In PCIT vs. Maruti Suzuki India Ltd 107 Taxmann.com 375, the Supreme Court considered the important issue whether proceedings initiated by the Department against a person who ceases to exist due to death or amalgamation is valid or not. CAs Nehal Shah and Tanupriya Patel have explained the true scope of the judgement and raised several pertinent follow-up questions. One of the interesting questions raised is whether, if the assessee’s successor omits to inform the Department of the death or amalgamation of an entity, the proceedings against the entity are curable and valid. A pdf copy of the article is available for download

In PCIT vs. Maruti Suzuki India Ltd 107 Taxmann.com 375, the Supreme Court considered the important issue whether proceedings initiated by the Department against a person who ceases to exist due to death or amalgamation is valid or not. CAs Nehal Shah and Tanupriya Patel have explained the true scope of the judgement and raised several pertinent follow-up questions. One of the interesting questions raised is whether, if the assessee’s successor omits to inform the Department of the death or amalgamation of an entity, the proceedings against the entity are curable and valid. A pdf copy of the article is available for download

I. INTRODUCTION

1.1 An enormous litigation is going around in Income tax proceedings wherein assessment Orders or notices initiating assessment proceedings are issued/passed in the name of non-existing entities i.e. those entities which are either merged, amalgamated, wound up, etc before passing of the Assessment Order hence such entities becomenon-existent entities in the eyes of law. Whether on such facts assessment order passed in the name of erstwhile entity shall be a valid order or not?

1.2 Hon’ble Supreme Court in the latest decision of Maruti Suzuki India Ltd 107 taxmann.com 375deals with the above situation [otherwise than in case of death] and held that a notice issued in the name of the amalgamating entity after amalgamation is void because the amalgamating entity ceases to exist andthis is a substantive illegality and not a procedural violation of the nature adverted to in section 292BB.The Hon’ble Supreme Court has also distinguished the decisions rendered by Hon’ble Delhi High court in the case of Skylight Hospitality LLP 405 ITR 296/[2018] 90 taxmann.com 413 (Delhi) and SLP dismissed by it in [2018] 92 taxmann.com 93. The facts and findings of Hon’ble Supreme Court are discussed here under which have been followed in a number of pronouncements rendered subsequently.

II. FACTS :

2.1 The brief facts are that the assessee SPIL was a joint venture between SMC and MSIL. Scheme of amalgamation was approved by the High Court by which SPIL (Amalgamating company) was amalgamated with MSIL (Amalgamated Company) w.e.f. 01.04.2012. The series of events which took place subsequently are as under:

| Date | Particulars |

|

28.11.2012 |

Return of income for AY 2012-13 was filed by SPIL (Amalgamating company) declaring income of Rs. 212.5 crore |

|

29.01.2013 |

Scheme of amalgamation of SPIL and MSIL was approved by the High Court with effect from 1 April 2012 |

|

02.04.2013 |

MSIL intimated the Assessing Officerabout the amalgamation. |

|

26.09.2013 |

The case was selected for scrutiny by the issuance of a notice under Section 143(2) followed by a notice under Section 142(1) to the amalgamating company i.e. SPIL. |

|

04.09.2015 |

The AO asked for disclosure of information in the course of assessment proceedings and same was addressed to SPIL(Now known as MSIL) |

|

22.01.2016 |

The Transfer Pricing Officer passed an order under Section 92CA (3) making an adjustment of Rs. 78.97 crores in respect of royalty paid by the assessee for the relevant previous year. |

|

11.03.2016 |

Thereafter, assessment proceedings continued with the participation of MSIL representing SPIL in the assessment proceedings. A draft assessment order was passed in the name of SPIL which sought to increase the total income of the assessee by Rs. 78.97 crores |

|

12.04.2016 |

MSIL filed an application before the Dispute Resolution Panel (DRP) as the successor of SPIL, which was subsequently amalgamated |

|

14.10.2016 |

DRP issued its order in the name of MSIL (amalgamated company) |

|

31.10.2016 |

The final assessment order was passed in the name of SPIL (amalgamated with MSIL) making an addition of Rs. 78.97 crores to the total income. |

As evident from the series of events which took place herein above, the final Assessment Order was passed by the Assessing Officer in the name of SPIL which was non-existent on the date of passing of such order (though the fact of amalgamation was duly intimated to the Assessing Officer by the amalgamated company).

