CA Shweta Ajmera has explained the concept of “blockchain” in a manner in which lay persons can understand it. She has pointed out that “blockchain” is already being widely used in several countries. She opines that the concept could prove to be a compliance revolution for transactional taxes such as transfer pricing, VAT, withholding tax, stamp duties, insurance premium taxes etc and it is only a question of time before India adopts it

1. Introduction:

1.1 The underlying technology of cryptocurrencies- as the Internet of value. For nearly four decades we have internet of information. It vastly improved the flow of data within and among firms and people, but it has not transformed how we do business. That’s because the Internet was designed to move information-not value from person to person. When we email someone a document or photograph or audio file, we’re really sending a copy of our original. This information is abundant, unreliable and perishable. Anyone else can copy, change and send it to somebody else. In many cases, it’s legal and advantageous to share these copies.

1.2 In contrast to expedite a business transaction, we cannot email money directly to someone-not just because copying money is illegal but because we can’t be 100 percent sure our recipient is who says he is. Information about identity needs to be scarce, permanent and unchangeable. So we go through powerful intermediaries to establish trust and maintain integrity. Banks, Governments and even big technology companies confirm our identities and enable us to transfer assets, they clear and settle transactions and keep records of these transfers. But the limitations of these intermediaries- their operational capacity and their vulnerability to hackers, rogue employees, and equally vulnerable suppliers- are coming more apparent. We need a new way forward.

1.3 In recent scenario, the medium Internet is boon for the economy, on the other hand it has proven to be worst due to misuse of internet and other technologies by hackers. Unethical hacking by the hackers and demanding ransom money to decrypt the data being encrypted by them. They hacks the information and demand ransom in form of Bitcoins. It has been seen in many cases that after payment of ransom amount, still the hackers are not giving the decryption code. The reason is hackers don’t have the code for the same. They buy encryption software from market and apply it randomly on different PC’s. Due to this, our information on our device (PC’s or mobile) is not secured and security of our information is a major concern in today’s scenario. This is a scary situation. What to be done?

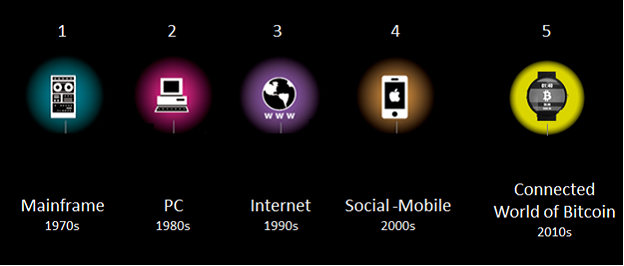

2. The Connected World and Blockchain- the fifth disruptive computing paradigm:

2.1 One model of understanding the modern world is through computing paradigms, with a new paradigm arising on the order of one per decade. First, there were the mainframe and PC (personal computer) paradigms, and then the Internet revolutionized everything. Mobile and social networking was the most recent paradigm. The current emerging paradigm for this decade could be the connected world of computing relying on blockchain cryptography. The connected world could usefully include blockchain technology as the economic overlay to what is increasingly becoming a seamlessly connected world of multidevice computing that includes wearable computing, Internet-of-Things (IoT) sensors, smartphones, tablets, laptops, quantified self-tracking devices (i.e., Fitbit), smart home, smart car, and smart city. The economy that the blockchain enables is not merely the movement of money, however; it is the transfer of information and the effective allocation of resources that money has enabled in the human- and corporate-scale economy.

2.2 With revolutionary potential equal to that of the Internet, Blockchain technology could be deployed and adopted much more quickly than the Internet was, given the network effects of current widespread global Internet and cellular connectivity.

