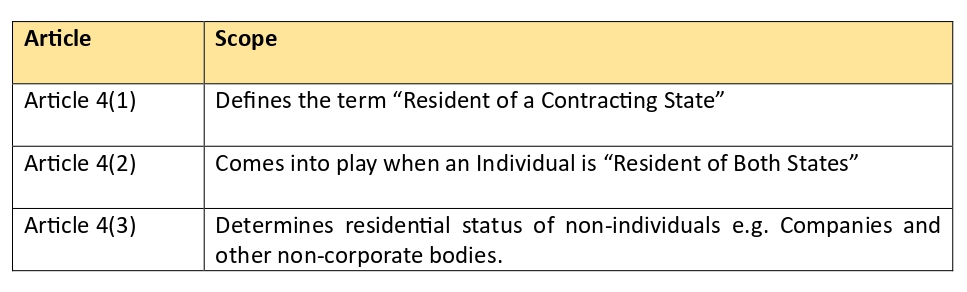

Article 4 of the Double Taxation Avoidance Agreement (DTAA) contains provisions for determination of Residential Status. This Article of DTAA

Article 4 of the Double Taxation Avoidance Agreement (DTAA) contains provisions for determination of Residential Status. This Article of DTAA

Article 4 of the Double Taxation Avoidance Agreement (DTAA) contains provisions for determination of Residential Status. This Article of DTAA has three paragraphs:

Article 4(1) – The Residential Status of an Individual is governed by the laws of the Contracting State, of which the Individual is resident. A person, who satisfies the conditions stated in Section 6 or Section 6(1A) of the Income-tax Act, 1961 would be treated as Resident in India, for the purpose of his liability to tax in India. In case the Individual claims to be resident of any other contracting state, for purpose of payment of tax, he has to satisfy the conditions laid down in the laws of that contracting state.

The broad criteria for determination of residential status of an Individual by different countries are based on domicile, citizenship, nationality, residence of the person, as the guiding factor.

Any person who is paying tax only on income from sources in that state, is not considered as resident of that state. Thus, liability to pay tax per se does not make a person resident, if such liability is only with respect to income from sources in that state.

Article 4(2) – Based on criteria laid down in Article 4(1), an individual may be treated as resident in two contracting states. This situation may make him liable to tax in both contracting states, on the same income, leading to double taxation of the same income. To eliminate the double taxation on account of residential status, and to determine the contracting state in which the income has to be taxed, Tie breaking rules have been provided in the Double Taxation Avoidance Agreements to determine residential status of the individual.

Following tests have to be applied sequentially to determine the residential status of the individual.

Tie Breaking Rules:

Step 1 – Availability of permanent home

Permanent home – It means a dwelling place available to the individual at all times continuously and not occasionally and includes place taken on rent for a prolonged period of time. This would include a dwelling place/room/apartment in a hotel. Availability for a short duration of stay or for temporary purpose shall not be regarded as a permanent home. It is to be tested on following factors:

(i) permanent home available to him in one contracting state – the individual shall be deemed to be resident of that contracting state.

(ii) permanent home available to him in both contracting states – the individual shall be deemed to be resident only of that contracting state with which his personal and economic relations are closure (centre of vital interests)

Step 2 – Determination of ‘Centre of vital interest’

Determination of centre of vital interest is a highly factual analysis which may not be applicable to any other individual or which has been decided by the courts in case of other individuals. The term requires determination of personal and economic relations. In whichever state these are closer, that state shall be the state of residence of the individual. The factors for determination are family and social relations, occupation, place of business, place of administration of his properties, political, cultural and other activities of the individual. – Individual shall be treated as resident of the Contracting State where such individual has Centre of vital interest.

Step 3 – Habitual abode

It is the state where the individual stays more frequently. It would include permanent home as well as any other place in that state, frequency, duration and regularity of stay. If the individual does not have a permanent home available to him in either of the contracting state or available in both states and his centre of vital interest cannot be determined – he shall be deemed to be resident only of the contracting state in which he has his habitual abode.

Step 4 – Nationality

If the individual has habitual above in both contracting states or does not have habitual abode in either of the countries – he shall be deemed to be resident only of the contracting state in which he is a national.

Step 5 – Determination by Competent Authority

If the individual is national of both contracting states or neither of them, the issue of determination of residential status shall be settled by mutual agreement by the Contracting States.

Tie breaker rule – Determination of Centre of vital interest – Judicial precedent

The Centre of vital interest is a question of fact and there is limited judicial precedent on the issue. Those available are detailed hereunder.

