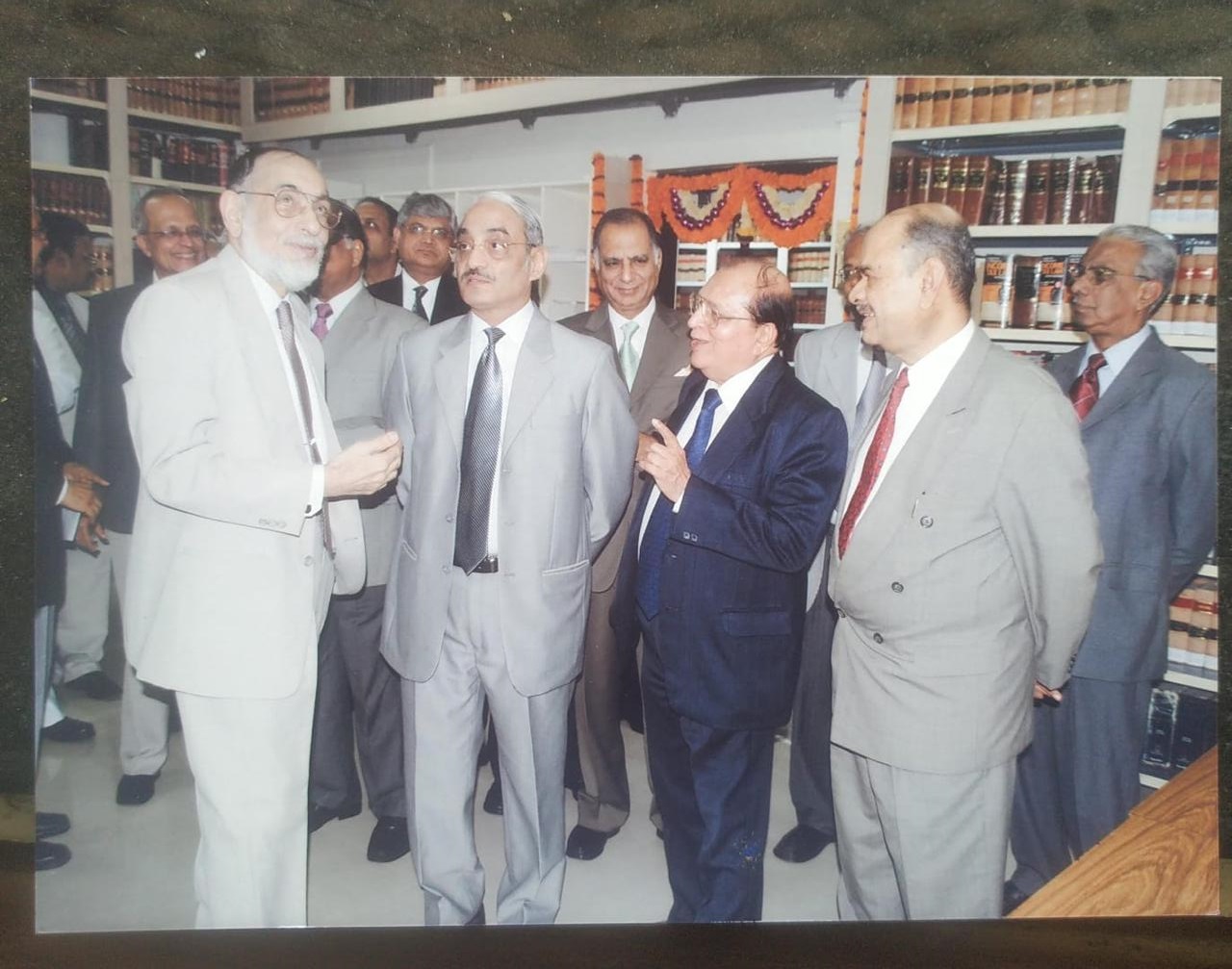

(From left to right) Hon’ble Mr. Justice DR. S. Radhakrishnan, Bombay High Court, Shri S.E. Dastur, Sr. Advocate, Hon’ble Mr. Justice Swatanter Kumar, Chief Justice Bombay High Court, Hon’ble Shri Vimal Gandhi, President ITAT, Shri Y.P. Trivedi, Sr. Advocate, Shri Dinesh Vyas, Sr. Advocate, S.N. Inamdar, Sr. Advocate,

(From left to right) Shri D.R. Raiyani, Advocate, S.N. Inamdar, Sr. Advocate, Dr. K. Shivaram, Sr. Advocate, Shri V.H. Patil, Advocate, Shri Narayan Varma, Chartered Accountant

Shri S.N. Inamdar, Senior Advocate & Past President of Chamber of Tax Consultants and eminent tax professional who had an illustrious career of over 57 years and was well known for his professional integrity and command over tax and corporate law.

