CA Pratik Sandbhor has highlighted the important aspects of the newly introduced Faceless Appeals Scheme and also explained its implications. He has dwelt upon the consequences of non-grant of a personal hearing and also the concept of “review” of the draft appellate order. The ld. author has also pointed out that there are several issues that need clarification from the CBDT for the smooth implementation of the scheme

CA Pratik Sandbhor has highlighted the important aspects of the newly introduced Faceless Appeals Scheme and also explained its implications. He has dwelt upon the consequences of non-grant of a personal hearing and also the concept of “review” of the draft appellate order. The ld. author has also pointed out that there are several issues that need clarification from the CBDT for the smooth implementation of the scheme

A New Innings of Appeals

There has been a long driven move of the Government to digitize the Indian Economy with an innuendo to bring a larger population under the tax radar. Accordingly the Government has introduced many moves to suppress the cash transactions and advance a cashless economy. At behest of said trajectory there has been a hustle to reduce the physical interface between the Assessing Officer and assesse to speed up the assessments process through efficient disposals andquality Assessment Order. The said move foreshadowed the convergence towards faceless assessments. Remarkably the Hon’ble Prime Minister launched the Faceless Assessments & Taxpayer’s Charter on 13/08/2020 as a part of the “Transparent Taxation – Honoring the Honest’ platform and accordingly the machinery of ‘National e-assessment Center’ has been put into motion.

The CBDT on 17/09/2020 further laid out norms for compulsory selection of scrutiny and portrayed its intentions for a taxpayer-friendly approach by relaxing the compulsory scrutiny norms.

Furthering the trajectory the Government on the occasion of birth anniversary of Shri DeendayalUpdhyay the leader of political party ‘ Bhartiya Jan Sangh’ a forerunner to ‘BhartiyaJanta Party’, firmly placed a foot towards ‘Faceless Appeals’. Accordingly the Faceless Appeals as touted in the past has been finally brought into effect from 25/09/2020 as per the CBDT Press Release dated 25/09/2020. As can be gleaned from the press release, the motive is to reduce the hardships to the appellant by facilitating the taxpayers to file their submission from the comfort of their home and shall further save the time and resources of the appellant. The scheme also seems to reduce the time span in disposal of appeals and reduce the burden of pending cases, just to quantify 4.6 lakh cases are pending before the CIT(A). Ex-facie the year 2020 in the tax prospects seems to adopt the 20-20 cricket format for faster disposal of cases through online proceedings.

Under the Faceless Appeals Scheme just like the Faceless Assessments the physical interface between the appellant and the Department has been dispensed off. Moreover even the National e-Assessment Scheme or the Assessing Officer cannot directly communicate with the appellate unit. Therefore the complete process right from allocation of appeals, communication of notice/questionnaire, verification/enquiry to hearing and communication of appeal order shall be online.

Further the operandi of the faceless appeals has been determined to include allocation of cases through Data analytics and AI under dynamic jurisdiction with central issuance of notice bearing DIN.As part of dynamic jurisdiction the draft appellate order shall be prepared in one city and reviewed in another. This assures quality appellate order by subjugating it to a review before the final appellate order is passed.

The shift towards Faceless Appeals was introduced vide amendment to section 250 by introducing sub-clause 6B & 6C to section 250 of Income Tax Act 1961. The said section is reproduced herewith to understand the framework for advancement towards the Faceless Appeals :-

[(6B) The Central Government may make a scheme, by notification in the Official Gazette, for the purposes of disposal of appeal by Commissioner (Appeals), so as to impart greater efficiency, transparency and accountability by—

(a) eliminating the interface between the Commissioner (Appeals) and the appellant in the course of appellate proceedings to the extent technologically feasible;

(b) optimising utilisation of the resources through economies of scale and functional specialisation;

(c) introducing an appellate system with dynamic jurisdiction in which appeal shall be disposed of by one or more Commissioner (Appeals).

(6C) The Central Government may, for the purposes of giving effect to the scheme made under sub-section (6B), by notification in the Official Gazette, direct that any of the provisions of this Act relating to jurisdiction and procedure for disposal of appeals by Commissioner (Appeals) shall not apply or shall apply with such exceptions, modifications and adaptations as may be specified in the notification:

Provided that no direction shall be issued after the 31st day of March, 2022.