Shalini Seekond (2016) 180 TTJ 1(Mum – Trib), a Srilankan lady,

• After marriage with an Indian national she was staying with her husband in Mumbai.

• Her husband’s home was held to be permanently available to her in India.

• Availability of her parents’ home in Srilanka, in absence of evidence of her living in Sri Lanka permanently, regularly and consistently, could not be treated as her permanent home.

• She owned a property in Srilanka, which was sold and reinvestment was made in India. It indicated shift in vital economic interest from Srilanka to India.

The Tribunal held that her centre of vital interest was in India.

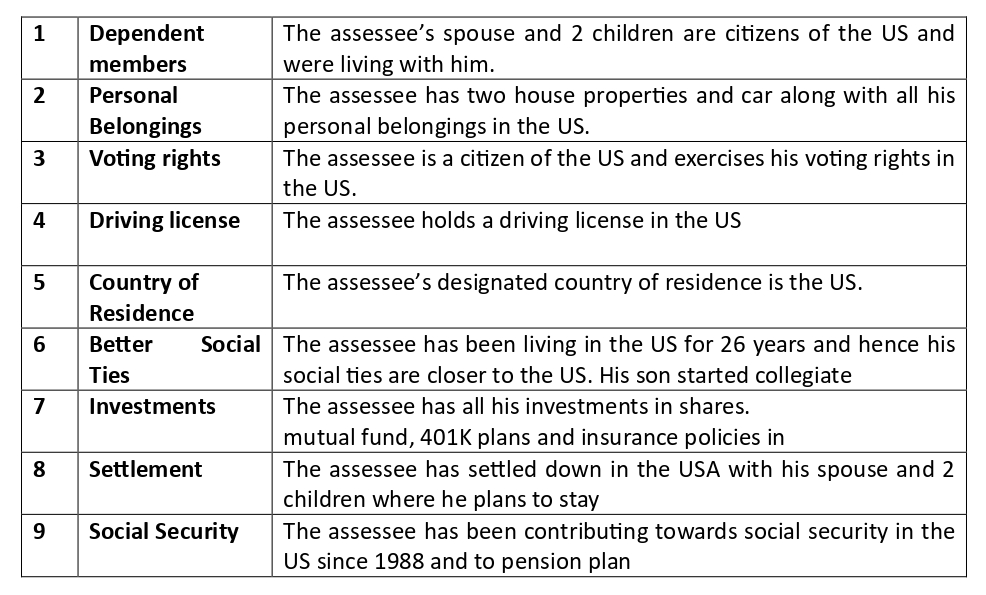

Dy. CIT v. Shri Kumar Sanjeev Ranjana (2019) 177 DTR 17 (Bang) (Trib)

The assessee, an Indian, had lived in India for 21 years migrated to USA and was working in the USA since 1986. He became a permanent resident in USA in 1992 and also became US citizen. His spouse and two children, who were born there, were all US citizens. From June, 2006 to August, 2012 the assessee was on deputation to India by his employer. He left India on 10.08.2012 upon completion of his assignment in India, and resumed his employment in the USA. Since then he was residing with his family in the USA.

The assessee had a house in India as well as in the USA. He had let out his house in the USA while he was on assignment to India.

The assessee became a tax resident of India for FY 2012-13 on the basis of his physical presence in India. The assessee also qualified as a tax resident of the USA for FY 2012-13. During the period 11.08.2012 to 31.03.2013 the assessee earned salary in the USA. The AO, sought to tax his entire global income, including salary earned in the USA for the period 11.08.2012 to 31.03 2013 to tax in India.

The assessee contended before the AO that he should be considered a tax resident of the USA under the tie-breaker rule of the India-USA DTAA on the basis that the assessee furnished detailed particulars on different aspects to establish that his ‘centre of vital interests’ was closer to the USA than to India. And to establish that his habitual abode was in the USA, the assessee highlighted two aspects, namely, time spent and intent of settling down in the USA on completion of the assignment.

The assessee had put in following, in support of his claim that during the period August 11, 2012 to March 31, 2013

AO, however, held that the ‘Centre of vital interests’ of the assessee was in India and was to be treated as resident and thus liable to tax in India on his global income. The assessee’s claim of exemption under Article 16 of the India-USA DTAA was also rejected on ground that the assessee had not furnished tax residency certificate.

