CAs Naresh Kumar Kabra and Ankit Modi have provided valuable guidance on how businesses will have to adapt to survive the disruption caused by Covid-19. The authors have given pointers on how the cash crisis can be met through orthodox methods of cost cutting. They have also provided practical insights as to ‘What Comes After’ the lockdown and how to prepare for it. A pdf copy of the article is available for download

CAs Naresh Kumar Kabra and Ankit Modi have provided valuable guidance on how businesses will have to adapt to survive the disruption caused by Covid-19. The authors have given pointers on how the cash crisis can be met through orthodox methods of cost cutting. They have also provided practical insights as to ‘What Comes After’ the lockdown and how to prepare for it. A pdf copy of the article is available for download

Overview

The Indian economy has declared its 6 years’ lowest real GDP in the third quarter of 2019-20, and the outbreak of COVID-19 has posed enormous challenges. The situation forced the government to impose 40 days (initially 21 daysand then extended by further 19 days) nation-wide restrictions and a complete lockdown to curtail the lethal impact of the outbreak. It has led the economic activities of the nation to a standstill and could impact both the demand & supply side of the economy.The lower reliance on intermediate imports, can possibly insulate the businesses from the global supply chain disruption.However, the deteriorating economy have forced the businessmen to think about their survival.

Impact on the Fund Flow Management:

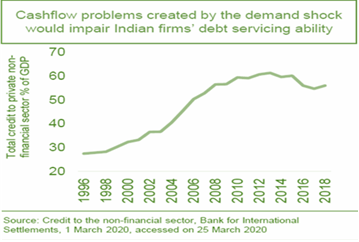

The lockdown has resulted in a shutdown of the industrial and commercial establishments and the supply chain in the economy. This has adversely impacted the cash flows as the inflows are curtailed to its lowest and outflows are difficult to be compromised. The industrial sector of India was already suffering from a slow-down phase and the exhausting liquid funds may lead to failure in satisfying the payment obligations or may lead to insolvency in some cases. A situation of liquidity crunch is highly expected the reason being that the falling or zero revenues that aren’t compensated by measures such as loan forbearance.

The lockdown has resulted in a shutdown of the industrial and commercial establishments and the supply chain in the economy. This has adversely impacted the cash flows as the inflows are curtailed to its lowest and outflows are difficult to be compromised. The industrial sector of India was already suffering from a slow-down phase and the exhausting liquid funds may lead to failure in satisfying the payment obligations or may lead to insolvency in some cases. A situation of liquidity crunch is highly expected the reason being that the falling or zero revenues that aren’t compensated by measures such as loan forbearance.

Impact on the Supply Chain:

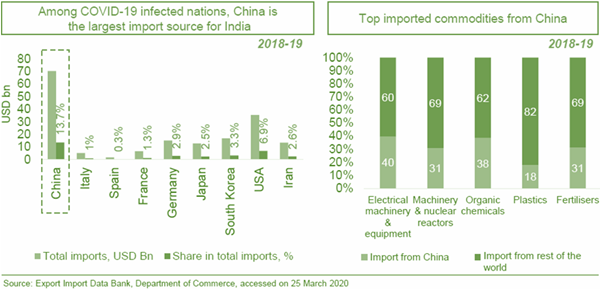

China is the largest source of imports for India. Shutdown of factories in China might result in shortage of raw material for firms who are largely dependent on them. However, the common practice of stockpiling in Indian firms might insulate them from facing the shortages or price hikes.

There is also an emotional shift among the people towards Chinese products or towards companies use Chinese products. The resulting impact of Government actions against China and consumer’s dislike are factors that need to be kept in mind.

Barring few industries, the economy is not expected to get effected significantly as continuous incentives under “Make in India Scheme” reduced its reliance on imports from other nations.

Impact on Customer Demands:

Considering the need of hour, the demand of non-essential goods may lead to a steep fall as the consumers are expecting an extension in lockdown period. Demands forEuropean & American countries export oriented businesses are supposed to get more effected in comparison to domestic supply-oriented units. Demands for essential goods like food and non-alcoholic beverages is expecting a sudden rise but situation may get uncontrolled in case of domestic supply chain disruption due to lockdown. Demands in case of restaurants, hotels, multiplex etc. industries isaffected severely, no rise in demand is expected in the upcoming 3 months.