(6D) Every notification issued under sub-section (6B) and sub-section (6C) shall, as soon as may be after the notification is issued, be laid before each House of Parliament.]

On perusal of the aforementioned amendment it is palpable that sub-section 6B & 6C enable the Government to introduce Faceless Appeals vide a Notification in the Official Gazette. However such Notification shall be subject to the approval in each of House of Parliament. Deriving powers from the said provision of Income Tax Act 1961 the Government on 25/09/2020 vide Notification No. 76/2020 introduced the Faceless Appeals Scheme, 2020 with immediate effect.

Key Strokes

The Faceless Appeals Scheme, 2020 broadly provides procedures for :

i. Appellate Proceedings

ii. Penalty Proceedings

iii. Rectification Proceedings

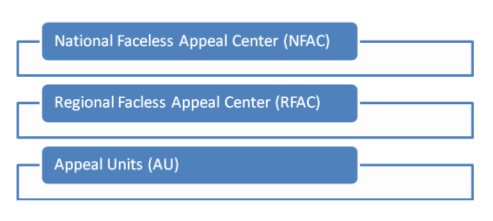

On reading through the procedures as laid out under the scheme it may be gleaned that the scheme is akin to the National E-Assessments and shall be operated through the Faceless Appeal Centres. The Faceless Appeal Centres same comprises of the

• The NFAC shall operate at the centre and act as an interface between the appellant or any other person or the National e-Assessment Centre (NEAC) or the Assessing Officer and the AU. In other words all the communications with the AU by the appellant or the NEAC/Assessing Officer shall be only through the NFAC.

• The RFAC shall facilitate conduct of the e-appellate proceedings & to dispose the appeals in accordance with this scheme

• Whereas the AU shall have the substantial burden of executing the appellate proceedings as per the scheme by admitting the additional grounds/additional evidences/further enquiries/ direct NEAC or Assessing Officer to carry out inquiries etc. In other words the AU shall be deciding the appeal in effect. The AU shall comprise of

– one or more CIT(A) and

– other income tax authority, ministerial staff to assist the CIT(A)

The primary flow of the appellate proceedings under the scheme may be summarized and understood as follows:-

A. Appellate Proceedings

1. Admission of Appeal

i. NFAC shall assign appeal to any AU in any one RFAC through automated allocation system. Therefore an AI algorithm shall allocate the appeal to AU without any human interference

ii. Condonation of Delay

The AU if satisfied shall condone the delay if any in filing the appeal or reject the same

iii. Exemption from tax payment u/s 249(4)(b)

The AU if satisfied may admit the appeal by waiving the requirement of payment of advance tax in case the appellant has not filed return of income, or reject the same.

iv. The NFAC shall intimate the admission or rejection of appeal to the appellant

2. AU calls for information through NFAC

i. Once the appeal is admitted the AU may request NFAC to obtain such information, document or evidence from the appellant or any other person.

ii. AU may also request report from NEAC or Assessing Officer as the case may be

iii. AU may direct NEAC/Assessing Officer to carry out further inquiry u/s 250(4) of the Income Tax Act 1961

iv. NFAC shall as the case may be serve notice on appellant or any other person or NEAC or Assessing Officer

v. The appellant or any other person or NEAC or Assessing Officer shall file their response/report within specified time.

vi. The NFAC shall forward the response/report of the appellant of any other person or NEAC or Assessing Officer to AU

3. Additional Grounds

i. NFAC shall forward the additional ground to NEAC or Assessing Officer as the case may be for their comments, and to the AU

ii. Where NEAC or Assessing Officer furnish their comments within specified time or extended time, the same shall be forwarded to the AU

iii. The AU if satisfied may admit the additional grounds or reject the same

iv. The NFAC shall intimate the admission/rejection of additional grounds to the appellant

4. Additional Evidence

i. The NFAC shall send the additional evidences to the NEAC or Assessing Officer as the case may be for their report on basis of Rule 46A of the Income Tax Rules 1962.