The assessee furnished the tax residency certificate in appellate proceeding before CIT(A), which established that he was also a tax resident of the USA. The assessee had a permanent home in India as well as in the USA. The CIT(A) applying the test of closer personal and economic relations (‘Centre of vital interests’) concluded that the ‘Centre of vital interests’ of the assessee was closer to the USA than to India. Accordingly, the CIT(A) held that the Assessee qualified for exemption under Article 16 of the India-USA DTAA. Therefore, the AO could not tax the salary income of the assessee earned in the USA in India. The matter then travelled to ITAT.

Hon’ble Tribunal held that:

Article 4 of the India-USA DTAA determines the tax residential status of a person. Where a person is a tax resident of both the States, Article 4 provides certain tie-breaker tests.

The first test pertains to the availability of a permanent home: The assessee had a house in India as well as in the USA. However, since he had let out his house in the USA, it was deemed to be ‘unavailable for use’. Hence, he did not satisfy the first test.

The second test is about ‘Centre of vital interests’. After examining various aspects, the CIT(A) had found that the ‘Centre of vital interests’ of the assessee was closer to the USA than to India. The conclusion of the CIT(A) arrived at based on facts cannot be faulted.

The ITAT held that the center of vial interest of the assessee being closer to USA, the assessee was to be treated as resident of USA.

Sameer Malhotra vs. ACIT – ITA No. 4040/Del./2019 order dated 28 12 2022

The assessee, an individual, for the assessment year 2015 – 16, derived income from employment in India from 01.04.2014 to 25.11.2014 and from employment in Singapore from 15.12.2015 to 31.03.2025 and declared income at Rs. 1,59,36,999/- on 29.08.2015. A revised return was filed on 07.08.2016, wherein income was declared at Rs. 47,82,630/-, and claimed that the income earned in Singapore was not taxable in view of DTAA between India and Singapore and he was not to be treated as resident of India during the relevant assessment year. The assessee in support of his claim submitted Tax Residency Certificate of Singapore.

The Assessing Officer found that the assessee was in India for more than 182 days during the F Y 2014 -15 and therefore, resident in India.

Proceedings before Commissioner of Income Tax (Appeals)

The Assessee, in appellate proceedings, claimed that he is resident of both India and Singapore and his residential status needs to be determined in accordance with Article 4(2) of the DTAA between India and Singapore.

The Commissioner (Appeals) held that the assessee owned a house in India, though it was let out and that he rented a home in Singapore. He further held that even under the tie breaker rule, the assessee was resident in India for the F Y 2014 – 15.

Proceedings before Income Tax Appellate Tribunal (ITAT)

The Assessee submitted that

He had a home available for him in Singapore from start of employment and that the home in India was let out.

He had shifted to Singapore with his family and was employed in Singapore.

He produced Tax Residency Certificate (TRC) from Singapore authorities for F Y 2014 – 15.

He had a bank account and Driving Licence in Singapore.

On behalf of the Department it was submitted that

The assessee had a home in India

Personal belongings including automobiles were in India

Personal bank accounts, Savings and Investments were in India

Voting rights were in India.

The Hon’ble Bench held that:

The home in India was not available to him during the period he was in Singapore, as it was let out. So, the test of availability of permanent home was absent in India.

The Assessee had rented an apartment in Singapore, So he had a home available in Singapore.

Vital interests of assessee were also in Singapore, as he had shifted to Singapore with his family.

The Assessee started employment in Singapore and had savings there.

The Assessee was a tax resident of Singapore in terms of Article 4 of India – Singapore DTAA.

Based on above, the Assessee was held to be tax resident of Singapore during the relevant period. According to Article 15(1) of the India – Singapore DTAA, the Assessees’ income from employment in Singapore was not taxable in India.

Ashok Kumar Pandey vs. ACIT – ITA No. 3876/Mum/2023 order dated 03.10.2024

The Mumbai Tribunal has very recently also examined the issue of ‘centre of vital interest’

The Assessee, an individual derived income from Capital Gains, Dividend, Interest Income and Income from House Property. He claimed that he is a resident but not ordinarily resident for A.Y. 2009-10 and a resident since A.Y. 2010-11. For the year under consideration A Y 2013 – 14, the assessee claimed that he is resident in India as well as in United States of America and therefore his residential status needed to be determined under Article 4(2) of the Indo-USA DTAA. The assessee also stated that he has a permanent home in India as well as in USA and, therefore, his residential status will depend upon his personal and economic relation and its closeness (centre of vital interest).