2.3 Just as the social-mobile functionality of Paradigm 4 has become an expected feature of technology properties, with mobile apps for everything and sociality as a website property (liking, commenting, friendly, forum participation), so too could the blockchain of Paradigm 5 bring the pervasive expectation of value exchange functionality. Paradigm 5 functionality could be the experience of a continuously connected, seamless, physical-world, multidevice computing layer, with a Blockchain technology overlay for payments—not just basic payments, but micropayments, decentralized exchange, token earning and spending, digital asset invocation and transfer, and smart contract issuance and execution—as the economic layer the Web never had. The world is already being prepared for more pervasive Internet-based money: Apple Pay (Apple’s token-based e-wallet mobile app) and its competitors could be a critical intermediary step in moving to a full-fledged cryptocurrency world in which the blockchain becomes the seamless economic layer of the Web.

3. Technology Stake

3.1 Bitcoin terminology can be confusing because the word Bitcoin is used to simultaneously denote three different things. First, Bitcoin refers to the underlying Blockchain technology platform. Second, Bitcoin is used to mean the protocol that runs over the underlying blockchain technology to describe how assets are transferred on the blockchain. Third, Bitcoin denotes a digital currency, Bitcoin, the first and largest of the cryptocurrencies.

3.2 Layers in the technology stack of Bitcoin Blockchain:

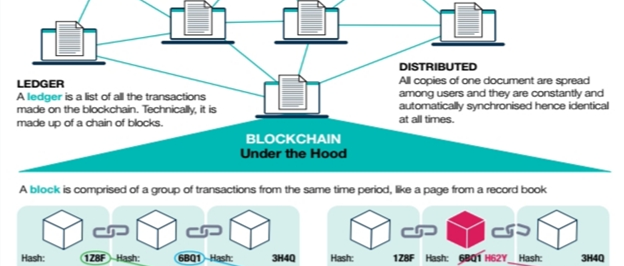

3.2.1 The first layer is the underlying technology, the blockchain. The blockchain is the decentralized transparent ledger with the transparent records- the database that is shared by all the network nodes, updated by miners, monitored by everyone, and owned and controlled by no one. It is like a giant interactive spreadsheet that everyone has access to and updates and confirms that the digital transactions transferring funds are unique.

3.2.2 The middle tier of the stack is the protocol- the software systems that transfers the money over the Blockchain ledger.

3.2.3 Than the top layer is the currency itself, Bitcoin, which is denoted as BTC or Btc when traded in transactions or exchanges. There are hundreds of cryptocurrencies, of which Bitcoin is the first and largest. Others include Litecoin, Dogecoin, Ripple,NXT and Peercoin.

3.3 The key point is that these three layers are the general structure of any modern cryptocurrency: blockchain, protocol, and currency. Each coin is typically both a currency and a protocol, and it may have its own blockchain or may run on the Bitcoin blockchain. For example, the Litecoin currency runs on the Litecoin protocol, which runs on the Litecoin blockchain. (Litecoin is very slightly adapted from Bitcoin to improve on a few features.) A separate blockchain means that the coin has its own decentralized ledger (in the same structure and format as the Bitcoin blockchain ledger). Other protocols, such as Counterparty, have their own currency (XCP) and run on the Bitcoin blockchain (i.e., their transactions are registered in the Bitcoin Blockchain ledger).

4 How Blockchain Operates?

4.1 Blockchain steps:

4.1.1 A blockchain is a shared ledger of transactions between parties in a network, not controlled by a single central authority. You can think of a ledger like a record book: it records and stores all transactions between users in chronological order. Instead of one authority controlling this ledger (like a bank) an identical copy of the ledger is held by all users on the network, called nodes. In the mentioned diagram it is described how a Blockchain operates.

4.1.2 Blockchains are distributed digital ledgers of cryptographically signed transactions that are grouped into blocks. Each block is cryptographically linked to the previous one(making it tamper evident) after validation and undergoing a consensus decision. As new blocks are added, older blocks become more difficult to modify (creating temper resistance). New blocks are replicated across copies of the ledger within the network , and any conflicts are resolved automatically using established rules.

