CA Rajat Power has pointed out that section 44AB of the income-tax Act, 1961, which provides for tax audit of certain taxpayers, has been amended in the recent past in order to relax the compliance burden on small taxpayers. However, while these amendments are well-intentioned, they have increased confusion amongst taxpayers. The Ld. author has explained the law in a simple manner and provided clarity on the subject

CA Rajat Power has pointed out that section 44AB of the income-tax Act, 1961, which provides for tax audit of certain taxpayers, has been amended in the recent past in order to relax the compliance burden on small taxpayers. However, while these amendments are well-intentioned, they have increased confusion amongst taxpayers. The Ld. author has explained the law in a simple manner and provided clarity on the subject

Introduction

Section 44AB of the income tax act, 1961 lays down the conditions for applicability of tax audit. Tax Audit has been an important tool to increase the efficiency of tax administration and curb the menace of tax evasion. However, recently the government has taken many steps towards relaxing the compliance burden of small taxpayers and has been committed to increase the ‘ease of doing business’ .The provisions of applicability of tax audit have undergone major amendments vide Finance Act 2016 and 2020. Albeit the provisions were made to reduce the compliance burden, they have increased the confusion among the taxpayers regarding applicability of tax audit. The author tries to analyze the various provisions relating to applicability of tax audit so as to provide clarity on the subject.