To minimize the impact of this once in a decade disaster and reincarnate your business, we would like to discuss a phased plan with you in the rest part of this article.

Phase 1 – How to deal with the current scenario

The increasing rate of cash outflows together with the decreasing cash inflows urges the organizations to review their cash flow management planning in order to cope up with the upcoming situation. Although, a situation of liquidity crunch is prevailing in the market but the businessman is advised to pay off staff salary & debts as this will help the organization gain employee’s confidence and increase its creditability & Goodwill. Following are some suggestions which might be considered in accordance with the need of hour:

PAY Now or PAY Later:

- Payment of advance tax, self-assessment tax, TDS, TCS, STT, CTT, Equalization levy for the month of March, April, May can be made up to 30th June 2020.This scheme is a treat for firms having borrowed funds.

- Moratorium* for bank interest:The Reserve Bank of India (RBI) sought to cushion both borrowers and lenders against the unprecedented disruption engendered by the COVID-19 outbreak, allowing borrowers a three-month grace period on loan repayments which include unsecured loans such as credit card repayments and personal loans.

Example – Let us all assume that you have taken a term loan on 1st March 2020-

Term Loan – Rs. 50 lacs; Period – 10 years; Interest rate – 9%; EMI – Rs. 63,338/-. Your EMI will become due on 1st day of every month starting from April 2020.

Since moratorium is just a deferment not waiver of EMI’s, interest will continue to accrue at the same rate during the moratorium period.

In the above example,interest for the month of March & April, 2020 will amount to Rs. 37,500/- & Rs. 37,781/- respectively (Compound interest) and will be added to the Principal amount. Now your loan amount will be Rs. 50,37,500/- as on 1st April 2020 & 50,75,281/- as on 1st May 2020.

Points to be kept under consideration:-

- You have to confirm whether your bank is providing moratorium services to you or not since RBI has just allowed all banks to provide Moratorium to their customers, not made it mandatory. It is upon your bank to provide you this facility.

- You will have to bear extra interest burden of Rs. 75,281/- on deferment of two EMIs.

- Your Repayment Schedule can be revised in two manners as below-

|

Case-1 |

Case-2 |

|

Tenure of the loan will be increased to recover the deferred EMIs and interest accrued during the moratorium period. |

If increase in tenure of Loan is not possible then EMI amount will be increased accordingly considering the new Principal Amount. |

|

Fresh Auto Debit or NACH Debit– |

Fresh Auto Debit or NACH Debit– “Required” (Since EMI amount is changed) |

(Businesses have to consider this scheme only in case of urgent cash requirements or extreme shortfall in liquid funds as this scheme can be availed at an additional cost only.)

However, if one wants to avail the facility of Moratorium for various types of credit facilities taken from the bank then it should be availed by prioritising in the following sequence-

|

Priority |

Credit Facility |

Reason |

|

First |

EMI based loan (Retail/Business Loan) |

Loan tenure / EMI will be increased and interest accrued can be paid over the period. |

|

Second |

Cash Credit/Overdraft Facility |

Total Interest accrued during the period of Moratorium will become due in the month of June 2020 |

|

Last |

Credit Card Facility |

Credit Card facility usually bears higher rate of interest and penal charges. |

- The Due date of creation of deposit reserve amounting to 20% of deposits maturing during FY 2020-21 (under Companies Act 2013) has been extended from 30th April 2020 to 30th June 2020. Companies can use these interest free funds to make good some necessary payment obligations (like salary, creditors etc.) or invests such amounts in order to gain some additional income.

- The Due date of investing funds equivalent to 15% of debentures maturing during FY 2020-21 in specified instrument (as per Companies Act 2013) has been extended from 30th April 2020 to 30th June 2020. Companies can use these interest free funds to make good some necessary payment obligations (like salary, creditors etc.) or invests such amounts in order to gain some additional income.

- Payment of output tax under GST i.e. GSTR 3B: Due dates of filling of GSTR 3B for the period February-April 2020 has been extended by the GST department, this has resulted in interest free deferment of payment obligations for taxpayers. The Extended dates for different class of tax payers are as under:

The taxpayers having aggregate turnover > Rs. 5 Crore in the previous F.Y. is expected to get most benefitted from this scheme as they can use interest free funds till 8th July 2020. Further, for firms borrowing funds @ 9% or above they may use funds at a comparatively lower rate than borrowing from other sources.