We are sharing his journey from his early days to stalwart in tax fraternity. We hope that this will inspire young professionals, Lawyers and Chartered Accountants.

1. Early Life and Education:

Can you share more about your childhood experiences growing up in Amravati and Pune? How did the cultural and educational environment influence your formative years?

Your father was a Sanskrit scholar and established the New English School. How did his commitment to education impact your own views on learning and knowledge?

2. Family Influence:

Your parents left a deep impact on you, teaching you the value of family life and bonds. Can you elaborate on specific lessons or values that have stayed with you throughout your life and career?

How did your mother manage the household efficiently despite facing financial challenges, and how did this shape your perspective on resilience and resourcefulness?

My childhood was spent in two cities- Amravati, near Nagpur in Vidarbha and Pune. My father was a First class First MA and a Sanskrit Scholar. Fired by patriotism he vowed not to serve the British Raj. He established a school in Amravati in 1923, under the banner of New English School. An eminent leader and social worker, Shri Dadasaheb Khaparde from Amravati, stood behind him solidly. Since, it was his own school, and treating it as a public service, my father worked whole of his life on a fixed salary of Rs. 90/- per month. When he retired in 1953, he had no pension, no provident fund or any other retirement benefit. It must be acknowledged to her credit, that my mother managed the household not only economically, but very efficiently. She never let us feel that we were poor, when, as a matter of fact, we were poor! My parents have left a deep impact on me and taught me the value of family life and family bonds.

In 1954, the Govt of India established a Sanskrit Commission with headquarters in Pune at Bhandarkar Institute of Research. The Central Govt appointed my father as the chairman. In 1954, therefore, we shifted to Pune. My father hired a one room kitchen apartment which was very close to or rather in the river Mutha. Thus, I completed my primary education in Amaravati and secondary education in Pune’s Ramanbaug School,

while study was always my priority. I also used to play badminton in school and represented our school in inter-school tournaments continuously for three years from 1957 to 1959.

3. Relocation and Education Challenges:

Moving to Pune in 1954 marked a significant change for your family. How did this relocation influence your educational journey and personal development?

Can you recount the challenges you faced after the Panshet dam collapse in 1961 and how Mr. N.A. Mavlankar’s intervention played a crucial role in supporting your education?

Initially aiming for the IAS, what motivated your decision to pursue commerce instead of arts or science? How did this choice shape your future career path?

I passed matriculation in 1961. I wanted to, and was encouraged by my parents, to aim for competitive exams and join the Indian Administrative Service (IAS). That I would opt for Govt service was taken for granted. I was amongst the first 50 (fifty) students in the Merit list of the Board. But in those years, the newspapers used to publish names of the first 30 students only. So, I was blissfully unaware of this fact.

But, I thought, even otherwise, that I should opt for commerce in preference to Art’s and Science. I thought it could help me to discharge the varied duties required to be performed by an IAS officer. (Ironically, I had not even heard of the Indian Revenue Service, then) I joined the Brihan Maharashtra College of Commerce, in Pune. My first day in college was 20th June 1961. On 12th July 1961, the Panshet dam collapsed and there were unprecedented floods in Mutha River. Our house was on the banks of the river and was a two story house. But the water flew above our two storied house with force and we lost almost everything. (Not that we had much to lose and no valuables) But my father had crossed 63 years of age and my mother was keeping indifferent health. My elder brother had joined the Indian Navy and was posted in Vizag, Andhra Pradesh. My parents had no energy to set up a house again. My brother came rushing on hearing the news and told my father that he will make some arrangements for our residence, but it may take two to three years.