III. ISSUES BEFORE THE HON’BLE SUPREME COURT

(A) During pendency of assessment proceedings, an entitywas succeeded by another entity (otherwise than on death) and considering following set of facts, whether assessment order passed subsequently in name of said non-existing entity, would be without jurisdiction or not?

(i) Notice issued u/s 143(2) and 142(1) was issued in the name of non-existent entity and such notice was issued after the scheme of amalgamation which was approved by the High Court and such fact was intimated by the amalgamated company to the Assessing Officer before issuing such notice u/s 143(2) of the Act.

(ii) Assessment Order was passed in the name of non-existing entity.

(iii) Along with the name of amalgamating company, the name of amalgamated company was also mentioned in the notice issued u/s 142(1) as well as in assessment order passed u/s 143(3).

(iv) The representative of amalgamated company duly participated in the assessment proceedings.

(B) Whether issuance of jurisdictional notice and subsequent assessment order passed in name of non-existing company is a substantive illegality and not a procedural violation of nature adverted to in section 292B or not?

IV. DECISION OF SUPREME COURT :

(A) ON FACTS OF THE CASE

(i) The income which is sought to be subjected to the charge of tax is the income of the erstwhile entity (SPIL) prior to amalgamation. This is on account of a transfer pricing addition of Rs. 78.97 crores, Under the approved scheme of amalgamation, the transferee has assumed the liabilities of the transferor company, including tax liabilities.

(ii) The consequence of the scheme of amalgamation approved under section 394 of the Companies Act, 1956 is that the amalgamating company ceased to exist in view of findings in the decision laid down in case of Saraswati Industrial Syndicate Ltd. 186 ITR 278.

(iii) Upon the amalgamating company ceasing to exist, it cannot be regarded as a person under section 2(31) against whom assessment proceedings can be initiated or an order of assessment passed;

(iv) The Assessing Officer assumed jurisdiction to make an assessment in pursuance of the notice under section 143(2). The notice was issued in the name of the amalgamating company in spite of the fact that prior to such date, the amalgamated company MSIL had addressed a communication to the Assessing Officer intimating the fact of amalgamation. In the above conspectus of the facts, the initiation of assessment proceedings against an entity which had ceased to exist was treated as void ab initio.

(B) THE DECISION OF SPICE ENFOTAINMENT [SUPRA] DISCUSSED AND FOLLOWED BY THE SUPREME COURT :

(i) In this case, amalgamation took place during the course of assessment proceedings and such facts were intimated to AO.The Hon’ble Delhi High court held that framing of assessment against a non-existing entity/person goes to the root of the matter which is not a procedural irregularity but a jurisdictional defect as there cannot be any assessment against a dead person hence same cannot be cured within the provisions of section 292B. The participation by the amalgamated company in the Assessment Proceedings would have no effect since there could be no estoppel against law.

(ii) Departmental appeal was dismissed by Supreme court in Civil Appeal No. 285 OF 2014, 286 OF 2014 dated 02/11/2017 and held that court do not find any reason to interfere with the impugned judgment(s) passed by the High Court.

The Supreme court at para 25 of its order thus observed that the doctrine of merger results in the settled legal position that the judgment of the Delhi High Court stands affirmed by the above decision in the Civil Appeals.

