Sh. Krishna Mohan Prasad, the Pr. DGIT, has argued with conviction that the Department should accept the orders of the CsIT(A) which are in favour of the taxpayer and not file appeals against them. He has explained that if the Government is reconciled to trusting taxpayers and accepting 99% of the returns without any scrutiny, there is no reason why a judicial decision given in favour of the taxpayer by a senior official of the Department should not be accepted

Sh. Krishna Mohan Prasad, the Pr. DGIT, has argued with conviction that the Department should accept the orders of the CsIT(A) which are in favour of the taxpayer and not file appeals against them. He has explained that if the Government is reconciled to trusting taxpayers and accepting 99% of the returns without any scrutiny, there is no reason why a judicial decision given in favour of the taxpayer by a senior official of the Department should not be accepted

Article in the “Taxalogue” titled “Reduction of Income Tax Litigation”

Sh. Krishna Mohan Prasad is an IRS officer of the 1984 batch.

He is currently posted as the Principal Director General of Income Tax, Directorate of Legal & Research, New Delhi.

He had worked extensively as Commissioner (Appeals) and Commissioner(Judicial) and has rich experience in administrative and judicial matters.

He has also been part of several committees formed by the CBDT regarding the reduction of litigation.

He has written an article titled “Reduction of Income Tax Litigation” in the “Taxalogue”, a publication of the Department, in which he has argued that once a case is decided by the Commissioner of Income Tax (Appeals), who is a senior officer of the Department, there is no valid reason for filing further appeal by the Revenue.

He has pointed out that if this is done, the litigation would be reduced by approximately in 80% or more cases, as in majority of the cases, it is the Department who files appeal in such cases.

He has also argued that the suggested amendment in the Income-tax Act would go a long way in overhauling tax administration, mobilizing more revenue, improvement of economy, reduction in administrative cost of the Income Tax Department & compliance cost of the tax payers.

Dept’s success rate is less than 10%

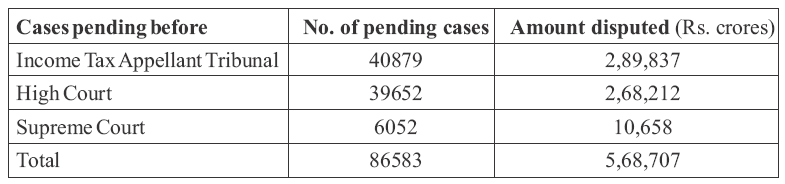

Sh. Krishna Mohan Prasad has pointed out that there is a huge pendency of tax cases in the Courts and the Tribunal, involving large amounts of disputed tax.

The aggregate pendency is of 86,583 cases and the amount disputed is Rs. 5,68,707 crore.

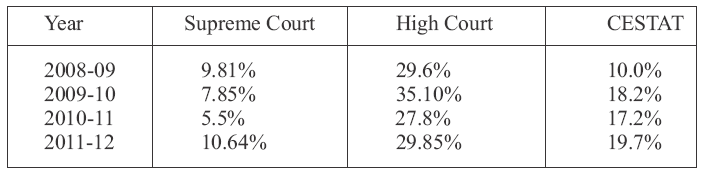

He has also pointed out, taking a cue from the figures related to indirect tax litigation, that the success rate of the Departmental Appeals at ITAT, High Court and Supreme Court is extremely low and is possibly less than 10%.

“When the success rate of departmental appeal is extremely low no gainful purpose is served in filling departmental appeal against the order of CIT(A), especially when the administrative and other costs of filing departmental appeal far exceeds the revenue collected,” he has submitted.

Dept officers should be bold and not file frivolous appeals

The learned author has taken drawn inspiration from the strictures passed by the Bombay High Court in CIT-2, Mumbai vs. L&T Ltd.

The Court took a stern view regarding the tendency of the officials to mechanically file appeals, without application of mind to the merits.

It was held as follows:

“(i) We are surprised if not shocked that such appeals are being brought before us and precious judicial time is being wasted that too by the Revenue. The least and minimum that is expected from the Revenue officers is to accept and abide by the Tribunal’s findings in such matters and when they are based on settled principles of law. If they are not deviating from such principles and are not perverse but consistent with the material on record, then, we do not find justification for filing of such appeals. We have found that merely expressing displeasure orally is not serving any purpose;

(ii) Time and again we have to deal with such Appeals. Merely because they are filed that they get listed on the Daily Admission Board. The Advocates filing them and routinely, so also those instructing them do not have authority to withdraw them. Consequently, they are pressed and argued resulting in a hearing, may be brief and an order of this Court dismissing them. Some times there are at least 35 such cases on our daily board. We do not understand why higher officials do not have the courage to take bold decisions particularly of not pursuing such matters upto this court or higher. Because the assessee is a leading Public Limited Company should not act as a deterrent for them to take a informed, rational decision and subserving larger Public Interest “.

The Court levied a fine of Rs. 3 lakhs on the Department and directed that the same may be recovered from the officials.