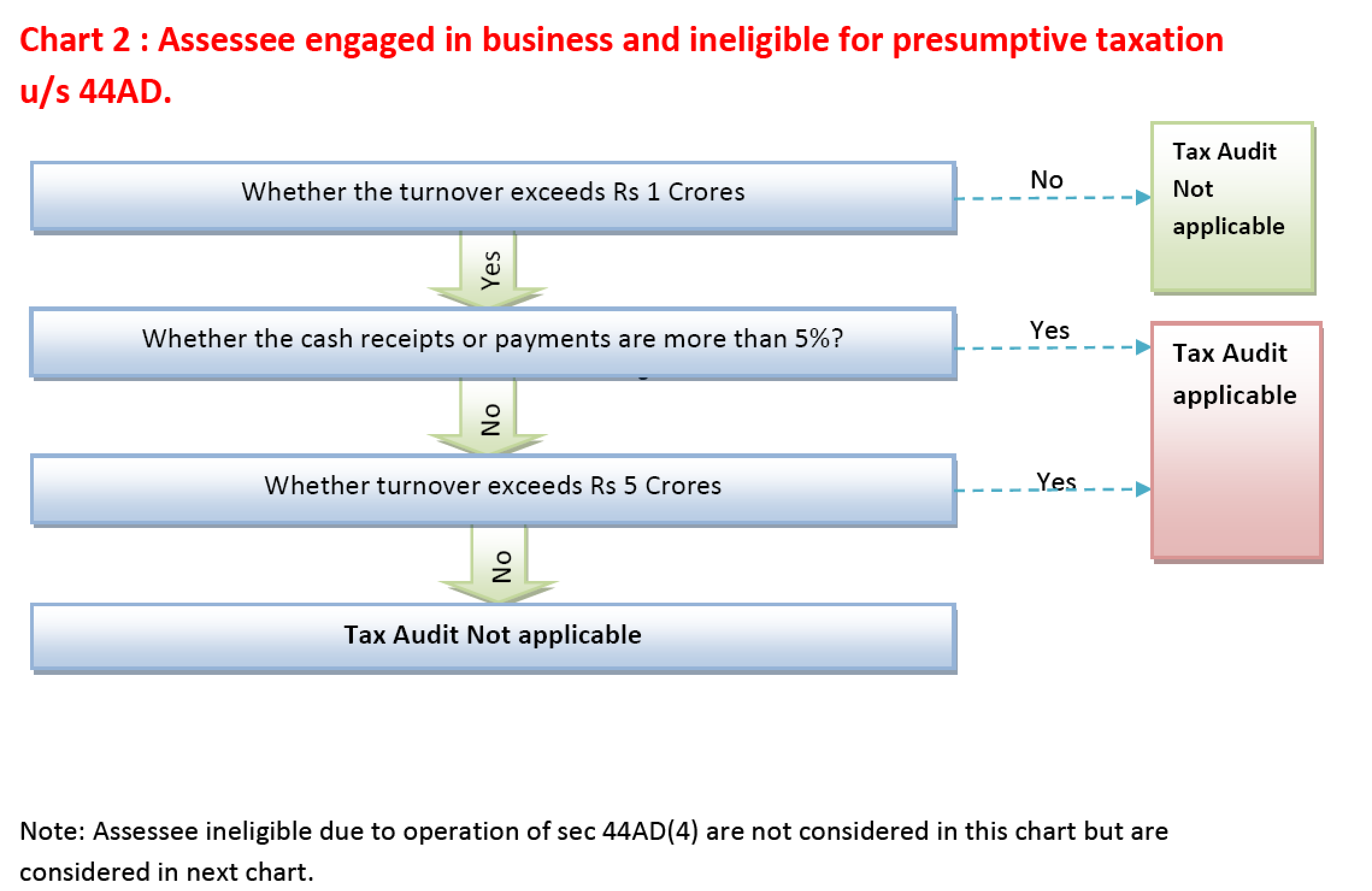

1. Tax audit based on turnover limit for business [Sec 44AB (a)]

Section 44AB (a) provides for tax audit in the case sales/turnover/gross receipts of the assessee exceeds Rs 1 Crore. Vide Finance Act 2020; a proviso was inserted to the said sub-section to provide that where the total cash receipts or payments do not exceed 5% of aggregate receipts or payments respectively the limit shall be increased to Rs 5 Crores. Thus the turnover limit of the assessee for the purpose of applicability of tax audit is Rs 5 Crs if the amounts of cash payments or receipts do not exceed 5% and Rs 1 Cr in other cases. For the purpose of this proviso, the receipts or payments should include all the receipt or payments whether on revenue account or capital account. An exception to this rule is carved out by the proviso to sec 44AB which provides that, if the turnover of the assessee is up to Rs 2 Cr and he is eligible and has declared profits as per presumptive taxation scheme u/s 44AD, he shall not be liable for tax audit.

