Chapter XXI – Penalties (Income-tax Act, 2025)

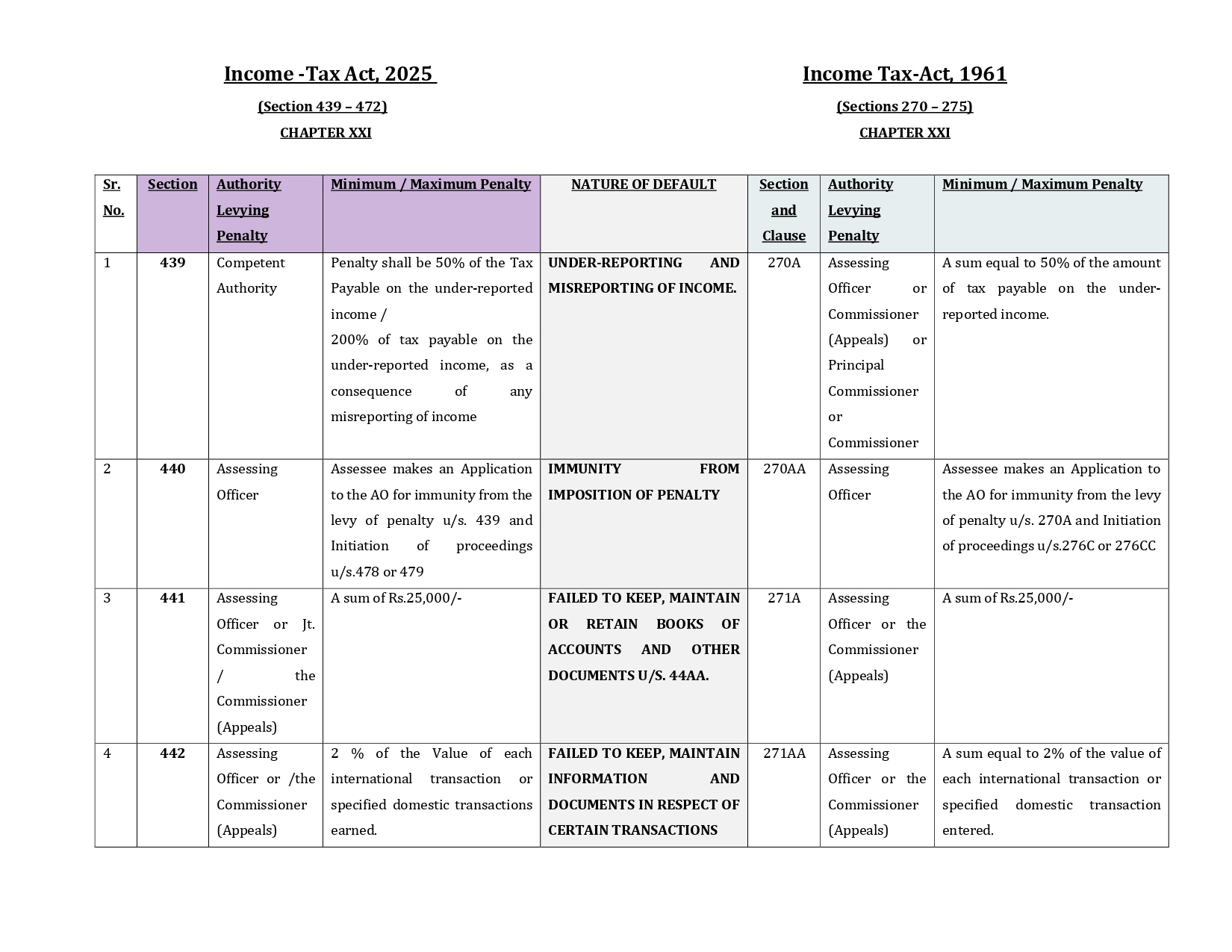

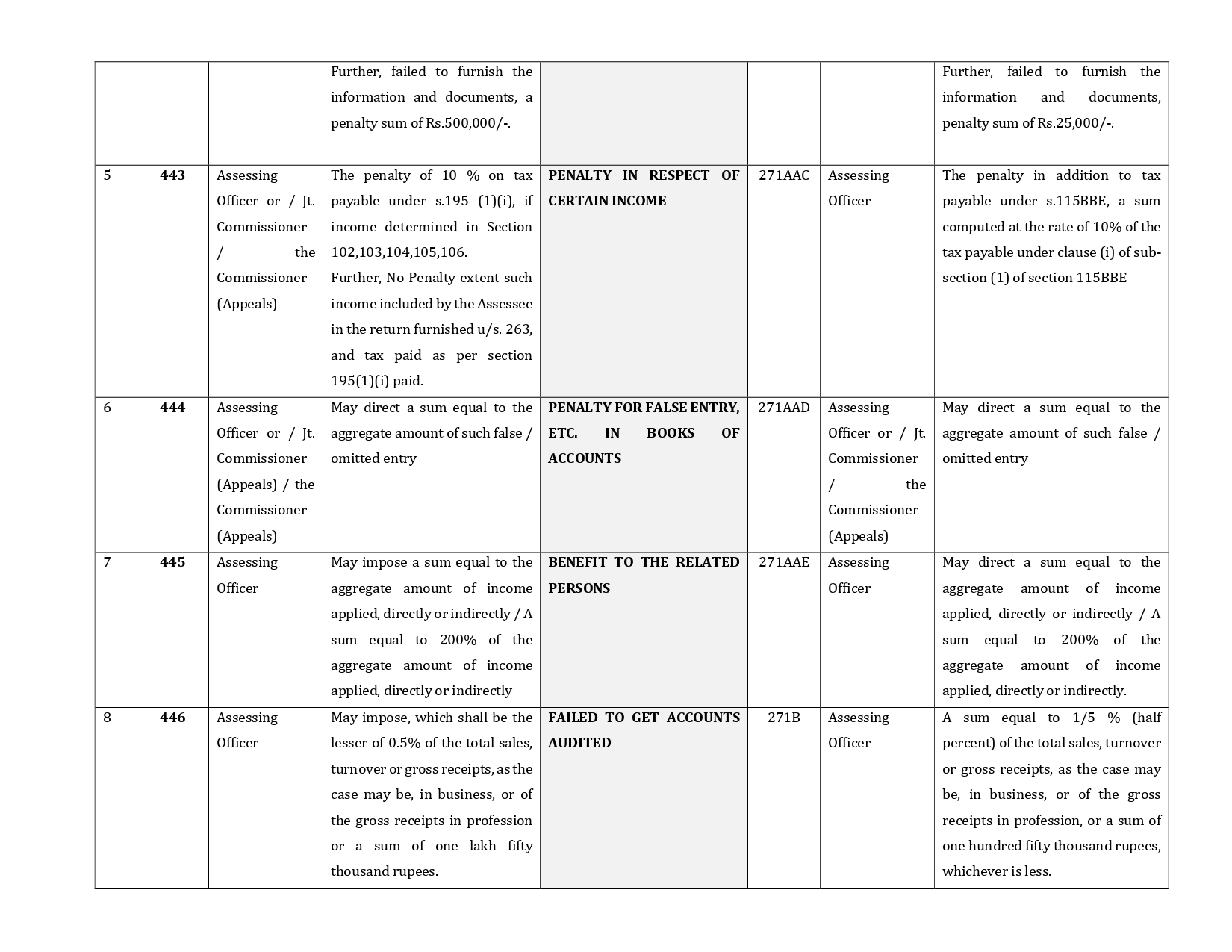

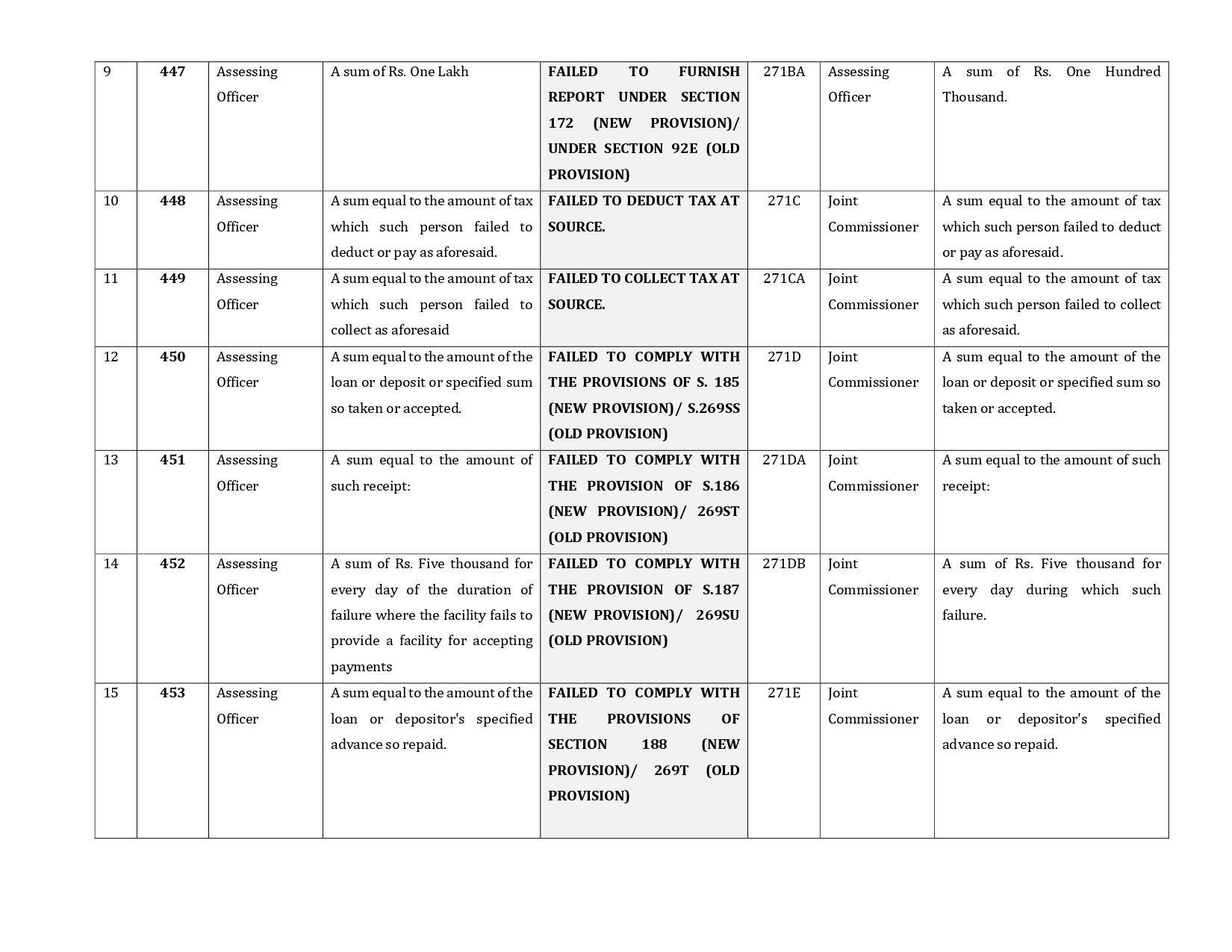

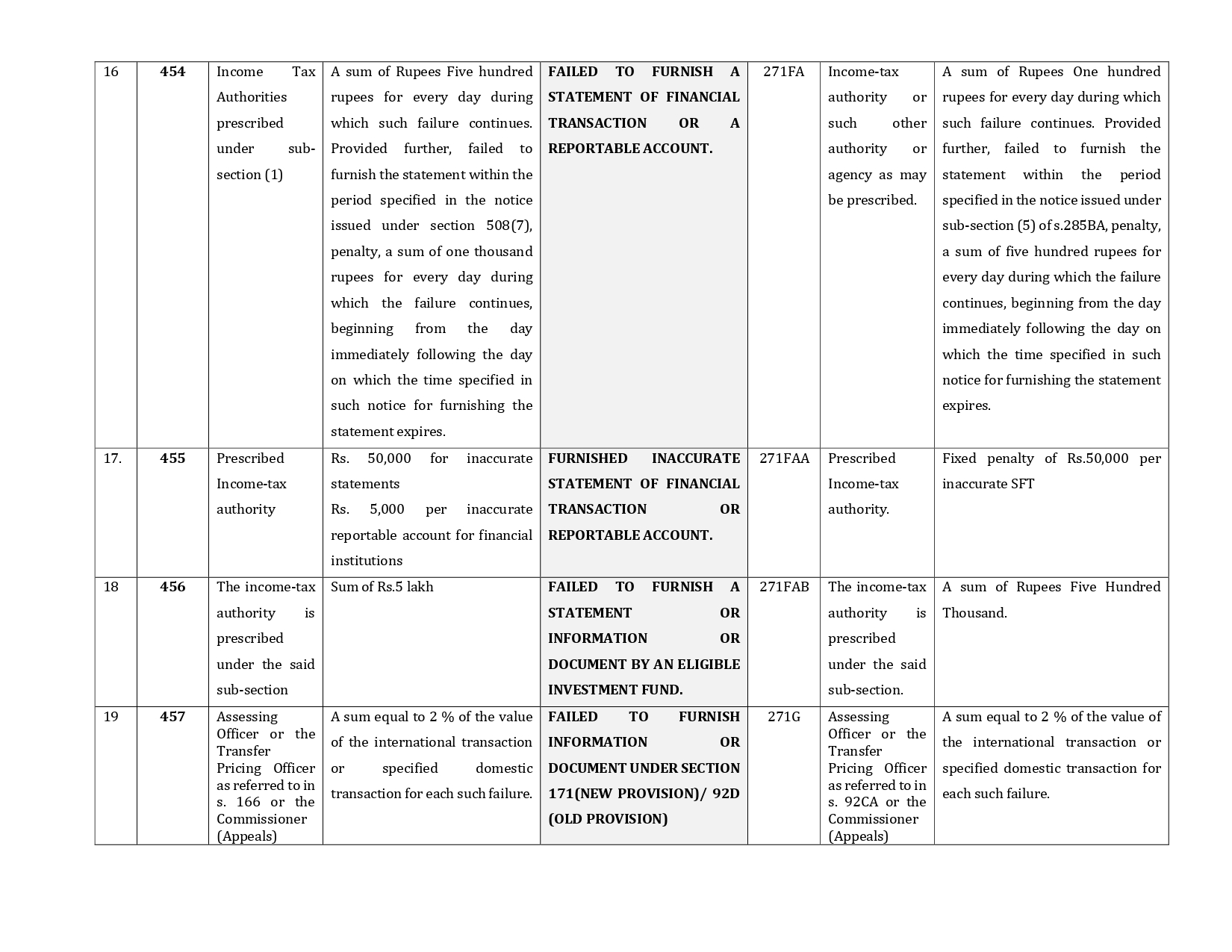