My father told me that he won’t be able to afford further education therefore and I will have to leave college. Some of our close relatives offered to help, but my father’s pride and self-respect bordering on ego, would not accept that. He even refused Govt help offered to flood affected people of Pune saying “There are more deserving people who need that help.” I went to meet the principal of our college Shri N. A. Mavlankar and told him everything. He simply said: “I want to meet your father. Give me your address where I can meet him”.

Next day, Mr. Mavlankar came to our relative’s place where I was staying. My father was also called there. Mr. Mavlankar told my father “Let him continue his education”. My father said: “I think he told you that now I cannot afford it”. Mr. Mavlankar coolly replied: “That is why I have come to meet you.” He not only has a free ship, but also has a scholarship of Rs. 100/- p.m. “I was stunned to hear this, because it was news to me. But my father bluntly asked him” But where will he stay? “The relative with whom I was staying promptly said: He can stay with us. “But I knew my father would not accept that. But before he could say anything Mr. Malvankar told him”. The new hostel of our college is under construction and nearing completion. I will give him free accommodation on priority.” My father kept quiet, but I knew in my heart that now he will agree.

4. Career Aspirations and Choices:

Were there specific role models or influences that guided your career choices during your college years?

Standing first in first class in Pune University and receiving a National Scholarship is an impressive accomplishment. How did these achievements impact your aspirations and choices for further education?

I occupied my hostel room on 10th September 1961, I was the first student to occupy a room in the new hostel. This was the first turning point of my life. While I did not neglect studies, I also actively participated in debating competitions and drama and one act plays performed at annual gatherings of our college. I was lucky to get love, affection and support from some of my professors, apart from Mr. Mavlankar, such as Dr.P.C.Shejwalkar, P. V. Patwardhan Arvind Kulkarni. A. Bhajang Rao and S.S. Murdeshwar and N.D.Apte. I also edited the college magazine and wrote articles and poems in it. In short, I enjoyed my college life. Icing on the cake was at the final B.com examination, I stood first in first class in Pune University and was awarded a National Scholarship of Rs. 400 p.m. This was the second turning point.

My father was very happy to hear that I will be getting the National Scholarship. It would have eased our financial worries also. But we were told, it takes a long time to process and the first payment may take six or more months. I joined Sydenham College in Mumbai to pursue my post-graduation in commerce (M. Com) and earnestly started studying for the competitive exams. The first step, of course, was to collect as much information as possible and read books on general knowledge. By that time, my brother had purchased a small house in Maha Housing Board Colony at Goregaon(w).

5. Transition to Income Tax Law:

The offer to become an Income Tax lawyer came as a surprise. What were your initial thoughts and concerns when Shri Y.P. Pandit approached you with this opportunity?

How did your family, particularly your father and brother, react when you presented the idea of transitioning to Income Tax law as a profession?

After about a month and a half later Shri.Y.P. Pandit, Father of a close friend of mine came to meet me in Sydenham College. I was surprised, as he was a Senior Income Tax Lawyer and was settled in Pune as he was a retainer to the Kirloskar group of companies. He told me that one that his partner, Mr. S.V. Muzumdar is joining Birla group and he may need an assistant or a junior. Then he asked me a straight question: “Would you like to become an Income Tax lawyer?”

I was taken aback, but told him about my father and our economic condition. He immediately said: “You don’t worry about money. I’ll take care of it. But you will have to do law.” I told him, I’ll ask my father and brother and come back to him. By that time, my elder brother had purchased a small house in Goregaon (west) as said before, and my parents were staying there. My brother was recently transferred to and was posted in INS Shivaji, the naval base in Lonavala.

As expected, my father was not inclined, but due to advancing age and delicate health he did not oppose directly but simply said: “you consult Yeshwant (my elder brother) I was slightly excited to think, that here is an opportunity to work as an independent professional instead of doing a job-may be as a Govt Officer.

Next day, I went to Lonavala and met my brother. My brother was a little apprehensive, but my sister-in-law said “I think you are cut out for practice. Join law we will be with you and behind you!” My brother told me to consult a first cousin of mine who was a leading lawyer in Nagpur. I wrote to him, but I was not sure whether he will respond, as apart from him being extremely busy, we were not in regular touch since we left Amravati

15 years ago. But his three-page reply came within three days. He wrote: “I have been hearing about your academic achievements and I’m sure you will do well. There are very a few good lawyers in Income Tax and he took the names of N.A.Palkhivala, R.J.Kolha and S.P.Mehta.”

