CA. Pankaj Agrwal has raised several interesting and important questions relating to the law governing a Hindu Undivided Family (HUF). He has provided a detailed explanation of section 6 of the Hindu Succession Act, 1956 and also referred to all the landmark judgements of the Supreme Court which have interpreted the law

CA. Pankaj Agrwal has raised several interesting and important questions relating to the law governing a Hindu Undivided Family (HUF). He has provided a detailed explanation of section 6 of the Hindu Succession Act, 1956 and also referred to all the landmark judgements of the Supreme Court which have interpreted the law

Lockdown has given us an opportunity to interact and to listen to professionals on varied subject of interest. I had an opportunity to join such two webinars on Hindu Undivided Family. Due to paucity of time and technological limitations, on some aspects, there could not be as much discussions as ought to be. The major issue is relating to section 6 of the Hindu Succession Act, 1956 as amended which gives rights to daughters. The issues which arise for discussion are as under:

1. Whether unmarried daughter, if her father has died before the commencement of the amendment Act of 2005, will become coparcener in the family in which she is presently member and her brothers and their children are coparceners.

2. Whether married daughter whose marriage has taken place prior to the amendment of 2005, will become coparcener in the family of which her father is coparcener.

3. What is the status of second and third generation daughter? Will they also be coparcener as their counterpart brothers would be.

4. Whether married grand-daughter in the family of which her grand-father is the coparcener-Karta and her father is coparcener will be coparcener.

5. Whether matrilineal descendant i.e. daughter’s children will also become coparcener and members of the family of her maternal grand-father of which their mother has become coparcenar by operation of law. How the share of daughter will get determined for the purpose of partition or devolvement by testamentary or intestate succession?

For finding answers to the above queries, we need to understand why an amendment to section 6 of the Hindu Succession Act was brought. What is the definition of Coparcener? Whether Coparcener is an individual or represents a unit.

Purpose of the amendment:

I reproduce from the report of Standing Committee of the parliament which recommended to the government for the change in law:

“12. Some sections of the Act came under criticism evoking controversy as being favourable to continue inequality on the basis of gender. One such provision has been the retention of the Mitakshara coparcenary with only males as coparceners. As per the Law Commission Report, coparcenary constitutes a narrower body of persons within a joint family and consists of father, son, son’s son and son’s son’s son.Thus ancestral property continues to be governed by a wholly patrilineal regime, wherein property descends only through the male line as only the male members of a joint Hindu family have an interest by birth in the coparcenary property. Coparcenary property, in contradistinction with the absolute or separate property of an individual coparcener, devolve upon surviving coparceners in the family, according to the rule of devolution by survivorship. Since a woman could not be a coparcener, she was not entitled to a share in the ancestral property by birth.

13. However, attempt was made to partially remove this disparity. Section 6 of the Act, although it does not interfere with the special rights of those who are members of a Mitakshara coparcenary, recognises, without abolishing joint family property, the right upon the death of a coparcener, of certain of his preferential heirs to claim an interest in the property that would have been allotted to such coparcener if a partition of the joint family property had in fact taken place immediately before his death (‘notional’ partition). To elaborate this further, the share of the deceased male in the joint property and the shares of his heirs are ascertained under the assumption of a ‘notional’ partition (i.e., as if the partition had taken place just prior to his death). Thus, section 6 of the Act, while recognising the rule of devolution by survivorship among the members of the coparcenary, makes an exception to the rule in the proviso. According to the proviso, if the deceased has left him surviving a female relative specified in Class I of Schedule I, or a male relative specified in that Class who claims through such female relative, the interest of the deceased in the Mitakshara coparcenary property shall devolve by testamentary or intestate succession under this Act as mentioned above, and not by survivorship.

14. Notwithstanding these facts, the direct interest in the coparcenary held by male members by virtue of birth remains unaffected. It affects only the interest they hold in the share of the deceased. A son’s share in the property in case the father dies intestate would be in addition to the share he has on birth. A man has full testamentary power over all his property, including his interest in the coparcenary.