4.1.3 Blockchain are composed of three core parts:

Blocks: A list of transaction recorded into a ledger over a given period. The size, period and triggering event for blocks is different for every blockchain. Not all the blockchains are recording and securing a record of movement of their cryptocurrency as their primary objective. But all the blockchain do record the movement of their cryptocurrency or token. Think of the transaction as simple as being recording the data. Assigning a value to it (such as happens in a financial transaction) is used to interpret what data means. Each Block is formed by a proof of work algorithms, through which consensus of this distributed system could be obtained via the longest possible chain.

Chain: A Hash that links one block to another, mathematically chaining them together. This is one of the most difficult concepts in blockchain to comprehend. Its also the magic that glues blockchains together and allows them to create mathematical trust. The hash in a blockchain is created from the data that was in the previous block. The hash is a fingerprint of this data and locks blocks in order and time. Although blockchain are a relatively new innovation, hashing is not. Hashing was invented over 30 years ago. This old innovaton is being used because it creates a one way function that cannot be decrypted. A hashing function creates a mathematical algorithm that maps data of any size to a bit string of a fixed size. A bit string is usually 32 characters long , which then represents the data that was hashed. The Secured Hash Algorithm(SHA) is one of some cryptographic hash functions used in a blockchains. SHA 256 is a common algorithm that generates an almost unique, fixed size 256 bit (32 byte) hash. For practical purposes, think of hash as a digital fingerprint of data that is used to lock it in a place within the blockchain.

Network: The network is composed of “full nodes” . Think of them as a computer running an algorithm that is securing the network. Each node contains a complete record of all the transactions that were ever recorded in that Blockchain. The nodes are located all over the world and can be operated by anyone.

How Blockchain Works ? –In a step by step way-

|

Step 1 |

A user requests a transaction |

|

Step 2 |

The request is transmitted to the network |

|

Step 3 |

The network validates the transaction or the transaction is not accepted |

|

Step 4 |

The transaction is added to current block of transactions |

|

Step 5 |

The block of transaction is than chained to the older block of transactions |

|

Step 6 |

The transaction is confirmed |

The above diagram, explains – Blockchain in practice- that is the components of blockchain and how they are related. (Reference OECD Primer)

5.1 Public Key Encryption:

5.1.1 The Blockchain is run on encryption hence the name crypto currency. Contemporary encryption what is called asymmetric or public key encryption. Public key encryption is based on mathematical problems which are much easier to solve forwards than backwards. For example, multiplying two six digit prime numbers like 323123 and 596977 together is a relatively easy task. With a minute and a pencil and a paper you would get 192896999171. But if instead you were given the number 192896999171 and asked to find the two prime numbers that divide it, you would need a lot of time to test all of the different possibilities. In public key encryption the numbers are much larger, but computers have to perform very similar tasks. A user has two keys: a public key used to encrypt message and a private key to decrypt them. The private key might consist of a very large prime numbers (hundreds and thousands of digits long) and the public key the result of multiplying them together.

5.1.2 The private key is used to generate the public key, and this generation process can be verified, meaning that the two keys are forever linked together. A user can be confident that they can share the public key with anyone without someone discovering their private key, as its very difficult to reverse the generation process.

5.1.3 Using the public key anyone can encrypt a message but the private key is required to decrypt it. Suppose you want to send a friend an encrypted message. Here’s the procedure:

1. Your friend uses their private key to generate a public key, which they can share with anyone. They send a copy of it to you.

2. You encrypt a message using their public key and then send the message to them. Anyone who intercepts the message wont be able to read it, as they don’t have the private key. This includes you-the encryption process only works one direction.

3. Your friend receives the message and uses their private key to decrypt it.

5.1.4 As long as no one but your friend has the private key, a message encrypted with their public key will never be read by anyone other than them.

6 Advantages(Uses) of Blockchain:

6.1 All the information on the blockchain is continuously reconciled and shared amongst the user of database. The thought leaders of the world in the Blockchain sphere offers numerous benefits of Blockchain technology which includes:

6.1.1 No Single point of failure-as it is distributed: This is the core concept and benefit of Blockchain. Instead of assigning a unique third party for the purpose of validation, Blockchain uses a consensus mechanism to do so.