(C) THE DECISION IN CASE OF APPELLANT FOR AY 2011-12 (Immediately previous year) DISCUSSED AND FOLLOWED BY THE SUPREME COURT

(i) Identical facts were in case of assessee for AY 2011-12(except in said year amalgamation order was received during the course of assessment proceedings) and the Delhi High courtdecided issue in favour of assessee and held that assessment order passed subsequently in name of said non-existing entity would be without jurisdiction and deserved to be set aside.SLP filed by department against above decision(for AY 2011-12) was dismissed by Supreme court in (Civil) Diary No(s). 14106 of 2018, dated 16-7-2018.

(ii) While deciding present issue in AY 2012-13, the Supreme court at para 34 of order observed that there is no reason to take a different view. There is a value which the court must abide by in promoting the interest of certainty in tax litigation.

(D) DECISION OF SKYLIGHT HOSPITALITY [SUPRA] DISTINGUISHED BY THE SUPREME COURT

In case of Skylight Hospitality, the AO duly mentioned the details of amalgamation in the copy of reasons recorded,fact was also mentioned in Tax Evasion Report, approval obtained from the Principal Commissioner, Order u/s. 127 of the Act and even PAN of the LLP was mentioned in some of the documents. These facts clearly proved that notice issued u/s 148/147 was meant for the petitioner(amalgamated company) and no one else and mere issue of notice in the name of erstwhile company was a procedural lapse curable under section 292B. The Supreme Court thus observed that such clerical error has not been proved in the present case and it is evident from the facts that notice as well as order passed in the name of erstwhile company is substantive illegality and not curable u/s 292B of the Act. On such grounds, the decision of Hon’ble Supreme Court in case of Skylight Hospitality was not followed in present case.

IV. KEY TAKEAWAYS FROM COMBINED READING OF THE DECISIONS REFERRED HEREIN ABOVE

(i) Once assessee gets amalgamated with the transferee company, its independent existence does not survive and therefore it would no longer be amenable to the assessment proceedings.

