One of the significant policy measures introduced to boost the Indian shipping industry was the introduction of Tonnage Tax Scheme under Chapter XII-G of the Income-tax Act, 1961 (the “Act”). The Tonnage Tax Scheme offers an alternative method of taxation for qualifying shipping companies, shifting from the conventional method of computation of income to a presumptive tax regime based on the net tonnage of ships operated. This regime was introduced by Finance (No. 2) Act, 2004 and became applicable from Assessment Year 2005-06. Prior to the introduction of Chapter XII-G, taxes of shipping companies were computed under the normal provisions of the Act. Certain shipping companies were eligible for a special deduction under section 33AC of the Act. The Indian shipping companies faced a stiff competition and sluggish growth vis-a-vis foreign shipping lines. The Ministry of Shipping constituted an Expert Committee headed by Shri Rakesh Mohan to look into the taxation of the shipping sector and also taxation regime of Indian shipping industry vis-a-vis foreign shipping industry. The Rakesh Mohan Committee in its report of January, 2002, in order to ensure an easily accessible, predictable, fixed rate, low tax regime for shipping companies, recommended the introduction of the Tonnage Tax Scheme in India, which was similar to, and adopted some of the best global practices prevalent.

Introduction

1. One of the significant policy measures introduced to boost the Indian shipping industry was the introduction of Tonnage Tax Scheme under Chapter XII-G of the Income-tax Act, 1961 (the “Act”). The Tonnage Tax Scheme offers an alternative method of taxation for qualifying shipping companies, shifting from the conventional method of computation of income to a presumptive tax regime based on the net tonnage of ships operated. This regime was introduced by Finance (No. 2) Act, 2004 and became applicable from Assessment Year 2005-06. Prior to the introduction of Chapter XII-G, taxes of shipping companies were computed under the normal provisions of the Act. Certain shipping companies were eligible for a special deduction under section 33AC of the Act. The Indian shipping companies faced a stiff competition and sluggish growth vis-a-vis foreign shipping lines. The Ministry of Shipping constituted an Expert Committee headed by Shri Rakesh Mohan to look into the taxation of the shipping sector and also taxation regime of Indian shipping industry vis-a-vis foreign shipping industry. The Rakesh Mohan Committee in its report of January, 2002, in order to ensure an easily accessible, predictable, fixed rate, low tax regime for shipping companies, recommended the introduction of the Tonnage Tax Scheme in India, which was similar to, and adopted some of the best global practices prevalent.

2. It was designed to provide Indian shipping companies a level playing field with global competitors, many of whom already enjoyed similar tax regimes in their respective countries. By introducing a tax system based on the tonnage of ships rather than net profits, the Government of India sought to provide a stable, predictable, and investor- friendly tax framework. This scheme offers several benefits:

• Lower and predictable tax liability, reducing uncertainties for shipping businesses.

• Encouragement for fleet expansion, making Indian ships more competitive globally.

• Simplified tax compliance, by replacing complex calculations with a fixed tax rate based on tonnage.

However, until now, the Tonnage Tax Scheme was available only to ships registered or licensed under the Merchant Shipping Act, 1958.

Proposed Amendments to Tonnage Tax Scheme by Finance Bill, 2025.

3. India has an extensive network of inland waterways, comprising rivers, canals, backwaters, and creeks, extending over 14,500 kilometers. These waterways hold significant potential for cost-effective and environmentally friendly transportation, which can reduce the burden on road and rail networks. However, the sector has remained under utilized due to fragmented regulations and infrastructure challenges. The Inland Vessels Act, 2021, was enacted to modernize and standardize the governance of inland water transport across India. It introduces uniform regulations for vessel registration, operation, and safety, replacing the outdated Inland Vessels Act, 1917. The Act promotes a seamless inter-state movement, enhances safety and pollution control, and encourages private sector investment by providing a clear legal structure and incentives for inland water transport.

