Income -Tax Bill, 2025 : An Insight into the Income -Tax Bill,2025. Date – 18-4-2025 (Friday)

Subject : Taxation of Income from Salary & related deductions and

rebates (Chapter IV – Part B. Salaries – Clauses 15 to 19, Chapter

VIII (except business deductions) (Clauses 123 to 134) and Chapter IX Part A- Rebates and reliefs) Clause – 157)

: Speaker, Advocate Ajay R. Singh, Mumbai.

Summary of the speech prepared by CA. Rajesh Mehta, former Secretary General AIFTP and CA. Apurva Mehta from Online lecture of Respected Mr. Ajay R. Singh, Advocate, Mumbai.

Mr. Samir Jani National President of the All India Federation of Tax Practitioners (AIFTP), welcomed Advocate Mr. Ajay R. Singh and all participants on zoom and YouTube.

Click here to YouTube Link

Mr. Samir Jani expressed thanks to the Past Presidents present in this virtual meeting, he expressed thanks and gratitude for humble support for this online lecture series by respected Sr. Adv. Dr. K. Shivaram sir and Chairman Direct Tax Committee Sr. Adv. Tushar Hemani.

Introduction of speaker:- Mr. Ajay R. Singh Advocate, practicing in High court and Supreme court and Tribunal. He is LLM from Mumbai University. He had been associated with the Chamber of Shri K.R. Dhanuka, Advocate, Shri B. V. Jhaveri Advocate and Dr. K. Shivaram Senior Advocate and deals in Appeals on direct taxes, survey-search matters, International Taxations, Prosecutions. Also dealing with Black Money Act, PMLA, Benami Act and other matters. Editor of the AIFTP journal, Vice President of ITAT Bar Association Mumbai, and Past President of the Chamber of Tax Consultants Mumbai. He is also been associated with BCAJ, ICAI, WIRC and various professional organizations.

Subject : Taxation of Income from Salary & related deductions and

rebates (Chapter IV – Part B. Salaries – Clauses 15 to 19, Chapter

VIII (except business deductions) (Clauses 123 to 134) and Chapter IX Part A- Rebates and reliefs) Clause – 157)

1. Why New Income -Tax Bill 2025?

The Income -Tax Bill 2025, was tabled in the Parliament on 13th February 2025. The main objective behind this bill is to make the Act clear, concise, simple, easier to understand, remove anomalies, remove redundant provisions, reduce the provisos and explanations and make the Act simple while reading. For salaried employees, this new Bill brings significant changes to how salary income is taxed. The main aim is to simplify the process and make it easier to understand, particularly for salaried individuals who might not be familiar with complex tax laws.

The new Income -Tax Bill, 2025 is scheduled to come into effect from April 1, 2026, providing taxpayers and businesses ample time to adapt to the revised regulations.

2. Key Structural Shifts from the Existing Act.

The objective was not to make any changes or amendment but it was more a move to make it simple so that a common man also can read and understand the provision. Certainly for the professionals also and the authorities who are dealing with the subject under the Act. So the aim was to reduce disputes and litigation which are arising merely because of interpretation involving the section.

At many places deeming provisions were there. After the section there are provisos and there is explanation over and above there are amendments which are carried out by Finance Act time to time. These changes and amendment over the last few years or in fact since the 1961 when Act was brought in had made this Act very bulky and difficult to understand because of the language which was used and amendment brought in time to time. Therefore it was thought to make this Act simpler by introducing realigning the sections, removing provisos and explanation and removing the redundant provisions under the Act.

3. Major Structural and Terminological Reforms Introduced in the Income -Tax Bill, 2025.

The New Bill omitted various provisions which were redundant, outdated, deleted. Replace the provisos and explanations with sub-section. The Income- Tax Bill, 2025, provides interesting facts compared to the Income -Tax Act, 1961. The legislation has been structured with 536 clauses, 23 Chapters, and 16 Schedules. This ensures a more streamlined framework while maintaining comprehensiveness.