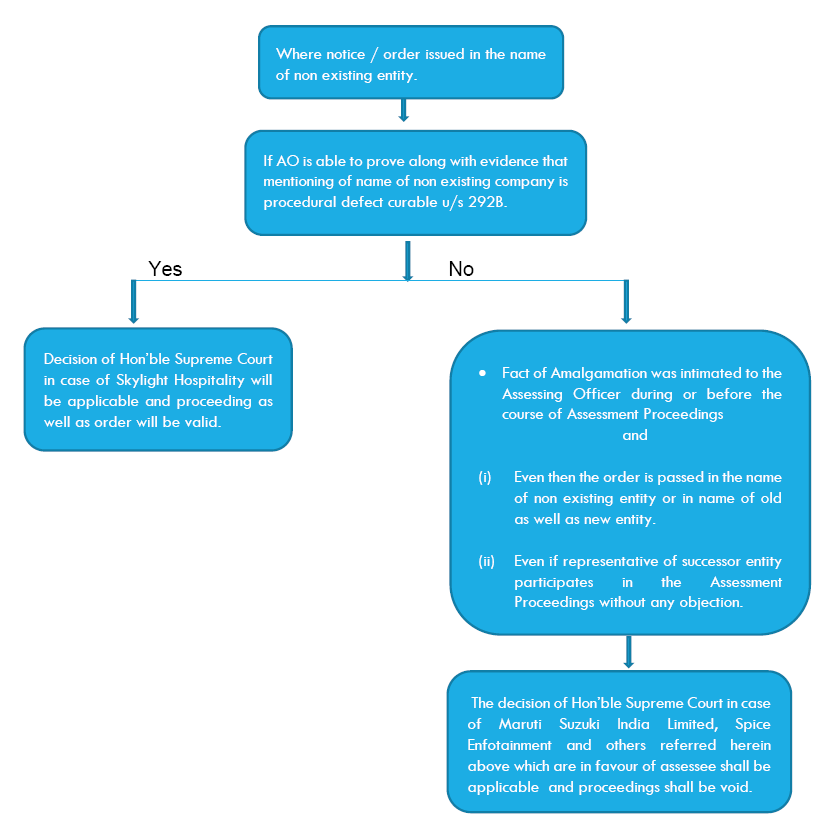

(ii) If reasons recorded in notice u/s 148 or background material of such noticesor correspondence speaks that AO intended to issue notice in the name of amalgamated company and not in name of non-existent company, there was a mere error in addressing it non existing company as well as there is clerical error/ procedural lapse in mentioning the name of the company, then the decision of Hon’ble Supreme Court/Delhi High court in case of Sky Light Hospitality LLP shall apply and such defect shall be curable under the provisions of section 292B of the Act.The primary condition is that the Assessing Officer has to prove with evidences that the act of mentioning wrong name was a clerical mistake.

However, where order is passed in the name of non-existing entityby the Assessing Officer out of ignorance even after being intimated by the assessee about succession of the assessee company, then such defect cannot be cured under the provisions of section 292B of the Act and the decision of Skylight Hospitality will not be applicable.

(iii) In case where before or after issuing notice by AO amalgamation has taken place in assessment proceedings, and the amalgamated company had brought the fact of the amalgamation to the notice of the assessing officer and despite this, the assessing officer did not substitute the name of the amalgamated company , did not issue new notice u/s 143(2)/142(1) in name of amalgamated company and proceeded to pass Assessment Order in the name of a non-existent entity, such defect is not curable u/s 292B and entire proceeding will be void.

(iv) In order to be a valid notice / order, the same has to be passed in the name of existing entity only. Mere mentioning the name of both the entities shall not render the notice / order as valid and entire proceeding shall be void.

(v) The participation by the amalgamated company in the Assessment Proceedings would have no effect since there could be no estoppel against law.

These facts are also summarised by following flow chart:

VIII. RELEVANT DECISIONS RENDERED SUBSEQUENT TO ABOVE DECISION AND THEIR IMPACT

(a) Gujarat High court in the case of GAYATRI MICRONS LTD.Vs ACIT [2020] 114 taxmann.com 318 has held that transferor company had ceased to exist as a result of approved scheme of amalgamation and in such case notice issued under section 148 in its name would be fundamentally illegal and without jurisdiction.

Similar observation is also made in following cases:

(i) Decision of Mumbai ITAT in the case of Siemens Technology & Services (P.) Ltd Vs DCIT [2019] 112 taxmann.com 279

- Decision of ITAT Bengaluru in the case of UNITED SPIRITS LIMITED (SUCCESSOR TO HERBERTSONS LTD.,) v/s. THE ASST. COMMISSIONER OF INCOME-TAX, CENTRAL ITA No.1153/Bang/2013, dated 14/02/2020

(b) Karnataka High courtin the case of M/S EMUDHRA LTD. v/s. ACIT inWrit Petition No.56004/2018 (T – IT) dated 10/12/2019 has followed above decision of Supreme court. The main grievance of department was that it was oblivious of the fact of amalgamation of company and the petitioner has not informed the amalgamation neither in the objections filed to the reasons recorded nor at any time, to the authorities.In this background, court has held as under:

“9. The main grievance of the learned counsel for the petitioner is that M/s. Tax smile.com India Pvt. Ltd., was amalgamated with M/s. eMudhra Ltd, in terms of the order dated 23/04/2015 passed in Company Petition No.23/2015 and connected matters, which was well within the knowledge of the department. However, notice under Section 148 of the Act was issued on 28/03/2018 on the non-existing company M/s. Tax smile.com India Pvt. Ltd.

10. It is not in dispute that the transfer memo along with forwarding memo dated 24/10/2018 was issued by the second respondent forwarding the file for further action to DCIT-2(1)(2), Bangalore, wherein it is specifically stated that the jurisdiction of the assessee lies with the officer at Bengaluru, in view of the amalgamation of M/s. Tax smile.com India Pvt. Ltd. with M/s. eMudhra Ltd. The Compliance Response Sheet at Annexure-H, furnished by M/s. Tax smile.com India Pvt. Ltd, indicates that the said company has been merged with M/s. eMudhra Ltd and merged entity’s return has been filed for the assessment year 2015-16 and the same has been acknowledged by the department. This document would disclose that the amalgamation of M/s. Tax smile.com India Pvt. Ltd with M/s. eMudhra Ltd, was within the knowledge of the department.