ii. The NEAC or Assessing Officer shall file its report within specified date and time or extended time

iii. The NFAC shall forward the same to AU

iv. The AU shall either admit or reject the additional evidence

v. The NFAC shall intimate the admission or rejection of additional evidence to the appellant

5. Further procedure on admission of additional evidence

i. The AU shall before taking such additional evidence into account prepare a notice to provide an opportunity to the NEAC/Assessing Officer to examine the evidence, cross-examine the witness or to produce any evidence or document

ii. The NFAC shall serve such notice on the NEAC or Assessing Officer as the case may be

iii. The NEAC or Assessing Officer shall furnish the required report within specified tie or extended time

iv. NFAC shall send such report to the AU

6. Production of Document/witness at request of NEAC or Assessing Officer

i. The NEAC or Assessing Officer may request NFAC to direct production of documents or a witness from the appellant.

ii. NFAC shall forward the said request to AU

iii. The AU if deems fit prepare a notice calling upon the appellant to produce such documents or witness

iv. NFAC shall serve notice on appellant

v. Appellant o file such documents/witness within specified time or extended time

vi. NFAC to forward such response to the AU

7. The AU may exercise power to enhance an assessment or penalty or reduce amount of refund after giving opportunity to the appellant

8. Disposal of appeal

i. The AU shall prepare a draft assessment Order in accordance with provision of section 251 of Income Tax Act 1961 and send the same to NFAC alongwith penalty proceedings if any to be initiated

ii. The NFAC

– where the aggregate of tax, interest, penalty, fee including surcharge and cess payable in respect of issues disputed in appeal is more than specified amount as referred to in clause x to paragraph 13 (no amount notified), shall send such draft order for review by an AU other than the AU which prepared the order.

– In any other case in accordance with risk management strategy notified by the Board including by was of automated examination tool (defined to be an AI algorithm) it may decide to

Finalise the appeal as per draft assessment order

shall send such draft order for review by an AU other than the AU which prepared the order

iii. Such other AU may either concur with the draft Assessment Order or suggest variations therein

iv. On concurrence NFAC shall finalise the appellate order

v. Where variations are suggested the NFAC shall assign the appeal to AU other than the AU which prepared or reviewed the draft appellate order

vi. The said AU after considering such variations pass a draft appellate order. Where the variations tantamount enhancement of income the appellant shall be granted an opportunity of hearing before preparing the draft appellate order

9. Communication of appellate order

i. The NFAC shall communicate the finalised appellate order to:

– The appellant

– The PCCIT/CCIT/PCIT/CIT as per section 250(7) of the Income Tax Act 1961

– The NEAC or Assessing Officer

ii. Where initiation of penalty has been recommended serve notice upon appellant calling on him to show cause as to why penalty shall not be levied.

B. Penalty Proceedings

i. The AU may for non-compliance of any notice, direction or order issued under the scheme send recommendations for initiation of penalty proceedings

ii. The NFAC shall serve a notice on the appellant accordingly

iii. The appellant shall file a response within specified time or extended time

iv. The NFAC shall assign the recommendation for penalty along with response to an AU in any RFAS

v. The AU after considering all the material on record shall prepare a draft order of penalty and send copy to NFAC or drop the penalty proceedings

vi. The NFAC shall either drop the penalty or pass order for imposition of penalty and communicate the same to the

– Appellant

– NEAC or Assessing Officer

C. Rectification Proceedings

i. The application for rectification may be filed by

– The appellant or any other person

– Appeal unit preparing, reviewing or revising the draft order

– NEAC or Assessing Officer as the case may be

ii. The Rectification application shall be admitted and proceed or rejected after granting an opportunity to the appellant or any other person or NEAC or Assessing Officer as the case may be

D. Appellate Proceedings

i. An appeal against the order of NFAC shall lie before the Hon’ble ITAT having jurisdiction over the jurisdictional Assessing Officer

ii. Where an order passed by the NFAC or CIT(A) is set aside and remanded back to the NFAC or CIT(A) by the ITAT, High Court or Supreme Court, the NFAC shall pass an order in accordance with the provisions of this scheme.

