Indian Migration – Overview

India has been a key contributor to global migration. Indians migrate for a variety of reasons such as better work opportunities, family reunification, higher education, access to a better quality of life such as better health, education and infrastructure and obtaining citizenship. The most popular destinations for Indian migrants include USA, UK, Canada, Malaysia, Singapore, Australia, Germany and the Gulf countries. India has a large population of highly skilled immigrants which contributes to the economy of the host countries where they migrate. Also, a large number of the emigrating Indians comprise of High Net Worth Individuals (‘HNWI’s’). The preferred destinations for HNWI’s are Europe, UAE, Singapore and USA. Further, since India does not allow dual citizenship, a considerable number of Indians have given up their citizenship in the past 12 years which is expected to multiply in the future years. Having said the above, starting life afresh in a new land is not an easy task compounded by the stringent income tax rules across the countries.

Indian Migration – Overview

India has been a key contributor to global migration. Indians migrate for a variety of reasons such as better work opportunities, family reunification, higher education, access to a better quality of life such as better health, education and infrastructure and obtaining citizenship. The most popular destinations for Indian migrants include USA, UK, Canada, Malaysia, Singapore, Australia, Germany and the Gulf countries. India has a large population of highly skilled immigrants which contributes to the economy of the host countries where they migrate. Also, a large number of the emigrating Indians comprise of High Net Worth Individuals (‘HNWI’s’). The preferred destinations for HNWI’s are Europe, UAE, Singapore and USA. Further, since India does not allow dual citizenship, a considerable number of Indians have given up their citizenship in the past 12 years which is expected to multiply in the future years. Having said the above, starting life afresh in a new land is not an easy task compounded by the stringent income tax rules across the countries.

Indian Migration – Overview

India has been a key contributor to global migration. Indians migrate for a variety of reasons such as better work opportunities, family reunification, higher education, access to a better quality of life such as better health, education and infrastructure and obtaining citizenship. The most popular destinations for Indian migrants include USA, UK, Canada, Malaysia, Singapore, Australia, Germany and the Gulf countries. India has a large population of highly skilled immigrants which contributes to the economy of the host countries where they migrate. Also, a large number of the emigrating Indians comprise of High Net Worth Individuals (‘HNWI’s’). The preferred destinations for HNWI’s are Europe, UAE, Singapore and USA. Further, since India does not allow dual citizenship, a considerable number of Indians have given up their citizenship in the past 12 years which is expected to multiply in the future years. Having said the above, starting life afresh in a new land is not an easy task compounded by the stringent income tax rules across the countries.

Steps to be taken by a person leaving India

• Planning of Residential Status: It is important to plan departure out of India to ensure that the residential status of the individual is Non-Resident (‘NR’) as per Income-tax Act, 1961 (‘ITA’) pursuant to relocation to an overseas country. This helps to limit taxability to “Indian income” only and any overseas income shall not be taxable in India in the year of departure (i.e. 1st April to 31st March).

• Bank accounts in India: One should refrain from holding multiple bank accounts after leaving the country. It is advisable to retain a maximum of two accounts and update contact details with the bank. Also, from a Foreign Exchange Management Act, 1999 (‘FEMA’) perspective, one is required to intimate bankers regarding change in status to “Non-Resident Indian” under FEMA and re-designate resident bank account to Non-Resident Ordinary (NRO) Account.

• Tax deduction rates for NR: The rates of deduction of TDS for NR’s is generally higher than rates applicable to Residents. Thus, one must inform the payer (Bank/Broker, etc.) regarding his/her change in residential status from Resident to NR for appropriate TDS deduction.

• Double Taxation Avoidance Agreement (DTAA): If a NR’s income is chargeable to tax in India and the foreign country in which he / she resides, such individual may claim benefit of the DTAA, if available. Where there is no DTAA or if the said income is taxable in both the countries, one may be eligible to claim ‘Foreign Tax Credit’ in the country of residence. A NR shall be required to obtain a ‘Tax Residency Certificate’ from his country of residence (i.e. foreign country) in order to claim the benefits of the DTAA.

• Reporting Obligations in India and foreign country: A NR shall be required to adhere to reporting obligations in India i.e. income tax return filing (if he / she derives taxable income in India), reporting of global bank accounts etc. as well tax filing obligations in the foreign country of which he / she is a tax resident.