6. Legal Training and Mentors:

You mentioned the significant influence of Shri G.L. Pophale in your legal career. Can you share more about the specific teachings or lessons you received from him that became pivotal in shaping your understanding of tax laws?

Winning a gold medal in Law and receiving a signed copy of Shri Pophale’s book seems like a milestone. How did these experiences contribute to your confidence and expertise in tax matters?

Frankly, I had no clue as to what Income Tax practice is about and information about Shri Y.P. Pandit given above was told to me by his son.

But with this encouraging and reassuming response, I made my decision and informed Shri. Y.P. Pandit accordingly. This was the third turning point in my life and must vital I In Shri. Pandit’s office, I was endowed with a divine blessing! Mr. Pandit had invited Shri. G L Pophale, then recently retired Accountant Member of the Tribunal & an expert in Income Tax. He had served all his life in the I.T. Dept and had a rich experience. Mr. Pandit requested him to guide and advise him- particularly in respect of the Kirloskar Group. Mr. Pandit had by then, settled in Pune and used to visit Mumbai two-three days a week. But he made another request. He asked Shri. Pophale whether he can train me and his son in Income tax laws. To my great delight and surprise, Shri. Pophale readily accepted. Thereafter, he taught me the like Pantoji, basics of Income tax law- like why a particular section was enacted and what is its origin, etc. He also gave me a list of about 100 judgments of the house of lord. Privy council and some of our own supreme court, which dealt with the fundamental principles, and concepts under Income Tax law. Thus, I sincerely feel my understanding of the tax laws became firm and strong. I cannot avoid the temptation to quote one instance in this regard.

7. Notable Case Experience:

• Reflecting on your argument before the Pune Tribunal regarding the definition of ‘Resident, but not ordinary resident,’ can you provide more details on the challenges you faced and how you navigated through them during the proceedings?

• What were the key insights or arguments you presented to the Tribunal, and how did you manage to maintain your stand despite intense questioning?

I argued one case before the Pune Tribunal dealing with the definition of ‘Resident, but not ordinary resident. I argued before the Tribal that the meaning has to be gathered (as it contained two “nots 1 1 in one sentence, defying basic rules of grammar and drafting) and explained to them why this concept came on the statute book and what should be its meaning. I stuck to my stand in spite of some very piercing- questions by Shri K.T. Thakore(Accountant Mandar and himself an expert ex-departmental officer) and K.Rangnatha Chari. Next day Shri. Thakare called me to his cabin and asked me. “Mr. Inamdar, you are so young and inexperienced, how could you argue so confidently about the most perplexing definition? And how do you know why this provision came on the statute book? I told him ” Sir, Shri. Phophale taught me this. He got up, took my hand in his hands and said: “Inamdar, you are really lucky.” Thus, to be trained by Shri. G.L.Pophale, was the most important turning point in my career! Shri.Pophale wrote a book called “Quarter century of direct taxation in India” which became my Bhagvad Geeta, Bible and Quran all put together. When I won a gold medal in Law, he presented a copy of that book, signed by him. That is why I called it a divine blessing!

8. Impactful Advice from Tribunal Members:

• You mentioned receiving three invaluable tips from tribunal members. Could you share those tips and elaborate on how they have influenced your professional approach and decision-making throughout your career?

• How do you believe the guidance and advice from experienced tribunal members shaped your growth as a legal professional?

9. Legal Practice and Professional Ethics:

• Shri H.M. Jhala’s advice about narrating facts in detail and correctly is insightful. How did this advice shape your approach to legal practice, especially in the context of tax law?

• Shri G.L. Pophale emphasized the importance of loyalty to law, commitment to the client, and fairness to the court. Can you share a specific instance where these principles played a crucial role in a challenging case?

I received three invaluable tips from some tribunal members, which I will never forget in my professional career.

I was in the habit of rushing to quote case law (perhaps to show off my excellent memory – as I used to remember by heart, page no and the volume no of ITR or ITD). Shri. H. M. Jhala, a godly person and accountant member – once told me “Mr. Inamdar you narrate the facts in detail and correctly and law will take care of itself! I will never forget this advice. When I told this to Shri. Pophale, he said you have received some golden advice, because Tribal is the final fact-finding authority and its findings of fact are binding on the high court and supreme court also. Shri V. Gopinathan once advised me “Mr Inamdar, you talk too fast. You Must learn to speak slowly with proper emphasis so your arguments will have greater impact on the listener!