11. Though the learned counsel for the revenue made an endeavour to contend that the Income Tax Department not being arrayed as party to the company proceedings, the order was not within its knowledge, cannot be countenanced for the reason that the Registrar of Companies before filing the appropriate affidavit before this Court in the said proceedings had issued notice to the Income Tax Department. Based on the reply received, wherein, it was observed by the department that M/s eMudra Ltd, is required to adhere to the provisions of the Income Tax Act and Rules and also notifications and instructions. Upon the claim being sanctioned and particularly on the sub sequent transfer memo issued and the Compliance Response Sheet submitted, the department cannot feign ignorance of the amalgamation order merely for the reason that no specific objection was raised by the petitioner on this aspect in the objections filed to the reasons recorded by the Assessing Officer.”

TAKE AWAY FROM ABOVE DECISION

Once matter relating to amalgamation was in knowledge of income tax department in company law proceedings wherein ROC had issued notice to income tax department before filing affidavit in High court, and once such amalgamation is approved by High court, it was held that department was aware of fact regarding amalgamation in company law proceedings hence even if assessee has not filed any specific letter to concerned assessing officer in connection with income tax proceedings, regarding such amalgamation taken place, subsequent notices issued by AO are held to be invalid notices.

(c) Decision of Delhi High court in the case of PCIT Vs GENPACT INDIA (PREVIOUSLY KNOWN AS GENPACT INFRASTRUCTURE (KOLKATA) PVT. LTD. ITA 172/2019, CM APPL. 40541/2019, dated 17/09/2019has following above decision and held that participation in the proceedings by the appellant in the circumstances cannot operate as an estoppel against law.

(d) Delhi High court in the case of PCIT Vs Transcend MT Services (P.) Ltd [2019] 109 taxmann.com 421 held that assessment framed by Assessing Officer on a non-existing company would be void ab initio. In this case, at para 14, court has referred decision of Skylight Hospitality LLP and observed that in said case, entity had got converted to a partnership by the name of Skylight LLP whereas in the present case, there is sea change with the original entity against which the assessment was framed viz., HDTS long ceasing to exist at least three years prior thereto, getting amalgamated with HICS and then getting re-named as TMS hence it followed decision of Maruti Suzuki India Ltd. (supra).

(e) Decision of Delhi High court in the case of EXPERION DEVELOPERS PVT LTD Vs ACIT in W.P.(C) 11302/2019 vide order dated 13/02/2020

- Pursuant to a scheme of amalgamation approved by Court vide order dated 20.12.2012, M/s. Experion Developers International Pvt. Ltd [hereinafter referred to as ‘EDIPL’, the erstwhile assessee], amalgamated with M/s. Experion Developers Pvt. Ltd. [hereinafter referred to as ‘EDPL’, the successor-in-interest and Petitioner herein] with effect from 01.04.2012.

- The AO issued notice u/s 148 of the Act for AY 2012-13 in the name of EDPL. The recorded reasons are primarily based on the ground that the investing / parent company, M/s. Gold Hotels & Resort Pte. Ltd. had made investment of ₹ 36.91 crores in the Petitioner Company (EDPL) and ₹ 183 crores in erstwhile EDIPL, though the said investing company did not appear to be carrying out any regular business activities in Singapore and has been floated to act as a conduit to funnel funds into Indian companies. Therefore, there are “reasons to believe” that the Petitioner’s income has escaped assessment. (Here Parent company has made investment in both companies EDPL as well as EDIPL and AO has issued notice in name of EDPL (existing company) for escarpment of income pertaining to both companies)

- In the writ petition filed before High court, EDPL has contended that common notice for reassessment issued in the name of EDPL is bad in law as separate notices are required to be issued in the name of EDPL in its own capacity and in the name of EDPL, as successor-in-interest of EDIPL separately since during the relevant time, i.e., AY 2012-2013, they existed as separate entities. The Court referred decision of Maruti Suzuki (supra) and after referring provisions of section 170(2) of the Act, it was held that “The aforesaid provision nowhere requires that two separate notices and separate assessment order are to be passed. On the contrary, the petitioner as a successor would also be liable for the income of the previous year in which the succession took place upto the date of the succession.”