• PAN Migration: When a person becomes NR, his PAN jurisdiction must be transferred from Domestic Taxation Ward to International Taxation Ward. This process of transfer is typically referred to as ‘PAN Migration’.

• Insurance Policies: One must keep the concerned insurance company informed about their residential status, new address and check whether the chosen plan will cover the country of residence. Further, no permission is required for payment of premium in India.

• Public Provident Fund: A NR can continue holding and making fresh investment in his / her existing PPF account, which was opened when he / she was a Resident. However, a NR cannot open a new PPF account on change of residential status from Resident to NR.

• Employee Provident Fund: A NR should be mindful regarding his / her Employee Provident Fund (‘EPF’) A/c in India. An EPF account becomes inoperative if the subscriber does not apply for withdrawal within 36 months of quitting the job and relocating to a foreign country. Thus, it is advisable to close down the EPF account within 3 years of going to a foreign country for an indefinite period of time.

Tax considerations on leaving India and becoming NR

Broadly, the key tax issues consist of change in residential status, taxability of global income, tax deduction at source, reporting and disclosure requirements in income tax return forms and outward remittances among others.

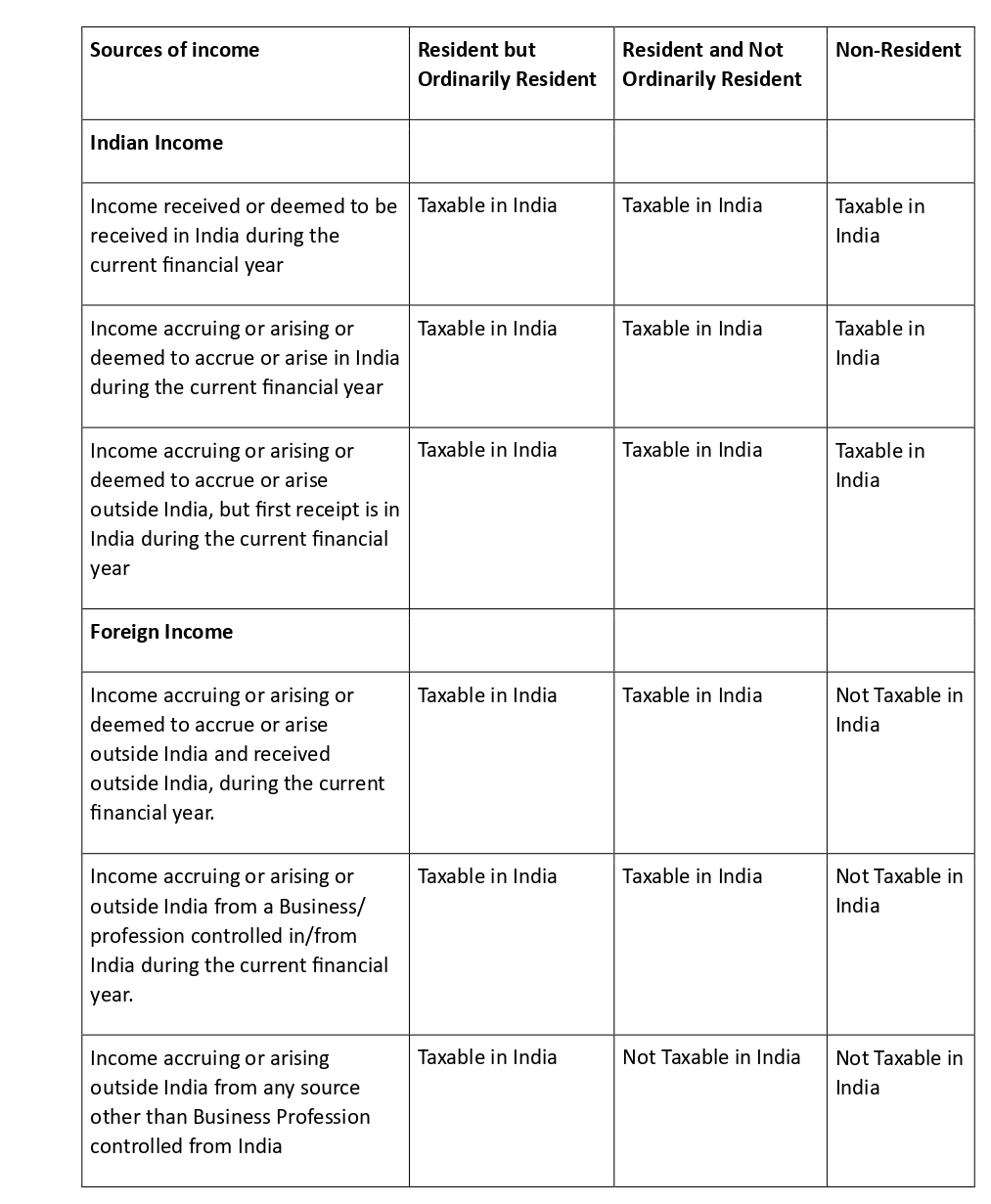

1. Scope of taxability in India under Section 5 of the ITA based on residential status:

• A “resident but ordinarily resident” pays tax in India on his entire world income, wherever accrued or received.

• A “not ordinarily resident” pays tax on taxable Indian income and on foreign income derived from a business controlled in or a profession set up in India

• A “non-resident” pays tax only on his taxable Indian income and his foreign income (earned and received outside India) is totally exempt from Indian taxes.

2. Taxability of global income

In case of a Non-Resident, only income from Indian sources shall be taxable in India. However, such individual may be liable to tax on income earned in the foreign country or global income since (i.e. including income from Indian sources) he / she shall become a tax resident / citizen of such foreign country upon leaving India. The individual can take recourse to the beneficial provisions of the DTAA between India and the foreign country in order to avoid double taxation of income. As per the DTAA’s between India and foreign countries, a NR individual can claim foreign tax credit in respect of doubly taxed income in his / her country of residence.