4. The recent amendments proposed in the Finance Bill, 2025, to Chapter XII-G of the Income-tax Act, 1961, are closely linked to the enactment of the Inland Vessels Act, 2021. Representations were received to extend Tonnage Tax Scheme to inland vessels to promote inland water transportation industry. These proposed amendments aim to extend the benefits of the Tonnage Tax Scheme to inland vessels. By extending the tonnage tax benefits to inland vessels, the government aims to:

• Promote Investment: Encourage private sector investment in the inland water transport sector by offering a favourable tax regime.

• Enhance Infrastructure: Facilitate the growth of a robust fleet of inland vessels, improving the country’s transportation infrastructure.

• Economic Development: Boost trade and commerce through more efficient and cost-effective inland water transport, contributing to overall economic growth.

These amendments are proposed to take effect from April 1, 2026, corresponding to the Assessment Year 2026-27 and subsequent years.

Chapter XII-G: An Overview

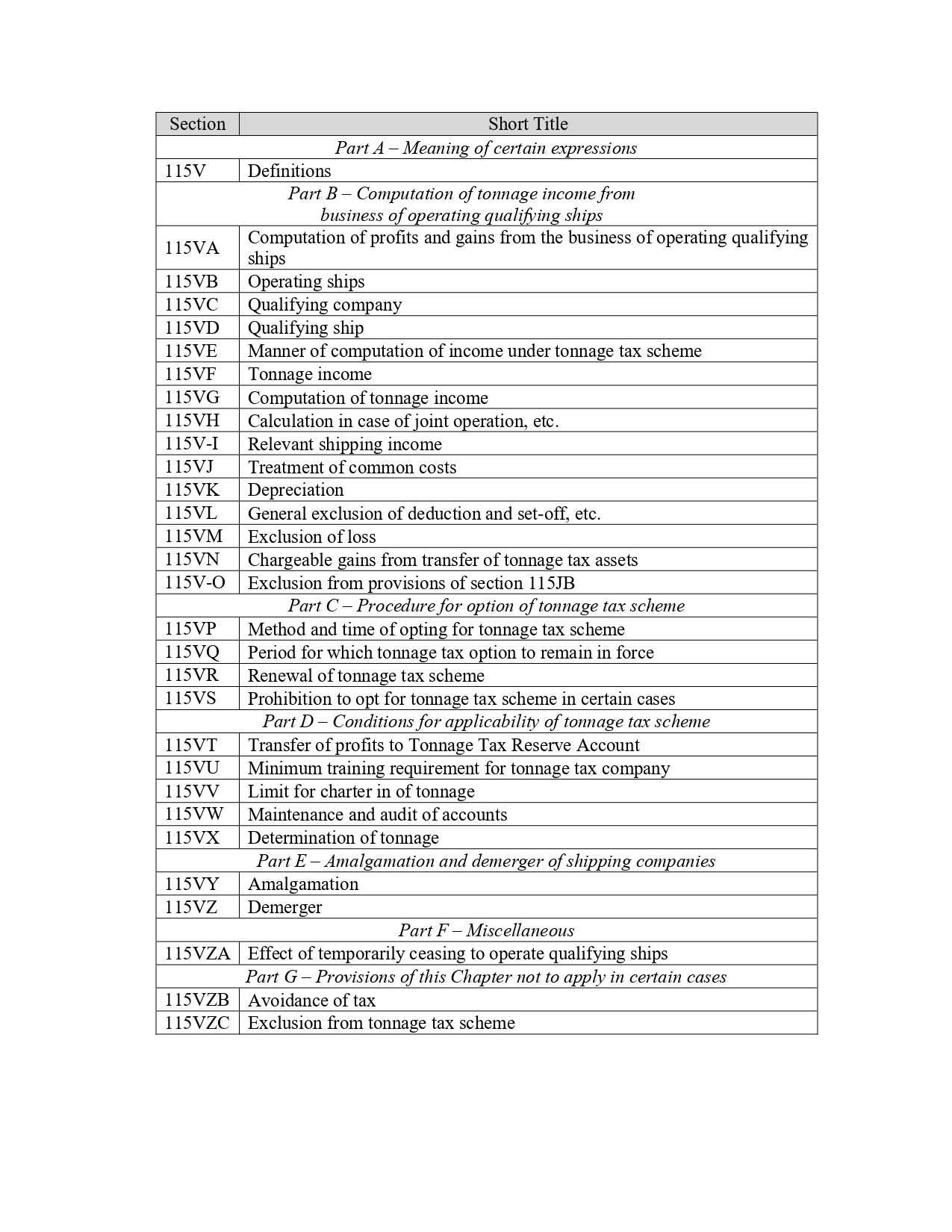

5. Chapter XII-G is divided into 7 parts and consists of 30 sections, providing a comprehensive code for taxation of eligible shipping companies.

The proposed amendments of Finance Bill, 2025 have been italicised for emphasis in the ensuing paragraphs.

Definitions (Section 115V)

6. In section 115V, the Finance Bill, 2025 proposes to amend the definitions of “bareboat charter”, “bareboat charter-cum-demise”, “pleasure craft” and “qualifying ship” to include “inland vessel”. The amended definitions are given below:

(a) “bareboat charter” means hiring of a ship or inland vessel, as the case may be, for a stipulated period on terms which give the charterer possession and control of the ship or inland vessel, as the case may be, including the right to appoint the master and crew;

(b) “bareboat charter-cum-demise” means a bareboat charter where the ownership of the ship or inland vessel, as the case may be, is intended to be transferred after a specified period to the company to whom it has been chartered.

(ea) “inland vessel” shall have the same meaning as assigned to it in clause (q) of section 3 of the Inland Vessels Act, 2021;

Section 3(q) of the Inland Vessel Act, 2021 defines “inland vessel” to include any mechanically propelled inland vessel or non-mechanically propelled inland vessel which is registered and plying in inland waters, but does not include-