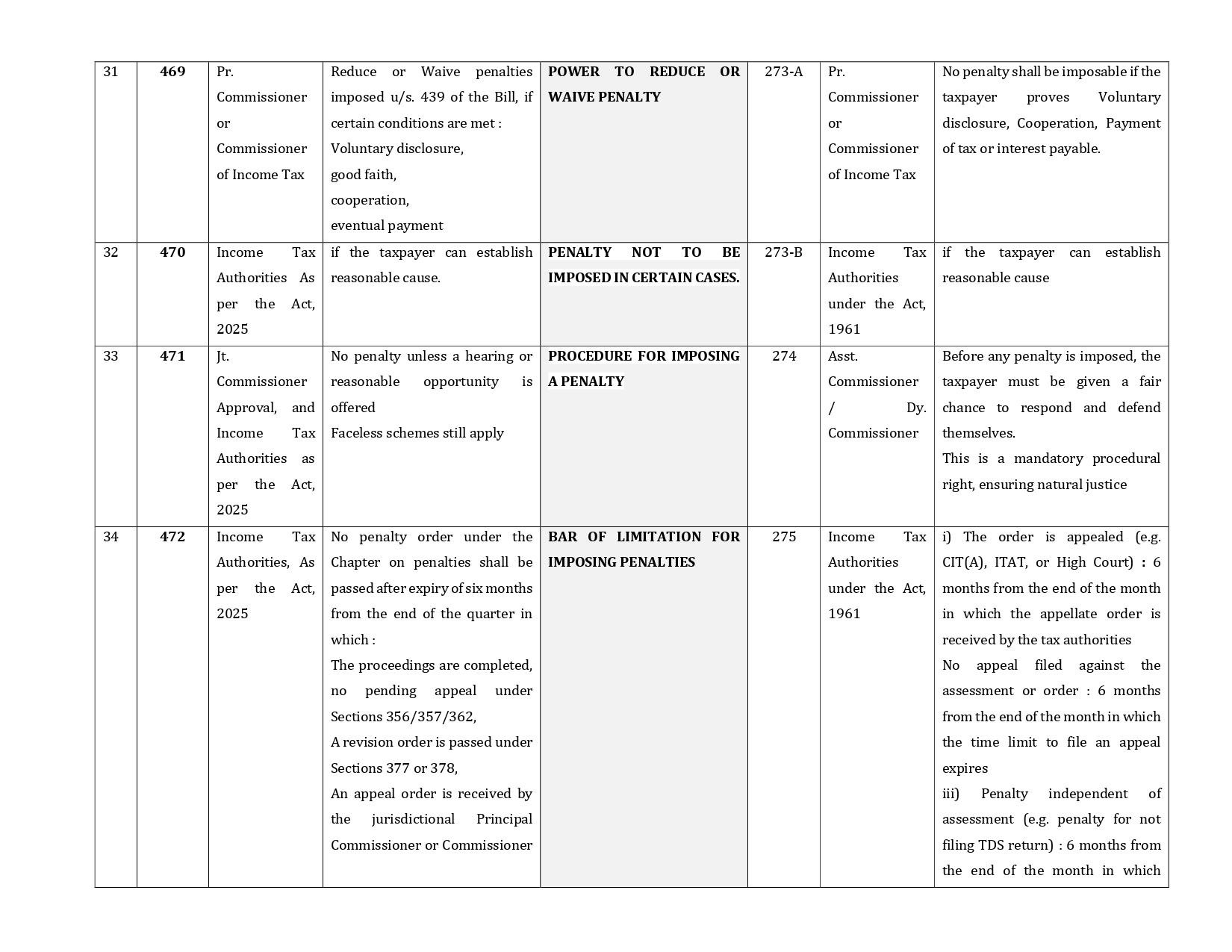

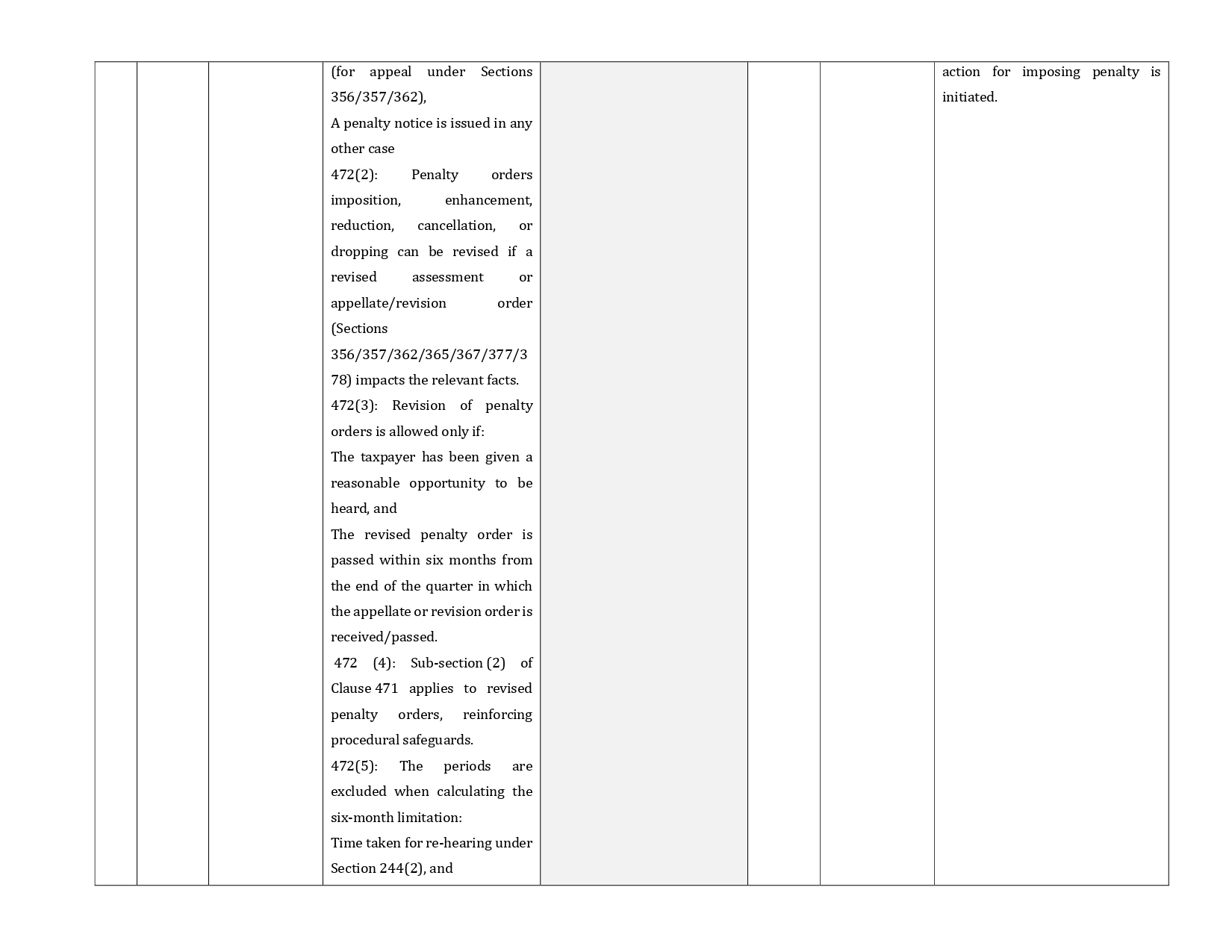

The Income-tax Act, 2025, replaces the Income-tax Act of 1961. Chapter XXI is the segment dedicated to penalties, making provisions for penal consequences arising from non-compliance with various tax requirements. It lays down the consequences for defaults such as failure to furnish returns, concealment of income, furnishing inaccurate particulars, or violation of procedural requirements. A key reform is the substitution of Section 275, which now provides a clear limitation period for passing penalty orders—calculated from the date of issue of the penalty notice, with a six-month cap from the end of the relevant quarter. Further, powers to impose penalties, earlier vested in the Joint Commissioner, have been delegated to Assessing Officers for quicker and more efficient administration.

