This Article won the Second Place in the 14th Padma Vibhushan N. A. Palkhivala Memorial national (Virtual) Moot Court & Research Paper Competition

A STITCH IN TIME: COMPARING THE CHANGES IN THE REASSESSMENT REGIME IN FINANCE BILL (2), 2024 AND THE LAW AS IT STOOD BEFORE

1. ABSTRACT

The Income Tax Act, of 1961 is the most frequently updated and amended law in force. Taxation is not a rigid structure which is written in stone and should be followed without any changes. To keep up with the passage of time and to ensure that the laws applicable do not become redundant, frequent changes and amendments are made to the taxation regime in the country. One similar amendment to the taxation law has been recently brought in by the Finance (No.2) Bill, 2024. When a part of the income of a person, has escaped from the liability of taxation in the assessment year, and if the Assessing Officer receives information suggesting the same, the AO shall issue a notice under S.148A to initiate the process of “reassessment,” which is to reopen the assessment of the year when the income escaped taxability. The Finance (No.2) Bill, 2024, has brought in major changes to the reassessment regime and this paper shall review the same in comparison to the law that stood immediately before the recent bill was passed.

2. INTRODUCTION

The Finance (No. 2) Bill, 2024 (hereinafter referred to as (No.2) Bill, 2024), given assent on the 16th of August 2024, has brought in various changes to the tax regime that was in place before the new bill was passed. While the (No.2) Bill, 2024 enacted by the parliament, has led to changes relating to various procedural and substantial aspects of direct and indirect branches of taxation, this paper will focus on the changes made by the (No.2) Bill, 2024 to the reassessment regime under the Income Tax Act, 1961 (hereinafter referred as IT Act) and contrast the recently amended provisions to the law as it stood before the introduction of the new Bill.

Sections 147 to 151 of the IT Act deal with provisions relating to the reassessment regime. The (No.2) Bill, 2024 has substituted the previous sections 148, 148 A, 149 and 151 and has made amendments to Section 153. The Finance (No:1) Bill, 2024 was passed in the month of February, and a majority of the significant reassessment regime provisions have been substituted in a period of merely 6 months from the introduction of the (No:1) Bill, 2024. The provisions relating to the reassessment regime underwent various amendments in the period of three years after the substitution effected by the Finance Act, 2021 which precedes the recent substitution under the (No.2) Bill, 2024. This paper aims to compare the recent amendment, and the law that existed before the amendment, the reasons behind the amendments and the scope of the amendment.

A STITCH IN TIME: COMPARING THE CHANGES IN THE REASSESSMENT REGIME IN FINANCE BILL (2), 2024 AND THE LAW AS IT STOOD BEFORE

1. ABSTRACT

The Income Tax Act, of 1961 is the most frequently updated and amended law in force. Taxation is not a rigid structure which is written in stone and should be followed without any changes. To keep up with the passage of time and to ensure that the laws applicable do not become redundant, frequent changes and amendments are made to the taxation regime in the country. One similar amendment to the taxation law has been recently brought in by the Finance (No.2) Bill, 2024. When a part of the income of a person, has escaped from the liability of taxation in the assessment year, and if the Assessing Officer receives information suggesting the same, the AO shall issue a notice under S.148A to initiate the process of “reassessment,” which is to reopen the assessment of the year when the income escaped taxability. The Finance (No.2) Bill, 2024, has brought in major changes to the reassessment regime and this paper shall review the same in comparison to the law that stood immediately before the recent bill was passed.

2. INTRODUCTION

The Finance (No. 2) Bill, 2024 (hereinafter referred to as (No.2) Bill, 2024), given assent on the 16th of August 2024, has brought in various changes to the tax regime that was in place before the new bill was passed. While the (No.2) Bill, 2024 enacted by the parliament, has led to changes relating to various procedural and substantial aspects of direct and indirect branches of taxation, this paper will focus on the changes made by the (No.2) Bill, 2024 to the reassessment regime under the Income Tax Act, 1961 (hereinafter referred as IT Act) and contrast the recently amended provisions to the law as it stood before the introduction of the new Bill.

