By CA Vidhan Surana and CA Satish Jethvani: Recently, CBDT had notified threshold limit to determine Significant Economic Presence. In light of said notification, we have analysed the term Significant Economic Presence and how it expanded the scope of “business connection” as defined in Section 9(1)(i) of the Act and how it is going to impact Indian businesses by citing Practice example.

Backdrop:

Traditionally your physical place of business determines your tax jurisdiction. However, in the current era of the digital economy, your physical place, for conducting business anywhere across the globe, is immaterial now. This change has created problems for the policymakers, as to how tax this type of businesses? Many digital giants, may not have a physical presence in India, however, they have a large consumer base in India through which they generate huge revenue out of it. However, it is found that they do not pay the due taxes on such revenue to the Indian exchequer. With a view to addressing this issue The Organisation for Economic Co-operation and Development (OECD) is working towards achieving a global consensus-based solution to the tax challenges arising from the digitalisation of the economy.

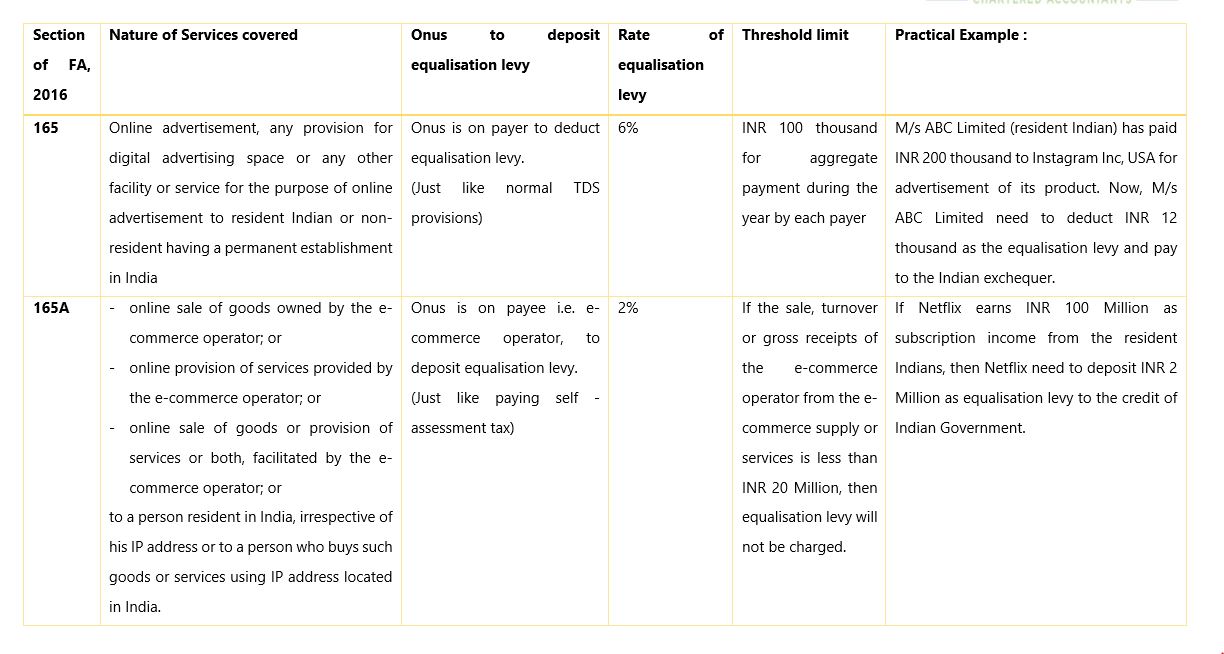

Equalisation Levy:

India was one of the first countries in the world to introduce a 6% equalisation levy in 2016, but the levy was restricted to online advertisement services. The scope of the equalisation levy has been expanded by the Finance Act, 2020 to cover e-commerce supply. Let’s recapitulate equalisation levy provisions in brief:

It is pertinent to note that, equalisation levy is not the part of Income Tax Act, 1961 hence non-resident e-commerce operator will not get the credit of the same in their home county.

Further, Incomes chargeable to equalisation levy are exempt from income-tax u/s 10(50) the Income Tax Act, 1961.

