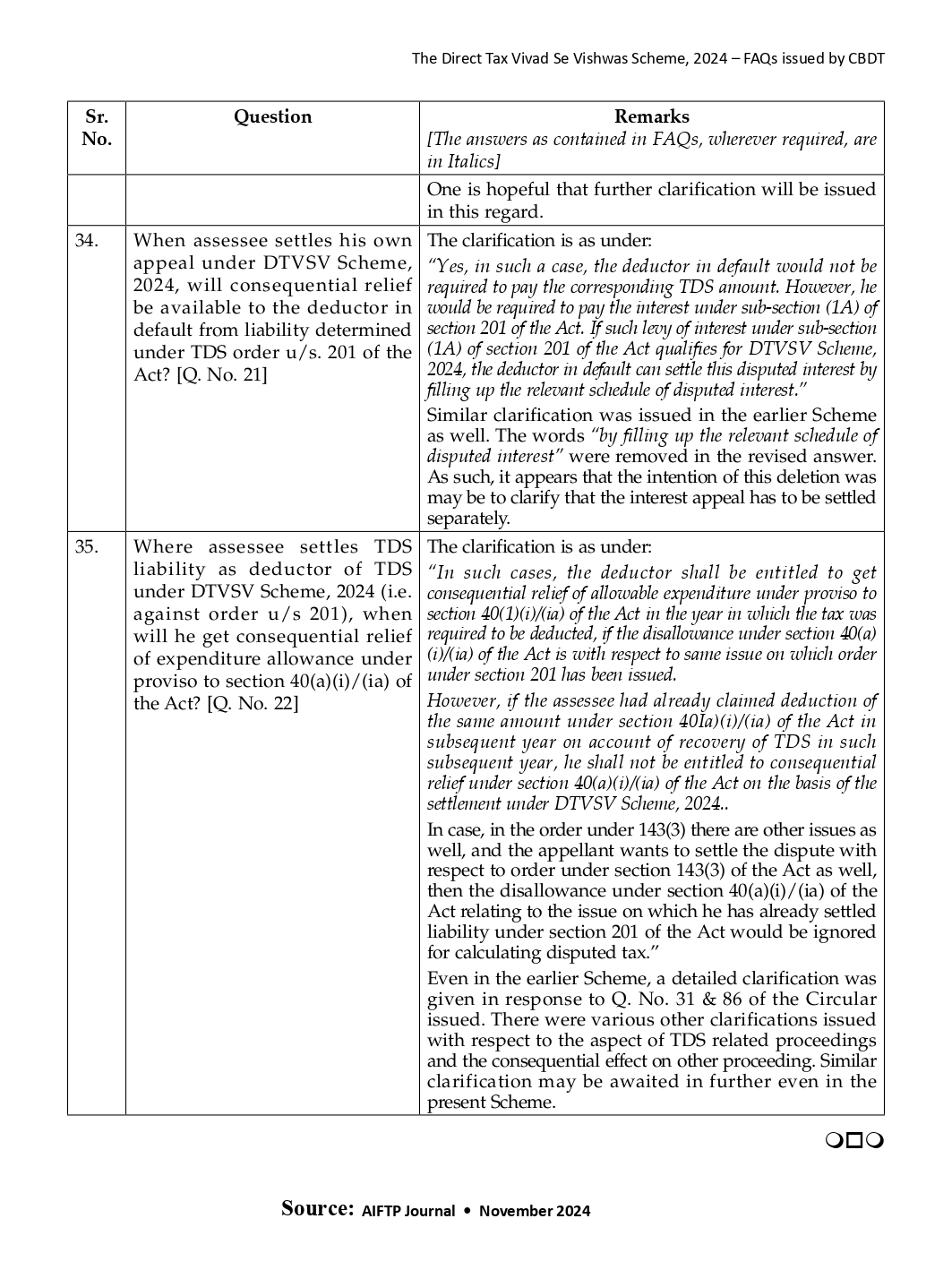

The Direct Tax Vivad Se Vishwas Scheme, 2024 – FAQs issued by CBDT

The Direct Tax Vivad Se Vishwas Scheme, 2024 – FAQs issued by CBDT

About the Author: Details are awaited

Pdf file of article: Not Available

Posted on: November 30th, 2024

Disclaimer: This article is only for general information and is not intended to provide legal advice. Readers desiring legal advice should consult with an experienced professional to understand the current law and how it may apply to the facts of their case. Neither the author nor itatonline.org and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this article nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission of itatonline.org

Leave a Reply