15. Thus, non-inclusion of women as coparceners in the joint family property under the Mitakshara system as reflected in section 6 of the Hindu Succession Act, 1956 relating to devolution of interest in coparcenary property has been under criticism for being violative of equal rights of women guaranteed under the Constitution in relation to property rights. This meant that females cannot inherit ancestral property as males do. If a joint family gets divided, each male coparcener takes his share and females get nothing. Only when one of the coparceners dies, a female gets a share of his interest as an heir to the deceased.

16. It has been further observed that as per the proviso to Section 6 of the Act, the interest of the deceased male in the Mitakshara coparcenary devolve by intestate succession firstly upon the heirs specified in Class I of Schedule I. As mentioned above, under this Schedule, there are only four primary heirs, namely, son, daughter, widow and mother. For the remaining eight, the principle of representation goes up to two degrees in the male line of descent as mentioned in para 6 (v), (vi), (x) and (xi). But in the female line of descent, it goes only upto one degree as mentioned in para 6 (vii) and (viii). Thus, the son’s son’s son and the son’s son’s daughter get a share but a daughter’s daughter’s son and daughter’s daughter’s daughter do not get anything.”

From the above it is evident that the amendment was brought to end gender inequality and to give daughters the same rights as their brothers were having in the family.

What is Coparcenery?

The joint and undivided family is the normal condition of Hindu society. An undivided Hindu family is ordinarily joint not only in estate, but also in food and worship. (1) A Hindu coparcenary is a much narrower body than the joint family. It includes only those persons who acquire by birth an interest in the joint or coparcenary property. (2) What are the incidents of Joint Family or Coparcenary property ?

I quote from Mulla’s Hindu Law page 370 which states the following incidents of joint family or coparcenary property:

“Joint family or coparcenary property is that in which every coparcenar has a joint interest and a joint possession. The incidents of a coparcenary were summarized in the undermentioned decision of the Supreme Court. (3) The following are the main incidents of joint family or coparcenary property. It:

(a) Devolves by survivorship, not by succession. – This proposition must now be read in the context of section 6 and 30 of the Hindu Succession Act 1956, in case where those sections are applicable.

(b) Is the property in which the male issue of the coparceners acquire an interest by birth.

However, both the incidents have to be read in the context of amendments made to section 6 which I will deal with later.

Section 6 of the Hindu Succession Act, 1956

6. DEVOLUTION OF INTEREST IN COPARCENARY PROPERTY

(1) On and from the commencement of the Hindu Succession (Amendment) Act, 2005, in a joint Hindu family governed by the Mitakshara law, the daughter of a coparcener shall,-

(a) by birth become a coparcener in her own right in the same manner as the son;

(b) have the same rights in the coparcenary property as she would have had if she had been a son;

(c) be subject to the same liabilities in respect of the said coparcenary property as that of a son,

and any reference to a Hindu Mitakshara coparcener shall be deemed to include a reference to a daughter of a coparcener :

Provided that nothing contained in this sub-section shall affect or invalidate any disposition or alienation including any partition or testamentary disposition of property which had taken place before the 20th day of December, 2004.

(2) Any property to which a female Hindu becomes entitled by virtue of sub-section (1) shall be held by her with the incidents of coparcenary ownership and shall be regarded, notwithstanding anything contained in this Act, or any other law for the time being in force, as property capable of being disposed of by her by testamentary disposition.

(3) Where a Hindu dies after the commencement of the Hindu Succession (Amendment) Act, 2005, his interest in the property of a joint Hindu family governed by the Mitakshara law, shall devolve by testamentary or intestate succession, as the case may be, under this Act and not by survivorship, and the coparcenary property shall be deemed to have been divided as if a partition had taken place and,-

(a) the daughter is allotted the same share as is allotted to a son ;

(b) the share of the pre-deceased son or a pre-deceased daughter, as they would have got had they been alive at the time of partition, shall be allotted to the surviving child of such pre-deceased son or of such pre-deceased daughter ; and

(c) the share of the pre-deceased child of a pre-deceased son or of a pre-deceased daughter, as such child would have got had he or she been alive at the time of the partition, shall be allotted to the child of such pre-deceased child of the pre-deceased son or a pre-deceased daughter, as the case may be.

Explanation For the purposes of this sub-section, the interest of a Hindu Mitkashara coparcener shall be deemed to be the share in the property that would have been allotted to him if a partition of the property had taken place immediately before his death, irrespective of whether he was entitled to claim partition or not.