6.1.2 Absolute transparency & Trust: As blockchains are shared and everyone can see what is on the Blockchain, this allows the system to be transparent and as a result trust is established. Transperancy is established through out the supply chain , right from supplier to consumer.

6.1.3 Robust cryptographic techniques and therefore highly secure. All transactions on the Blockchain are cryptographically secured and provide integrity.

6.1.4 100% immutability: Immutability refers to something which can never be modified or deleted. Once the data has been written in the Blockchain, it is extremely difficult to change it back.

6.1.5 No false information- To add false information or to remove transactions from previous block, one would have to recreate all the blocks from the desired change point forward, including the new block that is currently being solved, in order to redo the signature all the way back up the chain.

6.1.6 High Availability: As the system is based on thousands of nodes in a peer- to-peer network, and the data is replicated and updated on each and every node, the system becomes highly available. Even if nodes leave the network or become inaccessible, the network as a whole continues to work, thus making it highly available.

6.1.7 Faster Dealings: In the financial industry, especially in the post trade settlement functions, Blockchain can play a vital role by allowing the quicker settlement of trades as it doesnot require a lengthy process of verification, reconciliation and clearance.

6.1.8 Cost Saving: As no third party or clearing houses are required in the Blockchain model, this can massively eliminate overhead costs in the form of fees that has been paid to clearing houses or the trusted third parties.

6.1.9 Contracts: Most important advantage of using Blockchain is, it will help in creating contracts for movable as well as immovable property. A number is being allotted to every property and with the help of that unique number that property is being transferred.

7 Current Usage of Blockchain in Industries:

7.1 Insurance Industry: With automated insurance claim processing, policy conditions are written into a smart contract stored on Blockchain and connected to publicly available data via the Internet.

7.2 Banking: Blockchain can be useful in credit functions like letter of credit. It will cut out duplication of work.

7.3 Supply chain management: Blockchain holds complete provenance details of each component part, accessible by the manufacturer in production process.

7.4 Healthcare sector: Every citizen who is insured can use government provided or private insurance in any hospital and not to be denied service. Aashar can be linked for the same.

7.5 Internet of things(IOT)- IOT is increasingly becoming popular technology in both consumer and enterprise space. Blockchain technology facilitates the implementation of IOT platforms such as secured and trusted data exchange as well as record keeping.

7.6 Financial Services: International Payments, Capital market, trade finance, Regulatory compliance and audit, Insurance, KYC, P2P transactions.

7.7 Corporates: Supply chain management, Healthcare, Realestate, Media & Energy

7.8 Government: Record Management, Identity Management, voting, taxes, legislation.

7.9 Technology: Cyber security, big data, Data Storage & Internet of Things.

8 Limitations of Blockchain

8.1 The Blockchain industry is still in the early stages of development, and there are many different kinds of potential limitations:

8.1.1 Technical challenges: The issues are in clear sight of developers with different challenges posited and avid discussion and coding of potential solutions. Insiders have different degrees of confidence as to whether and how these issues can be overcome to evolve into the next phases of Blockchain industry development. Some think that the de facto standard will be the Bitcoin blockchain, as it is the incumbent, with the most widely deployed infrastructure and such network effects that it cannot help but be the standardized base. Others are building different new and separate blockchains (like Ethereum) or technology that does not use a blockchain (like Ripple). One central challenge with the underlying Bitcoin technology is scaling up from the current maximum limit of processing transactions per second .Some of the other issues include increasing the block size, addressing blockchain bloat, countering vulnerability mining attacks, and implementing hard forks (changes that are not backward compatible) to the code, as summarized here.

