CA Nidhi Surana Jain has explained the provisions of the newly introduced “Vivad se Vishwas” scheme with special reference to sections 270A and 270AA of the Income-tax Act, 1961. She has pointed out that certain controversial interpretations could arise which could lead to further litigation. She has requested the CBDT and the Central government to work hand in hand and remove the areas of ambiguity and close the loopholes arising from the interpretation

CA Nidhi Surana Jain has explained the provisions of the newly introduced “Vivad se Vishwas” scheme with special reference to sections 270A and 270AA of the Income-tax Act, 1961. She has pointed out that certain controversial interpretations could arise which could lead to further litigation. She has requested the CBDT and the Central government to work hand in hand and remove the areas of ambiguity and close the loopholes arising from the interpretation

In the light of the recent budget announcement of “Vivad se Vishwas” Scheme by Hon’ble Finance Minister Mrs. Nirmala Sitharaman on 1st February 2020 during her budget speech for FY 2020-21, which literally translates into “No Dispute but Trust” Scheme, it is necessary to look at the current Tax Regimen concerning penalty and gauge the Income-tax department’s pulse and exactly where it is at concerning to penalizing of tax payer.

It is an undisputed fact that Tax dispute consumes time, energy and resources both on the part of Govt. as well as taxpayers. And penalty on such tax disputes, leads to further hardships on the tax payer, and the tax payers enter into penalty proceedings now for the penalty amount, so there is penalty dispute arising from the tax disputes. And an unbreakable chain of litigation, which keeps on circling the same issue is seen.

Under “Vivad se Vishwas” scheme taxpayers are NOW required to pay amount of disputed taxes and they will get immunity from interest, penalty and prosecution, under the condition that the disputed taxes are paid before 31st March 2020. Those who avail this scheme post 31st March 2020, need to pay extra 10 % of disputed taxes. This scheme will remain operational till 30th June 2020; however, there is expectation of this date being extended by few months (probably up to Sep – Dec 2020).

Significant aspects to avail the said scheme:

1. Declarant (Tax payer) files a declaration as per the new provisions in the scheme with the designated authority (CIT or some one as notified by Principal CIT) on or before the last date (to be notified by CG)

2. Only those cases (appeals/writs) which are outstanding or pending as on 31.01.2020 are eligible to avail the scheme.

3. The word Tax Arrears is clearly defined, which means:

a. aggregate amount of disputed tax including interest and penalty on such disputed tax,

b. disputed interest

c. disputed penalty

d. disputed fees

4. Amount payable by tax payer (Declarant):

|

Tax Arrears = |

Those who pay before 31st March |

Post 31St March |

|

Disputed |

Pay only Tax dispute amt |

Pay tax dispute amount +10% of tax dispute amount |

|

Disputed |

Pay only 25% of Interest/ Penalty |

Pay 30% of Interest/ Penalty |

5. The designated authority within 15 days from the date of receipt of declaration, issue order Tax payer (declarant) and grant certificate prescribing amount payable. And the declarant will pay the amount within 15 days from the date of receipt of the certificate and inform the Designated Authority of such payment.

6. As soon as tax payer (Declarant) receives a certificate post declaration, it is deemed as the appeal with the appellate forum [CIT(A), ITAT, HC or Supreme Court] is withdrawn.

7. Though the Tax payer(Declarant) should withdraw such appeal where the tax arrears are disputed.

8. Declaration shall be presumed to be void and as if never made

• Is any material particulars furnished in the declaration is found to be false at any stage.

• Declarant violates conditions mentioned in Act

• Declarant not act as per undertaking given by him.

9. Any amount paid in pursuance of declaration shall not be refunded in any case.

10. The Scheme cannot be availed and shall not apply to

• Where the case is of because of Search conducted u/s 132

• Where prosecution has already been initiated

• Where tax arrears is pertaining undisclosed income/asset outside India

• Where notice of enhancement of income is received from CIT(A) post 31/01/2020

• Where Cases are of Double Taxation Relief with Foreign countries

• Where prosecution for any offence punishable under IPC, Narcotic Drug, Benami Act, etc.