i. a fishing vessel registered under the Merchant Shipping Act, 1958 or the Marine Products Export Development Authority Act, 1972; and

ii. any vessel that are specified as not to be inland vessels by notification by the Central Government.

(f) “pleasure craft” means a ship or inland vessel, as the case may be, of a kind whose primary use is for the purposes of sport or recreation.

(h) “qualifying ship” means a ship or inland vessel, as the case may be, referred to in section 115VD.

Eligibility to invoke the Tonnage Tax Scheme

7. A company must meet multiple conditions to be eligible for the Tonnage Tax Scheme. These conditions relate to the nature of the company, its business activities, and the type of ships or inland vessel operated. The relevant sections to determine eligibility include 115VB, 115VC, 115VD, and 115VP. All these sections are proposed to be amended to include inland vessels.

I. The company must be operating ships or inland vessels (Section 115VB)

7.1. A company is eligible for the Tonnage Tax Scheme only if it is operating a ship or inland vessel, as the case may be. A company is considered to be operating ships or inland vessel if:

• It operates a ship or inland vessel it owns.

• It operates a ship or inland vessel that is chartered in.

• It operates a part of a ship or inland vessel through arrangements like includes slot charter, space charter, or joint charter arrangements.

A company is not considered to be operating a ship or inland vessel if:

• It has chartered out a ship or inland vessel under a bareboat charter-cum-demise agreement.

• It has chartered out a ship or inland vessel under a bareboat charter for more than three years.

II. The company must be a qualifying company (Section 115VC)

7.2. To qualify for the Tonnage Tax Scheme, the company must be a qualifying company, i.e. meet all of the following conditions:

1. It must be an Indian company.

2. The place of effective management (POEM) must be in India – The company must be controlled and managed from India. This means:

Decisions of the board of directors or executive directors must be taken in India, or

If the board of directors merely approves decisions made by executive directors, or other officers of the company, those executives or officers must function from India.