(4) After the commencement of the Hindu Succession (Amendment) Act, 2005, no court shall recognise any right to proceed against a son, grandson or great-grandson for the recovery of any debt due from his father, grandfather, or great-grand father solely on the ground of the pious obligation under the Hindu law, of such son, grandson, or great-grandson to discharge any such debt :

Provided that in the case of any debt contracted before the commencement of the Hindu Succession (Amendment) Act, 2005, nothing contained in this sub-section shall affect- (a) the right of any creditor to proceed against the son, grandson or great-grandson, as the case may be ; or (b) any alienation made in respect of or in satisfaction of, any such debt, and any such right or alienation shall be enforceable under the rule of pious obligation in the same manner and to the same extent as it would have been enforceable as if the Hindu Succession (Amendment) Act, 2005, had not been enacted.

Explanation for the purposes of clause (a), the expression "son", "grandson" or "great-grandson" shall be deemed to refer to the son, grandson or great-grandson, as the case may be, who was born or adopted prior to the commencement of the Hindu Succession (Amendment) Act, 2005.

(5) Nothing contained in this section shall apply to a partition, which has been effected before the 20th day of December, 2004.

Explanation For the purposes of this section "partition" means any partition made by execution of a deed of partition duly registered under the Registration Act, 1908 (16 of 1908) or partition effected by a decree of a court.

In the light of the above discussion, I will deal with the questions framed at the beginning:

1. Whether unmarried daughter, if her father has died before the commencement of the amendment Act of 2005, will become coparcener in the family in which she is presently member and her brothers and their children are coparceners.

The answer is ‘No’ because she was not ‘the daughter of coparcener’ when the amendment Act came into effect from 9th September 2005. The Hon’ble Supreme Court in Prakash and others Vs. Phulvati and others held as under:

“17. The text of the amendment itself clearly provides that the right conferred on a ‘daughter of a coparcener’ is ‘on and from the commencement of Hindu Succession (Amendment) Act, 2005’. Section 6(3) talks of death after the amendment for its applicability. In view of plain language of the statute, there is no scope for a different interpretation than the one suggested by the text of the amendment. An amendment of a substantive provision is always prospective unless either expressly or by necessary intendment it is retrospective. In the present case, there is neither any express provision for giving retrospective effect to the amended provision nor necessary intendment to that effect. Requirement of partition being registered can have no application to statutory notional partition on opening of succession as per unamended provision, having regard to nature of such partition which is by operation of law. The intent and effect of the Amendment will be considered a little later. On this finding, the view of the High Court cannot be sustained.

23. Accordingly, we hold that the rights under the amendment are applicable to living daughters of living coparceners as on 9th September, 2005 irrespective of when such daughters are born. Disposition or alienation including partitions which may have taken place before 20th December, 2004 as per law applicable prior to the said date will remain unaffected. Any transaction of partition effected thereafter will be governed by the Explanation.”

2. Whether married daughter whose marriage has taken place prior to the amendment of 2005, will become coparcener in the family of which her father is coparcener.

The answer is ‘yes’. Initially, in the bill the following proviso was proposed which did not find place in the final amendment Act.

“Provided that nothing contained in this sub-section shall apply to a daughter married before the commencement of the Hindu Succession (Amendment) Act, 2004.”

The law as it stands today, there is no distinction between ‘married’ and ‘unmarried’ daughter.

3. What is the status of second and third generation daughter? Will they also be coparcener as their counterpart brothers would be.

The answer is daughters of each generation upto 4th generation will become coparcener. As the son’s son and son’s son’s son become coparcener by birth as per traditional custom and law so the son’s daughter and son’s son’s daughter will also become coparcener as if they would have been ‘son’. The term used is ‘daughter of a coparcener’ and hence, the daughters of second and third generation will also be coparcener.

4. Whether married grand-daughter in the family of which her grand-father is the coparcener-Karta and her father is coparcener will be coparcener.

The answer is ‘yes’ as she is daughter of coparcener- his father. She will also become coparcener in the family headed by her grand-father as well as in the family of her father.