Note:There is a lot of uncertainty now on how long this crisis will last and what will happen subsequently? How long will revenues remain stalled? When will the industry return to its normalcy? So, the businessmen are advised to manage their cash flows in such a way that its inflows are coping to meet their upcoming obligations subsequent to adaptation of above policies.

Revisit Your Variable Costs-

Reducing the variable costs is a quicker and effective method to immediately reduce cash outflows than focusing on deferment of payments and eliminating the fixed costs. Consider 15-20% cut in all of expenses incurred in last six months showing in Statement of Profit and Loss and make a budget on such basis. Communicate with your vendors for providing discount and reducing the cost which will be a good move as you are providing business to them in this slowdown.

There are some typical variable cost-reduction triggers, such as imposing travel bans and non-essential meeting restrictions, deferring luxury purchases,events and welfare activities, and placing restrictions on discretionary spend like entertainment and training. Video Calls/Conferencing for meetings and use of Social Media or other inexpensive channels for advertising can be afforded for the time being.

When labour is a significant cost line in a business, redesign the whole process, restructure the production procedures and realign the manpower requirement according to the situation. Consider layoffs and even retrenchment, if required. Look for opportunities to reduce contract labour and re-distribute work to your permanent workforce. Encourage employees to take available leave balances to reduce liabilities on the balance sheet. And, if necessary, consider offering voluntary, or even involuntary, leave without pay to preserve cash. Reducing variable costs will feed the working capital requirement of businesses to an extent.

Dispose Your Capital Investment Plans-

Preparing a cash flow forecast by keeping in mind both Optimistic and Conservative approach will clear the air to make you able to rethink the decision of Capital Investments.Considering what is really the need of the business’s survival and restructure for the near term until the situation improves, will give you an idea which capital expansion plans can be postponed, what capital investments should be reconsidered and what capital investments are required to regain the position and for creating competitive advantage?

Prepare Your Human Resource for ‘What Comes After’–

After a long period of rest and being in quarantine, you cannot expect your human resources to work at full efficiency from Day 1. There is dire need of keeping the workforce connected and keep their engines running during this period and thereafter. The two categories of manpower is being used by any business- a) Worker b) Employee.

Worker- These are your most useful components of production process who have been kept your business operating and generating revenues. Most of them do not have another source of income to feed their families. In these testing times, you can come forward and do your part to pay them their daily wages, in-spite of no production and revenue on the other side. This will make the bond stronger and will motivate them to give back 100% to your business when it restarts.

Employee- Your employees are the other asset to your business in form of human resource who can find you a way in this situation of uncertainty. The lockdown which now going to continue till 3rd May 2020, is the best time to utilize their intellect and creativity when there is no regular work to do.

- Reach out to them- Be empathetic,honest and transparent

- Spring cleaning of the organisation; Fill all gaps and complete all pending tasks through them

- Ask them for suggestions for cost cutting and new revenue generation sources

- Make them able to ‘Work From Home’ while considering the data security

- Don’t cut their pay, defer it – Talk to them straight away regarding current situation of business

Plan for management of your human resource when your restart your business-

- Prepare your projections and plan your productions

- Take decision on number of workers which will be required to restart the essential function and production

- Identify your key employees (and their roles) who will be required to get your business back on track

- Plan your production and working in 2 or more shifts on rotational basis

- Bifurcate all the workers and employees to come in different shifts in a day

- Plan to outsource maximum work; manage work through contractors

Phase 2 – Rebuilding Your Business

Demand & Supply Management:

The disruption in Demand and Supply has already been started due to this pandemic. A quick response of shutting everything down to slow the spread of disease also limits the movement of essential workers and stops critical supply chains from functioning effectively. This will stop the gears of a business from spinning and will pose a great challenge to restart with full speed.

Supply-

There will be a big challenge with all suppliers to restart their business as usual on Day 1 when this lockdown ends. There might be a possibility that they end up in a cash crisis and are not able to come into operation for a longer period of time. The following issues might be faced-

- No or lesser procurement of material

- Increased rates

- Delay in procurement

- Degraded quality etc.

Following can be the Action plan-

- Analyze the impact of this disruption on your procurement partners and decide whether they will be able to provide you with required material in required quantity as per your forecast on Day 1 of the restart.

- If situation is not good to go with them, then find new suppliers at tier 2 or tier 3 to provide necessary materials to your business.