• Where order of detention u/s COFEPOSA Act has been made

Conclusion

The “vivad se vishwas” scheme is similar to the ‘Indirect Tax, Sabka Vishwas’ scheme, which was introduced by Finance Minister Nirmala Sitharaman during her maiden budget presentation in July 2019. The “Sabka Vishwas” legacy dispute resolution scheme was aimed at reducing disputes related to excise and service tax payments.

It seems that scheme is a fantastic way to put a hold on long running litigations, and reduce the cost of litigation on both ends. This will help Tax payers focus on their businesses instead of wasting energy on such tax disputes leading to financial headaches.

One cannot ignore, the New Penal provisions

Let us now analyze and understand the new Penalty Section 270A (effective from AY 2017-18), and 270AA, empowering the AO to grant immunity from imposition of penalty under section as well as initiation of prosecution proceedings under section 276C and 276CC.

In order to rationalise and bring objectivity, certainty and clarity in the penalty provisions, section 270A replaced section 271(1)(c) with effect from financial year 2016-17 (assessment year 2017-18). While the earlier penalty provisions of Section 271(1)(c) of the Act dealt with concealment of income and furnishing of inaccurate particulars of income, the new penalty provisions classify escaped income prudently into under-reported or mis-reported income.

The new penalty provisions provide for levy of penalty as under:

• Under-reporting of income: penalty of 50% of tax payable on under-reported income

• Misreporting of income: penalty of 200% of tax payable on misreported income

These two new concepts are explained in the ensuing paras. Reading the old penalty section vis a vis new ones.

|

Particulars |

Section 271(1)(c) |

Section 270A |

|

Basis of penalty levy |

(1) If the Assessing Officer or the Commissioner (Appeals) or Principal Commissioner or Commissioner in the course of any proceeding under this Act, is satisfied that any person- |

(1) The Assessing Officer or the Commissioner (Appeals) or the Principal Commissioner or Commissioner may, during the course of any proceedings under this Act, direct that any person who has under-reported his income shall be liable to pay a penalty in addition to tax, if any, on the under-reported income |

|

Subject matter of penalty |

The terms ‘concealment of income’ or ‘furnishing inaccurate particulars of income’ were subject matter of litigation. |

The section lists down the scenarios covered and excluded from the under-reported income. Further, it also provides broad identification as to what would constitute mis-reporting of income. |

|

Amount on which penalty is initiated |

Penalty proceedings were initiated on the amount of disallowance made |

Penalty proceedings only on the under-reported income, i.e., on net disallowance made (Discussed in para below) |

|

Quantum of Penalty |

100% to 300% of the amount of tax sought to be evaded |

In addition to tax, 50% of tax payable on under-reported income. Further, 200% of tax payable where under-reported income is in consequence of any misreporting thereof. |

|

Relief from Dual Penalty |

No such provision |

As per sub-section 11, no addition or disallowance of an amount shall form the basis for imposition of penalty, if such addition or disallowance has formed the basis of imposition of penalty in the case of the person for the same or any other assessment year. |

Under-reporting of income

While the Section does not define the term ‘under-reported income’, it does provide situations which can lead to under-reporting of income under the following two broad headers:

|

When return of income is filed |

When return of income is not filed or where return has been furnished for the first time under section 148 of the Act |

|

Income assessed > income processed u/s. 143(1)(a) |

Income assessed > Maximum amount not chargeable to tax |

|

Income reassessed or recomputed > income assessed or reassessed or recomputed previously |

|

|

Deemed total income (DTI) assessed or reassessed u/s. 115JB (MAT) or 115JC (AMT) > DTI processed u/s. 143(1)(a) |

Deemed total income (DTI) assessed u/s. 115JB (MAT) or Sec. 115JC (AMT) > Maximum amount not chargeable to tax |

|

Deemed total income reassessed >Deemed total income assessed or reassessed immediately before such reassessment |

|

|

Total income assessed or reassessed has the effect of reducing the loss or converting such loss into income |

|

What appears above is a plain vanilla arithmetic calculation where difference between income assessed and income as per the intimation/return of income is considered to be under-reported income. However, the section excludes the following while determining under reporting of income:

|

Case |

Condition |

Remarks |

|

Amount of income in respect of which assessee offers an explanation |

Income-tax authority is satisfied that the explanation is bona fide and all the material facts have been disclosed to substantiate the explanation |