(f) Decision of Madras High court in the case of OASYS GREEN TECH PRIVATE LIMITED Vs ITO in W.P.Nos.21858 and 1759 of 2018 And WMP Nos.25634, 2180, 16198 and 18734 of 2018 order dated 21/01/2020

The brief facts of the case were as under:

(i) OAS(transferor) company didn’t file return of income for AY 2010-11 and said company is amalgamated with OGT (transferee), with effect from 01.02.2015 per order of the Madras High Court dated 20.08.2015 in Company Petition Nos.203 and 204 of 2015.

(ii) Notice under Section 148 of the Act dated 31.03.2017 addressed to OAS was issued, since, admittedly, the Department was unaware of the factum of amalgamation.

(iii) On 14.09.2017 OGT wrote to the Department bringing to its notice the merger and also requesting that the notice be handed over to the bearer of the letter.

(iv) Subsequent notices have been issued to ‘OGT (formally known as OAS)’ and the order of assessment has also been passed in the name of OGT.

While holding that AO has issued valid notice and subsequent order is valid order, Hon’ble court took cognizance following two major facts and decided issue against assessee.

- OGT has admittedly filed a return of income in the name of OAS for A.Y.2013-14 even subsequent to amalgamation and also received refunds issued to OAS. ( The court referred to subsequent conduct of OAS after amalgamation)

- The Department has not been put to notice of the factum of amalgamation by OGT prior to notice u/s 148 of the Act. The court distinguished its earlier decision in the case of Alamelu Veerappan Vs ITO [2018] 95 taxmann.com 155 wherein it was held that notice issued in name of dead person is not enforceable in law and there is no statutory obligation on part of legal representative of deceased to immediately intimate death of assessee or take steps to cancel PAN registration.

The court observed that so far as case of Alamelu Veerappan (supra) is concerned, the decision is wholly distinguishable, since it relates to the provisions of Section 159(2) dealing with a deceased assessee and his legal representatives, whereas the present assessment is made in terms of Section 170 dealing with succession to business or profession otherwise than on death.

OBSERVATION FOR THIS DECISION

(i) Whenever there is merger or amalgamation or any type of business restricting, same need to be brought on record of Assessing Officer. The High court also decided issue against assessee considering conduct of assessee for filing return even in name of amalgamating company even after amalgamation order.

(ii) In above case, the assessee seems to have not taken argument that at the time of amalgamation as per company law proceedings, AO was also informed by Registrar or other authority.

(g) Decision of Ahmedabad ITAT in the case of SNOWHILL AGENCIES P. LTD. (MERGED WITH GALLOPS MOTORS P. LTD.) VERSUS PCIT vide order dated 21 January 2020 wherein order was passed by CIT u/s 263 of the Actagainst the company, which ceased to exist pursuant to order of the amalgamation of Hon’ble High Court. DR has contended that decision of Maruti Suzuki (supra), can not be applied as it was the case relating to assessment order whereas present case was relating to order u/s 263 of the Act and same is not assessment order. He submitted that that “once an assessment order has been passed, then subsequent appellate proceedings or revisional proceeding is continuation of original assessment proceedings. They can be continued against such entity. In other words, according to him, after passing of the assessment order, the time would freeze qua existence of an entity, as a person for the purpose of taxation under Income Tax act.”