3. It must own at least one qualifying ship – A company that does not own a ship or inland vessel and functions solely on chartered ships or inland vessel does not qualify for the scheme.

4. The main business must be operating ships – The company’s primary business must be operating ships, and not merely ancillary activities.

III. The company must operate qualifying ship (Section 115VD)

7.3. A “qualifying ship” is a ship or inland vessel, that meets all the following conditions:

• It must be a seagoing ship or a vessel or inland vessel of net tonnage of at least 15 tons.

• In case of a ship, it must be registered under the Merchant Shipping Act, 1958 or, if registered outside India, it must have a license issued by the Director-General of Shipping. In case of an inland vessel, it must be registered under the Inland Vessels Act, 2021

• It must have a valid certificate indicating its net tonnage. Valid certificate is explained under section 115VX(1)(b).

Certain ships are specifically excluded from the Tonnage Tax Scheme. The following do not qualify:

1. Seagoing ship or vessel or inland vessel primarily used for goods or services normally provided on land. Ships that do not perform maritime functions such as cargo transport, passenger transport, or offshore activities are excluded. Example floating hotels, restaurants, casinos, offshore power plants / factories.

2. If a ship is being used as a floating version of a land-based service, it does not qualify for the tonnage tax scheme.

3. Fishing vessels.

4. Factory ships (used for processing fish or other produce).

5. Pleasure crafts (ships used for personal or recreational purposes).

6. Harbour and river ferries.

7. Offshore installations (e.g., oil rigs).

8. Qualifying ship converted into fishing vessels for more than 30 days in a year.

IV. The company must opt for the scheme (Section 115VP)

7.4. Even if a company meets the above conditions, it must actively opt for the Tonnage Tax Scheme by making an application to the Joint Commissioner of Income-tax (JCIT) in the prescribed form and manner. The application is to be made within 3 months of incorporation, or becoming a qualifying company, as the case may be. A company located in an International Financial Services Centre (IFSC) and claiming deductions under section 80LA may apply within three months from the date on which the deduction ceases. The JCIT shall examine the application and approve or reject the application within one month. The proposed amendment extends this time period to three months from the end of the quarter in which the application was received. This gives tax authorities more time to verify applications, conduct physical inspections if required, and make an informed decision.

Once approved, the scheme applies from the assessment year in which the option is exercised and remains in effect for a period of 10 years from the date the option is exercised.

Computation of Income and Tax Under the Tonnage Tax Scheme

8. The computation of income under the Tonnage Tax Scheme is distinct from the regular computation of income under the Act. Instead of taxing actual profits, the scheme provides for a presumptive taxation mechanism, where income is determined based on the net tonnage of qualifying ships.

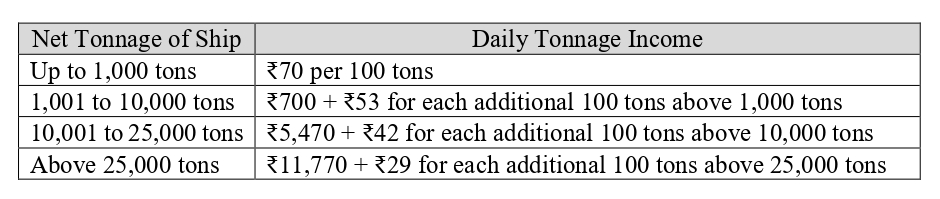

The relevant provisions for computation of income are contained in Sections 115VE to 115VO. The Finance Bill, 2025 does not propose any amendment to computation of income. The slab for inland vessels remains the same as for ships.