Sections 147 to 151 of the IT Act deal with provisions relating to the reassessment regime. The (No.2) Bill, 2024 has substituted the previous sections 148, 148 A, 149 and 151 and has made amendments to Section 153. The Finance (No:1) Bill, 2024 was passed in the month of February, and a majority of the significant reassessment regime provisions have been substituted in a period of merely 6 months from the introduction of the (No:1) Bill, 2024. The provisions relating to the reassessment regime underwent various amendments in the period of three years after the substitution effected by the Finance Act, 2021 which precedes the recent substitution under the (No.2) Bill, 2024. This paper aims to compare the recent amendment, and the law that existed before the amendment, the reasons behind the amendments and the scope of the amendment.

3. DEVELOPMENTS UNDER THE (NO: 2 BILL, 2024)

The (No.2) Bill, 2024 has substituted Sections 148, 148 A, 149 and 151, has amended Section 153 and has not made any changes in the other provisions. However, the recent bill has made changes in the substantial provisions dealing with reassessment which may change the landscape of reassessment in the forthcoming years.

3.1. Issue of notice where income has escaped assessment – Section 148

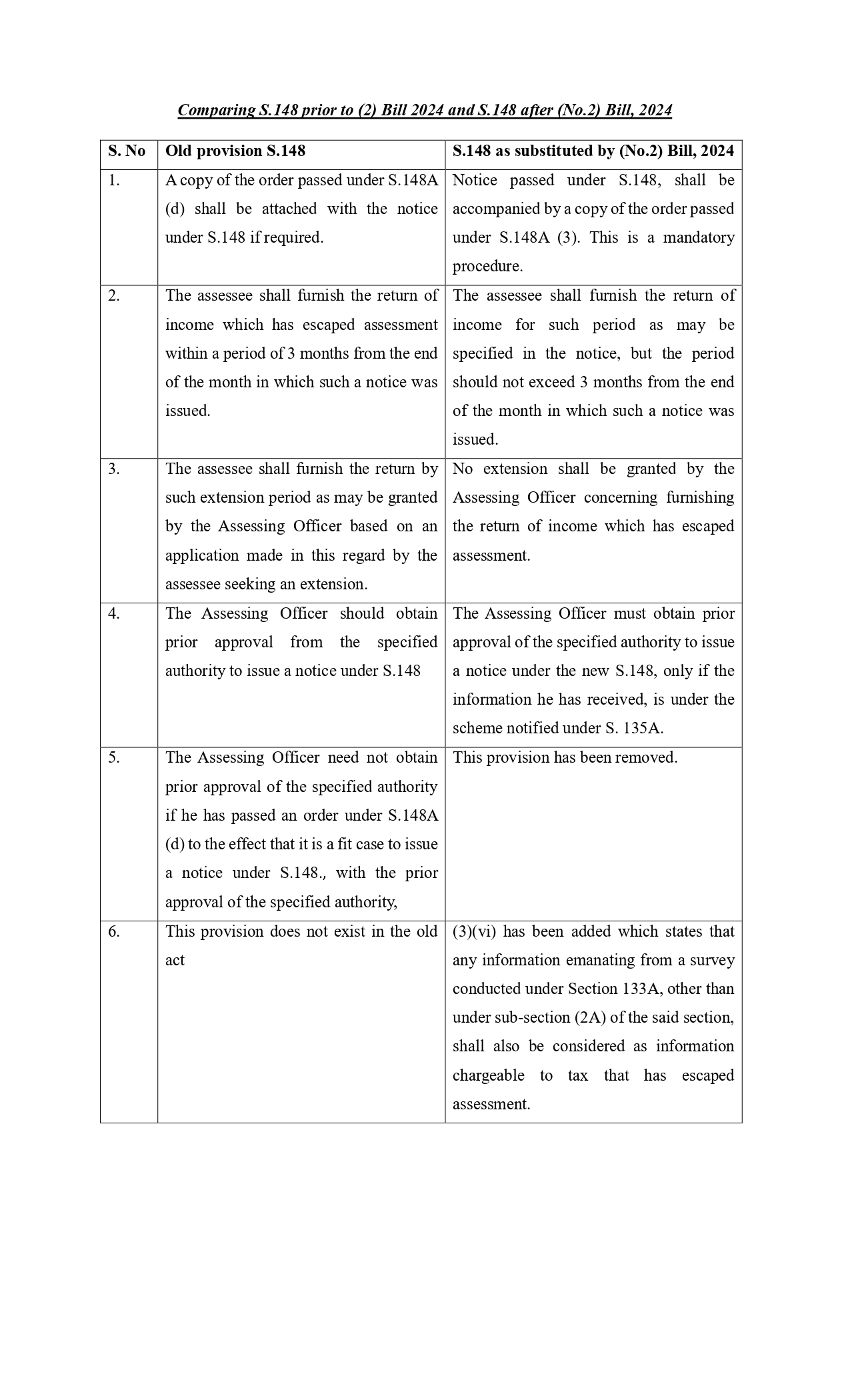

The (No.2) Bill, 2024 has substituted the previous section and has made material changes in the procedure of issuing notice under the present section.

While serving a copy of order passed under S.148 A is optional under the old provision, the new provision states that Assessing Officer (hereinafter referred to as AO) shall “subject to the provisions of Section 148A, issue a notice to the assessee, along with a copy of the order passed under sub-section (3) of Section 148A”, emphasizing that the notice under the current S.148 shall be compulsorily accompanied by the order passed under S.148 A. This change increases the efficiency of the reassessment regime as the notice is accompanied by reasons stated under the order as to why the case of the assessee is fit for reassessment, hence establishing clear grounds for reassessment.

As per the old provision, the assessee has been given a period of three months, to furnish his return of income which has escaped assessment in the previous year, from the end of the month during which notice under S.148 has been issued. The provision also accounts for the grant of extension for “such further period as may be allowed by the Assessing Officer based on an application made in this regard by the assessee”. The old provision was ambiguous as did not mention a specific day by which the assessee should have furnished his return, however, the present provision provides for a specific date as mentioned in the notice, by which the assessee should file his return of income. According to the (No.2) Bill, 2024, the assessee should furnish his return of income that has escaped assessment “within such period as may be specified in the notice, not exceeding three months from the end of the month in which such notice is issued”. This establishes a clearer timeline to be followed while furnishing income during reassessment. The new provision also did away with the procedure of seeking extensions, thus fixing stricter deadlines, and speeding up the reassessment procedure.