E. Exchange of Communication

i. All the communication shall be exclusively through electronic mode.

F. Authentication of electronic record

i. The electronic records shall be authenticated by the NFAC by digital signature

ii. Any appellant or any other person required under the Income Tax Rules to submit his return of income with a Digital signature shall attest the electronic record under the scheme in similar manner or in other cases vide EVC

G. Delivery of Electronic record

i. Every notice or order or ther electronic communications shall be

– Placed on appellant’s registered account

– Sending authenticated copy on appellant’s registered e-mail account

– Uploading authenticated copy on appellant’s mobile app

Followed by a real time alert

ii. Every response to electronic communication under this scheme shall be filed by the appellant through registered account and an acknowledgement shall be generated on successful submission of the same.

H. No personal appearance in Centre or Unit

i. A person shall not be required to appear personally or through an authorized representative at the NFAC, RFAC or the AU

ii. Though a request for a personal hearing before the AU to make oral submission and representation under this scheme

iii. The CCIT or DGIT of the concerned RFAC may on satisfaction of circumstances specified under clause (xi) to para 13 allow a personal hearing. (No such circumstances have been specified)

iv. A personal hearing on approval shall be conducted through Video Conferencing or Video Telephony including use of any tele communication software.

v. The Board shall establish suitable facilities for Video Conferencing or Video Telephony including tele-communication software which supports the same

I. Power to specify format, mode procedure & process

i. The PCCIT or PDGIT in charge of NFAC is empowered to lay down standard procedures and processes for effective functioning of the NFAC. RFAC & AU under this scheme

ii. They shall determine the format, mode procedure & process for the operation of Faceless appeals including the specification of amounting order to refer a draft appellate order for review and circumstances for personal hearing.

Highlights of 2020: Faceless Appellate Scheme:-

The salient features of the Faceless Appeals Scheme could be enlisted as follows:-

a. The NFAC acts as an interface between the AU and the appellant or NEAC/Assessing Officer. Any notice in the course of proceedings shall be served by the NFAC only.

b. The additional grounds may be admitted on considering report from NEAC/Assessing Officer

c. The additional evidences may be admitted on report of the NEAC/ Assessing Officer and on admission the additional evidences shall be considered further on providing an opportunity to the NEAC/Assessing Officer

d. The AU has power of enhancement

e. The AU may initiate penalty proceedings in course of appellate proceedings

f. The NFAC passes the final appellate order or penalty order or the rectification order

g. The scheme though makes reference to specified time limit for filing a response, it nowhere determines such specified time. Also no time limit for passing of appellate order has been set out.

h. The appellate order is subject to review before finalisation and in case of any variation suggested in review it is further subject to revision.

i. The AU preparing, reviewing and revising the draft appellate order is different and may also be from a different RFAC altogether.

j. Strangely the draft penalty order is not subject to any review or revision

k. The penalty may be initiated for non-compliance of any notice, direction or order under the Scheme.

l. The scheme provides for rectification of the appellate order, however no time limit for an application for rectification has been specified under the scheme

m. The appeal against the appellate order under this scheme shall lie before the ITAT having jurisdiction over the jurisdictional Assessing Officer

n. Orders passed by CIT(A)/NFAC set aside to the NFAC or CIT(A) shall also be filed by the NFAC in accordance with provisions of this Scheme. Therefore Order passed by the CIT(A)/NFAC already set aside by the ITAT, High Court or Supreme Court to the CIT(A) and pending for disposal shall also be passed by the NFAC in accordance with the provisions of the Scheme.

o. Under the scheme all the electronic records including the notices or order or any other electronic communication shall be authenticated by digital signature or EVC

p. A personal hearing may be requested by the appellant, however the same shall be granted on approval of CCIT/DGIT in charge of RFAC on basis of specified circumstances ( not specified). Once approved the personal hearing shall be carried out through Video Conferencing or Video telephony only

q. The PCCIT or DGIT in charge of NFAC shall with prior approval of Board lay down the standard procedures and processes for effective functioning of NFAC, RFAC and AU

Issue for the Third umpire

However there persist certain issues that need clarification for the smooth implementation of the Faceless Assessments. Certain issues in the opinion of the author are enlisted herein below:-

1. At the outset the constitutional validity of introducing such a scheme vide notification in an official gazette is under question and we will have to wait till the same is considered by the Judicial authorities.