I. Computation of Income Under Tonnage Tax Scheme (Section 115VE, 115VF, 115VG)

8.1. The profits from the business of operating qualifying ships are to be computed only under the Tonnage Tax Scheme if the company has opted for it. The tonnage tax business giving rise to shipping income is treated as a separate business, distinct from any other business carried on by the company, and profits from shipping income are computed independently. The tonnage income of a company is computed based on the net tonnage of each qualifying ship it operates as under:

Step 1: Round off net tonnage of qualifying ship

8.1.1. The net tonnage of a qualifying ship is rounded off to the nearest multiple of 100 tons, ignoring kilograms. If the last figure is 50 tons or more, it is rounded up to the nearest multiple of 100. If the last figure is less than 50 tons, it is rounded down to the nearest multiple of 100.

Step 2: Compute daily tonnage income

8.1.2. The daily tonnage income is computed using the following slab:

Step 3: Multiply daily tonnage income by the number of operational days

8.1.3. The tonnage income of each ship is computed as under:

Daily tonnage income x Number of days in previous year

If the ship or inland vessel is operated as qualifying ship for only for part of the year, tonnage income is calculated for the number of days in the part of the year when qualifying ship was operational.

Step 4: Aggregate the tonnage income from all ships

8.1.4. The tonnage income of all qualifying ships operated by the company is aggregated to determine the total tonnage income of the company.

No separate expenses, deductions or set-offs are permitted while computing tonnage income. The tonnage income computed under the scheme is deemed to be the business income chargeable under the head “Profits and Gains of Business or Profession”. The relevant shipping income referred under section 115V-I once taxed under the scheme shall not be separately taxed.

II. Income Computation for Joint Operation of Ship (Section 115VH)

8.1. If a qualifying ship is operated jointly by two or more companies, then each company is taxed based on its proportionate share in the qualifying ship’s operations. The income of each company is computed as if it were the sole operator of the qualifying ship.

III. Meaning of “Shipping Income” covered under the Scheme (Section 115V-I)

8.2. The Tonnage Tax Scheme applies only to relevant “shipping income”. The shipping income is excluded from the taxation under normal provisions of the Act and taxed under the Tonnage Tax Scheme. “Shipping income” includes:

A: Profits from Core Activities: The Core Activities of a shipping company includes:

1) Activity of operating qualifying ships.

2) Following other ship-related or inland vessel-related activities:

Shipping contracts of providing pooling arrangements.

Shipping contracts of affreightment (transportation agreements).

On-board and on-shore activities of passenger ships such as fares, food and beverages.

Shipping trades of slot charters, space charters, joint charters, feeder services, leasing of containers for container shipping.

B: Profits from Incidental Activities: Incidental activities are activities which are incidental to the core activities as prescribed under rule 11R of the Income-tax Rules, 1962. These include:

1) Maritime consultancy charges.

2) Income from loading or unloading of cargo.

3) Ship management fees or remuneration received for managed vessels.

4) Maritime education or recruitment fees.

Income from incidental activities is included in relevant shipping income only if it does not exceed 0.25% of turnover from core activities. If it exceeds this limit, the excess is taxed under normal provisions of the Act.

The activities noted above, the profits of which are eligible for the Tonnage Tax Scheme are referred as Tonnage Tax Activities. If a tonnage tax company operates any ship or inland vessel, which is not a qualifying ship, the income attributable to such non- qualifying ship shall be computed under normal provisions of the Act.

IV. Treatment of Common Costs (Section 115VJ)

8.3. If a tonnage tax company also carries on non-tonnage tax business, common costs must be allocated reasonably. Depreciation on assets used for both businesses must be allocated in proportion to their use.

V. Depreciation for Tonnage Tax Companies (Section 115VK)

8.4. Depreciation is not separately allowed on qualifying ships covered under the Tonnage Tax Scheme. The book written-down value (WDV) of block of assets being ships or inland vessels as on the first day of first previous year of the Scheme is divided into two blocks:

Qualifying assets (tonnage tax business).

Other assets (other business).

This division is done in the ratio of book WDV of the qualifying ships (qualifying assets) and book WDV of non-qualifying ships (other assets). The block of qualifying assets is treated as a separate block. If an asset moves from tonnage tax business to normal tax business or vice-versa, its book WDV is transferred accordingly. “Book WDV” means the WDV as appearing in the books of account.