The first proviso of the old S.148, states that no notice shall be issued under the section unless “the Assessing Officer has obtained prior approval of the specified authority to issue such notice.” The AO is given very minimal power to perform functions under the IT Act as per this proviso, as he must obtain approval from the specified authority, each time he seeks to issue a notice under this section. This decreases the momentum of the reassessment procedure and curtails the powers of the AO, without their decision-making powers. However, according to the new bill, the second proviso states that “Provided further that where the Assessing Officer has received information under the scheme notified under Section 135A, no notice under this section shall be issued without prior approval of the specified authority”. This proviso clearly states that only if the information was received under S.135A, the AO must receive the approval of the specified authority. The new section has granted powers to the AO to issue notices under S.148 without prior approval from the specified authority, except for a few circumstances. This change speeds up the procedure of reassessment.

The second proviso of the old section states, “Provided further that no such approval shall be required where the Assessing Officer, with the prior approval of the specified authority, has passed an order under clause (d) of Section 148A to the effect that it is a fit case to issue a notice under this section”. The proviso states that if the AO has passed an order under S.148A stating that the assessee has a fit case to issue a notice under S.148, then the AO need not seek approval of the specified authority to issue a notice under S.148. The new provision has done away with this proviso as –

i) The notice under S.148 would be accompanied by the copy of the order passed under S.148A, which declares that the assesses case is fit to a notice under S.148 and,

ii) The AO can issue notice under the new S.148 of the IT Act, without seeking prior approval of the specified authority (except for information under S.135A), so the proviso is not an exceptional circumstance as per the new S.148.

S.148(3)(vi) was added by the (No.2) Bill, 2024 which has added “any information in the case of the assessee emanating from a survey conducted under Section 133A, other than under sub-section (2A) of the said section,” to be considered as information chargeable to tax that has escaped assessment.