There are more use of tables and charts in the whole bill. In the entire Bill there are not a single proviso or an explanation, in future whether it will be added or not is matter of time, but as on today, there are no provisos and no explanation. The definition section remains the same, Section 2 which includes 112 clauses which explains all the important definition at one place.

3. Tax Year vs AY (Assessment year) :

The another major shift is the concept of assessment year and previous year which was there in the existing Act and now has been shifted to tax year. The term used in section is now tax year. This is a major departure from the earlier Act which uses the concept of previous year and the assessment year. Earlier the use of words assessment year created lot of confusions, difficult in understanding for a person who is reading or dealing with the act for the first time and therefore it was thought why not to align this particular concept and make it very simple as referring to tax year. At certain places you will also find the term financial year though tax year has been defined, financial year has not been defined under the bill, the term has not been defined under the existing act. The meaning of term financial year one has to borrow the meaning from the General Clauses Act, 1897 and therefore a financial year will always mean to be 12 months starting from 1st April. A tax year basically has been used as a unit or the period for taxation. The term shall be referred in respect to all transactions and income for that particular year. Whereas financial year has been used for the purpose of timelines, compliance and for procedural issue. A particular year may have a financial year, may have a tax year smaller as compared to the financial year because either the income has been received during that particular period, the business has been set up during that particular period etc. So therefore we need to understand this basic difference as far as tax year is concerned viz-a-viz the earlier period when we were using previous year as well as assessment year and the term which we will be finding at various places is financial year also just to remove any confusion one needs to understand that this act will come in play from 1st April 2026.

The first year of the Tax Year will be tax year 2026-27 question will be there what about financial year 2025-26 how it will be used or how it will be termed? The answer is financial year 2025-26. It will be termed as assessment year 2026-27 for all purposes. Only from the financial year which will be beginning from 1st April 2026 that tax year will come in play as per the new income tax bill 2025 and this tax year will be used thereafter for all the financial years.

4. Simplification and Reorganization of Definitions and Income Heads.

The definition clause has put all the definition in clause 2 at one place so that it is simple to understand. Most of the definitions are similar to what was there in the existing Act. Intent of this bill is not to amend but the intent is to make it simple clear easy to understand. So the language has been modified to that extent. However the meaning remains the same. The terms which have been defined at number of places in the existing Income tax Act in the same manner, now has been placed in the new section. There has not been any much difference except the wordings have been changed. The number of heads which are there, all income earned by the taxpayer is categorized in the five heads as it was there under the existing Income tax act, income from house property, income from salary, profits and gains of business and profession, capital gain and income from other sources. So as far as heads of income is concerned, there is no change. But the sections which were previously in the existing act has been now changed. Now Salary income under clause 15, house property under clause 20, Business and profession clause 26, Capital gain 67 onwards, other sources clause 92 onwards. Similarly, other provisions of clubbing, set off, carry forward, transfer pricing, etc. has been accordingly the provisions has been changed.

Clause 15 deal with income that is chargeable to tax under the head salary. It has three heads

A. Salary due from employer including former employers. So any salary that is due from an employer even it is from a former employer to an individual during the tax year whether paid or not will be taxed under the head salaries.

B. Salary paid before it became due, this is the second head. Even if the salary is not yet due, any amount paid or allowed to the employee by or on behalf of the employer during the tax year will be considered taxable under the head salaries. C. The third clause is about arrears of salary from previous year. If there are any arrears of salary which are not taxed in previous year and if those arrears are paid or allowed to the employee in the current year they will be included in the taxable salary for that year.

So the clause 15 which deals with salary and following income shall be chargeable to the income tax under the head salary has these three major heads.

5. Clause 15: Taxability of Salary Including due, advance, and arrears payments.

Earlier under the existing Act the section had explanation one and explanation two. Explanation 1 talks about where a salary is paid in advance and Explanation 2 talks about remuneration commission or any similar payment paid or received by a partner of a firm. These two explanation find place under the new bill in sub clause 2, 3, and 4. So clause 2 speaks that employer includes former employer also. Sub clause 3 says that if any salary paid in advance is included in the total income of any person for any tax year, it shall not be included again in the total income of such person when the salary becomes due. Sub clause 4 talks about any salary, bonus, commission, remuneration by whatever name called due to or received by a partner of a firm, from the firm, shall not be regarded as salary for the purpose of this section. If a particular individual receives a money before it is officially due i.e. an advance, this amount or this advance salary will be taxed in one tax year, it will not be taxed again, the position was similar in the existing law, has been similarly incorporated in this bill also. The difference is merely the arrangement of the sections and the clauses.