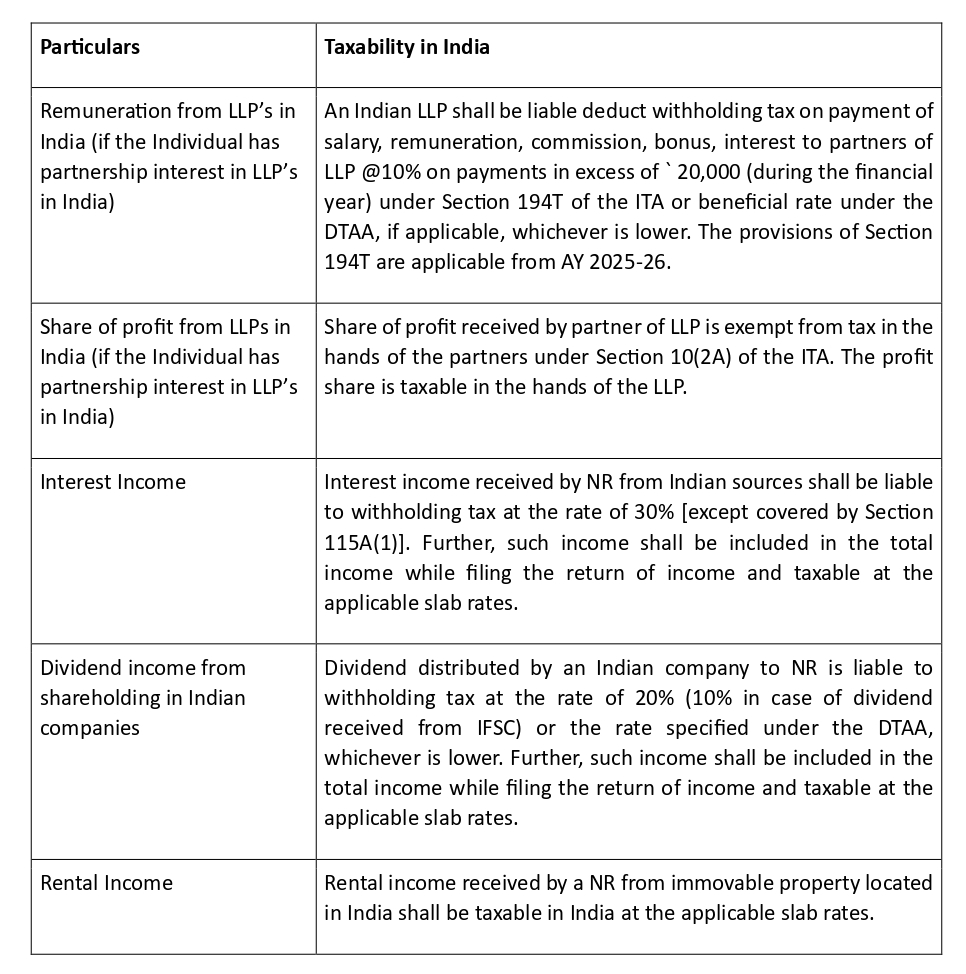

3. Tax implications for a NR in India from various sources of income in India

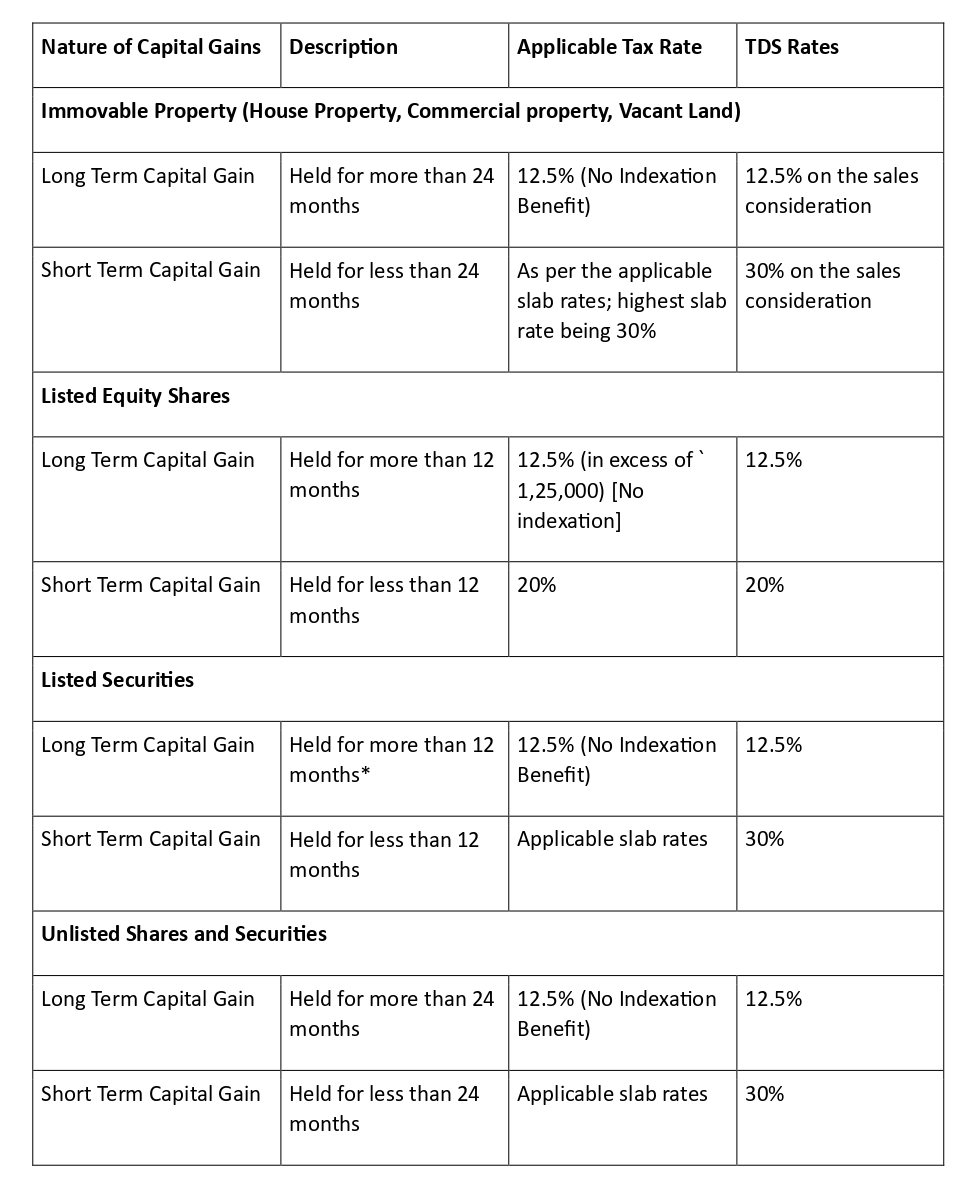

Taxability of capital gains for a NR in India

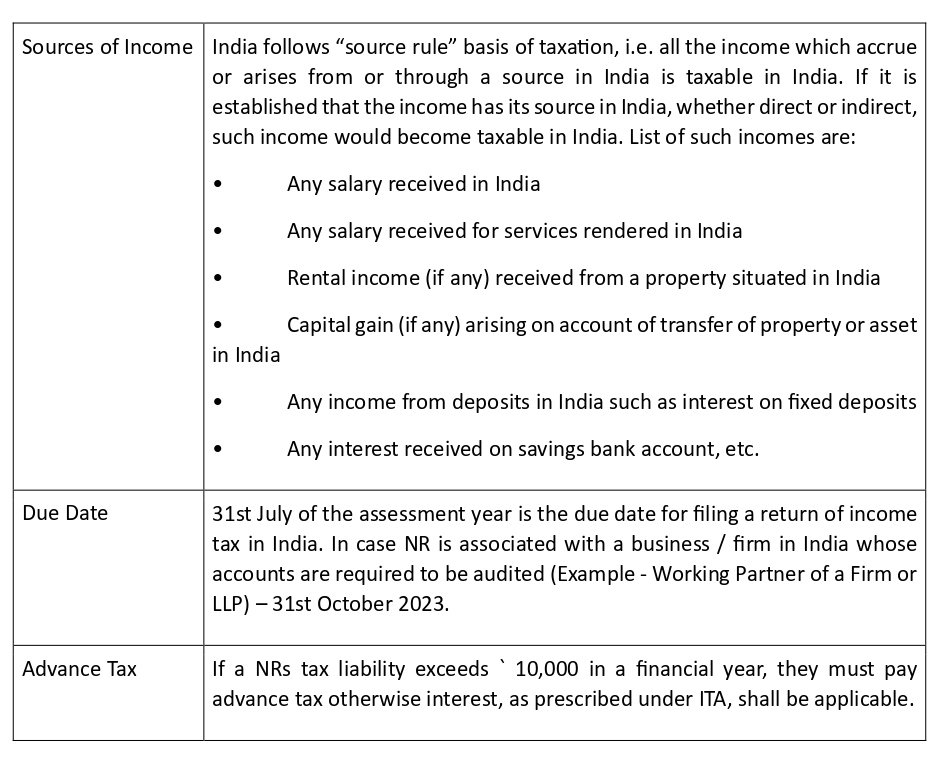

4. Filing and Reporting requirements in India

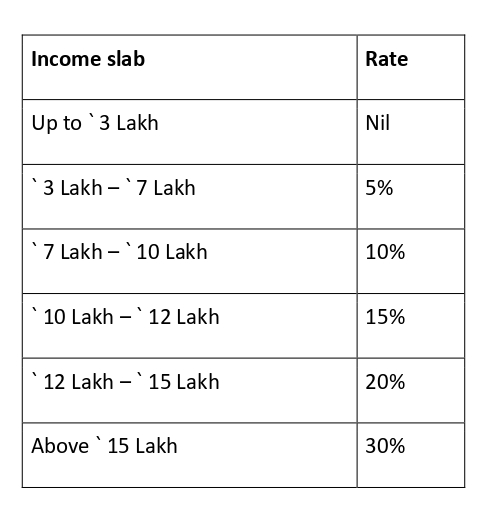

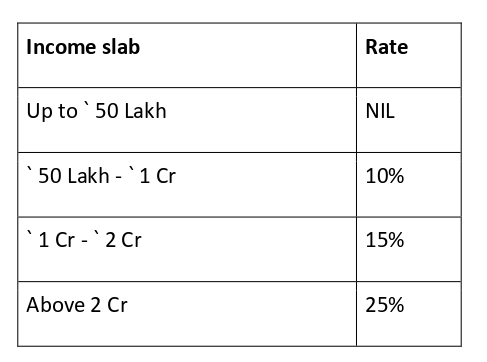

Income Tax Slab Rates in India

Income Tax Surcharge Rate in India

When is a NR required to file Return of Income in India?

It is important to determine the residential status of an individual depending on his / her stay in India. A NR is required to file a return of income if he / she has taxable income in India. A NR is required to file a return of income in India in the following situations:

• If the total Income from all sources in India exceeds the basic exemption limit for the financial year. The basic exemption limit for the financial year 2023-2024 is ` 300,000 for NRI irrespective of the age.

• Seeking a refund from the tax authorities for the excess taxes paid in India.

• Avail the benefit of carrying forward of losses

However, there are certain exceptions applicable to a NR with respect to the requirement of filing return of income in India.

Exception 1

NRI earning below mentioned income shall be liable to file returns in India, irrespective of their Total Income being less than the Basic Exemption limit.