Satisfaction • GTO v. Gautam Sarabhai Ltd. [1989] 29 ITD 212 (Ahd.) • GTO v. Rajmata Shanta Devi P. Gaekwad [2000] 112 Taxman 243/[2001] 76 ITD 299 (Ahd.) |

|

The amount of under-reported income determined on the basis of an estimate |

If the accounts are correct and complete to the satisfaction of the income-tax authority but the method employed is such that the income cannot properly be deduced therefrom |

Whether any vague or an unreasonable estimate made by the assessee can get covered within the exclusions? |

|

The amount of under-reported income determined on the basis of an estimate |

If the assessee has, on his own, estimated a lower amount of addition or disallowance on the same issue and has included such amount in the computation of his income and disclosed all the facts material to the addition or disallowance |

|

|

The amount of under-reported income represented by any addition made in conformity with the arm’s length price determined by the Transfer Pricing Officer |

Where the assessee had maintained information and documents as prescribed under section 92D, declared the international transactions under Chapter X and disclosed all the material facts relating to the transaction |

It is pertinent to note that the prescribed documentation relating to international transaction be correctly maintained. |

|

The amount of undisclosed income on account of a search operation |

Where penalty is leviable under section 271AAB in respect of such undisclosed income. |

Since penalty is levied under other provision of the Act, no penalty under section 270A |

Levy of Penalty discretionary

The power to direct levy of penalty under the said section is discretionary as the wordings of the statute provide "The Assessing Officer or the Commissioner (Appeals) or …… may, during the course of any proceedings under this Act, direct that…."..

Penalty to be levied on net disallowance :

|

– |

If in the assessment there are additions as well as reductions, the net amount would be considered as under-reported income subject to penalty; |

|

– |

Thus, under-reported income includes only difference between the net additions in assessed income and the income as per the intimation; |

|

– |

Thus, penalty is not levied on the total amount of disallowance made in the course of assessment proceedings as was done in erstwhile section 271(1)(c) of the Act. It is the net disallowance which shall be subject matter of levy of penalty under the new statue. |

Mis-reporting of income

As per sub-section 9 of section 270A, under-reported income represents misreported income in the following Cases:

• misrepresentation or suppression of facts;

• failure to record investments in the books of account;

• claim of expenditure not substantiated by any evidence;

• recording of any false entry in the books of account;

• failure to record any receipt in books of account having a bearing on total income; and

• failure to report any international transaction or any transaction deemed to be an international transaction or any specified domestic transaction, to which the provisions of Chapter X apply.

Generally, mis-reporting implies a wrong reporting to mean deliberate action with a view to achieve a desired result. Thus, the assessee should make disclosure of all material facts and provide evidence for all claims made.

A question may arise whether there can exist a mis-representation without there being any under-reporting of income? The same is not specifically provided for under the provision.

Legislative framework for immunity

A taxpayer can make an application seeking immunity from levy of penalty under section 270A, as well as initiation of prosecution proceedings under sections 276C (willful attempt to evade tax) and 276CC (failure to furnish return of income). The application needs to be made within one month from the end of the month in which the assessment order has been received by the taxpayer, subject to the following conditions:

• Tax and interest payable as per the order under section 143(3) or 147 is paid within the time allowed in the notice of demand; and

• No appeal is preferred against such order.

The tax officer is required to pass an order accepting or rejecting such application within one month from the end of the month in which the application is received. Rejection application can be passed only after giving the taxpayer an opportunity of being heard.