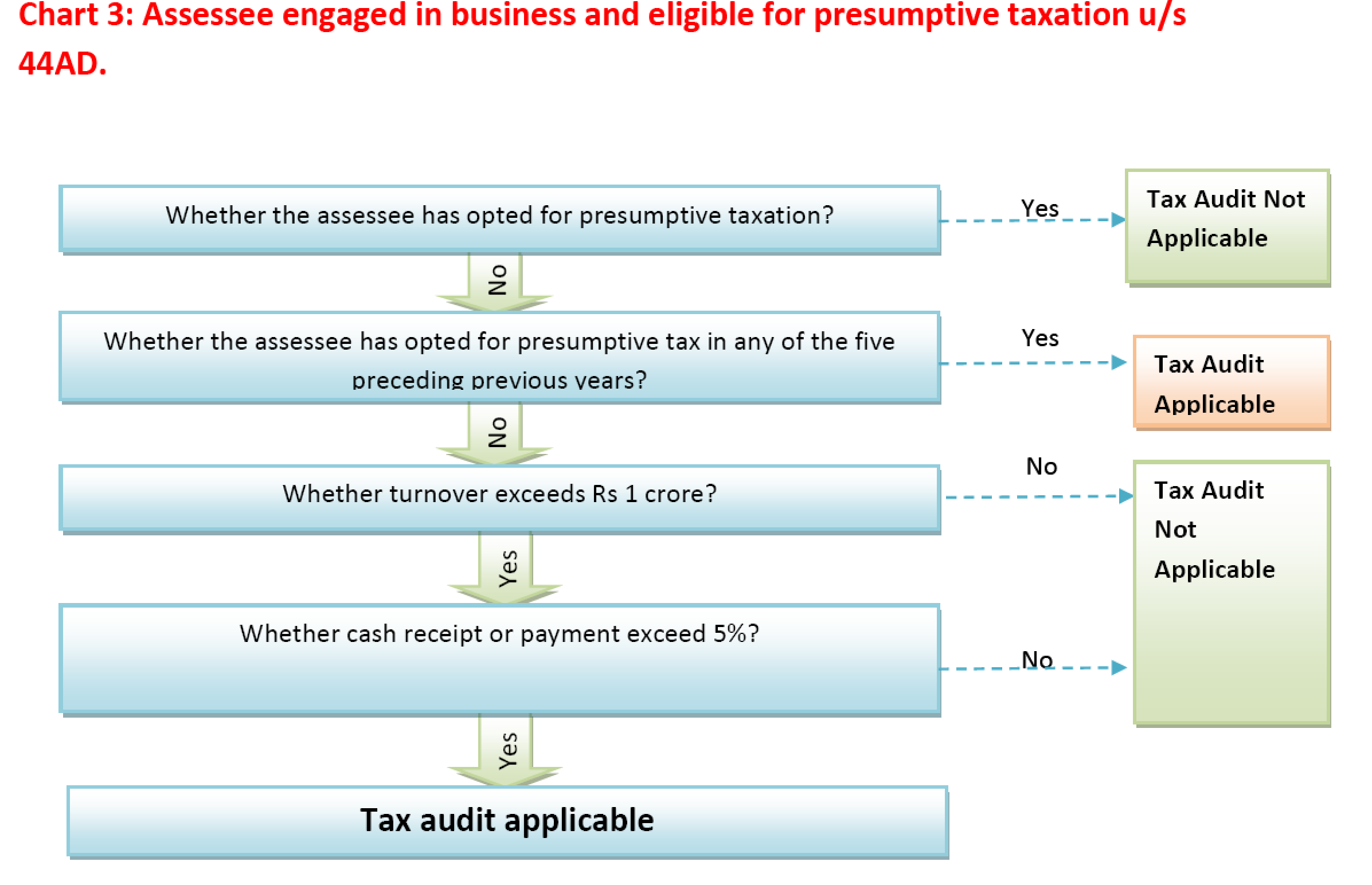

2. Tax audit applicability vis-à-vis presumptive taxation u/s 44AD for business [Sec 44AB(e)]

Sec 44AD is a special provision which provides presumptive taxation scheme for small taxpayers with a view of reducing their compliance burden. Sec 44AD (1) starts with non-obstante clause and overrules sec 28 to sec 43C. The section provides that in case of eligible assessee engaged in eligible business, a profit of 8% of total turnover or such a higher amount as claimed to have been earned by the assessee shall be deemed to be profits and gains of business. Subsequently, in order to encourage banking transaction the Fin Act 2017 provided that in case of receipts through banking channels the amount of deemed profits shall be 6% instead of 8%. The provisions of sec 44AD apply only to the eligible assessee engaged in eligible business. Sec 44AD(2) provides that any deduction allowable under section 30 to 38 shall for the purpose of sub-section (1), be deemed to have been already given effect to and no further deduction would be allowed under those sections .

Explanation to sec 44AD provides the definition of the eligible assessee and eligible business to whom the section shall apply. Eligible assessee is defined to be an individual, HUF or a partnership firm other than LLP, who is a resident; and who has not claimed deduction under sections 10A, 10AA, 10B, 10BA or deduction under any provisions of Chapter VIA under the heading "C. – Deductions in respect of certain incomes” i.e. profit linked deduction. Eligible Business means any business other than business of plying, hiring or leasing goods carriage as referred in sec 44AE and having turnover less than 2 Crores.

Sec 44AD (6) provides that the provisions of sec 44AD shall not apply to person carrying on profession as referred in sec 44AA (1), person earning commission or brokerage income or person carrying on any agency business. If the assessee is an eligible assessee and is engaged in more than one business one of which is an eligible business and other is a business specified in sub-section 6; or is engaged in eligible business and any profession referred in sec 44A (1) he shall be ineligible for presumptive taxation not only for those business as specified in sub section 6 but also for other businesses which was otherwise eligible. Baring the above assesses, all other assesses are eligible for presumptive taxation scheme.

Sec 44AD was amended by Fin Act 2016. Before the amendment tax audit was applicable in every case where the assessee declared profit lower than the deemed profits as per presumptive tax scheme. However, there were certain amendments made to Sec 44AB (e) and Sec 44AD (4) by the Fin Act 2016 which changed this position.