6. Comprehensive definition and components of salary under the New Income -Tax- Bill, 2025.

Section 16 explains what is salary and what shall be included under head salary. So for the purpose of this part salary includes it has given a list of items that are included under the head salary. The existing provisions where what salary includes was provided under section 17 wherein subsection one defines salary includes. In the new bill salary has been explained under sub under section 16. So it includes wages, annuity or pension, gratuity, fees or commission, perquisites, profit in lieu or in addition to salary and wages, advance salary, leave encashment, contribution to provident fund beyond the tax-free limits, contribution to employees pension scheme account, contribution to Agniveer corpus by central government. So these are the heads which will be included. These are the nature of income which will be included under the head salary and will be taxed under new clause 15.

Similarly, perquisites which was earlier part of section 17 now also is part of section 17. And here the list of perquisites and what it includes has been listed out which includes various items including value of rent-free accommodation, value of any benefit, amenities granted or provided free of cost or at concessional rates in various type of situations and cases. other benefits or amenities which have been granted, treatments and medical related benefits. The section also defines what is fair market value, family definition, gross total income, hospital, specified security, sweat equity shares. So all this has been put at one place, which under the existing provision one was to refer some part was provided under the explanation, that is hospital, family and gross total income. However, in the new law subsection 4 of section 17 list out other terms and the meaning of those terms including the family gross total income and hospital. So now one has to read the section at one place and there is no need to go at a different schedule or a different definition. One has to read one section , to understand that particular head of income.

7. Clause 18: Definition and Scope of ‘Profit in Lieu of Salary’ Under the New Clause 18.

Going further, the new clause 18 provides what profit in lieu of salary includes, the profit, any amount or any compensation due to or received from his employer or a former employer in connection with the termination of his employment or modification of the terms and the conditions relating thereto. The amount due or received whether in lumpsum or otherwise by the assessee from any person before joining any employment or after cessation of his employment with that person. Any payment due to or received by an assessee from the employer or a former employer or from the provident or other fund to the extent to which it does not consist of contribution by the assessee or interest on such contribution amount received under the keyman’s policy including a sum allocated by way of bonus under such policy. So the profit in lieu of salary purposes as well as salary, the meaning has been assigned under clauses, 16, 17 and 18 of the new Bill. The meaning and the further explanation of certain terms is also provided under the same head.

8. Simplifying and Clarifying the Section by Consolidating Definitions and Removing Redundancies.

Making the section more clear, giving precise meaning of the relevant terminology used in the section and the section itself under the subsection head and removing of provisos and explanation and making the section a comprehensive section simple to understand rather than making it complex and referring to some other part of the act time and again. More or less the Act borrows the same definition meaning assigned in the existing act.

9. Comparison of New and Old Tax Regimes for Salaried Individuals under Income-Tax Bill, 2025.

Going further, will the tax rate change?

Before the Income tax Bill 2025 was introduced changes in the tax rates slabs was brought in for a salaried individual by the Finance bill 2025. So there is no new change in the slab rate of income tax in this new bill.

It is important to note that the draft bill does not propose any changes to the existing tax slabs or rates. Therefore, salary income for a financial year will continue to be taxed according to the current slabs and rates applicable for that year.