8.1.2 Throughput: The Bitcoin network has a potential issue with throughput in that it is its processing speed.

8.1.3 Size and bandwidth: Due to increase of transactions day by day, the size and bandwidth is low.

8.1.4 Security: There are some potential security issues with the Bitcoin blockchain. The most worrisome is the possibility of a attack, in which one mining entity could grab control of the blockchain and double-spend previously transacted coins into his own account. The issue is the centralization tendency in mining where the competition to record new transaction blocks in the blockchain has meant that only a few large mining pools control the majority of the transaction recording.

8.1.5 Wasted resources: Mining draws an enormous amount of energy, all of it wasted. On one hand, it is the very wastefulness of mining that makes it trustable—that rational agents compete in an otherwise useless proof-of-work effort in hopes of the possibility of reward—but on the other hand, these spent resources have no benefit other than mining.

8.1.6 Usability: The API for working with Bitcoin (the full node of all code) is far less user-friendly than the current standards of other easy-to-use modern APIs, such as widely used REST APIs.

8.1.7 Versioning, hard forks, multiple chains: Some other technical issues have to do with the infrastructure. One issue I s the proliferation of blockchains, and that with so many different blockchains in existence, it could be easy to deploy the resources to launch a 51-percent attack on smaller chains. Another issue is that when chains are split for administrative or versioning purposes, there is no easy way to merge or cross-transact on forked chains.

9 Global adoption of Blockchain – Which Countries are leading the charge?

9.1 India

9.1.1 NITI Aayog or the National Institution for Transforming India is the government’s policy think-tank which focuses on developing policies that will lead to long-term and sustainable growth for India by cooperating with various organisations both within the government and from the outside.

9.1.2 Speaking at the launch of the fourth centre for the World Economic Forum in Maharashtra, PM Narendra Modi spoke about Blockchain & Artificial Intelligence will increase employment. The World Economic Forum is an international organisation that focuses on improving the world’s economic growth by promoting public and private cooperation. The new centre in Maharashtra is the fourth centre after San Francisco in the USA, Tokyo in Japan and Beijing, China which is focused on the “4th industrial revolution.”

9.1.3 PM Modi’s stance on blockchain is coming at a crucial time in India’s development as the government led by his supporters is pushing for a massive digitisation drive in the country. As part of the move, the government is gearing up to connect over 2.5 lakh villages with optic fibre and provide AADHAR benefits to the country’s 132 crore population. Support for Blockchain is also coming at a confusing time for the state of cryptocurrencies in India as the official stance of the Reserve Bank of India remains aversive to nationless cryptocurrencies.

9.2 Dubai:

9.2.1 Dubbed as the “city of the future”, Dubai, which plans to have robot cops, flying taxis and autonomous vehicles on its roads in coming years and appointed a minister in-charge of Artificial Intelligence recently, is planning yet another transformation: to become the world’s first blockchain-powered government. By 2020, the emirate wants all visa applications, bill payments and license renewals, which account for over 100 million documents each year, to be transacted digitally using blockchain.

9.2.2 According to Smart Dubai, which is conducting government and private organization workshops to identify services that can be best enhanced by blockchain adoption, the strategy could save 25.1 million man hours, or $1.5 billion in savings per year for the emirate. Much of this enhanced productivity will stem from moving to paperless government.

9.2.3 According to Forbes report, Dubai has accepted the Blockchain technology for transferring properties as well. Dubai Land Department (DLD), the government agency tasked with overseeing land purchases and approving real estate trades, in October, launched a blockchain-powered system to help secure financial transactions, electronically record all real estate contracts, and connect homeowners and tenants to property-related billers, such as electrical, water and telecommunications utilities.By 2020, Dubai wants to become the first government in the world to conduct all of its transactions using blockchain.

9.2.4 The emirate estimates that adding visa applications, bill payments, license renewals and other documents to a blockchain could save 5.5 billion dirham (£1.1 billion) annually in document processing alone. It could also cut CO2 emissions by up to 114 MTons due to trip reductions and redistribute up to 25.1 million hours of economic productivity.