Section 44AB (e) provides that the tax audit shall be applicable to the assessee to whom provisions of sec 44AD (4) apply. Sec 44AD(4) as amended by Fin Act 2016 provides that when the assessee declares profit as per the presumptive taxation scheme in a previous year and in any of the five years immediately succeeding the previous year declares profit not in accordance with the scheme, he shall not be eligible for the scheme for the next five years . Moreover as per sec 44AD (5) r.w.s. 44AB (e) he shall also be liable to maintain books of accounts and get his accounts audited in such case if his income exceeds maximum amount not chargeable to tax. However, the above condition will apply only for five years subsequent to the year in which assessee has opted out of the scheme and after the lapse of such five years he shall not be liable to tax audit u/s 44AD(4) even if he declares profit lower than 8%/6%.

The amended provisions of Sec 44AD (4) are made applicable from A.Y. 2017-18. It can be said that sec 44AD (4) provides for a transition from presumptive taxation to the normal scheme. The legislative intent behind this amendment may be to act as deterrent for the assessee from misusing the provisions of presumptive taxation by frequently shifting from presumptive taxation to non-presumptive taxation and vice-versa. Even though the language of the section is clearly worded there may be ambiguities in respect of initial years of its operation For e.g. consider A.Y. 2019-20, as discussed earlier prior to A.Y. 2017-18, there was applicability of tax audit in every case where the profit declared was less than 6%/8%, however there was no five years restriction for opting out of the scheme. Hence, it is possible that before A.Y. 2017-18 the assessee had declared profit as per presumptive taxation in any one year say A.Y. 2015-16, and declared profit as per normal scheme in next year A.Y.2016-17 and again declared profit as per presumptive taxation for A.Y 2017-18 . Now the cardinal point for consideration is whether the provisions of the amended sec 44AD(4) are to be considered for all the previous five years even before its insertion i.e. A.Y. 2014-15 or from the Assessment Years subsequent to insertion of the said section i.e. A.Y 2017-18 and AY 2018-19. If the provisions are interpreted literally, when the assessee has opted out of the scheme in any of the five preceding years the provisions of sub section 4 may apply. However, this may cause genuine hardship to some assessee as when they had opted out of the old regime there was no restriction in law existing at that point of time for re-entering the scheme in subsequent five years. Hence, such an interpretation of amendment affects the vested right of the assessee, and will also amount to giving retrospective effect to the said provisions. Moreover, even circular No 3/2017, provided that the assessee can declare profit less than 6%/8% after maintaining books of account as per sec 44A if his turnover is less than 1 Crore. The same circular also provides an illustration for explaining the provisions of Sec 44AD (4). Even in this illustration the circular ignores the Assessment Years prior to A.Y. 2017-18 for the purpose of considering the applicability of provisions of sec 44AD(4). In the view of the above legal position it can be inferred that the assessee shall be eligible to opt for presumptive taxation/ declare profits lower than 8%/6% without taking into consideration whether he had opted for presumptive taxation for any of the Assessment Year prior to A.Y 2017-18 or not. Needless to say, he would be liable for tax audit if he has declared profit as per presumptive taxation in A.Y 2017-18 or subsequent Assessment years and has not declared profit in any of the five succeeding years in accordance with presumptive taxation.