Principal T.K.Tope used to teach us Indian Constitution in Govt law College. He once told us “When you practice law and when any Act / law comes before you, the first question you should ask is: Whether it is constitutionally valid?

Shri. G.L.Pophale, at an informal discuss told me “Remember, law is a profession not a business. Three principles you should always bear in mind. Loyalty to law, commitment to your client and fairness and honesty to the court. Always remember that you are an officer of the court and not a hired agent of your client.”

10. Ethics in Tax Practice:

Your perspective on ethics and morality in tax practice is distinctive. How do you balance the principles of tax avoidance with the ethical responsibility to ensure actions do not result in illegal activities or intentional tax evasion?

In your view, how has the interpretation of tax laws evolved over the years, and what challenges do tax professionals face in maintaining ethical standards in the ever-changing legal landscape?

Ethics and morality are the two pillars of any profession- and more so of the legal profession. But I did not take this in a narrow sense. When I started tax practice, I firmly believed and still believe that morality does not mean you should pay whatever tax is demanded from you. I believe that law does not oblige a tax payer to pay maximum tax, he can pay and he can be taxed only on the income which he has, in fact, earned and not on

income which he would have earned but has not in fact earned real income. Every taxpayer is entitled to arrange his affairs so as to pay minimum tax, by legitimate means. I remember, in one case of tax planning. I started my arguments before the Tribunal in these words: “Your Honour in this case, I have used the law, but not abused or misused the law! (Words used in GAAR)

For me, ethics and morality meant, to ensure that any advice I give or action I take, should not aid, abet actively assist, encourage, prompt or result, in any illegal action or intentional tax evasion as opposed to tax avoidance by legitimate ways and interpretation of law.

I am aware that many of my friends and colleagues in the profession may not agree with my views!

11. Passion for Indian Classical Music:

Your family’s deep connection with Indian classical music is fascinating. How has your passion for music influenced your life and professional career?

Considering the musical achievements within your family, how do you see the intersection between the artistic and legal aspects of your life?

Apart from professional activities my main interest in life has been music- particularly Indian classical music. In fact, it is no exaggeration to say that music runs in our family. My wife is a violinist and has performed on Pune Station of the All-India radio (Aakash Vani). Her father was also an accomplished violinist and learnt western classical music also by going to Italy as he considered violin as a European instrument (How he

landed in Italy in 1932 is another interesting story). He was heavily welcomed and got good publicity. One Austrian newspaper published a news article with the headline: “Indian’s Yehudi Menuhin arrives in Europe.” He gave stage performances, he played Indian music and also earned him profound publicity so much so that Italy’s dictator Mussolini invited him to his palace in Naples Italy gave him time of 15 minutes to play Indian music. But the meeting lasted for more than 45 minutes and my father-in-law played songs, sung by Balgandharv before Mussolini. It is a matter of divine coincidence that after nearly 80 years (in 2012), my son composed music for the film Balgandharva and one song composed by him won a National Award.

My father-in-law was the first Indian artist to play solo violin on BBC radio in London in 193. He was hardly 24 years old then.

12. Family and Personal Achievements:

Your sons ventured into the entertainment industry. Can you share any specific experiences or challenges you faced as a parent supporting their career choices?

Reflecting on your son’s National Award-winning composition for the film Balgandharva, how did it feel to see a creative endeavor intersect with your family’s musical legacy?

My two sons did not take up my profession but joined the entertainment industry. My elder son Kaushal has composed music for several Marathi films and telefilms, jingles and programs including 1995 World Beauty Queen contest in Bangalore. His pride song of Marathi has made him a household name and prayer composed by him for the film UBUNTU is adopted by several schools in Maharashtra as their official prayer. My younger son has directed two feature films and several telefilms, episodes and jingles.

13. Professional Network and Collaborations:

You mentioned key individuals like Hemant Gore, CA M.K. Patankar, and CA Ramesh Jambhekar who played a crucial role in your professional life. How did these relationships contribute to your growth, and what key lessons did you learn from these associations?

Serving as President of the Chamber of Tax Consultants, what innovative programs or initiatives did you undertake during your term, and how did it shape your perspective on professional organizations?