3.2. Procedure before issuance of notice under Section 148 – Section 148A

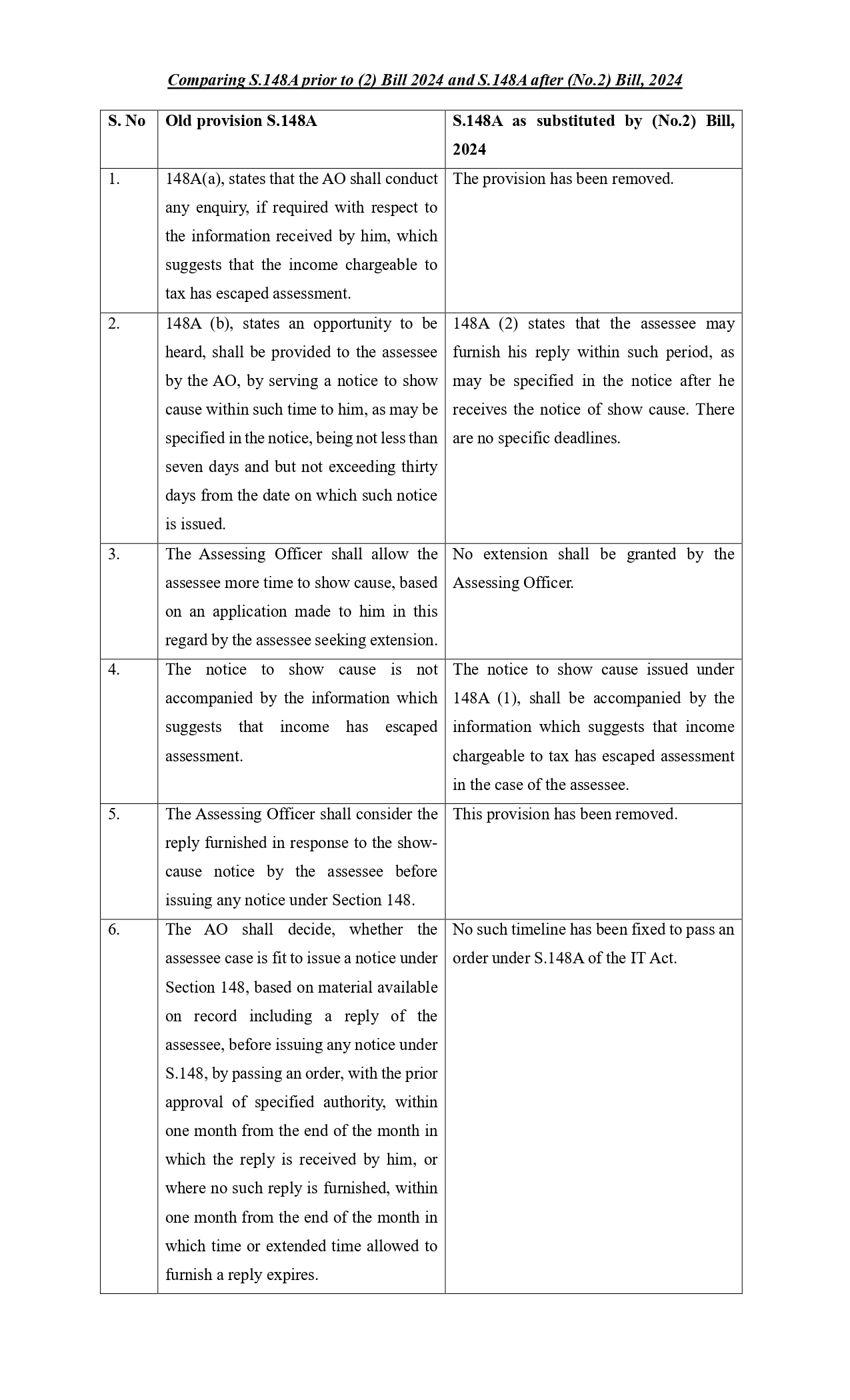

S.148A was substituted by (No:2) Bill, 2024 to eliminate cumbersome procedures and establish a concise and coherent procedure while contemplating if an assessee case is fit for issuance of notice under S.148 of the IT Act.