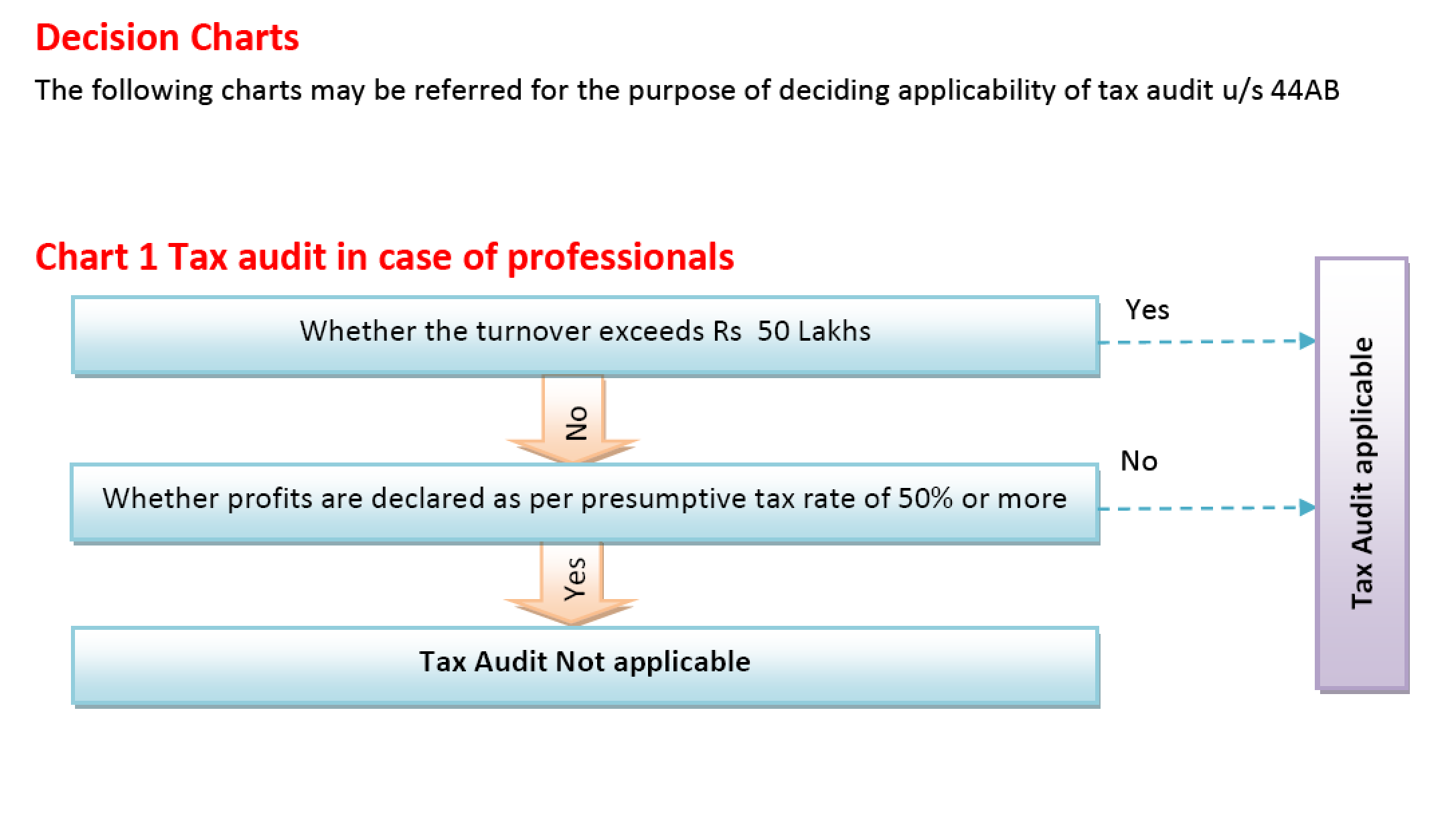

3. Tax audit in case of professionals [Sec 44AB(b) and Sec 44AB(d)]

Sec 44AB (b) provides for tax audit where the gross receipts of the professional exceeds Rs 50 Lakhs. Sec 44ADA inserted by Finance Act 2016 provides a scheme of presumptive taxation in case of professionals. Sec 44ADA provides that in respect of any assessee being a resident carrying on a profession as mentioned in sec 44AA(1) and whose gross turnover does not exceed Rs 50 lakhs , an amount equal to 50% or such a higher amount as claimed to be earned by the assessee shall be deemed to be profits of the profession. Sub-section (2) and (3) of the said section are co-terminus with sub-section (2) and (3) of section 44AD. Sub-section 4 of the said section provides that where the assessee declares profit lower than 50%, he shall be liable to maintain books of accounts and get his accounts audited. Sec 44AB(d) also provides that tax audit shall be applicable in case of professional to whom sec 44ADA apply, and who has claimed his profit to be lower than the presumptive tax rate of 50%.

4. Applicability of tax audit u/s 44AB(c)

Sec 44AB(c) provides that where the assessee is engaged in a business to which the provisions of section 44AE, 44BB or 44BBB apply and he claims his profit to be lower than the deemed profits as per the respective section, he shall be liable for tax audit if his total income exceeds maximum amount not chargeable to tax.

