We are pleased to inform you that the All India Federation of Tax Practitioners (AIFTP) has published a Book titled “New Reassessment Regime: Law, Procedure and Practical Guide” in association with the Taxmann.

The publication is dedicated as a Tribute in the fond memory of the late Justice Dr. B. P. Saraf, Former Chief Justice of Jammu and Kashmir High Court.

Dr. K. Shivaram, Senior Advocate and Mr. Tushar Hemani, Senior Advocate edited the publication. The publication is authored by Mr. Shashi Bekal, Advocate.

The messages for the said publication are written by Hon’ble Mr. Justice Rajesh Bindal, Supreme Court, Hon’ble Mr. Justice Ujjal Bhuyan, Supreme Court, Hon’ble Justice Mr. K. R. Shriram, Chief Justice of Madras High Court, Hon’ble Mr. Justice Abhay Ahuja, Bombay Court, Hon’ble Dr. Justice Neela Gokhale, Bombay High Court, Hon’ble Mr. Somashekhar Sundersan, Bombay High Court and Hon’ble Mr. Justice C. V. Bhadang, President of the Income-tax Appellate Tribunal and Former judge of the Bombay High Court

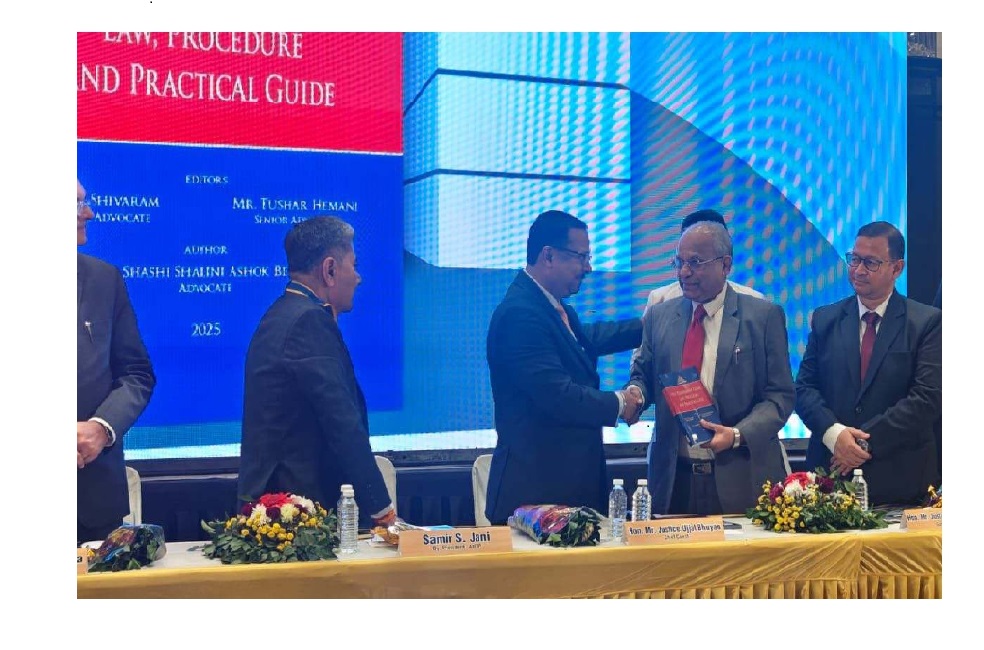

The publication was released by Hon’ble Mr. Justice Ujjal Bhuyan, Supreme Court, Hon’ble Mr. Justice B. D. Karia, Gujarat High Court, Hon’ble Mr. Justice Soumitra Saikia, Guwahati High Court, and Hon’ble Mr. Justice Pranav Trivedi, Gujarat High Court on December 14, 2024, at the 27th National Convention of the All India Federation of Tax Practitioners at Junagad.

The price of the publication is Rs. 1,395/-. ITATOnline subscribers can avail the book at Rs. 1,000/- (Including Courier charges). For details contact: aiftpho@gmail.com.

About the publication

“New Reassessment Regime: Law, Procedure and Practical Guide”

The concept of reassessment under the Income-tax Act, 1961 has undergone significant changes in recent years, particularly with the amendments introduced through the Finance Act, 2021 and again through Finance Act (2), 2024. This provides an in-depth analysis of the reassessment provisions, shedding light on the complexities and judicial interpretations that have emerged in the wake of these changes.

The publication, containing 14 chapters, explores key provisions related to reassessment under Section 147 to Section 153 of the Income-tax Act, 1961, and additionally, the book delves into appellate proceedings, revision proceedings, High Court, penalty proceedings and prosecution. The publication also throws light on Writ remedies available to a taxpayer and provides a checklist for effective representation. The publication also contains relevant CBDT guidelines for conducting reassessment.

This book will be a very useful reference guide for tax professionals, practitioners, and anyone seeking a comprehensive understanding of the new reassessment regime.

The price of the publication is Rs. 1,395/-. ITATOnline Members can avail the book at Rs. 1,000/- (Including Courier charges). For details contact: aiftpho@gmail.com.

Kindly share a copy of the Book on New Reassessment Regime: Law, Procedure and Practical Guide