As per S.148A (a) of the previous provision, “The Assessing Officer shall, before issuing any notice under Section 148, (a) conduct any enquiry, if required, with the prior approval of specified authority, with respect to the information which suggests that the income chargeable to tax has escaped assessment;”. The old provisions called for an enquiry, if required about the information received which suggests that assessee income which was susceptible to tax, has escaped assessment in the relevant financial year. An enquiry about the information received may take months to complete, and due to such enquiry, the period by which notice should have been issued to the assessee to furnish his return of the income that escaped assessment may expire, defeating the purpose of the timelines stipulated under the IT Act. The new provision has removed the procedure of initiating enquiry about the information.

148A (b) of the previous provision states that “the AO before issuing a notice under S.148, shall provide an opportunity of being heard to the assessee, by serving upon him a notice to show cause within such time, as may be specified in the notice, being not less than seven days and but not exceeding thirty days from the date on which such notice is issued, or such time as may be extended by him on the basis of an application in this behalf,”. The old provision had specific deadlines to be met by the assessee, which were very restrictive in nature as the assessee had been given very minimal time to show cause to the notice issued under this section. The section also provided the possibility of seeking an extension, which may affect the hierarchy and flow of the procedure. The new S.148A(2) states that on “receipt of the notice under sub-section (1), the assessee may furnish his reply within such period, as may be specified in the notice.” The new section gives the AO discretion to decide when the assessee should show cause to the notice and does not allow any extension of show cause, maintaining the regularity of the procedure.

As per the new provision, the notice to show cause “shall be accompanied by the information which suggests that income chargeable to tax has escaped assessment in his case for the relevant assessment year.” The old S.148A only mentioned that the notice of show cause should be issued as a separate document. This new provision is a welcomed change as, according to the new provision, the show cause notice should be accompanied by the information received which suggests the assessee’s income has escaped assessment. This provision is effective in strengthening the reassessment regime if the assessee knows the information which suggests the income that has escaped from the assessment, the reply will be more specific and the assessee may even furnish the income which escaped assessment as per the provisions without any delay.

As per S.148A(c) of the old provision, the AO shall “consider the reply of assessee furnished, if any, in response to the show-cause notice referred to in clause (b)” The clause has been removed and is not included in the new substituted S.148A.

As per S.148A(d), the AO shall “decide, on the basis of material available on record including reply of the assessee, whether or not it is a fit case to issue a notice under Section 148, by passing an order, with the prior approval of specified authority, within one month from the end of the month in which the reply referred to in clause (c) is received by him, or where no such reply is furnished, within one month from the end of the month in which time or extended time allowed to furnish a reply as per clause (b) expires”. The old provision has mandated that the order shall be passed within one month from the end of the month when the reply is furnished by the assessee/when it should have been furnished by the assessee/when the extension was due, as to whether a case is fit for issuing notice under S.148.The new S.148A (3), states that “The Assessing Officer shall, on the basis of material available on record and taking into account the reply of the assessee furnished under sub-section (2), if any, pass an order with the prior approval of the specified authority determining whether or not it is a fit case to issue a notice under Section 148.” While the old provision, set deadlines for when the AO should pass an order under S.148A, the new provision does not impose any such specific deadline for passing an order under S.148A.