Sec 44AE provides for presumptive taxation in case of any assessee owning not more than 10 goods carriage at any time during the previous year and who is engaged in the business of plying, hiring or leasing such goods carriage. The amount of presumptive profit in such case is as follows

1. Heavy vehicle i.e. vehicles having gross weight more than 12,000 kg- Rs 1,000 per ton of gross vehicle weight or unladen weight for every month or part of the month for which vehicle is owned by the assessee.

2. Other than heavy vehicles- Rs 7,500 per month or part of the month for which vehicle is owned by the assessee.

Where the assessee to whom the provisions of sec 44AE apply declares the profit which is lower than the presumptive profit as per sec 44AE, he shall be liable to maintain books of accounts and get his accounts audited.

5. Turnover whether to include GST

The turnover for the purpose of Sec 44AB/Sec 44AD is not defined in the act. The ‘Guidance Note on Tax Audit’ issued by the ICAI provides that where the assessee has included the amount of excise and sales tax in the amount of sale price, the turnover will include the amount of excise and sales tax.(Inclusive method of accounting) However, if the Excise duty or sales tax recovered are kept in separate account and payments to the authority are debited in the same account, the amount of excise duty and sales tax should not be included in turnover.(Exclusive method of accounting)

Sec 145A is applicable for the purpose of determining the income chargeable under the head PGBP. Turnover of the assessee being an integral part of income chargeable under the head PGBP, the provisions of sec 145A shall apply for the purpose of calculation of turnover. Sec 145A (ii) as amended by Fin 2018 provides that the valuation of sales, purchases and inventory shall be adjusted to include the amount of taxes, duties or cess. Even, the ICDS provides for inclusive method of accounting. In the view of the above it can be inferred that the turnover should include the amount of GST even if the assessee follows exclusive method of accounting.

6. Let us consider few examples so as to better understand the provisions

Example 1

Turnover of the assessee is Rs 85 Lakhs, Profit from business is Rs 5.5 Lakhs and Assessee has not opted for presumptive taxation in any of the five preceding previous years

Solution:

i) Applicability of provisions of sec 44AB(a)

In the given case the turnover of the assessee is less than Rs 1 Cr hence the assessee shall not be liable for tax audit u/s 44AB(a)

ii)Applicability of provisions of sec 44AB(e)

In the given case the assessee has not declared profits as per presumptive taxation scheme in any of the five preceding years, hence he shall not be liable for tax audit u/s 44AB(e) r.w.s 44AD(4)

Example 2

Turnover of the assessee is 1.5 Crs, Cash receipts/payments are Rs 15 Lakhs, Profit from business is Rs 7 Lakhs and Assessee has not opted for presumptive taxation in any of the five preceding previous years

Solution:

i)Applicability of provisions of sec 44AB(a)

In the given case the cash payment/receipts are greater than 5% of total payment/receipts hence the assessee shall be liable for tax audit u/s 44AB(a) as the turnover exceeds the limit of Rs 1 crore and the assessee has not declared profit in accordance with the provisions of sec 44AD.(There is no need to consider the applicability of provisions of Sec 44AD(4) in such case as the assessee is liable for tax audit u/s 44AB(a)]

Example 3

Turnover of the assessee is 1.5 Crs, Cash receipts/payments are Rs 5 Lakhs, Profit from business is Rs 7 Lakhs and Assessee had opted for presumptive taxation in any of the five preceding previous years

Solution:

i)Applicability of provisions of sec 44AB(a)

In the given case the cash payment/receipts are less than 5% of total payment/receipts hence the assessee shall not be liable for tax audit u/s 44AB(a) as per the proviso to sec 44AB(a)

ii)Applicability of provisions of sec 44AB(e)

In the given case the assessee has declared profits as per presumptive taxation scheme in any of the five preceding years and has not declared profits as per presumptive taxation for current year, hence the provisions of sec 44AD(4) shall apply and he shall be liable for tax audit u/s 44AB(e) r.w.s 44AD(4).