The ITAT has followed decision of Maruti (supra) and held that order u/s 263 as invalid order and further observed that “Jurisdiction deserves to be flowed from the Act in the authority, and not consent of the assessee. If we accept the contentions of the ld. CIT-DR, then it would suggest that notice would be given to “A” person by Commissioner under section 263, but ultimately on the basis of his order tax liability would fall upon “XYZ”. This is not permissible under the law nor has been contemplated in the section.”

(h) Decisions followed when assessee was dead on the date of issue of reassessment notice.

- Decision of Pune ITATin the case of SMT. ARCHANA ASHOK DUKRE VERSUS ITO, WARD-3, LATUR, ITA No. 2237/PUN/2016 (Assessment Year: 2005-06), Dated: – 15 November 2019.

- Late M.P.Vimala Bai, Rep. By L/r. M.P.Jay Anantha Swamy.,

Hyderabad Vs ITO in ITA No 1267/Hyd/2017 dated 05/09/2019

(IX) CERTAIN CRITICAL ISSUE

(a) The Supreme Court has held that once assessee is amalgamated with transferee company, it cannot be regarded as a person under section 2(31) against whom assessment proceedings can be initiated or an order of assessment passed. On the basis of said dictum of court, one may argue that whether before issuing notice/order, onus would be on AO to ascertain whether entity is existing or not? In that Scenario, onerous onus would be on AO.

(b) Here, Hon’ble Calcutta High court in the case of CIT VS Shaw Wallace Distilleries Ltd [2016] 70 taxmann.com 381 has observed that the assessee maintained a studied silence and did not bring to the notice of the revenue, in particular the Assessing Officer, about the amalgamation sanctioned by the High Court in entire assessment proceedings but AO came to know only in remand proceedings in appellate proceedings and court held that amalgamated company cannot use their silence to avoid tax liabilities. The court has enforced the liability upon assessee to inform the AO regarding such amalgamation once the notice is received by them or at the most during the assessment proceedings.

(c) One issue may arise that if it is not the responsibility of AO to enquire about such non-existence or death, would it mean that any notice issued to non-existent entity is curable defect?. Hon’ble Gujarat High court in the case of Chandreshbhai Jayantibhai Patel vs The Income Tax Officer [2019] 101 taxmann.com 362 (also referred in above decision of Supreme court) has observed that notice u/s 148 of the Act was issued to a dead person. Upon receipt of such notice, the legal representative has raised an objection to the validity of such notice. The legal representative not having waived the requirement of notice under section 148 and not having submitted to the jurisdiction of the Assessing Officer pursuant to the impugned notice, the provisions of section 292B would not be attracted and hence, the notice under section 148 has to be treated as invalid.

The Court has however observed that AO can issue fresh notice in the name of legal representative if it is not barred by the limitation. Ratio of above decision can squarely be applied to case of amalgamation or demerger of other business reorganisation and one may rely upon such decisions when it was not intimated to department about amalgmatiion.

(d) However, if amalgamation has taken place prior to issue of notice u/s 148 of the Act or under any other provisions of the Act and assessee has not intimated to department regarding such amalgamation, department can very well take ground that such notice is not invalid notice even after decision of Maruti (supra) and court may have to interpret legality of the case.

The High court in the case of OASYS GREEN TECH PRIVATE LIMITED (supra) and EMUDHRA LTD.(supra) has thrown light on this issue which is discussed in preceding paras which also suggest that by decision of Supreme court in the case of Maruti (supra), issue of notice on non-existent entity vis a vis department unaware of such amalgamation is yet not settled by Judiciary and litigation can still persist.

(e) In this scenario, it is advisable to intimate assessing officer regarding any business reorganisation immediately on receipt of order of court or other authority.

X) Conclusion :

On overall consideration of findings given by the Hon’ble Supreme Court in case of Maruti Suzuki India Ltd. and other judicial authorities (which have followed such findings), assessment order passed in the name of non-existent entity is invalid order (except situation like SKY Light LLP discussed herein above) and such mistake cannot be rectified u/s 292B of the Act.

| Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. Neither the author nor itatonline.org and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission of itatonline.org |