Even though depreciation is not allowed on qualifying assets under the scheme but each year, the WDV is reduced as if the depreciation is allowed. Maintaining a separate block for qualifying assets also helps in determining capital gains on sale of qualifying assets under section 115VN.

VI. Exclusion of Deductions, Set-Offs and Losses (Section 115VL, 115VM)

8.5. Any loss, allowance or deduction under Sections 30 to 43B (e.g., rent, repairs, insurance, depreciation, interest) shall be deemed to have been fully allowed in that previous year. No deductions under Chapter VI-A are allowed against tonnage income. Even in case where there are losses from operating qualifying ships in the books, such losses cannot be set-off against other income, and cannot be carried forward. Further, as per section 115VG(6), losses from other business cannot be set-off against tonnage income.

As per section 115VM, losses from operating qualifying ships pertaining to period prior to opting for the Tonnage Tax Scheme shall be deemed to be fully set off when it opts for the scheme i.e., such losses are wiped and cannot be set off against other business also.

VII. Treatment of Capital Gains on Sale of Qualifying Ship (Section 115VN)

8.6. If a capital asset forming part of block of qualifying asset is sold, the capital gains are computed under the normal provisions of section 45 to 51. The WDV of such qualifying asset shall be the WDV computed under the Tonnage Tax Scheme.

VIII. Minimum Alternate Tax (MAT) not Applicable (Section 115V-O)

8.7. The book profits from shipping income taxed under the scheme are exempt from applicability of MAT under section 115JB.

Compliance Requirements Under the Tonnage Tax Scheme

9. Once a company opts for the Tonnage Tax Scheme, it must comply with strict conditions to retain its eligibility. Non-compliance can lead to exclusion from the scheme or additional tax liabilities. The key compliance provisions are contained in Sections 115VT, 115VU, 115VV, 115VW, 115VX, 115VS and 115VZA.

I. Transfer of Profits to Tonnage Tax Reserve Account (Section 115VT)

9.1. A tonnage tax company must transfer at least 20% of its book profit from tonnage tax activities to a Tonnage Tax Reserve Account (TTRA) each year and utilize the reserve within 8 years:

a) For acquiring a new ship or inland vessel for business; and

b) Until the acquisition of such new ship or inland vessel, for any other business purpose of operating qualifying ships, but not for:

Distribution as dividends or profits.

Remittance outside India.

Creating any asset outside India.

“New ship or inland vessel” includes pre-owned ships only if such ship or inland vessel was never owned by a person resident in India. Therefore, purchase of second-hand ships or inland vessels owned only by foreign entities qualifies as acquisition under this section.

Consequences of failure to utilise the reserve: If the company fails to utilise the reserve as aforesaid, or transfers / sells the acquired ship or inland vessel before the expiry of 3 years from end of the previous year in which it was acquired, the following shipping income shall be ineligible for the Tonnage Tax Scheme and taxed under the normal provisions of the Act:

MR

Taxable Income = —– × (SI – TI)

TR

MR = Misutilised / unutilised reserve amount of Relevant Year TR = Total reserve created in Relevant Year

SI = Total shipping income of the Relevant Year

TI = Tonnage income already taxed in the Relevant Year Relevant Year = Year in which the reserve was created

Consequences of failure to transfer funds to TTRA: If the company fails to transfer 20% of the book profits from tonnage tax activities to TTRA as aforesaid, the following shipping income shall be ineligible for the Tonnage Tax Scheme and will be taxed under the normal provisions of the Act:

Shortfall

Taxable Income = ——— × SI

20% of BP

Shortfall = Shortfall in transfer to reserve

BP = Book profits from shipping activities

SI = Total shipping income

In case a company fails to transfer 20% of its book profit from shipping activities to TTRA for two consecutive years, the company loses eligibility for the Tonnage Tax Scheme. From the financial year following the second year of failure, its income shall be taxed under normal provisions of the Act.