The assessee claimed that he holds US passport and is US National, had permanent home available in India as well as USA. The assessee’s wife, son and daughter were also US nationals. The assessee had investments in USA as well as balances in bank accounts in USA. The assessee had very nominal income in the current year in India and also had loss. Assessee produced copy of bank statement showing balance of Rs. 29,53,232 as on 26.03.2013. The assessee and his wife were holding 50% share each in the company Revel Films Pvt. Ltd. He submitted that his economic and social interest are more in USA and not in India and, therefore, according to Article 4(2) of DTAA, he should be considered as resident of USA. He also relied upon the decision in the case of DCIT vs. Kumar Sanjeev Ranjan. He referred to the several tests mentioned in that judgment and accordingly, he submitted that if all the tests are applied, centre of vital interest of assessee is in USA.

The Hon’ble Bench after hearing both sides and pursuing the documentary evidences, observed that:

The assessee had stayed in India for more than 183 days; therefore, he was resident but not ordinarily resident in India during the relevant year.

Assessee’s claim that he was resident of India as well as USA was accepted by the revenue.

Assessee’s claim that he has permanent home available to him in India as well as in USA was accepted by the revenue.

Assessee claims that his centre of vital interest was in USA, was disputed by Revenue. According to revenue assessee has closer personal and Economic interest in India than USA.

Personal relations

Assessee and his entire nucleus family is US national, holding US passport.

Assessee was staying in US earlier but has come back to India. He is staying In India with his Spouse, one daughter and son whereas another daughter is staying in US for study purpose. All are registered as overseas citizen of India.

His extended family, comprising his father, mother, brothers, sisters are all U S national holding U S Passport.

Economic interests

Financial reports from Meryl Lynch, UBS Portfolio and Meryl Lynch Wealth showed that he had investments and bank balances both in India as well as USA.

He is director in Revel Films Pvt Limited, held Share capital 50 % of Rs 50,000 and his wife also holds Rs. 50,000. He and his wife are directors of the company and attended 5 Board Meetings of the company as those are only shareholders and directors of the company.

The Hon’ble Bench held that:

The facts need to be analysed looking at personal relationship as well as economic relationship and both must be considered together to determine the centre of vital interest of an individual close to a particular state.

For determination of personal relationship, connect with the nucleus family is more important, then extended family. For determination of economic relationship, more credential be given to active involvement in the commercial activities then passive investments. For determination of economic relationship, place of business, place of Administration of property and place of earning wages (remuneration) (profit) is of importance.

Keeping in mind the above factors, the Hon’ble Bench proceeded to determine the issue and held

Physical stay – The Assessee has stayed in India for more than 183 days and therefore is resident in India under Indian Tax law.

Personal relationship – He has stayed in India with his wife, son and daughter. The other daughter is staying in USA for the purpose of study. The stay of his extended family including parents in USA is not so much relevant to decide whether his personal relationship is close to USA or not. Weightage was given to nucleus family rather than extended family.

Economic interest – He has come back to India for carrying on business in a private limited company which is set up by him and his wife. The assessee and his wife have investments in the company and have also given substantial loan to the company. Assessee has attended along with his wife five Board meetings of the above company. Therefore, it is important to note that assessee has an active involvement in a running of this company in India.

Active involvement in earning income – Assessee’s income from investments in USA and the rental income from property are passive income and he does not have any active involvement in USA for earning wages, remuneration,

profit.

Conclusion by ITAT – Comprehensive appraisal of the personal relationship and economic relationship of the assessee, tilt more in favour of being close to India then US. The assessee was held to be a resident of India in terms of Article 4(2)(a) of the Indo- US – DTAA as a resident of USA.

Final Take Away – The determination of Centre of Vital Interest, is based on facts of each case and there is no laid down criteria/direction. Various factors have to be weighed in its determination. Issues to be analysed for determination of Personal and Economic relations could be summed up as under:

Family and social relations – Nucleus family to be given more weightage over extended family.

Personal Belongings,

Place of administration of his properties,

Cultural and other activities of the individual.

Occupation,

Place of business,

Economic relationship & Economic Interests

Place of business,

Place of Administration of property and

Place of earning wages (remuneration) (profit) is of importance.

Active involvement in the commercial activities then passive investments

Political,

Voting rights,

Social Security

Article contributed by CA A K Srivastava, Member NEC 2016 – 2025 National Joint Secretary – NZ 2016 and National Vice President NZ 2020.

[Source : Souvenir published on 27th National Convention of AIFTP 2024]

About the Author: Details are awaited

Pdf file of article: Not Available

Posted on: December 24th, 2024

Leave a Reply