5. Whether matrilineal descendant i.e. daughter’s children will also become coparcener and members of the family of her maternal grand-father of which their mother has become coparcenar by operation of law. How the share of daughter will get determined for the purpose of partition or devolvement by testamentary or intestate succession?

To find answer to this query, we need to understand the provisions of section 6. Whether this section is granting ‘rights’ or conferring ‘status’. Section 6 (1)(a) provides that she ‘become a coparcener’. What does it mean? It means, by law, she is conferred with status of ‘coparcener’. The hon’ble Supreme Court in the case of DANAMMA @ SUMAN SURPUR & ANR. Vs. AMAR & ORS. held as under:

“24) Section 6, as amended, stipulates that on and from the commencement of the amended Act, 2005, the daughter of a coparcener shall by birth become a coparcener in her own right in the same manner as the son. It is apparent that the status conferred upon sons under the old section and the old Hindu Law was to treat them as coparceners since birth. The amended provision now statutorily recognizes the rights of coparceners of daughters as well since birth. The section uses the words in the same manner as the son. It should therefore be apparent that both the sons and the daughters of a coparcener have been conferred the right of becoming coparceners by birth. It is the very factum of birth in a coparcenary that creates the coparcenary, therefore the sons and daughters of a coparcener become coparceners by virtue of birth. Devolution of coparcenary property is the later stage of and a consequence of death of a coparcener. The first stage of a coparcenary is obviously its creation as explained above, and as is well recognized. One of the incidents of coparcenary is the right of a coparcener to seek a severance of status. Hence, the rights of coparceners emanate and flow from birth (now including daughters) as is evident from sub-s (1)(a) and (b).”

Sub-section (2) also says that such property shall be held by her with the incidents of coparcenary ownership. What are the incidents of ‘coparcenary property’? One such incident has been ‘devolves by survivorship, not by succession” and the other incident has been that the male issue of coparcener acquires rights in such property by birth. If it is interpreted that the daughter alone and not her descendents will have the rights in the family, how these 2 pertinent incidents of coparcenary ownership will get fulfilled. Further, the coparcenary is a sub-unit within the family.

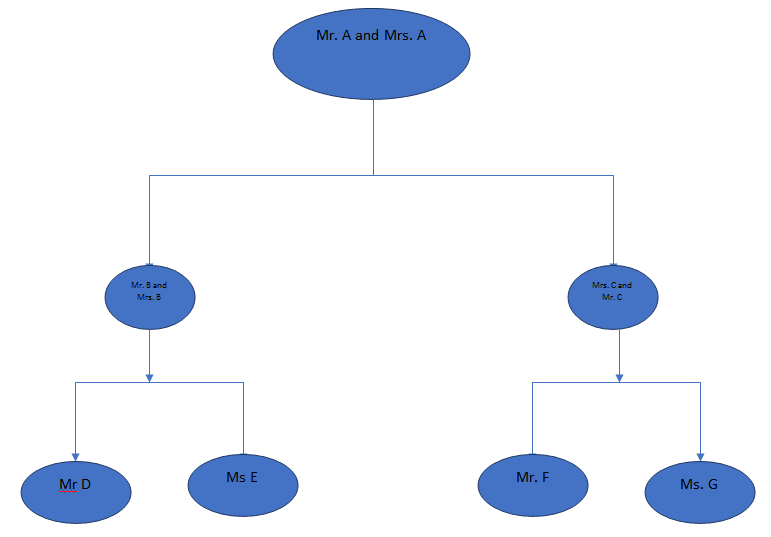

One more anomaly will arise, if it is held that only daughters will be entitled. Take an example of the following family tree:

If Mr B makes a will of his interest in coparcenary property, in case of his unfortunate death, how much share will go by succession to his heirs. And in the same circumstances, if Mrs C makes a will, how much share she can bequeath by succession.

As per my understanding, Mr. B is entitled for 1/16th Share on notional partition as under:

Mr A, Mrs. A, Mr B and Mrs C, each will have one share. So Mr B is entitled for ¼ th Share. Further, in this ¼ th share, there will be 4 claimant viz. Mr. B, Mrs. B, Mr. D and Ms. E. So ¼ th of ¼ th, his share comes to 1/16.

