| Court: | Bombay High Court |

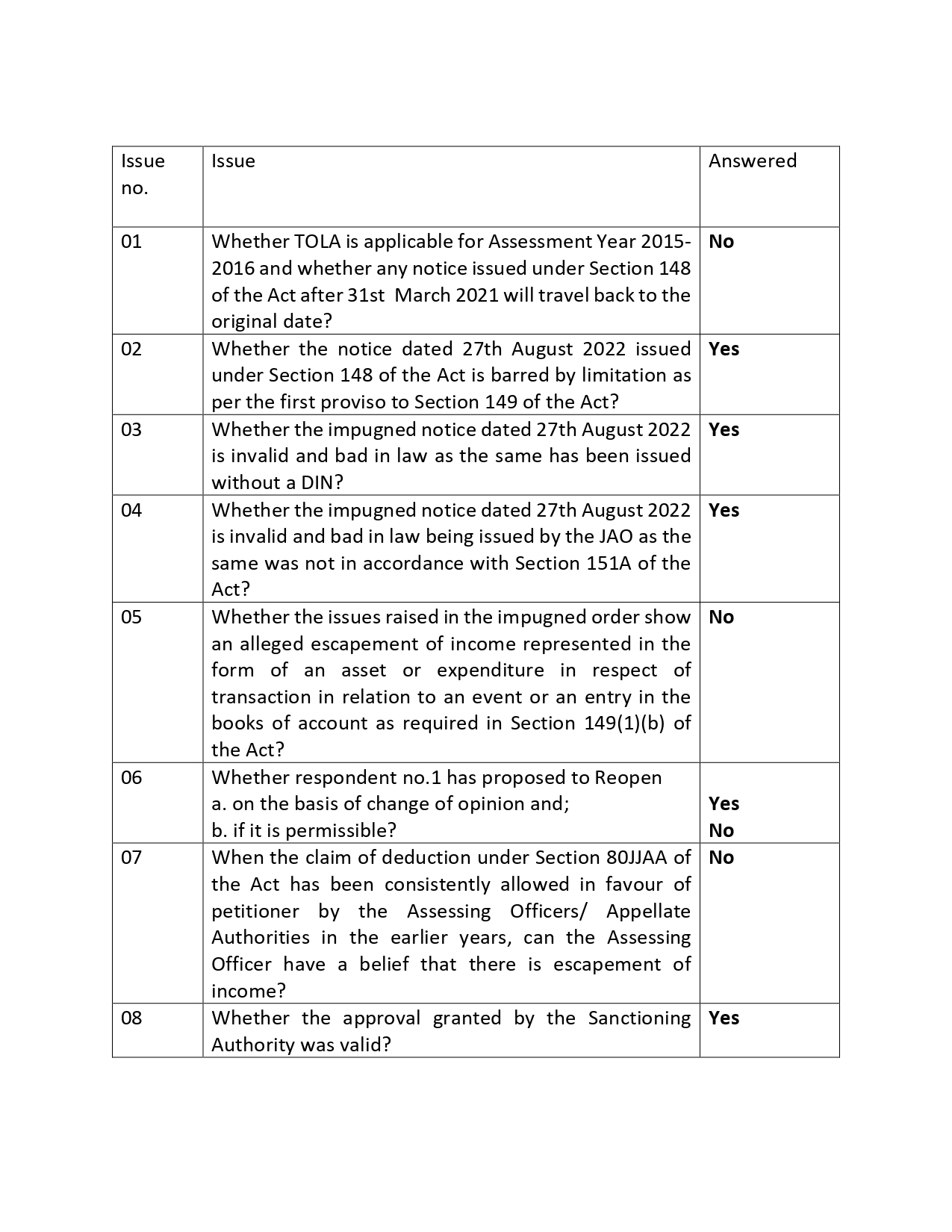

| Head Notes: | S. 148A : Reassessment – Conducting inquiry, providing opportunity before issue of notice – Whether TOLA is applicable for Assessment Year 2015-2016 S. 148A : Reassessment – Conducting inquiry, providing opportunity before issue of notice – Whether TOLA is applicable for Assessment Year 2015-2016 and whether any notice issued under Section 148 of the Act after 31st March 2021 will travel back to the original date? – Held No- Whether the notice dated 27th August 2022 issued under Section 148 of the Act is barred by limitation as per the first proviso to Section 149 of the Act? – Held yes – Whether the impugned notice dated 27th August 2022 is invalid and bad in law as the same has been issued without a DIN? -Held Yes- Whether the impugned notice dated 27th August 2022 is invalid and bad in law being issued by the JAO as the same was not in accordance with Section 151A of the Act? – Held Yes – Whether the issues raised in the impugned order show an alleged escapement of income represented in the form of an asset or expenditure in respect of transaction in relation to an event or an entry in the books of account as required in Section 149(1)(b) of the Act? -Held No- Whether respondent no.1 has proposed to reopen on the basis of change of opinion and if it is permissible? (a) . on the basis of change of opinion – Held yes (b) if it is permissible? – Held No – When the claim of deduction under Section 80JJAA of the Act has been consistently allowed in favour of petitioner by the Assessing Officers/ Appellate Authorities in the earlier years, can the Assessing Officer have a belief that there is escapement of income? Held No – Whether the approval granted by the Sanctioning Authority was valid? Held Yes–Writ petition is allowed and notice and consequential orders are quashed. [S. 80JJAA , 147, 148, 149, 149(1)(b), 151A, Art . 226] Petitioner is engaged in information technology consulting, software development and business process services. The petitioner has claimed deduction under section 10AA, and 80JJA of the Act. The assessment was completed under section 143(3) of the Act. The reassessment notice was issued under section 148 of the Act on 8th April, 2021. the petitioner, filed a writ petition challenging the notice issued under Section 148 of the Act on the ground that the said notice has been issued on the basis of the provisions which have ceased to exist and are no longer in the statute. The petition was allowed on 29th March 2022 and the