I was lucky to get many good friends who assisted and enriched my life and made living enjoyable and comfortable. Foremost amongst them were Hemant (Nandu) Gore, a Ranaji cricket player and a royal person. CA M.K. Patankar of Pune, CA Ramesh Jambhekar of Nasik Vilas Shah CA. They were not confined to the category of “A friend in need, is a friend indeed”. Of course, they helped me in times of need, but more importantly, they gave me moral boost and solid support. They encouraged and helped me to move ahead in life. Nandu encouraged me to buy a bigger house, move to my own office in the Fort area, and was after me to buy any household item, of which he had purchased- such as T.V., room, air conditioner, furniture etc.

Jambhekar and Patankar Saheb, kept unflinching faith in me and entrusted even heavy and complicated cases to me in my early career. I got some very good friends in my profession. I was privileged to become President of the chamber of Tax consultants. This was solely because of respected Shri. V.H. Patil saheb. I told him I have not worked in the chamber at all and was unaware of its functioning. I should not fail on that ground. He assured me that he will give me a support team of one vice president (Vipin Batavia) and three secretaries – Vipul Joshi and Akbar Merchant and Sanjeev Lalan, who not only helped me immensely, but also became my good friends. We did some innovative programs in association with Bombay Chartered Accountants Society (BCAS). I however, regretted many times that I should have worked in the Chambers for a few years at least so that I could serve the chamber better.

I remember, in my last speech made, at the time of expiry of my term as President in which I had said. “I should have climbed the steps to become President of this august body, but I took the elevator!

14. Stint with Industry and Directorial Role:

Your experience as a consultant to various industrial groups and as a director on multiple boards is extensive. Can you share a specific example where your role as a director presented a challenging ethical dilemma, and how did you navigate it?

My stint with industry was also extremely educational. It shaped my views – from local to global, of looking at events, people, career, profession- and the world in general. I was able to be associated as a consultant to various industrial groups such TVS Chennai, Finolex, Sudarshan chemicals, Kirloskars, Kanoria, Toshniwal which taught me many things. At one time, I was on the Board of 12 listed companies and five, unlisted but public companies. My colleagues on the Board Such as N K Firodia, SS Maratha V.R. Rao, Dr. Rathi were luminaries and giants in their chosen fields. I benefited immensely from their association, knowledge and attitudes. They taught me one basic principle_ that a director of a company is a trustee of the shareholders and not a servant of the owner or of the management. Therefore, I never hesitated in expressing my views, If I thought something was not in the interest of general or public shareholders. However, I must record here that the promoters and management of the above groups were extremely receptive and took the opinion expressed, in the right spirit.

15. Role Models and Influences:

Shri. Shantanurao L. Kirloskar and Shri. N.A. Palkhiwala are mentioned as role models. Can you elaborate on specific qualities you admired in them and actively tried to incorporate into your own professional and personal life?

How did the mentorship or guidance from these role models shape your career decisions and values as a tax professional?

My role-model or idol in life was, of course, Shri. Shantanurao L. Kirloskar, the doyen of Indian industry. He did not directly teach me anything, but I learnt a lot from him. Same is the case of my role-model, idol in professional life_ Shri. N.A. Palkhiwala it was always my effort to inculcate and adopt the following qualities from them: – loyalty to the legal profession / law. Clarity in thinking; courtesy and respect towards all and sundry power of expression, and above all honesty to and empathy and respect for the tax payer and pride in the Nation. I firmly believe that the above qualities or attributes are equally – or perhaps more essential for a tax professional. I am extremely indebted to all these people and bow before them in gratitude and respect.

About the Author: Details are awaited

Pdf file of article: Click here to Download

Posted on: February 23rd, 2024

Vey impressive journey which will motivate many young professionals. We are really obliged to the ITAT Bar Association for publishing the article . We request the editorial to publish the many more such articles . They can request shri Y.P .Trivedi sr advocate shri S.E .Dastur sr advocate to share their success journey in the profession

I have been staying in the same building and knew him as respected Inamdar kaka for last 30 years but after reading about his life journey today I wish I knew this earlier so that I could tell him personally that how proud and blessed I feel to know him. What an inspiring life. May Morya bless your soul. We will always miss your presence in the building.

What a frank, open and succinct biography that covers almost all aspects of a working life. Thank you for sharing