9.3 China:

9.3.1 China is not at all new to the world of blockchain innovation, and in fact has been one of the earliest adopters of the technology. Since the inception of Bitcoin, China has held on to a huge dominance regarding manufacturing and operation mining equipment. Additionally, in the early days of Bitcoin, China was routinely responsible for over 80% of the global traded volume for Bitcoin.

9.3.2 China is one of the most lucrative markets for Blockchain Technology because of its large population of young people, aged between 15 and 35 who are already heavily reliant on digital modes of payments. For example, a large number of people in China already use digital codes to make payments in places like vending machines, restaurants and grocery stores. As a result, the digital payment market is huge in China.

9.3.3 Since the digital payments market is so huge for China, there are some different approaches to facilitating payments. Blockchains can be very useful for facilitating the payments as they are more secure and cheaper than other forms of payments. Keeping this in mind, the KIK messenger platform conducted its KIN token ICO. KIK messenger has over 100 million users in China who use its web-based payments. Now, with the KIN token, these users can seamlessly transition to using blockchains to make payments more secure under the hood.

9.4 United Kingdom:

9.4.1 In July 2018, the UK’s Food Standards Agency (FSA) completed a pilot using blockchain to track the distribution of food. The FSA claimed the trial marked the first time that distributed ledger technology has been used as a regulatory tool to ensure compliance in the food sector.

9.5 The European Union:

12.6.1 The European Union Intellectual Property Office (EUIPO) is investigating how blockchain could combat counterfeiting, which costs the EU €60 billion (£53.5 billion) each year according to the agency’s research. The overall objective is to have a good app or product based on blockchain that can stop or at least diminish the amount of counterfeited products that we have nowadays in the EU.

9.6 Estonia:

9.6.1 Blockchain provides the backbone of the renowned e-Estonia programme, which connects government services in a single digital platform. The project integrates a vast quantity of sensitive data from healthcare, the judiciary, legislature, security and commercial code registries, which are stored on a blockchain ledger to protect them from corruption and misuse.

9.6.2 Estonia began testing distributed ledger technology in 2008, before the Bitcoin white paper that first coined the term “blockchain” had been published. Estonia dubbed the technology “hash-linked time-stamping” at the time.

9.7 Switzerland:

9.7.1 The Swiss city of Zug is one of Europe’s leading supporters of blockchain. Zug already accepts cryptocurrency as payment for public services, has digitised ID registrations built on the blockchain, and recently completed an e-voting trial.

9.8 Georgia:

9.8.1 Georgia’s government has experimented with blockchain in a land registry project developed with the Bitfury Group, dubbed the National Agency of Public Registry (NAPR).

9.9 Gibraltar:

9.9.1 Gibraltar launched Europe’s first regulated bitcoin product in 2016, when the Gibraltar Stock Exchange (GSX) unveiled a cryptocurrency called Bitcoin ETI. The British overseas territory has also introduced a bespoke license for fintech firms using blockchain, and created a blockchain subsidiary of its stock exchange.

9.9.2 In February 2018, the Gibraltar Blockchain Exchange (GBX) announced the completion of its first token sale, which was issued in the Rock Token (RKT) cryptocurrency. A total of 60 million RKT was distributed in the public token sale.

9.10 The details about initiative taken by few of the countries are mentioned above. China and Dubai are leading countries, which had adopted Blockchain. Other countries have started accepting the same.

10 Impact on Taxation:

Change is inevitable. From manual submission of tax returns and financial statements, computation of tax and other documents needed by tax authorities, we have shifted to online filing of tax returns as well as e- assessments. What next? Looking at the technology adoption globally, whether Blockchain is going to completely change the tax system? When it will be adopted? How much it will going to impact government, tax payers, tax return filers, professionals and others? What does Blockchain meant about tax compliance?

10.1 Automation and Artificial Intelligence have already changed our taxation system. Blockchain is set to play a crucial role in the digitization of taxation by providing the ‘wiring’ needed for real time record keeping, verification and information exchange. Smart contracts will offer faster and more efficient ways to evaluate and settle tax liabilities.