3.3. Time limit for notices under Sections 148 and 148A – Section 149

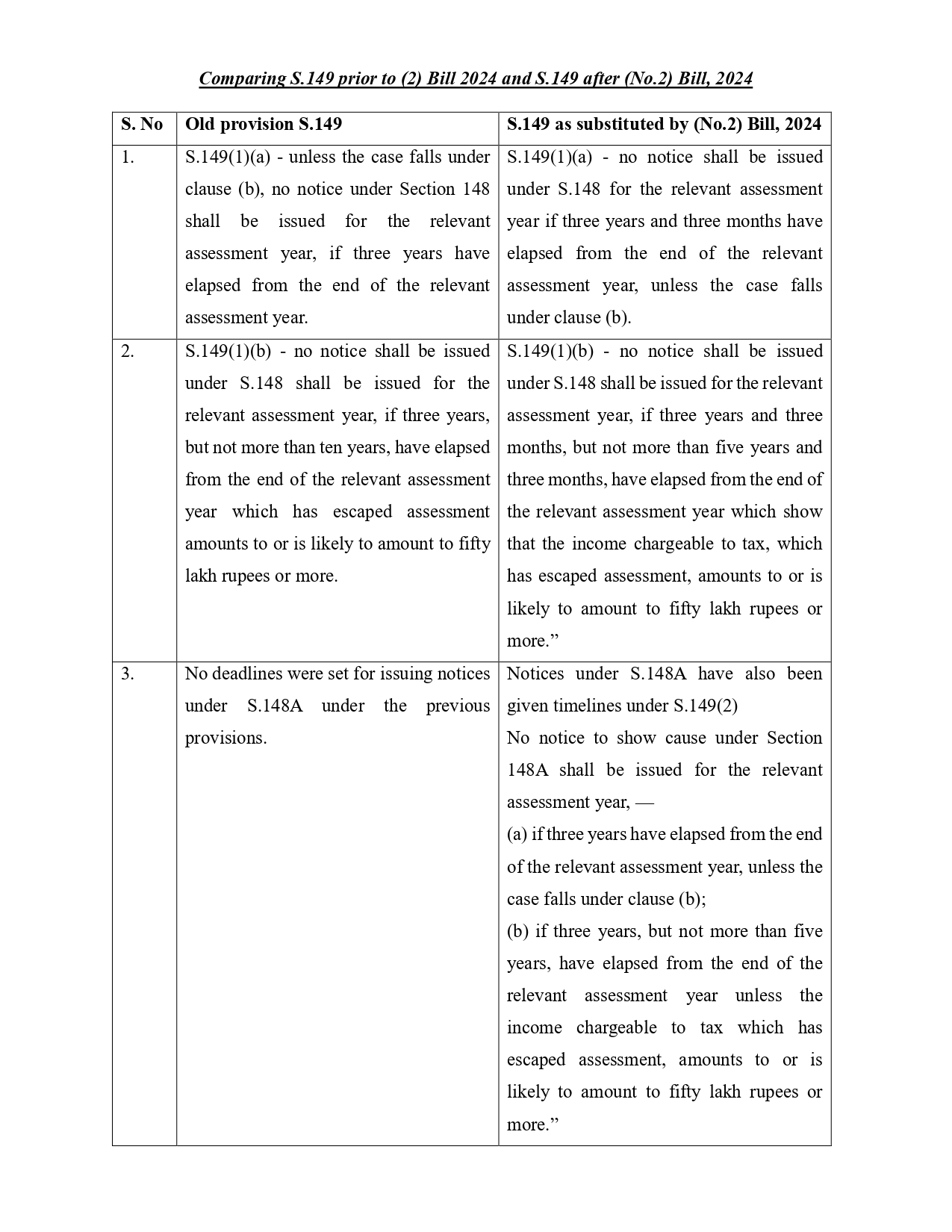

S.149 discusses the time limit for notices issued under S.148 and 148A of the IT Act. The provisions have been substituted by (No.2) Bill, 2024.

As per the old S.149(1)(a), “no notice under Section 148 shall be issued for the relevant assessment year if three years have elapsed from the end of the relevant assessment year, unless the case falls under clause (b);” . This timeline has been extended in the new provision of S.149(1)(a) which states that no notice shall be issued under S.148 for the relevant assessment year, “if three years and three months have elapsed from the end of the relevant assessment year, unless the case falls under clause (b);”.