Example 4

Turnover of the assessee is 2.5 Crs, Cash receipts/payments are Rs 10 Lakhs, and Profit from business is Rs 8 Lakhs,

Solution:

i)Applicability of provisions of sec 44AB(a)

In the given case the cash payment/receipts are less than 5% of total payment/receipts hence the assessee shall not be liable for tax audit u/s 44AB(a) as per the proviso to sec 44AB(a)

Note: As the turnover of the assessee is greater than Rs 2 Crores the provisions of sec 44AD will not be applicable in this case. Hence, there is no need to consider the applicability of sec 44AD(4)

From the example 3 and example 4 it is observed that where the assessee has turnover less than Rs 2 Crores and declares profit less than 8%/6% tax audit is applicable, where as in case the assessee has turnover between 2 Crs to 5 Crs, no tax audit is applicable even if he has declared profits less than 6%/8%. (In both the cases cash receipts/payments do not exceed 5%). Thus, it creates apparent anomaly whereby greater compliance burden is placed on small taxpayers rather than large tax payers which is against the purpose and object of the sec 44AD of easing the compliance burden of small taxpayers. Hence, it may prima facie appear that the provisions violate Article 14 of the constitution of India i.e equality before law.

However it is pertinent to note that though Article 14 forbids class legislation; it is a trite law that it does not forbid reasonable classification of persons, objects and transactions by the Legislature for the purpose of achieving specific ends. Classification to be reasonable should fulfill the following two tests as laid down by the judiciary:

(1) It should not be arbitrary, artificial or evasive. It should be based on an intelligible differentia, some real and substantial distinction, which distinguishes persons or things grouped together in the class from others left out of it.

(2) The differentia adopted as the basis of classification must have a rational or reasonable nexus with the object sought to be achieved by the statute in question.( Laxmi Khandsari v. State of Uttar Pradesh, AIR 1981 SC 873, 891)

In example 3 tax audit is applicable under sec 44AB(e) r.w.s. 44AD(4) and in example 4 tax audit is applicable under section 44AB(a). Legislative intent and object behind enacting both the provisions are different and the same should not be confused. As stated earlier Sec 44AD(4) is enacted to prevent the assessee from misusing the provisions of sec 44AD and the provisions of sec 44AB(a) are enacted so as to enable the assessee to maintain proper books of accounts and to disclose true profits. As the purpose and object of both the provisions are different, the classification made based on this object cannot be considered to be arbitrary or unreasonable. Hence, the provision does not vitiate Article 14