10.2 GST implementation in India has already brought many changes in the taxation system. Government has started Data Mining considering the information submitted by assessee in GST return, Income tax return and Transfer Pricing data. They have started with the matching concept. Whether the data submitted by assessee to Direct tax and Indirect tax department is matching? Whether Arms Length Price adopted by different assessee dealing in specific business is matching? Big data analysis, data security, data mining in taxation has already started.

10.3 With the adoption of Blockchain technology there will be simplification of tax compliance and increased transparency. The characteristics of Blockchain technology: real-time, immutable, decentralized, trusted and transparent transactions, are the very characteristics which have become increasingly important in our global tax system. The international drive for tax transparency and anti-tax avoidance measures has created uncertainty in international transactions, and increased companies’ compliance burdens. Blockchain has the potential to simplify and automate tax compliance and transparency; once companies have blockchains in place recording all expenses and every transaction on their books, tax authorities may obtain access to this data to calculate and enforce payment of taxes in real time and reduce the opportunity for fraud and avoidance.

10.4 It could also be a compliance revolution for transactional taxes such as VAT, withholding tax, stamp duties and insurance premium taxes. Blockchain, applied to VAT and other taxes like payroll, makes the role of a business, acting as an intermediary agent collecting taxes on government’s behalf redundant, by automatically withholding and paying taxes in real-time using smart contracts. This could significantly lower the cost of tax compliance for corporations and governments alike.

10.5 The technology could also help with transfer pricing, by providing technical solutions for the application of transfer pricing rules with smart contracts where frequent transactions occur among a network of parties.

10.6 It is difficult to characterize the Blockchain transactions. Nevada has become the first state to ban local governments from taxing Blockchain use.

10.7 As Blockchain is embraced by an ever increasing number of financial services providers and when it is brought into scope by the regulatory environment, it could change all aspects of doing business, including managing tax cost.

11 Conclusion:

Blockchain technology is a new tool with potential applications for organizations, enabling secure transactions without the need for a central authority. The use of Blockchain technology is still in its early stages, but it is built on widely understood and sound cryptographic principles. Currently, there is a lot of hype around the technology, and many proposed uses for it.

Transactions of any kind will be cheaper, fast and secure when completed via Blockchain. The intermediaries and mediators will be misplaced.

For currencies these are banks, for patents- the patent office, for election- the electoral commission, for smart contracts- the executors, and for public service- the state authorities.

Blockchain technology goes far beyond cryptocurrencies and tokens and its usefulness as a wider economic and administrative tool is well worth exploring.

Companies as well as authorities are exploring different aspects of Blockchain. They are doing so with an objective to create a system which is safe and secure. Blockchain will be helpful in creating brand value; it will create more opportunities to explore in future. Since Blockchain has many features that the companies might be looking at when they want to promote themselves, it becomes one of the most sought – after technology for the future.

12 References:

(1) Lamport, Leslie. “The Part-Time Parliament.” ACM Transactions on Computer Systems, vol. 16, no. 2, Jan. 1998, pp. 133–169.,https://dl.acm.org/citation.cfm?doid=279227.279229.

(2) Narayanan, A., Bonneau, J., Felten, E., Miller, A., and Goldfede, S., Bitcoin and Cryptocurrency Technologies: A Comprehensive Introduction, Princeton University Press, 2016.

(3) Nakamoto, S., “Bitcoin: A Peer-to-Peer Electronic Cash System,” 2008.

(4) NIST(National Institute of Standard & Technology)- Blockchain Technology overview.

(5) OECD Blockchain Primer.

(6) ENISA Report on Distributed ledger technology & Cyber security.

| Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. Neither the author nor itatonline.org and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission of itatonline.org |

Where can I learn about block chain in Mumbai ?

Institute of Chartered Accountants of India does a workshop on Blockchain at frequent intervals