S.149(1)(b) states that no notice issued under S.148 shall be issued for the relevant assessment year, if “three years, but not more than ten years, have elapsed from the end of the relevant assessment year unless the Assessing Officer has in his possession books of account or other documents or evidence which reveal that the income chargeable to tax, represented in the form of—

(i) an asset;

(ii) expenditure in respect of a transaction or in relation to an event or occasion; or

(iii) an entry or entries in the books of account,

which has escaped assessment amounts to or is likely to amount to fifty lakh rupees or more”

The new substituted provision of S. S.149(1)(b) states that no notice under S.148 shall be issued for the relevant assessment year, if “three years and three months, but not more than five years and three months, have elapsed from the end of the relevant assessment year unless the Assessing Officer has in his possession books of account or other documents or evidence related to any asset or expenditure or transaction or entries which show that the income chargeable to tax, which has escaped assessment, amounts to or is likely to amount to fifty lakh rupees or more.”

Section 149(1) after the (No.2) Bill, 2024, has extended the deadlines for issuing notice under S.148 from three years to three years and three months, and in cases where the income chargeable to tax, which has escaped assessment, amounts to fifty lakhs or more, the deadline has been extended from three years to ten years to a period of three years, three months and between five years and three months.

The new Section 149 has also added the timeline for issuing notices under S.148A of the IT Act. According S.149(2), “No notice to show cause under section 148A shall be issued for the relevant assessment year, —

(a) if three years have elapsed from the end of the relevant assessment year, unless the case falls under clause (b);

(b) if three years, but not more than five years, have elapsed from the end of the relevant assessment year unless the income chargeable to tax which has escaped assessment, as per the information with the Assessing Officer, amounts to or is likely to amount to fifty lakh rupees or more.”

This is an anticipated and accepted addition as the previous provision did not establish timelines for issuing orders under S.149 of the IT Act. S.149(2) as brought in by (No.2) Bill, 2024 acts as a tool to ensure an orderly and timely completion of the reassessment procedure.

3.4. Sanction for issue of notice – Section 151

According to the old provision of S.151, Specified authority for the purposes of Section 148 and Section 148A shall be, —

“(i) Principal Commissioner or Principal Director or Commissioner or Director, if three years or less than three years have elapsed from the end of the relevant assessment year;

(ii) Principal Chief Commissioner or Principal Director General or Chief Commissioner or Director General, if more than three years have elapsed from the end of the relevant assessment year.”

However, according to the newly substituted S.151 of the IT Act, the specified authority shall be “the Additional Commissioner or the Additional Director or the Joint Commissioner or the Joint Director, as the case may be.”

This substitution has done away with having the senior officers of the income tax department and has appointed the middle cadre of commissioners as the specified authority. This ensures that the procedure is being continued without any obstacles in the reassessment procedure due to the established hierarchy.

3.5. Amendment to other provisions – Section 152

While S.152, deals with various provisions, (4) added by the amendment made by (No:2) Bill, 2024 specifically focuses on the assessment/reassessment regime. Section 152(4) states that “Where, in a case other than that covered under sub-section (3), a notice under section 148 has been issued or an order under clause (d) of section 148A has been passed, prior to the 1st day of September 2024, the assessment, reassessment or recomputation in such case shall be governed as per the provisions of sections 147 to 151, as they stood immediately before the commencement of the Finance (No. 2) Act, 2024.” This amendment states that where any notice has been as per 148 or order as per 148A before the 1st September 2024, the law affecting such orders and notices shall be the ones immediately before the (No:2) Bill, 2024 came into effect.

4. DISCUSSION

At a microscopic level of observation of the amendment, a few provisions are favourable to the administration, and a few are favourable to the assessee. As filing income tax returns is a cumbersome and culminating process, the assessee may face difficulties in gathering all necessary data and ensuring that the assessee’s returns are precise. The biggest anxiety when an assessee receives a reassessment order would be, as to why it has been issued, however the amendment made to the provision vide (No.2) Bill, 2024 has put an end to this misery as the AO has to send a notice of show cause under S.149 along with the information which suggests that the income chargeable has escaped assessment. Issuing the information at the onset of the process makes it easier for the assessee to be ready with the reply to the show cause.