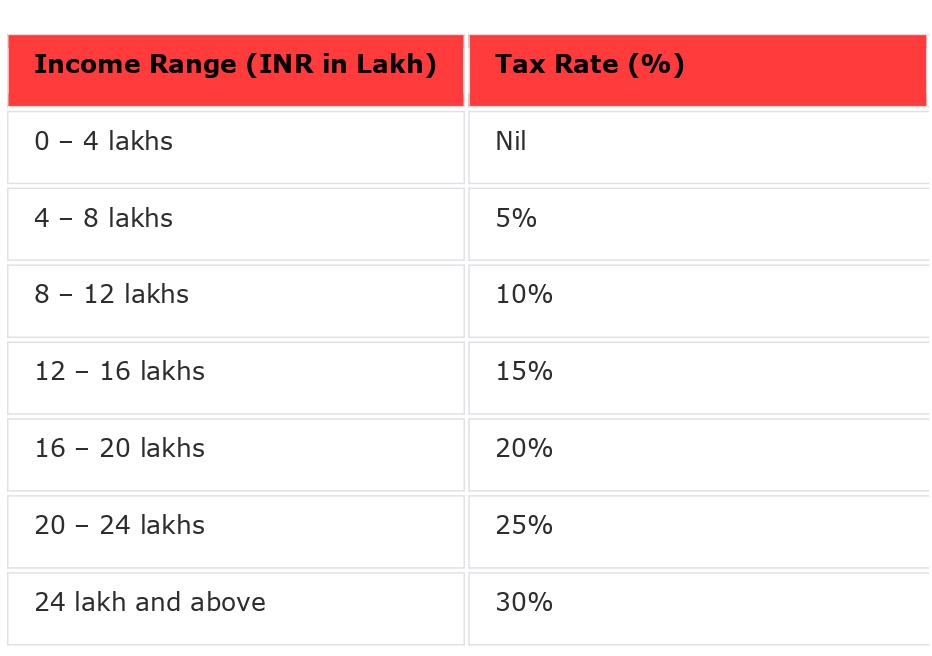

Under the revised structure, no income tax will be payable on earnings up to Rs. 12 lakh. Additionally, new tax slabs and rates have been introduced:

Under the revised tax structure, individuals earning up to INR 12,00,000 annually will have no tax liability due to an increased rebate of INR 60,000. For salaried employees, incomes up to INR 12,75,000 will be tax-free, due to a standard deduction of Rs. 75,000. These changes will significantly benefit taxpayers by reducing their tax burden.

Under the new tax regime the income tax slab which has been provided a individual enjoys additional standard deduction of 75,000 which will effectively raise the zero tax threshold to 12.75 lakhs.

Salaried employee enjoy the standard deduction of Rs. 75000 however he will not get the other rebates and deductions which will be available to an individual who opts for the old regime The traditional slab rate which is there under the old regime will be available where the deductions like 80C, 80D, HRA etc. will be available to a taxpayer and which regime is better for an individual salaried employee, will always depend on facts of each case. One cannot have a standardized formula to decide whether the new regime or the old regime is better for him/her. It all depends upon his structure of salary as well as certain other factors. For example, a particular individual who has borrowed funds for the purpose of buying a residential house. However, due to his employment, he has posted in a different city wherein he has to live in a rented premises. He is entitled to HRA. At the same time, he is paying the interest on the housing loan which he has bought for residential house. Seeing the peculiar situation without going in much details of computation, for such type of an individual the old regime will be beneficial rather than going in the new regime, because there he will get a more deduction as far as his interest liability is concerned and as far as HRA etc. is concerned this may not be though the for another individual who may be falling in the same slab of salary it may not be beneficial to him. So this is very factual and situational factor which will depend on facts of each case and therefore it is very important as a professional that in case of a salaried individual we make him understand before the start of the financial year how his income would be taxable and how he can arrange his affairs in a more effective and proper manner so that unwanted tax liability does not come at the end when he’s comes to file his return.

10. Importance of Early Tax Education for Salaried Individuals to Avoid Unforeseen Liabilities.

It is very important as professional we need to educate individuals who are not much aware about these technicalities and they will still go by the general perception that yes I will get this deduction or I will not entitle to this particular deduction under this new regime. So this calculation is always fact based seeing the income and other factors and it is very important that individuals salaried individuals this understanding is brought to their notice at the beginning itself and not at the time of filing of return when all the transactions have been completed. Due to lack of proper guidance Unknowingly the individual assessee are saddled with heavy tax liabilities.