Mrs C is similarly placed as far as composition of her family is concerned. If the interpretation that daughter alone has interest is applied, she will be entitled to will her 1/4th Share. The intendment of law has been to bring females at par with their counterpart males and not to favour them. In traditional law, mother has been given a share equal to her sons when partition takes place amongst her husband and her sons. Such provisions were made to safegaurd her interest as she generally used to be non earning member of the family. Similarly, provisions used to be made for marriage of unmarried daughters at the time of partition. So, in my view, husband may not have any share in this case but her children will have shares and so her share will be 1/3rd of ¼ i.e. she can will for 1/12 interest in the coparcenary property and not 1/4th share.

In conclusion, I will say that now, every person will have coparcenary rights in joint family of his paternal as well as maternal side. However, we have to wait till the decision of apex court comes as we are yet to digest that daughters have been given right in joint family property.

I look forward from my professional colleague for their valuable comments.

(2) Surjit Lal Chhaabda V CIT Bombay AIR 1976 SC 109; CIT Vs. Luxminarayan 59 Bom 618 . Mulla page 359.

(3) State Bank of India Vs. Ghamandi Ram AIR 1969 SC 1330

| Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. Neither the author nor itatonline.org and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission of itatonline.org |

Respected Sir,

A very enlightening article. What would be the status of a HUF in which there is a widow and two unmarried daughters (Both major). HUF was formed in 1972 and Father (Karta) expired in 1997. Who will be the Karta since there is no coparcener as the HUF has only female members.

In my view this is no longer an HUF. All are holding the property as tenants in common. First, I assume that it was HUF because of ancestral property otherwise with daughters before 2005, there could not have been any HUF. When the father has died in 1997, he being the single coparcener, and no one else to claim, in my view, HUF has ceased to exist.

Thank you for your reply Sir.

Respected Sir,

Read your article and enlightened. It is true that over a period, ancestral property concept is fading away.

Thanks and regards.

A very good analysis provided by you on the impact of the amendment to Hindu Succession Act, 1956. My query is:-

1) Whether daughter of coparcener would have right in the property for the properties acquired BEFORE amendment to Hindu Succession Act? Or else, the Daughter shall be having rights in the coparceners property only which is acquired ON OR AFTER amendment to Hindu Succession Act?

2) What if the coparcener father has ADOPTED a daughter after amendment act, i.e. will that adopted daughter be having rights in the property of her coparcener father?

There will not be any distinction of properties when they were acquired. Daughters will have right in all the properties.

Adopted daughter will also have the same rights.

Thank you sir for concurring with my view which I find many of us are not able to digest. I will certainly search and go through your article.

Very interesting and thorough analysis sir. Thank you for sharing. Would be interested to know your thoughts about what would happen if the daughter becomes a foreign citizen, and doesn’t even have an OCI.

In my view, merely becoming a foreign citizen will not deprive her rights here.

Someone expert on citizenship law may throw some light on the same. Even FEMA permits to hold all those assets which one was holding when one becomes NRI.

The proposition that a female will have coparcenary rights in joint family of her paternal as well as maternal side seems unfair. She will have a similar right in her in-laws property too. And in my opinion a persons right in the maternal family property could not be perpetual. It has to end with him/her and no further.

First thing, a female does not have any right in her in-laws property. She only has a right of maintenance and only in case of partition amongst father and his children, she gets a share.

There is no question of fairness or unfairness. The law has brought on same footing both lineage through son and daughter. It is my understanding. In any case this goes only upto 4 degree.

Can you advise whether the share of the female members is perpetual, i.e., the share of great grand-daughter of a daughter will be given to her great grand-daughter (great grand daughter of the great grand daughter)?

I did not say so. As there is coparcenary upto 4 degree i.e. father, son, son’s son and son’s son’s son in normal traditional law, so in daughter lineage also it can go upto 4 degree.

RESPECTED SIR, YOUR ANALYSIS IS CORRECT. AFTER THE AMENDMENT OF SECTION 6(3) THE ANCESTRAL PROPERTY CONCEPT IS ALMOST ON THE DEATH-BED. I HAVE UPLOADED AN ARTICLE “ANCESTRAL PROPERTY CONCEPT FADING AWAY”. YOU MAY HAVE A LOOK. ADVOCATE BHAVE