II. Minimum Training Requirement (Section 115VU)

9.2. A tonnage tax company must train trainee officers in accordance with guidelines framed by the Director-General of Shipping. The company must obtain a certificate from the Director-General of Shipping confirming compliance with the training requirements. The certificate must be attached with the return of income under Section 139. If the company fails to comply for five consecutive years, it shall be ineligible for the Tonnage Tax Scheme from the beginning of the following year.

III. Limit for Chartering-in of Tonnage (Section 115VV)

9.3. The Tonnage Tax Scheme is meant primarily for qualifying ship-owning companies. However, companies may charter-in qualifying ships subject to certain limitations. The net tonnage of chartered-in qualifying ships cannot exceed 49% of the total net tonnage operated by the company in any financial year. This percentage is calculated on an average basis over the financial year in accordance with formula prescribed under rule 11S of the Income-tax Rules, 1962. If the limit of ships or inland vessels chartered-in exceeds 49% in a single year, the company’s tonnage tax option will not apply for that year, and its income will be taxed under normal provisions of the Act. If the limit is breached for two consecutive years, the company shall be ineligible for the Tonnage Tax Scheme from the beginning of the following year.

A ship or inland vessel chartered-in under a bareboat charter-cum-demise is not considered in the charter-in for this section.

IV. Maintenance and Audit of Accounts (Section 115VW)

9.4. A qualifying company must maintain separate books of account for its tonnage tax business and furnish an audit report in Form 66 from an accountant before the due date specified under section 44AB.

V. Determination of Tonnage of Ships or Inland Vessels (Section 115VX)

9.5. The tonnage of a ship or inland vessel for the purposes of the Tonnage Tax Scheme is determined on the valid certificate issued under the Merchant Shipping Act, 1958, or the Convention on Tonnage Measurement of Ships, 1969, or Inland Vessels Act, 2021, as the case may be. In the case of ships registered outside India, the tonnage shall be determined based on the license issued under Sections 406 or 407 of the Merchant Shipping Act, 1958, or any other evidence as may be accepted by the Director-General of Shipping.

VI. Prohibition on Re-Entering the Scheme (Section 115VS)

9.6. If qualifying company voluntarily opts out of the Tonnage Tax Scheme or becomes ineligible due to non-compliance of section 115VT, 115VU, 115VV, or an order is passed under section 115VZC, it shall be barred from re-entering the scheme for 10 years.

VII. Effect of Temporarily Ceasing to Operate Qualifying Ships (Section 115VZA)

9.7. If a company temporarily ceases to operate a qualifying ship, it shall still be deemed to be operating that qualifying ship for the purposes of Chapter XII-G. Thus, any short-term disruptions in operations, such as repairs or maintenance, etc. do not affect a company’s tonnage tax status. However, if a qualifying company continues to operate a ship or inland vessel which temporarily ceases to be a qualifying ship, such ship or inland vessel shall not be considered as a qualifying ship for the purposes of this Chapter.

Transfer Pricing and Anti Abuse Provisions

10. The tonnage tax scheme, being a presumptive taxation regime, is susceptible to potential abuse through artificial income shifting, related-party transactions, and tax avoidance arrangements.

I. Transfer of Goods or Services within the Same Company [Section 115VI(7)]

10.1. Section 115VI(7) addresses the risk of shifting of income between tonnage tax business and non-tonnage tax businesses within the same company. It provides that where any goods or services are transferred between these businesses for consideration, which is not at arm’s length, the relevant shipping income shall be computed as if the transfer had occurred at market value and the Assessing Officer is authorized to determine the income on a reasonable basis.

II. Transfer of Income to Tonnage Tax Company [Section 115VI(8)]

10.2. Section 115VI(8) deals with excessive profits being artificially shifted to the tonnage tax company. If the AO finds that, owing to a close connection between the tonnage tax company and any another person, or due to any other reason, the business between them is so arranged that income earned by tonnage tax company exceeds what would ordinarily arise in an arm’s length transaction, the AO may recompute the relevant shipping income on a reasonable basis.