The (No.2) Bill, 2024 has established timelines for issuing a notice under S.148 which is to be followed by the AO, the deadline within which the assessee should furnish the return of income which has escaped assessment, the deadline within which a notice to show cause is to be issued, time frame within which the assessee should send in his reply to the S.148A notice, period by which an order is to be passed by the AO under S.148A, thus setting up a systematic and practical procedure which can be followed under the reassessment regime. Removing the provision of granting extension, simplifies the process and makes it administratively routine and more structured. The incorporation of timelines would prevent unnecessary interference and remove prejudice and harassment by the department, and the assessee would be able to keep up with the deadlines as the amended provisions are devoid of any ambiguity.

The need to get prior approval from the specified authority by the Assessing Officer has been done away with and this would speed up the procedure of reassessment and additionally give more autonomy to the assessing officer.

5. CONCLUSION

A cursory reading of the newly substituted or amended provisions to the law as it stood immediately before the passing of the Finance (No.2) Bill, 2024, makes it appear that the changes seem to be very minimal in nature and rather a concise version of the previous provisions, However, a thorough analysis and assessment shows that though the changes appear to be nominal in nature, the new provisions have brought clarity and consistency to the reassessment procedure. Scanning word by word while going through both the recent provisions and the law that preceded the recent amendment, it is evident that the new provisions have cleared the ambiguity, brought in well-established procedures, and have evolved through the various amendments to make the recent law, a much-welcomed change by the taxpayers, the advocates, the accounting professionals as well as the Income Tax Department.

As the newly substituted provisions relating to the reassessment regime were given effect, merely a month ago, it is rather short-sighted to currently assess their effectiveness and judge if they would fare better than the law that preceded them. However, merely comparing the old provisions and the recent ones, it can be understood that the changes brought in are well-thought, well-drafted and in the near future, declared as well executed and while the current legal scenario may take time to embrace the recent changes made to the law, it is widely agreed that change is the law of the world.

BIBLIOGRAPHY

1. Sunil Arora, Reassessment of Income – Amendments vide Finance Act, 2024, TaxGuru (September 3, 2024) https://taxguru.in/income-tax/reassessment-income amendments-vide-finance-act-2024.html

2. The Finance (No.2) Bill, 2024, Bill No. 55 of 2024, §44 (August 16, 2024)

3. The Income Tax Act, 1961, §148

4. The Finance (No.2) Bill, 2024, Bill No. 55 of 2024, §44 (August 16, 2024)

5. The Income Tax Act, 1961, §148

6. The Income Tax Act, 1961, §148

7. The Finance (No.2) Bill, 2024, Bill No. 55 of 2024, §44 (August 16, 2024)

8. The Income Tax Act, 1961, §148A(a)

9. The Income Tax Act, 1961, §148A (b)

10. The Finance (No.2) Bill, 2024, Bill No. 55 of 2024, §44 (August 16, 2024)

11. The Finance (No.2) Bill, 2024, Bill No. 55 of 2024, §44 (August 16, 2024)

12. The Income Tax Act, 1961, §148A (c)

13. The Income Tax Act, 1961, §148A (d)

14. The Finance (No.2) Bill, 2024, Bill No. 55 of 2024, §44 (August 16, 2024)

15. The Income Tax Act, 1961, §149(1)(a)

16. The Finance (No.2) Bill, 2024, Bill No. 55 of 2024, §45 (August 16, 2024)

17. The Income Tax Act, 1961, §149(1)(b)

18. The Finance (No.2) Bill, 2024, Bill No. 55 of 2024, §45 (August 16, 2024)

19. The Income Tax Act, 1961, §151

20. The Finance (No.2) Bill, 2024, Bill No. 55 of 2024, §46 (August 16, 2024)

21. Ruchesh Sinha, Pankaj Aggarwal, Anuj Goyal, “Reassessment provisions has been revamped, “again” vide Finance Bill 2024”, Taxmann, (July 24, 2024), https://www.taxmann.com/research/income-tax/top-story/105010000000024279/abcd

22. The Finance (No.2) Bill, 2024, Bill No. 55 of 2024, §47 (August 16, 2024)

About the Author: Details are awaited

Pdf file of article: Click here to Download

Posted on: October 25th, 2024

This study stands out for its logical structure, thorough research, and strong analytical depth. It’s clear that you have a robust understanding of the subject, and you’ve contributed valuable insights to the field. Congratulations on an impressive piece of work.