Some businesses are mainly dependent on imported goods. We have analyzed the impact of COVID-19 on imports in the upcoming paras.

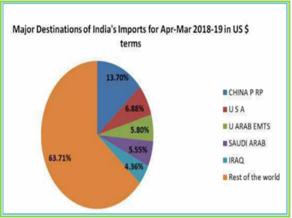

Find substitute supplier nations: Among the top 5 destinations of India’s imports, China & USA together constitutes around 20.5% of its total imports. Since these nations have been drastically hit by the coronavirus pandemic, they too are facing complete shutdowns in their industrial sectors. The major commodities imported from these nations include China [electronic items, electrical equipment, organic chemicals, plastics and fertilizers] and USA [Aircrafts, chemical products, electrical machinery& equipment, mineral fuels, vehicles]. Foreseeing the upcoming situation, continuous supply from these nations is expected to be contingent as the Indian govt. may impose certain import restrictions to control trade deficits or the nations will aim towards self-sustainability before initiating exports. It is thereby advised to the industries dependent on imports from these countries to either look for a domestic substitute or search for availability of the same in other nation for uninterrupted supplies.

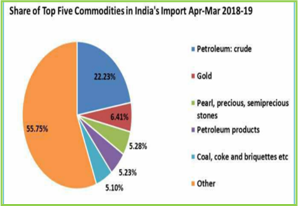

Find domestic substitutes:The top 5 commodities that India imports i.e.petroleum products, Gold, Precious Stones, Coal etc. together constitutes around 44.25% of its total imports. India at least for these commodities are somewhere dependent on other nations. Since these nations are also struggling to get a breakthrough from the pandemic, it would be unjustifiable to expect uninterrupted supplies from them. Thereby, it will be a wise decision for all such industries (who are majorly dependent on these commodities) to pay significant attention to manage their inventory levels in such a way to reduce the risks of stock-out, procurement at higher rates, or increased holding cost.These industries should also look for a domestic substitute of the required material for uninterrupted supplies.

Demand-

There is no book to refer which gives us an idea of how the graphs will behave, whether they will go up or down or will they be steady. We all are learning from experiencing the situation. Sales and growth forecasting is more challenging than ever now, including whether a specific customer segments will be partially or fully frozen and for what period of time.

The dependency on present customer base will have to be kept aside and new markets will have to be explored to survive this uncertainty.

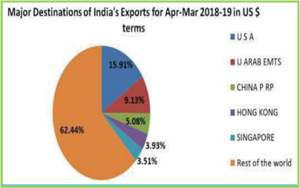

Explore new markets for your product: Among the top 5 destinations of India’s Exports, USA, China & UAE together constitutes around 30.13% of its total exports. The major commodities exported to these nations include China [ores, slag & ashes, iron & steel, plastics, organic chemicals and cotton], USA [Medical appliances, agricultural products, precious metal and stone (diamonds), Jewellery]& UAE [precious stones, apparels, ships/boats, iron & steel etc.]. One whose sales are dependent on these countries, should either find new ways to get into the other markets, being less impacted from COVID-19 or explore the domestic consumption of their products.

There are two possibilities for an opportunity in International Businesses:

• Chinese products not being preferred in huge markets like USA or Europe

• Snatching market share from organizations that might be unable to manage their cash reserves

It will be strategic to identify beneficial markets and try to penetrate our products in such markets.

Explore new revenue sources:Out of crisis comes opportunity, and sometimes we can snatch victory from the jaws of defeat. This disruption gives you all the time to rethink your strategies and divert the funds in more sensible projects according to the evolved situation. Since everything will be starting over from zero, there is no harm in starting something new.

If current revenue stream has been disturbed and will take a long time in recovery, a business can consider other ways to compensate the cash flows. As a lot of businesses will come out from this lockdown with empty pockets and without an aggressive strategy, they will be creating various new business opportunities for others who have tackled this situation.

Properly assessing the changing need of the market, will provide a new way of thinking to add a new stream to the source of income. One might think of using the existing assets to develop a different product according to the need of the customers.

Inventory Management-

Inventory is the life blood of these businesses. Too much of it and the business struggles with cash flow and capital allocation. Too little of it and it faces shortages and customer dissatisfaction.

Retailers who supply the products which are not necessities, are facing massive inventory blockage and plummeting sales. As discussed earlier also, there is no forecast which can be called correct. Businesses need to know what they have in their warehouses, in stores, what is selling at what time, and where, so they can quickly react to changing conditions and customer needs?This is called “Dislocation of Inventory”.