III. General Anti Avoidance Rules [Section 115VZB and 115VZC]

10.3. Section 115VZB contains a general anti-avoidance rule (GAAR) specific to the Tonnage Tax Scheme. It provides that if a tonnage tax company enters into a transaction or arrangement that results in a “tax advantage” for:

For a person other than a tonnage tax company, or

For the tonnage tax company in respect of its non-tonnage tax activities,then the benefits of the Tonnage Tax Scheme will not apply to such transaction or arrangement. An arrangement or transaction is said to result in a “tax advantage” if:

The determination or allocation of expenses, costs, or interest reduces taxable income or increases the loss from non-tonnage tax activities.

It the tonnage tax company produces profits under the tonnage tax regime more than what is ordinarily expected from tonnage activities.

In such cases, the AO may issue a show-cause notice calling for explanation. After providing an opportunity of being heard and obtaining approval from the Principal Chief Commissioner or Chief Commissioner, the AO may, by an order in writing, exclude the company from the Tonnage Tax Scheme. If exclusion is ordered, the tonnage tax option shall cease to be in force from the first day of the previous year in which the transaction or arrangement was entered into. However, if the company proves to the satisfaction of the AO that the transaction was a bona fide commercial transaction and not designed to obtain a tax advantage, the exclusion may not apply.

Conclusion

11. The extension of the Tonnage Tax Scheme to inland vessels is a significant policy shift which can boost India’s inland water transport sector. By aligning tax incentives with regulatory advancements under the Inland Vessels Act, 2021, the Finance Bill, 2025, seeks to simplify the taxation of inland water transport companies. This reform not only encourages the growth of a robust inland vessel fleet but also complements India’s broader infrastructure goals by promoting an eco-friendly and cost-effective mode of transportation.

Some Judicial Precedents

12. ACIT vs. West Asia Maritime Ltd. (TM) [2012] 16 ITR (T) 175 (Chennai – Trib.)

The law does not say that the ship should always do its voyage between international ports. The law does not say anything about the distance to be covered by ship in a single voyage. The law presumes that the benefit of tonnage tax scheme is available to all seagoing ships satisfying the condition where it is operated between Indian ports or between Indian ports and foreign ports. The operation of a sea going ship does not assume any different character only for the reason that the ship is operating between two Indian ports.

Held that the contention of the assessing authority that the ship was excluded from the ambit of tonnage tax scheme mainly for the reason that the ship was rendering services only between Indian ports, which would have also been rendered on land by road or rail, was too far-fetched. There was no such stipulation anywhere in law. The tonnage tax scheme does not distinguish ships operating in coastal waters and ships operating in international waters. There is no bar on the coastal shipping for the tonnage tax scheme.

13. CIT vs. Jaggon International Ltd. [2013] 214 Taxman 630 (Delhi)

Where assessee’s vessel was engaged in drilling operations in different places and was registered under Merchant Shipping Act, Assessing Officer rejected assessee’s claim holding that vessel ‘D’ was not a qualifying ship, but was an offshore installation – Offshore installations are fixed for a specific purpose and after finishing purpose are dismantled and shifted to other site – it was held to be a ‘qualifying ship’ under section 115VD eligible for tonnage tax scheme; it would not be an off-shore installation

14. ACIT vs. Four M Maritime (P.) Ltd. [2015] 152 ITD 557 (Chennai – Trib.)

Ship, transporting coal from one port to another within India, would be a qualifying ship for Tonnage Tax Scheme (TTS). If assessee was eligible for claiming TTS under Chapter- XIIG, then a disallowance under section 14A cannot be made.

[Source : AIFTP Journal-February, 2025]

About the Author: Details are awaited

Pdf file of article: Click here to Download

Posted on: March 25th, 2025

Leave a Reply