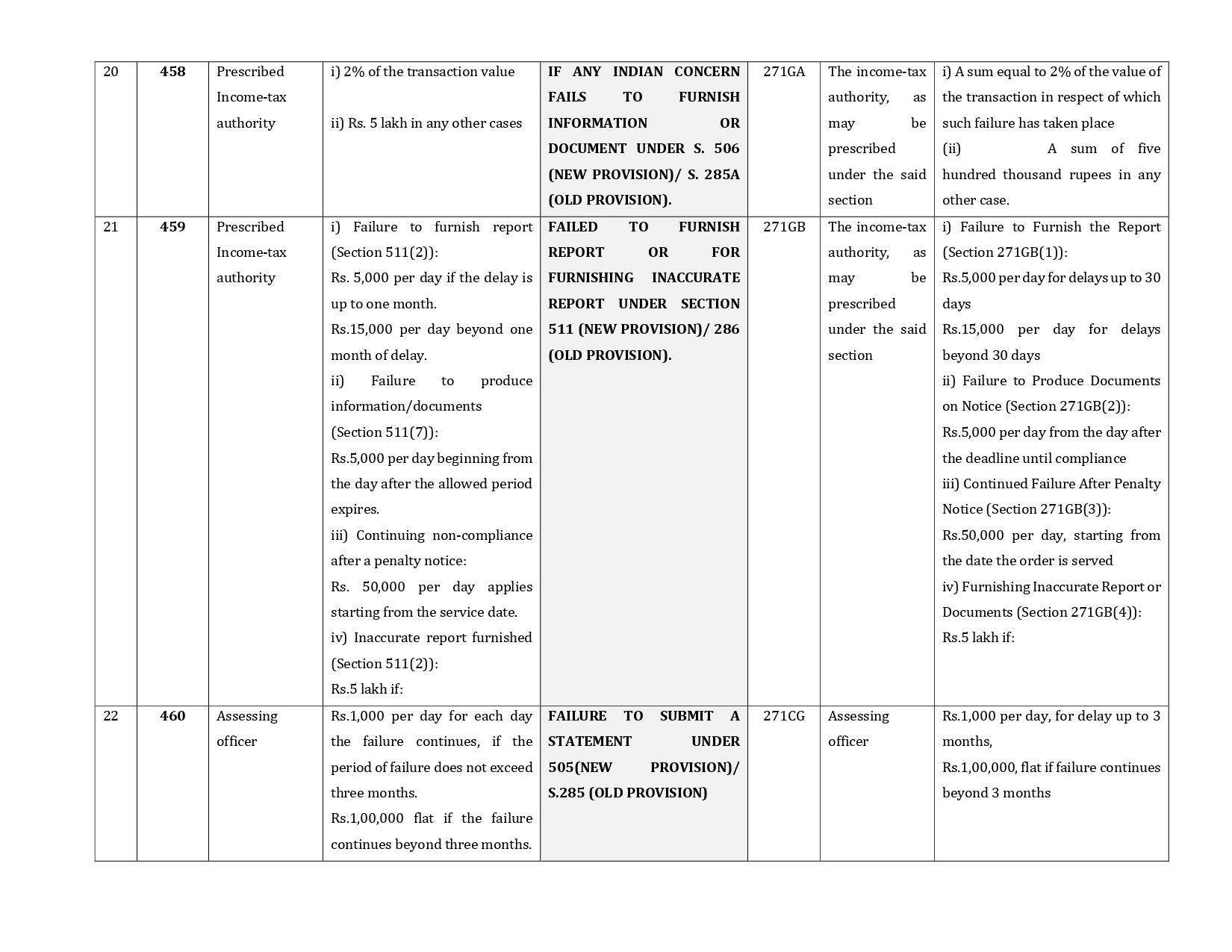

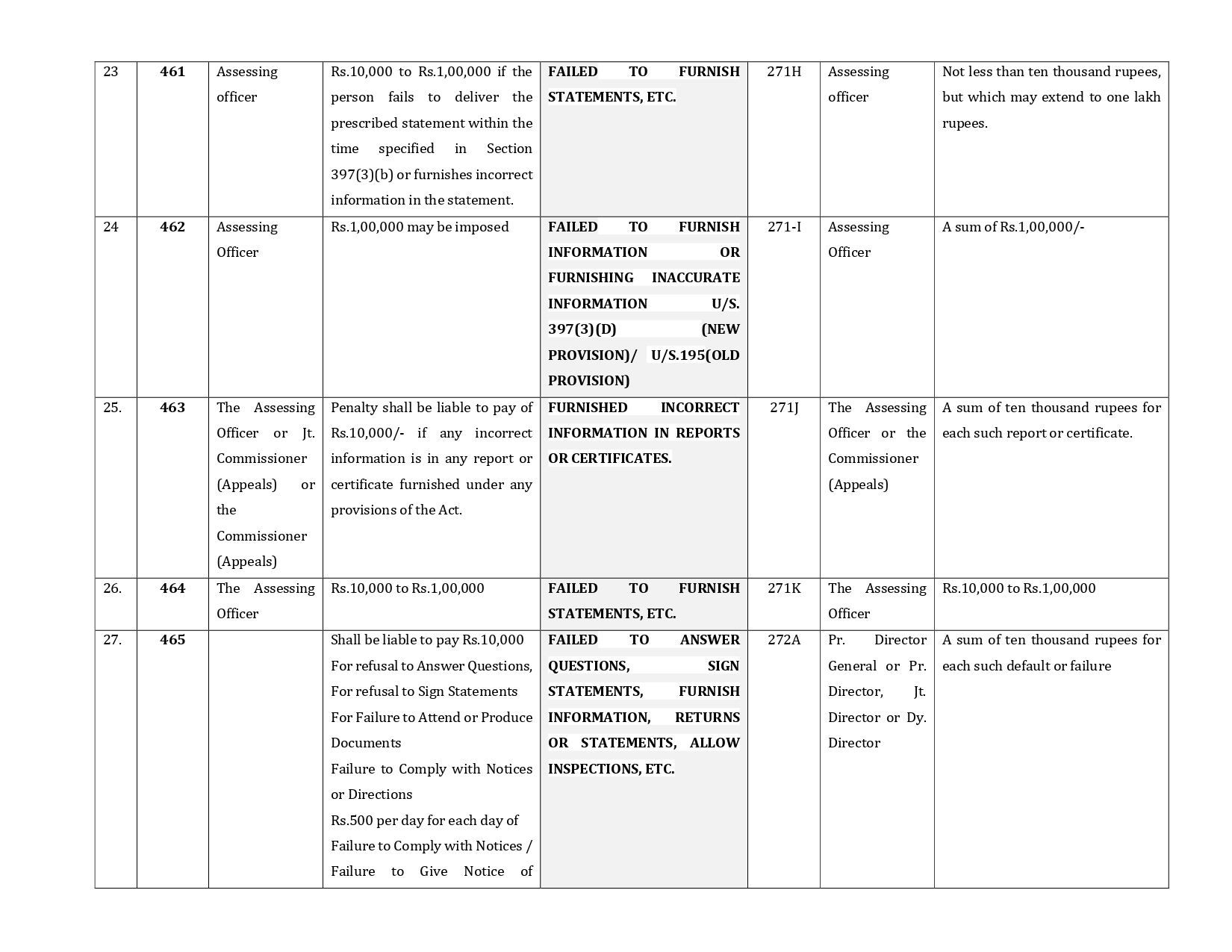

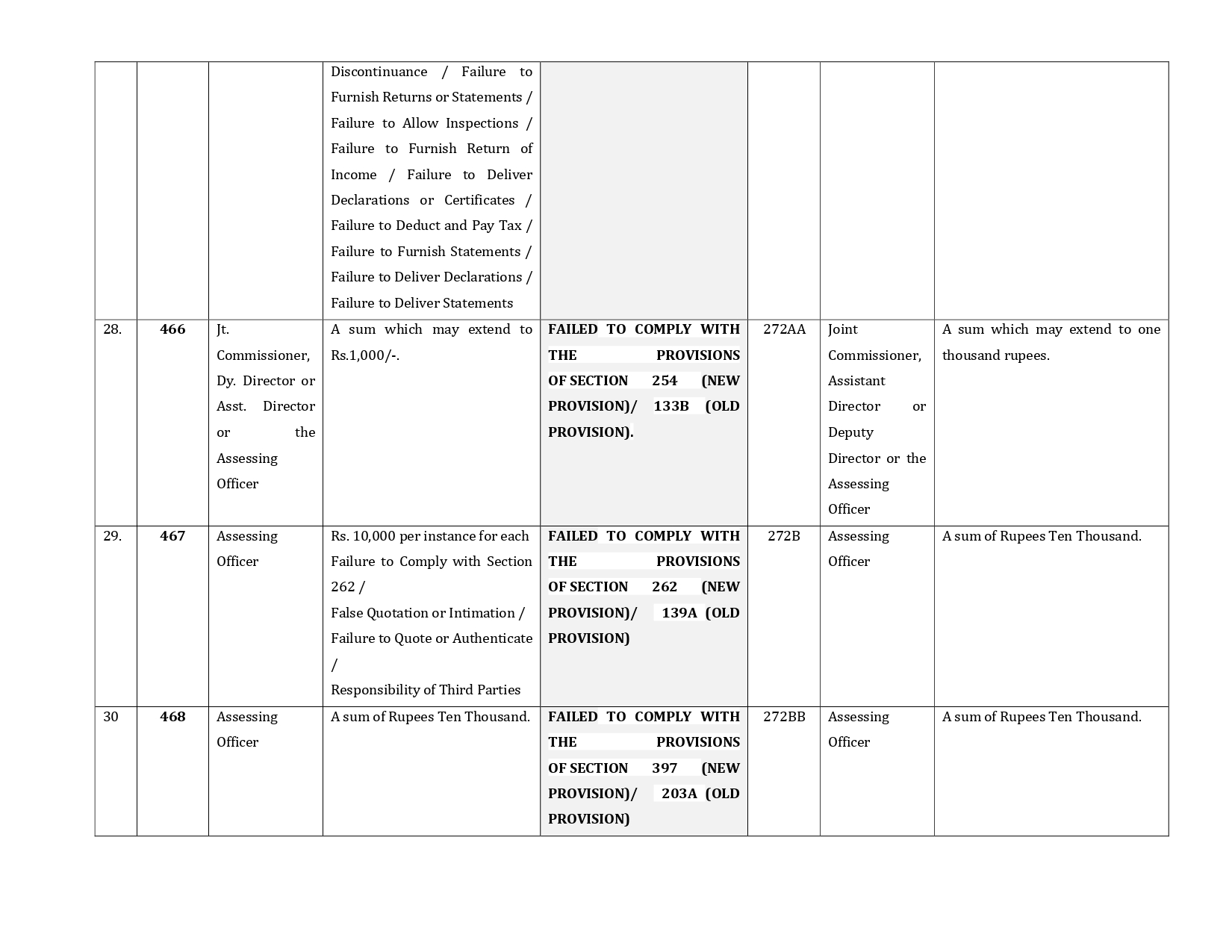

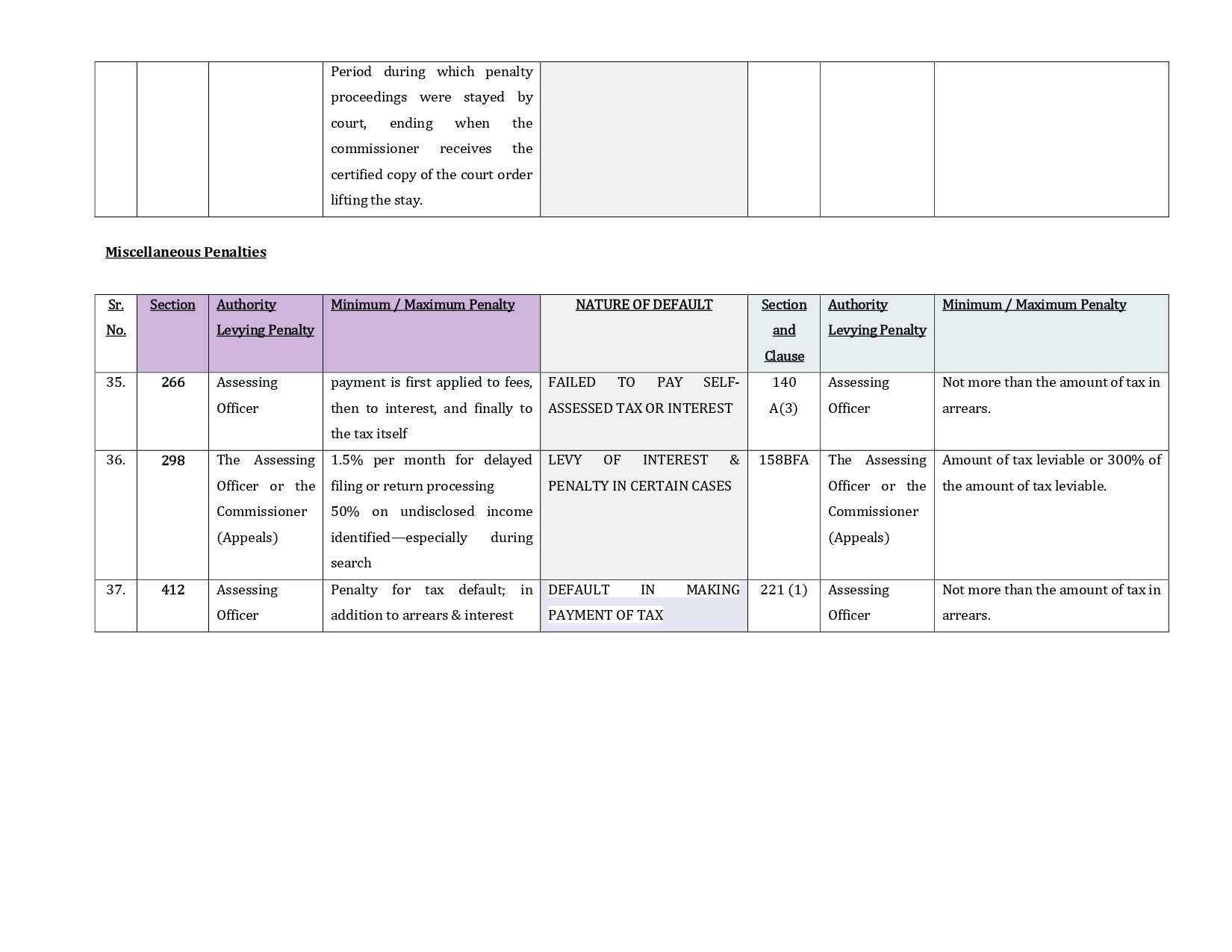

CORRESPONDING ANALYSIS OF PENALTY PROVISIONS UNDER THE INCOME TAX ACT, 2025

Conclusion:

The substitution of Section 275 in Chapter XXI of the Income-tax Act, 2025, introduces uniformity in limitation for passing penalty orders by fixing a clear starting point—the date of issuance of the penalty notice—and prescribing a six-month period from the end of the relevant quarter for completion. This uniform framework removes ambiguity, curtails prolonged litigation, ensures consistency in application across cases, and strengthens the principle of certainty in tax administration.

About the Author: Details are awaited

Pdf file of article: Click here to Download

Posted on: August 28th, 2025

very good work mam

VERY GOOD EFFORTS

Good Efforts Thanks!