2. The press release dated 25/09/2020 in respect of the Faceless Assessments 2020 carves out certain exceptional cases involving serious frauds, major tax evasions, sensitive and search matters, international tax & black money Act. That would be appreciated considering the complexity of issues however the Scheme does not carve out any such appeals and the same need to be specifically provided under the Scheme

3. The Scheme provides for review of draft order (under specified circumstances) before it is finalized by the NFAC. Also the press release makes a mention that a draft passed in one city shall be reviewed in another. Further the Scheme mentions that the draft order shall be reviewed or revised in different AU in any RFAC. Therefore the draft order may be prepared, reviewed and revised in absolutely different jurisdictions which raises a question, how the decision of jurisdictional High Court as also the ratio of Vegetable Products Ltd – Supreme Court – 88 ITR 192 be applied?

4. Further the appeals set aside by the ITAT/High Court or SC to the file of CIT(A) to reconsider an issue, need to be excluded from the ,ambit of scheme or atleast be considered within circumstances for personal hearing. Otherwise an appeal argued physically say before the Hon’ble ITAT by would require comprehensive deliberations before the CIT(A) and the same may not be effectively sailed across merely through a submission.

5. The scheme enables the NEAC or Assessing Officer to claim cross-examination of witness however no such provision is made whereby the appellant can ask for cross-examination where the Assessing Officer relies on a statement of third party

6. The NEAC or Assessing Officer after admission of additional evidence is given an opportunity to give its comments on the additional evidences filed by the appellant however the appellant is not granted any opportunity to file an rebuttal or rejoinder as done usually in the physical hearings.

7. The NFAC may refer the draft appellate order for review where the amount of tax, penalty, interest etc exceeds a specified amount. However in absence of such specified amount the scheme cannot be implemented

8. The Scheme provides for initiation of penalty for non-compliance of any notice, direction or order issued under the scheme, however there exists no such provision under the Income Tax Act 1961 empowering the CIT(A) to levy such a penalty.

9. The provisions of the Income Tax Act 1961 have not been amended to facilitate the implementation of the Scheme. Number of provisions of the Income Tax Act 1961 like the section 2(16A), 154, 131, 133, 158A, 158AA245, 253, 270A, 271, 275 need to be amended and brought in line with the Scheme obviously subject to the constitutional validity of the Scheme itself.

10. The procedure for requesting a personal hearing has not been determined as also the circumstances in which personal hearing shall be allowed has not been specified.

Appearance before the appellate forum if not the most is a substantial part of the appellate proceedings which has been systematically cut out by this Scheme. However the circumstances for a personal hearing need to determined more liberally considering the intricacies of an appeal and enabling the appellant to put his point across.

To sum it up the scheme seems to be a move towards faster & effective disposal of appeals pending before the CIT(A) with an interesting twist of review of a draft appellate order. The entire approach of review of a draft appellate order, sings on the note of “ My name is blurryface and I care what you think’.

To part with ………the effectiveness of the Scheme shall be better know as it pans out practically and then we may ascertain if it is grand success like the 20-20.

Pratik Sandbhor

CA, CS, CMA(USA), LLB, Dpl. Intl. Taxation, BCom

| Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. Neither the author nor itatonline.org and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission of itatonline.org |

The A U may not be able to impose penalty for non attendance or response to notice under 131 by a witness since no penalty is available unlike Rs 500/10000 in the past

CBDT MUST PROVIDE A LIMITATION PERIOD TO COMPULSORILY DECIDE

On the FLIP side :

“VIRTUAL”- (X PHysical) – Impact of GST on ‘lawyers’; for a typical case say, a lawyer in INdia representing client before an authority with seat located outside of the ‘territorial jurisdiction’ (e.g. arbitrator or ‘arbitration tribunal ‘) Any Thoughts TO Share !!!