Key considerations for opting for immunity

The key considerations while opting for immunity are as under:

|

|

|

|

|

|

|

Uncertainties and concerns around immunity provisions

There is some ambiguity in the application of the immunity provisions as well as some concerns, which a taxpayer needs to consider while evaluating the decision to apply for immunity:

| • Once an application for seeking immunity is made, the tax authorities may perceive that the additions / disallowances made in the assessment order are admitted. | |

|

• Immunity is provided qua assessment order in its entirety, and not qua specific additions / disallowances. Therefore, the taxpayer has to forego his right to appeal with respect to all the additions made in the assessment order. |

|

|

• If an application for immunity is rejected, the taxpayer still has an option to file an appeal before the Commissioner of Income-tax (Appeals) against the order. The period from the date of application till the date of receipt of the order rejecting the application is not to be considered for reckoning the time limit of 30 days for filing an appeal. While this extension is helpful to some extent, it may not be useful if the due date for filing appeal has already lapsed prior to the filing the immunity application. In such case, the appeal may be filed only with a request for condonation of delay. In case the application for condonation of delay is not accepted, the taxpayer would be in a detrimental position. |

|

|

• If the demand payable is reduced pursuant to rectification, it is unclear whether payment of the lower demand would be acceptable for seeking immunity or not. Here again, it is not clear if the tax officer does not accept the rectification application. |

|

|

• In case where rectification application has been made and rejected, the question remains on whether a taxpayer can consider filing an appeal against the rectification order if the immunity has been granted. |

|

|

• Order passed accepting or rejecting the immunity is not an appealable order. |

|

|

• It appears that a taxpayer cannot file an application for immunity in case of a final assessment order, where a case is referred to the dispute resolution panel under section 144C. |

|

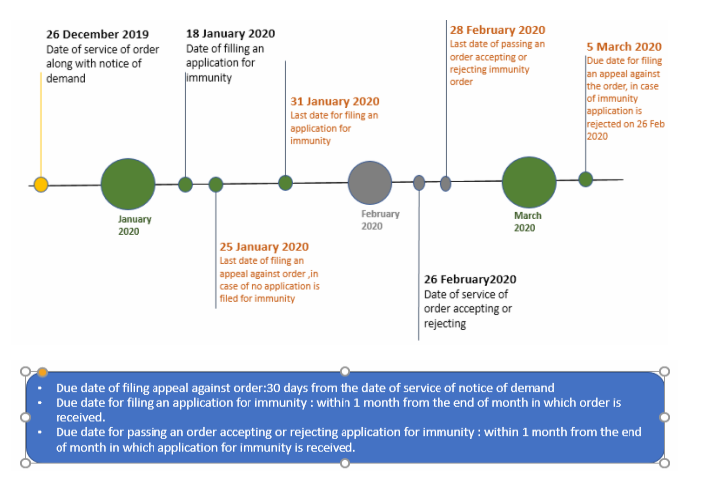

Timelines

For ease of understanding, the timelines relating to immunity are explained vide below illustration:

Concluding remarks

The implementation of the immunity provisions would however be put to test now. There are bound to be certain interpretation issues as highlighted above. Both the tax authorities and the taxpayer will be required to take constructive steps to ensure that the implementation of these immunity provisions are successful.

As of now, the decision is with the taxpayer on whether to file an immunity application or not, and the same needs to be taken swiftly.

To Sum up

The Current Tax scenario is the Government is in a forgiving mood, in light of the new penalty section and the latest Scheme, one can aptly say it’s a pardoning tax regime, but the nitty-gritty of sections and new provisions as per the scheme are new and virgin norms and section. They are open to interpretation and since there is no backward reference available, the CBDT and Central government will have to work hand in hand to remove any areas of ambiguity and close any loopholes if found. Nor even these various steps taken if construed wrongly or applied incorrectly or compliance defects may further lead to increase in litigation instead of lowering it.

| Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. Neither the author nor itatonline.org and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission of itatonline.org |

1)IF TAX IS PAID, WHETHER PENALTY INITIATED WILL BE WAIVED

2)IF THERE IS NO PENALTY LEVIED, BUT LIKELY, WHETHER IT WILL BE WAIVED ON 100% TAX PAYMENT, OR SEPARATE 25 % /30% PAYABLE ON LIKELY PENALTY

3)WHEN PAYMENTS ARE MADE IN INSTALLMENTS, HOW TO ALLOCATE BETWEEN INTEREST & TAX

4) IF THERE IS NO DISPUTED PENALTY/ PENALTY ORDER, WHETHER IT WILL BE WAIVED

5) IF APPEAL IS FILED FOR TAX DEMAND ASSESSED, WHETHER PENALTY, IS WAIVED

Excellent article, covered most of the points. Very informative and I think Government has to consider these points into consideration..