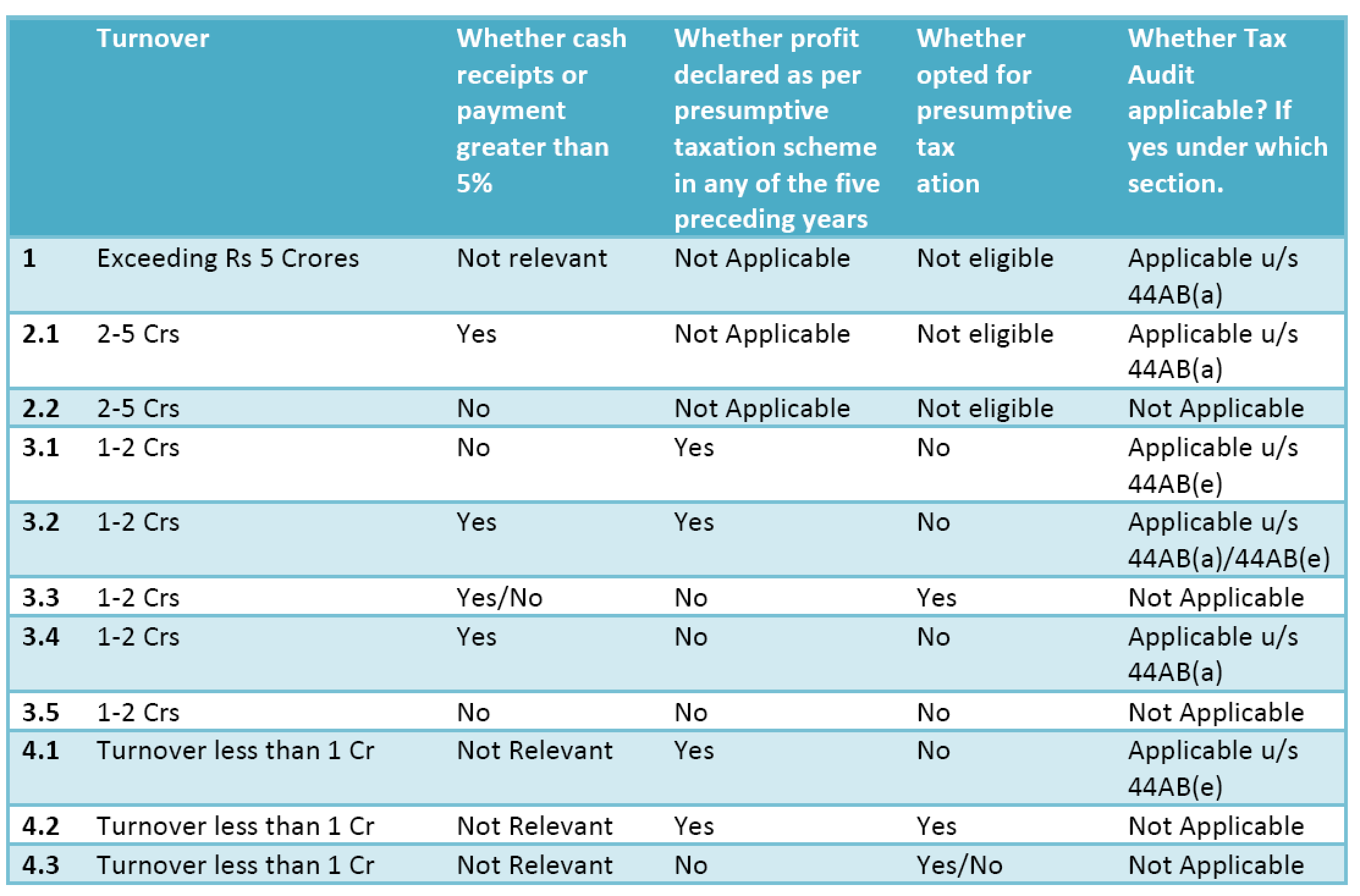

Summary

The chart summarizes the applicability of tax audit u/s 44AB(a) and sec 44AB(e)

| Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. Neither the author nor itatonline.org and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission of itatonline.org |

Partnership Firm

Turnover : 1.05 Cr

Cash Receipt / Payment : Less then 5%

Net profit after Remuneration and Interest : Less then 6%

Opted Presumption Taxation in last 5 years : NO

Some CA are saying Audit Required… and some saying No.

Now is there any clarification from ICAI or CBDT on it.

Sir

Doesnt the Block of 5 years break automatically if the case doesnt fall in 44AD and hence audit was done under 44AB …

For Example

AY 2020-21 Turnover is more then 1Cr but less then 2cr.

AY 2019-20 Cant opt 44AD as Turnover was over 2 CR

AY 2018-19 Opted 44AD as Turnover was less then 2CR

AY 2017-18 Opted 44AD as Turnover was less then 1CR

since in AY 2019-20 it is out of section 44AD…

Now does this rule of Block of 5 year break in AY 2019-20?

No need to see the past (Block of 5 Years)

What constitute the “turn over” or “gross receipt” mentioned in the Section 44AB in the case of an Employees credit co-operative society engaged in the business of accepting deposits from members and provide loans to members? Is it mandatory to subject the accounts audited by a CA over and above the statutory audit conducted by the Director of Co-operative Audit?

Please advice.

Sir, please confirm the following.

In case of proffesional having t/o below 50 lakhs and maintaining books of accounts, tax audit will be applicable?

If yes then it would mean sec 44ada is a compulsory section?

The author has made very keen observations and has explained it in a very lucid way

What about applicability of tax audit in case of loss ?

Whether partnership firm has to audit its book of account if there is loss ?

An individual.having loss in PGBP and having income of 2.4 lakh from other source. Whether audit applicable ?

Even in TAX AUDIT cases no books of accounts are maintained in most of the cases, since no scrutiny at all by the Department. To find a solution as to whether such books of accounts are maintained or not? Otherwise there seems to be no meaning in keeping Sections 269S, 269T and 40 (A) (3) etc. Kindly find a solution as to WHETHER SUCH BOOKS ACCOUNTS or not?

JOTHI RAMALINGAM MOBILE 9382789630