Taxpayers spend Rs. 1000+ crore in legal costs

The learned author has opined that challenging/ defending the orders of the CsIT(A) has a high impact cost for the Department as well as the taxpayers.

He has estimated that taxpayers spend nearly Rs. 1000 crore by way of huge fees to Chartered Accountants and lawyers in dealing with the litigation at ITAT, High Court and Supreme Court.

A similar cost is incurred by the Department by way of Payments to Departmental Counsel at High Courts and Supreme Court.

There is also the cost of manpower and office space required to be incurred.

If 99% of returns are accepted, why not orders of the CsIT(A)

The author has pointed out that the stated policy of the Government is that 99% of the Returns of income are not scrutinized and are accepted.

Similarly, 99% of the assessment orders of Assessing Officers are accepted and not subjected to revision.

“When 99% Returns of the taxpayers and Assessment orders of AOs which happen to be much junior to CIT (A) are accepted, what is the harm in accepting Orders of CIT (A), who generally after more than 20 years of service, and after vigilance clearance and on the basis of excellent performance annual reports are promoted as Commissioner by the DPC held by UPSC?” he has asked pertinently.

Uncertainly discourages investment decisions and slows down economic progress

The ld. author has also rightly pointed out that stability and certainty is important for a good tax policy.

He has emphasized that uncertainly over final tax liability greatly discourages important investment decisions and slows down the economic progress.

He has also pointed out that large numbers of extremely educated and talented Indian citizens, both in the department and as tax practitioners, are involved in fruitless litigation.

“It is high time the department should accept the decision of its own very senior officer,” he has suggested.

Very high and true thoughts sir

GOOD THOUGHT BOLD STEP BUT DO AWAY AN OLD SYSTEM IS VERY DIFFICULT WE SHOULD IMPROVE EXISTING SYSTEM -A COMMITTEE TO DECIDE FILING OF APPEALS WITH DUE APPLICATION OF MIND TO FACTS AND LAW AND NOT MECHANICAL IN APPROACH -APPEAL FILING TIME BE INCREASED TO 120DAYS

Good suggestions Mohan Sahab but the fact is that most of the officials work as per the advice and suggestions suggested by various professionals practicing before higher courts etc. There is no doubt to say that on general issues like allowance or disallowance of claim and deduction related issues if decided in favour of the assessee by CIT(Appeals) it should be accepted by the department without any further appeal if on merits. The only legal issues which pertain to interpretation of law etc should be challenged in tribunals and courts. His views are most welcomable.

Valuable article, lots of buried truth slightly revealed. Hats off sir, I request you, not to stop your initiative upto its implimentation.

GOOD SUGGESTION

The article is well thought of. but who is to bell the cat?

The Central Action Plan 2018-19 provides that CIT(A) will receive incentives if they enhance assessments, strengthen the assessment order and/or levy penalty u/s 271(1)(c).

This move has been condemned by leading representatives of Industry a nd also by top tax professionals.

in the light of the above Now the question is in the minds of tax litigant is whether the first appellate authority is necessary

The Government can reduce the cost by outsourcing the professionals both advocates and chartered accountants with integrity to dispose the appeal which will have tsunami effect of disposal of the all the appeals within a reasonable period and would reduce the heavy expenditure incurred by the Government and litigtion cost of the litigants

This system is not new the French Government implemented in India at Pondichery before the independence by engaging chartered Accountants.

The unanimous learned Shome Parthasarathy committee report which recommended accountability. The committee report is was put as useless lumber.

We seriously need Bold and open minded CIT (Adm) like Mr. Prasad Pr. D GIT, who is well acquainted with the value of money and time involve upon filing frivolous appeals.

Very Good and practical suggestion ! It will help save useful time and money and will give relief to Assesses who are already under lot of pressure for variety of compliance work.

Very practical suggestion given by sir ,one more request from sir that he can give suggestions for tax dispute resolutions scheme …in which 1 lakh crore of fund is blocked

Hats off to the bold suggestion.

Department works with distrust on it’s own officials. After increase in Monetary limits many CsIT appeals are dismissing appeals. If such a decision that no appeals would be filed by revenue the dismissals would increase.

The article is only dealing with one side of the larger issue. No frivolous appeals, Yes. Why only appeals. there should be no frivolous assessment order. But merits of the additions made / issues involved can not be sacrificed at the altar of reduction of litigation. Unfortunately, the seniority of the appellate authority has not much to do with the quality of the orders emanating from these authorities. While reduction of litigation is welcome, it should not be done at the cost of merits and the consequent revenue lost. It is Indian ingenuity that almost all processes are manipulated/ misused to advance individual interests ….always at the cost of nation/ society.

BOLD STEP, THANK YOU SIR, GOOD ARTICLE

So bold, courageous and open minded idea. If his suggestion were to be accepted, what will happen to so many CIT(A)s and their administration. Will CBDT provide work or like US provide a yellow cover on their table. A Million $ question

Hats off. The need of the hour is only this for the country to progress without any litigation, friction so on and so forth