Objective to introduce Significant Economic Presence:

The objective of introducing the Significant Economic Presence (SEP) could well be understood from the Memorandum explaining the provisions of the Finance Act, 2018, wherein is stated that;

For a long time, nexus based on physical presence was used as a proxy to regular economic allegiance of a non-resident. However, with the advancement in information and communication technology in the last few decades, new business models operating remotely through digital medium have emerged. Under these new business models, the non-resident enterprises interact with customers in another country without having any physical presence in that country resulting in avoidance of taxation in the source country. Therefore, the existing nexus rule based on physical presence do not hold good anymore for taxation of business profits in the source country. As a result, the rights of the source country to tax business profits that are derived from its economy is unfairly and unreasonably eroded.

Thus, the intention of the lawmaker was to tax digital transactions through SEP. However, one may argue that the lawmaker is already taxing these digital trasactions, through the Equalisation levy.

What constitutes SEP?

A non-resident will be considered to have SEP in India in either of the following cases:

I. Transaction in respect of any goods, services or property are carried out by a non-resident with any person in India (including provision of download of data or software in India), if the aggregate of payments arising from such transaction(s) exceed the specified amount; or

II. Systematic and continuous soliciting of business activities or engaging in interaction with such number of users in India as may be prescribed

Non-residents having SEP in India would be now deemed to have a ‘business connection’ in India, and income attributable to the SEP would now be taxable in India (except in cases where a tax-treaty is applicable).

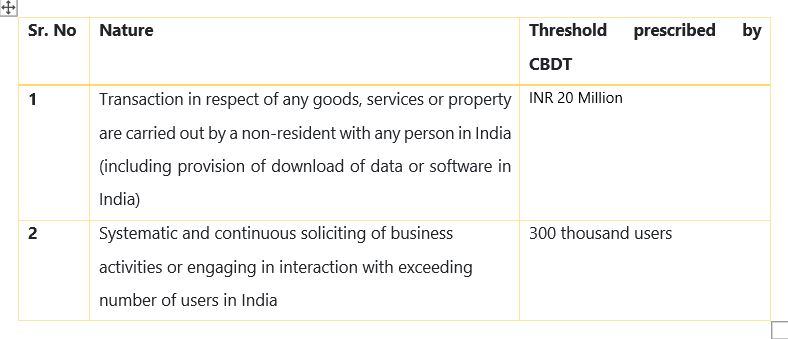

Threshold limit of SEP as prescribed by the CBDT:

CBDT vide notification no. 41/2021 dated 03rd May, 2021 , prescribed the following limits for SEP:

Please note that, if non-resident wants to avail the benefits of tax treaty, then above SEP will not be applicable. This is because if a tax treaty is applicable, foreign companies’ income is taxable in India only if it has a ‘Permanent Establishment’ (PE) in India and the income is attributable to the PE.

Relevance of SEP on your business:

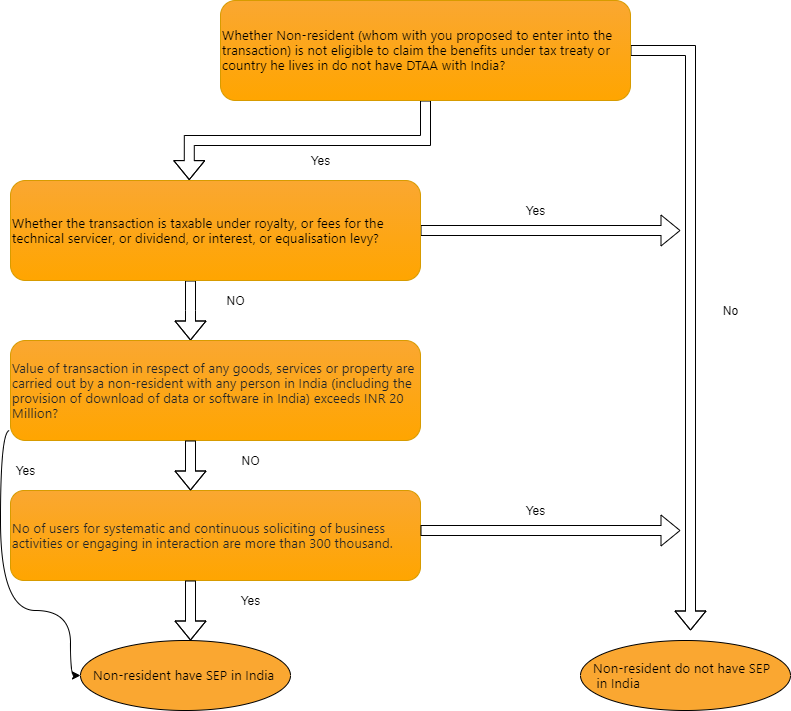

Following flowchart will help you to understand, whether Non resident has SEP in India or not?