• Income from Short Term Capital Gains on equity shares or units of equity oriented mutual fund.

• Income from Long Term Capital Gains.

Exception 2

It shall not be necessary for a Non-Resident Indian to furnish a Return of Income if the income comprises only Special Investment Income and TDS on the same has been deducted. Special Investment Income is income derived from the following Indian assets acquired in foreign currency:

• Shares in a public or private Indian company

• Debentures issued by a publicly listed Indian company (not private)

• Deposits with banks and public companies

• Any security of the Central Government

• Other assets of the central government as specified for this purpose in the official gazette.

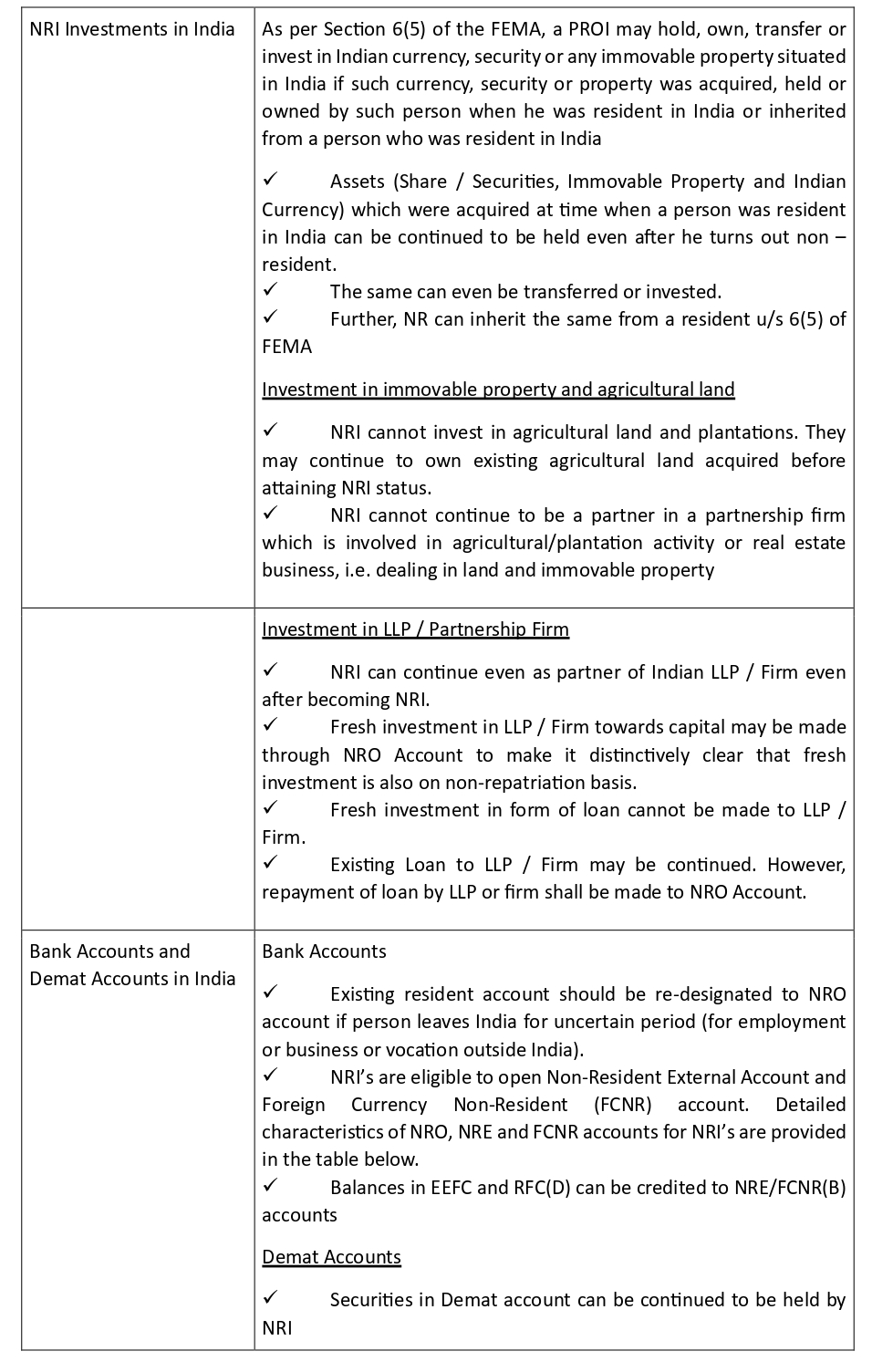

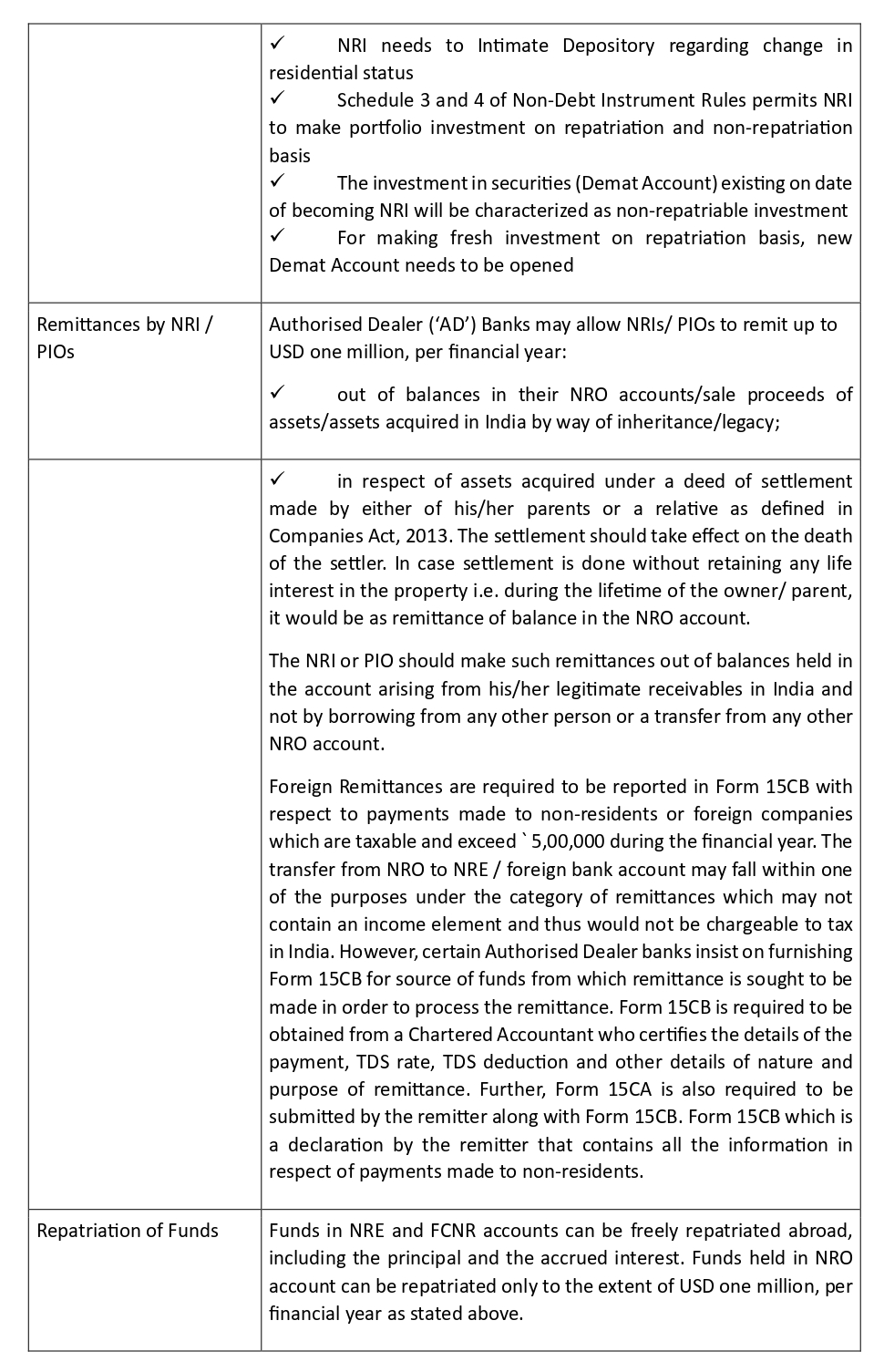

• Regulatory considerations while leaving in India

Filing of Return of Income in India by a NR

Impact under FEMA for Emigrating Indians

(Source : AIFTP Journal December 2024)

About the Author: Details are awaited

Pdf file of article: Click here to Download

Posted on: January 7th, 2025

Leave a Reply