Having unified inventory visibility across channels in a single database is crucial. This does not only enable organizations to make rapid and agile replenishment and stock transfers, it also means they avoid overspending on inventory.

A detailed analysis of on-hand and on-order inventory will yield an understanding of merchandise that can be sold through direct channels or liquidated upon reopening. Use of JIT approach,fundamental improvements in end-to-end supply chain inventory visibility, demand planning, inventory and safety stock policies, production planning and scheduling, lead-time compression, network-wide available-to-promise, and SKU (stock keeping unit) rationalization will do the needful for the current situation.

The delivery of On-order Inventory can be postponed. Proper communication of the real situation of the business to your suppliers will help in doing so. Reach out to your suppliers and materialize the long term relationship between businesses of both.

Logistic Chain Management-

The transportation to a business is like veins to a human body. The logistics facilities also have been hit hard during this time and put on complete halt by COVID-19. The logistics both for imports and domestic procurement has been impacted and requires immediate restoration.

For starters, determining the components that are critical for operations of your business. And also get a clear idea of all those components that are sourced from the areas which are highly impacted and also which have no ready substitutes either in foreign or domestic markets.

Supply chain risks related to thosecomponents/commodities can then be analysed to assess the risk of interruption from suppliers of tier-two and onward.

The substitutes for logistic partners need to be found out in such situation on increased costs or compromised delivery time.

Businesses must engage with their key suppliers across tiers in an effort to form arrangement to restore the transportations and manage the supply chain disruption.

Manage Your Receivable & Payables-

Supply chains are affected and managing cash flow becomes more important, it’s worth taking a hard look at how your receivables and payables are being managed.

Keeping in mind of the situation and long relationship with your customers, it’s important to improve the rigour of your collection processes. Identify the impact on your customers and assess the expected change in their payment practices. Timely delivery and billing will be the basic necessities to quicken the payment process.

The use of trade receivable financing platform TReDS has also become popular in recent times. This platform involves three participants MSME Supplier, Corporate Buyer and Financier. The invoice is uploaded by either buyer or supplier depending on the method of discounting and is approved by the other party. Once the invoice is approved the financiers on the platform start to bid on the invoice. The supplier accepts the bid and the discounted amount is credited in its account in T+1 day, where T is the day of acceptance.

Another way to preserve and build your working capital is to take longer period to pay to your suppliers of Goods or Services. This approach might lead to harm the relationship with the suppliers or might lead to late deliveries and quality issues. But moving intelligently and working with suppliers to establish such an agreement which provides benefit to both whether short term to one and long term to another, will serve the purpose. In some cases, the businesses might have to be quick in the payment considering the critical position of supplier in order to preserve the integrity of the supply chain.

Conclusion

When going gets tough, the tough get going!This is not a usual natural disaster like flood, earthquake etc. for which everyone is prepared in the present time. This is something like once in a century and there is no database to refer to for assessing the probable impact and strategizing. This situation requires businesses to rethink their plans, realign their strategies, reengineer their processes, rewrite their policies, restructure their revenue models, recast the roles of key persons, regain the command and restart the systems all over again.

The coming time will bring a lot of challenges and risk to the businesses like Capital Management Risk, Financial Risk, Operational Risk, Regulatory risk etc. The time after COVID-19 will never be the same and will require quick adaptation of the situations. Focus on cash to cash conversion cycle rather than profit or loss and targeting the top line.

Routine cash expenses and delayed cash recoveries are often ignored amidst achievement of the goal of sale targets. A coordinated and integrated approach to manage all three elements of supply chain- supplier, customer and inventory will minimize the impact of this global pandemic.

It might not be a very tough time for businesses who work strategically and manage themselves throughout this. However, many small or unmanaged businesses will take a fall during this period. It is the best time to eye upon such businesses and think about investing and buying stakes. Benefits will flow to the organisation in form of synergies.

| Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. Neither the author nor itatonline.org and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission of itatonline.org |

A wonderful effort of both the writers with complete professional approach but easily understandable by a common man.

My congratulations to both CA Naresh and CA Ankit. Please do update it with all new developments

I appreciate your efforts CA Naresh and CA Ankit for a comprehensive write up with valuable inputs for industry. Hope they will be benefitted.