11. Simplifying Tax Laws for Easier Compliance and Better Synchronization with the Income Tax Portal.

Why this simplification is important. The bill and the FAQs reflects that simplification is made more to clear the doubts or the confusion which was there prevailing prior to in the existing Act, simpler language, avoiding legal jargons, making the tax rule easier to understand.

Terms like perquisite, profit in lieu of salary are now explained in a much simple language. Easier filing of return. Earlier due to complicated rules and forms filing of tax returns was very confusing as far as individuals are concerned. Now salaried individuals will be able to file their return also in a simple manner without any hassles and hurdles. Ultimately the objective of this simplification also can be linked with the new portal which has been developed and has been effective from last few years. More complex the Act is, the difficult it is to match and synchronize with the portal.

We have seen at many places what the Act prescribe and how the portal reacts to that is not in tandem. It doesn’t synchronize it. Therefore, it was very important to make the Act also simpler and matching with the portal. This simplification will help to ease out the issues of matching of income tax rules and practical application of these by income tax authorities, otherwise misapplication and wrong application issues are faced by the individuals, professionals at the ground level. And individuals are left remedy less. New bill will make life easier as far as understanding the law is concerned and implementation of the same. The individuals will be benefited. Clear language, clear definition, least chances of errors and confusion while filing the returns. Preparing of documentations by the accountant which was earlier confusing will be more easier. There will not be any surprises. These changes are not with the intent to increase the tax burden but it is more for easier to understand and implement the particular law. This is a relief for the salaried individual by making the process of paying taxes on salary income easier, avoiding eliminating complex language and making it simple to understand. As one of the goal of the Finance Minister is also that the return would be prepared in advance by collecting the data which will be available with the tax dept and which is already synchronized with the Income tax portal. Your return will be prepared in advance and it will throw you the details. This is one of the step where one can connect now that how making of the language simple of this Act will help to achieve these goals. The synchronization of the Act is with this intent also we have to wait for all this for the year 2026.

12. Applicability of Judicial Precedents from the 1961 Act to the New Income Tax, Bill 2025 :

There are some FAQs, one is that there is merely a shift and realignment of the provision whether the judgments or the interpretation which has been rendered by the Courts and the Tribunals in the 1961 Act can that be used, borrowed applicable under the new bill, the interpretation which has been given by the courts on certain terms or words particular transactions will be applicable as a good precedent in the new bill. As the new bill objective itself explains this that the purpose is not the amendment but the purpose is to make it simple and easier. Unless there is a tinker with the definition or there is a change in the meaning which has been brought in with a purpose or objective in that situation only the decisions rendered under the 1961 Act may not be applicable or may be distinguished. Otherwise the decisions or the precedent value of the judgments which was rendered under 1961 Act will certainly be available under the New bill 2025.

13. Consolidation and Integration of Deductions in the New Income -Tax Bill, 2025.

Coming to the rebates and deduction. A very important section 80A, 80 AB, 80AC and 80B. These four section of 1961 Act has been merged and put at one place under section 122 of the new bill. The consolidation and restructure of this provision are substantially same. There is no major change but the presentation is far more integrated and put at one place with the objective that while looking into the computation of total income the requirement of filing the return of income and claiming the deductions or the exemptions which are there is understood at one place under the existing law. One has to see the different sections to understand and correlate all these four to understand ultimately what is and how an assessee will be allowed. It has now been consolidated and integrated in one clause 122. Similarly, if we see deductions for life insurance premium or deferred annuity, contribution to provident fund, there is no major change which was earlier 80C is now clause 123 and there is no major change in the language, listing of qualifying investment which was previously detailed within section 80C itself has now been moved to schedule 15 for better modularity legislative clarity. The basic structure and intent of the deductions remains same. The quantum of deduction, overall limit of 1,50,000 is provided. The eligibility of payments remains the same. This is there in most of the rebate and deduction clauses. 80CCD deduction in respect of employees contribution to pension scheme of central government which we now can see in new clause 124. Here also 124 is a mirror image of section 80CCD and it consolidates both employers and employees contribution at one place. It also carries the 14% deduction of government employees and 10% for others. It is put in line with the amendment made in 2024 under section 80CCD(2). Apart from this there are no substantive change in deduction limits or conditions. The intent and mechanics remains the same for this particular clause. Also section 80CCH, 80D, 80DD, the corresponding clause which is there in the bill in clause 125, 126 and 127.