As per the provisions of Income Tax Act, 196, it is payer’s responsibility to dedcut TDS as per applicable rates on payment being made to non resident. Consequently, if the non-resident has SEP in India, then non-resident’s business income earned from India will be deemed to be accrued and arised in India. So, while making payment to those non residents who have SEP in India, Indian payer needs to dedcut TDS @ 40% plus applicable surcharge and education cess on such income attributed to SEP in India.

The comprehensive provisions on SEP seems to go beyond the stated objective of taxing digitized businesses as mentioned in Memorandum explaining the provisions of the Finance Act, 2018 and they may bring within its purview even non-digitized businesses. Furthermore, the prescribed thresholds for constituting SEP appear to be on the lower side, especially for the threshold on transaction in respect of goods, service or property of INR 20 Million. Lastly, the income attribution mechanism for non-residents constituting ‘business connection’ (including by way of SEP) remains blurred, it is hoped that the Government would provide guidance on this matter to provide certainty to foreign businesses.

The comprehensive provisions on SEP seems to go beyond the stated objective of taxing digitized businesses as mentioned in Memorandum explaining the provisions of the Finance Act, 2018 and they may bring within its purview even non-digitized businesses. Furthermore, the prescribed thresholds for constituting SEP appear to be on the lower side, especially for the threshold on transaction in respect of goods, service or property of INR 20 Million. Lastly, the income attribution mechanism for non-residents constituting ‘business connection’ (including by way of SEP) remains blurred, it is hoped that the Government would provide guidance on this matter to provide certainty to foreign businesses.

Appicability:

Above provisions will come in force from 01st April, 2022.

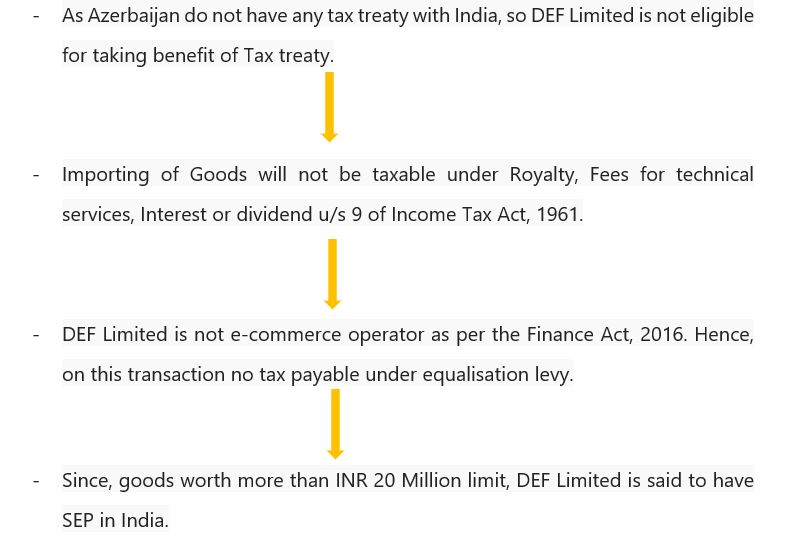

Practicle Example:

ABC Limited imported goods worth INR 5 Crores from DEF Limited which is sitauted at Azerbaijan (a Countrry sitauted at Western Asia). DEF Limited do not have any business connection in India.

Considering above, ABC Limited need to deducted TDS @ 40% plus applicable surcharge and education cess on the income attributed to SEP in India of DEF Limited.

Disclaimer:

This document is intended for private circulation and knowledge sharing purpose only. All efforts have been made to ensure the accuracy of information in this publication. The information contained in this document is published for the knowledge of the recipient but is not to be relied upon as authoritative or taken in substitution for the exercise of judgment by any recipient. The publication is a service to our clients to provide an overview of the Direct Tax Proposals and shall not be construed as professional advice or an authoritative opinion. Whilst due care has been taken in the preparation of this publication and information contained herein, we will not be responsible for any errors that may have crept in inadvertently and do not accept any liability whatsoever, for any direct or consequential loss howsoever arising from any use of this publication or its contents or otherwise arising in connection herewith.

About the Author: CA Vidhan Surana is the Founder and Managing Partner of Surana Maloo & Co.

Pdf file of article: Click here to Download

Posted on: June 5th, 2021

Leave a Reply