Nidhi, you have taken lot of effort explaining in detail about the VIV scheme.

A great article. Summarising current vsv scheme, very lucid language. kudos to the author.

Reading the new scheme along with the penalty sections, a good read. Will help the practicing community. As for the questions like what will happen to the 20% tax paid before filing of the appeal, it is a given that the same will be considered and only remaining 80% ought to be paid. More amendments are expected, to fill the gaps in the scheme. A fairly nice article.

Beautiful Graphic representation how to opt for immunity and the timeline.

Clear bifurcation of two limbs of section 270AA, a valiant effort by the author to explain the a scheme which has multiple loopholes.

Very informative article. Not the best scheme from the Government but your article will help many CAs across India in understanding this act..

As soon as a taxpayer (Declarant) receives a certificate post declaration, it is deemed as the appeal with the appellate forum [CIT(A), ITAT, HC or Supreme Court] is withdrawn ——– at CIT (A) and ITAT level it is deemed to be withdrawn on the filing of declarations but for HC and SC matters proof such withdrawal of such appeal has to be part of declarations.

Is it an article on the VSV scheme ? Does not look like !!!!!

What happens to 20% tax already paid while appeal is pending. Will it be allowed as deduction or we end up paying 120%

What happens when assessee has paid 100% tax & filed appeal to save further interest if he looses ? Does he end up paying 200% ?

What happens to interest already levied especially for re-opened cases where interest is almost equal to tax payable – does tax payable include interest also as determined in the assessment order ? Will that interest be waived ?

With a different stroke :

Reference to ‘BOTH ENDS’ in the writer’s conclusion is devoid of substance. (FONT supplied)

Is not the entire brunt of ‘cost of litigation’, – irrespective of at whose instance, – in the ultimate analysis, exclusively brought to bear upon the honest taxpayers’ community solely contributing to the national treasury?

The recent authoritative media report that barely 1.5 cr people pay income tax in our country out of a staggering more than 130 cr population seems to provide the clue for seeking and finding an answer!

courtesy

The common refrain is it will settle penny stock issues.However thousands have got relief from Nov 2017 to August 2019 in tribunals across the country and less issues pending .It should be kept in mind that a SC decision declaring the bogusness of whole affairs can only unsettled the assessee and advisors.

The bogus share capital and the infamous 263 matter will come for settlement only if a GROUP has acquired the company.The accomodation entry people and companies in their hands are not going to settle for obvious reasons.AND THEY FORM MAJOR CHUNK OF PENDING APPEALS AND MATTERS.

Still the government should not hope the scheme will go IDS 2016 WAY.

The fear is that like IDS 2016 it is not that too many seminars and discussions and few DECLARATIONS.

IT IS NOT AT ALL INFORMATIVE ARTICLE. THE TITLE IS TOTALLY ISGUDING. I READ TILL THE LAST WORD WITH A HOPE THAT THERE WOULD BE SOMETHNG VERY IMPORTANT AND BARIN STORMING BUT IT IS WASTAGE OF TIME.

Article just repeated the bill. There are issues like an Assessee has already got the favourable verdict in ITAT and department is contesting in High court, still Assessee has to pay the full tax to settle the case. No Assessee will do it.

Further if the assessment order or any order is passed In the month of January and the time limit to file the appeal is not expired, then the scheme seems not applicable.

Compare to sub ka Vishwas scheme this scheme may have only few buyers.

Only hopeless case will get settled under this scheme

Learn English first CA Deepika Soni

No clarification or opinion has been given where A O has initiated penalty proceedings for Misreporting instead of underreporting being Bonafide mistake u/s 115BBA

Thanks

Lalitang Shah