Same is the situation to section 80E for which the corresponding clause in the bill is 129. The section 129 aligns with section 80E. No change of eligibility, scope of deduction, or the condition, the 8-year cap and the definition of higher education are retained without any alteration, without any change, and the position remains same. For 80EE deduction in respect of interest on loan taken for residential house, the corresponding clause is 130 and 130 of the Income tax bill 2025 provides a deduction up to 50,000 to an individual on interest payable in respect of loan taken from financial institution acquiring a residential house. Other conditions are there about the limit or the property amount. No change, eligibility remains same. Quantum of deduction remains same. Same is for 80EEA deduction for 1.50 lakhs and for electric vehicle which is 80EEB. So the point is that there are no substantive or any change in the scope or the limits or the eligibility criteria as far as these deductions are concerned. We touch upon also to 80G and 80GGB which is in respect of donations made by an assessee to approved institution. 80GGB is contribution made to a political party. The provision continues to disallow cash contribution and aims to promote transparency in corporate political funding. No major change. It is this corresponds to 80GGB of Income tax act. Similarly deduction in respect of contribution given by any person to political party. It’s a same replica of the other section of cash payment and eligibility criteria remains intact and it is same.

14. Clarity in Tax Interpretation and Avoidance of Misleading Borrowings.

One has to be very careful that we don’t borrow any new interpretation altogether, only to avoid any tax. If we have seen the shift there is a major shift in administration of tax laws also and the interpretation given by the courts. Once the language is so simple, lucid and straightforward, scope of any third interpretation or any other borrowings from outside is far minimum and one has to fall within the scope of this definition and meaning which is provided for the purpose of taxation and I don’t see that there is any further ambiguity which is left as far as income from salary is concerned.

15. Challenges in Verifying Incorrect Deduction Claims by Salaried Employees.

Now, recently what has been detected is that people, salaried employees especially, they are claiming all available deductions whether they have done it, invested it, or not. So that kind of scams have also been detected. Government want to stop such scams, but it is virtually impossible to verify from all assesses whether those deductions are correctly claimed or not. Due to the integrated portal and new return filing regime detection will be possible and processing of returns will be faster and hassle free.

16. Certainty and Reduction in Litigation Due to shift from settled law of the 1961 Act to the New Regime.

The definitions have been borrowed from and the meaning has been borrowed from the existing 1961 Act and there is no major change. There will be certainty as far as interpretation of these provisions are concerned because the law is already settled under the 1961 Act for these issues and it will only be transferred in the new regime. So I don’t see that any future litigation will also come up to that extent wherever the issues are settled will not again come up, and it will be accepted there is no change in the definition or the meaning which is there and therefore I would also say that the CBDT will also not bring in any new taxability of income or new criteria by way of circulars or notifications. So there will be more certainty and litigation to that extent will reduce.

Vote of Thanks:- AIFTP National Treasurer Mr. Bhaskar Bhai Patel presented vote of thanks.

Disclaimer :

Summary of the speech is prepared by the members of the Research team of the All India Federation of Tax Practitioners (AIFTP) with the intention of spreading the education and reference to the members of the AIFTP and tax payers. While due care and sincere efforts have been made while preparing the summary of the speech of Mr. Ajay R. Singh Advocate. There may be errors or omission in the contents or citations, neither the research team nor the AIFTP or www.itatonline.org, may be held responsible to the inadvertent errors / omission. The readers are requested to send their views or suggestions, by email to aiftpho@gmail.com which will enable the research team to make more value addition while preparing the summary of speech of learned speakers.

All disputes are subject to Mumbai Jurisdiction.

Mr. Rajesh Mehta (Former Secretary General AIFTP)

Date : 2-6-2025

About the Author: Details are awaited

Pdf file of article: Click here to Download

Posted on: June 2nd, 2025

Leave a Reply