Court held that the notice dated 8th April 2021 was invalid. On a Special Leave Petition that the Revenue had filed in the case of UOI v. Ashish Agarwal (2022) 444 ITR 1 (SC), the Hon’ble Apex Court, in exercise of jurisdiction under Article 142 of the Constitution of India, passed orders with respect to the notices and inter alia held that the notices issued under Section 148 of the Act after 1st April 2021 be treated as notice issued under Section 148A(b) of the Act and provided for time lines to be followed by the Assessing Officers for providing assessees the information and material relied upon by the Revenue for initiating reassessment proceedings. The Hon’ble Apex Court also clarified that all the defences available to assessees under the provisions of the Act would be available to assessee. The Assessing Officer passed the order under section 148A(b). After considering the objection order under section 148A(d) was passed. The petitioner challenged the said order by filing writ petition before High Court. The Honourable High Court has framed the following issues for consideration : (1) Whether TOLA is applicable for Assessment Year 2015-2016 and whether any notice issued under Section 148 of the Act after 31st March 2021 will travel back to the original date? (2) Whether the notice dated 27th August 2022 issued under Section 148 of the Act is barred by limitation as per the first proviso to Section 149 of the Act? (3) Whether the impugned notice dated 27th August 2022 is invalid and bad in law as the same has been issued without a DIN? (4) Whether the impugned notice dated 27th August 2022 is invalid and bad in law being issued by the JAO as the same was not in accordance with Section 151A of the Act? (5) Whether the issues raised in the impugned order show an alleged escapement of income represented in the form of an asset or expenditure in respect of transaction in relation to an event or an entry in the books of account as required in Section 149(1)(b) of the Act? (6) Whether respondent no.1 has proposed to reopen on the basis of change of opinion and if it is permissible? After a detailed discussion and considering the submissions of the Assessee and Revenue, the Honourable Court answered the questions as under : |

| Law: | Income-Tax Act |

| Section(s): | 148A |

| Counsel(s): | Mr. J.D. Mistri, Senior Advocate a/w. Mr. Madhur Agrawal i/b. Mr. Atul K. Jasani for petitioner |

| Dowload Pdf File | Click here to download the file in pdf format |

| Uploaded By | itatonline |

| Date of upload: | May 4, 2024 |

Leave a Reply