CA Nidhi Surana has conducted an exhaustive study of the provisions of section 271AAD of the Income-tax Act, 1961, which imposes penalty for false entries etc in the books of account. She has explained the precise scope of the section with reference to practical examples and case laws. She has opined that the provision is too wide in its scope and poses the danger of being abused by Assessing Officers

CA Nidhi Surana has conducted an exhaustive study of the provisions of section 271AAD of the Income-tax Act, 1961, which imposes penalty for false entries etc in the books of account. She has explained the precise scope of the section with reference to practical examples and case laws. She has opined that the provision is too wide in its scope and poses the danger of being abused by Assessing Officers

Various mis-endeavours have come to light, after the introduction of Goods and Service tax Act, where in several cases there was a fraudulent input tax credit (ITC) claim. In these cases, fake invoices are obtained by suppliers registered under GST to fraudulently claim ITC and reduce their GST liability. These invoices are found to be issued by racketeers who do not actually carry on any business or profession. They only issue invoices without actually supplying any goods or services. The GST shown to have been charged on such invoices is neither paid nor is intended to be paid. Such fraudulent arrangements deserve to be dealt with harsher provisions under the Act.

Therefore, to counter such fraudulent practices in the Income tax Act, 1961( hereinafter referred to as ‘The Act’) a new section 271AAD has been inserted by the Finance Act, 2020 for levy of penalty for making fraudulent claims of Input tax credit(ITC) under the GST Act, 2017.

The new provision introduced was to provide for a levy of penalty on a person, if it is found during any proceeding under the Act that in the books of accounts maintained by him there is a (i) false entry or (ii) any entry relevant for computation of total income of such person has been omitted to evade tax liability. The penalty was equivalent to the amount of false entry made or the entry omitted by an assessee in his books of account maintained by him Hence Section 271AAD the penal provision under Income Tax Act, was formulated and introduced in Finance Act, 2020 which will take effect from 1st April, 2020.

The provision reads as under:

Section-271AAD. Penalty for false entry, etc., in books of account

271AAD. (1) Without prejudice to any other provisions of this Act, if during any proceeding under this Act, it is found that in the books of account maintained by any person there is—

(i) a false entry; or

(ii) an omission of any entry which is relevant for computation of total income of such person, to evade tax liability,

the Assessing Officer may direct that such person shall pay by way of penalty a sum equal to the aggregate amount of such false or omitted entry.

(2) Without prejudice to the provisions of sub-section (1), the Assessing Officer may direct that any other person, who causes the person referred to in sub-section (1) in any manner to make a false entry or omits or causes to omit any entry referred to in that sub-section, shall pay by way of penalty a sum equal to the aggregate amount of such false or omitted entry.

Explanation.––For the purposes of this section, “false entry” includes use or

intention to use—

(a) forged or falsified documents such as a false invoice or, in general, a false piece of documentary evidence; or

(b) invoice in respect of supply or receipt of goods or services or both issued by the person or any other person without actual supply or receipt of such goods or services or both; or

(c) invoice in respect of supply or receipt of goods or services or both to or from a person who does not exist.’.

The rationale behind the insertion of the section has been explained in the Notes on in Clause 98 of the Finance Bill 2020, which seeks to introduce the said penal section in following words

Clause 98 of the Bill seeks to insert a new section 271AAD in the Income-tax Act relating to penalty for false or omission of entry in books of account. It is proposed to insert a new section 271AAD, under which penalty shall be levied on a person who is required to maintain books of account, if it is found that the books contain a false entry or that any entry has been omitted which is relevant for the computation of his total income. Such person shall be liable to pay by way of penalty a sum equal to the aggregate amount of such false and omitted entries. Penalty shall also be levied on any other person who causes the person required to maintain books of account to make or causes to make any false entry or omit or cause to omit any entry in books of account. The false entries shall include use or intention to use forged or falsified documents such as a false invoice or, in general, a false piece of documentary evidence; or invoice in respect of supply or receipt of goods or services or both issued by the person or any other person without actual supply or receipt of such goods; or invoice in respect of supply or receipt of goods or services or both to or from a person who does not exist. This amendment will take effect from lst April, 2020.

Further, the objective behind the insertion of the section could be found in the Budget Speech of Finance Minister wherein she has stated that the provision has been brought ‘to discourage taxpayers to manipulate their books of accounts by recording false entries including fake invoices to claim wrong input credit in GST, it is proposed to provide for penalty for these malpractices.’(Para 6.8 of Budget Speech)

Effective From:-

It is stated that the provision shall be effective from 1st April, 2020. There are apprehension as to whether the provision shall be applicable from A.Y. 2020-21 or A.Y. 2021-22.

A glance at other clause of the memorandum to Finance Act shall clear the ambiguities.

Clause 3- “This amendment will take effect from 1st April, 2020 and will, accordingly, apply in relation to the assessment year 2020-21 and subsequent years”.

Clause 4- “These amendments will take effect from 1st April, 2021 and will, accordingly, apply in relation to the assessment year 2021-22 and subsequent years.”

Clause 5- “This amendment will take effect from 1st April, 2022 and will, accordingly, apply in relation to the assessment year 2022-23 and subsequent years”

Clause 98- “This amendment will take effect from 1st April, 2020” (emphasis supplied)

The bare reading of clauses 3,4 & 5, along with clause 98 reveals a significant contrast. In other words it could easily be interpreted that the legislature has deliberately delinked the operation of the section from the particular assessment year. This delinking empowers the AO to levy the penalty as envisaged in the section from 1st April 2020 under the specified circumstances. Therefore, if legislature’s intention was to make section 271AAD applicable from A.Y. 2020-21 then it would have provided so in similar manner as in clause 3,4 & 5.

Hence, in absence of the same, the provisions of section 271AAD shall apply from Financial Year 2020-21.

Complete overview of the provision

The motive and intend behind the insertion of the said new section, which initially only targeted GST’s Fraudulent input tax credit became extremely broad by the words used in the provision i.e. “Without prejudice to any other provisions of this Act, if during any proceeding under this Act, it is found that in the books of account maintained by any person”

Understanding the provision and its scope and limits:

1. Parallel Penalty Provision may lead to multiple penalization for the single offense:-

The provision starts with “Without prejudice to any other provisions of this Act” that shall mean that penalty u/s 271AAD can be imposed parallelly along with other penal provisions of the Income Tax Act.

Interpretation– It appears that penalty u/s 271AAD can be imposed along with other specific penalties viz., 271AAB, 271AAC, etc. under chapter XXI of the Act. So multiple penalties can be initiated and levied for the same offense.

2. Application of this section extremely broad with the word any proceedings under this Act:

The words ”if during any proceeding under this Act” means penalty can be levied only and only if default is identified during any assessment, reassessment, search, survey or any other proceedings under the Act. The section clearly envisages that if the AO finds any such default he may levy the penalty without waiting for any information from GST department etc.

Interpretation– Any Penal Proceedings are followed after the completion, assertion and satisfaction of any misdemeanour on part of the Assessee in any preceding proceedings. So only after identification and satisfaction to the effect that books of accounts contain false entry or omitted entry in any proceedings under the Act, can penalty proceedings u/s 271AAD could be initiated against the assessee.

3. False Entry or omission of entry found in the Books of Account maintained:

The clear stipulation in the provision states that “it is found that in the books of account maintained by any person there is—

(i) a false entry; or

(ii) an omission of any entry which is relevant for computation of total income of such person, to evade tax liability”

Interpretation– Ambiguity remains pertaining to the words books of account maintained, since Books of Account has been defined u/s 2(12A) of Income Tax Act, 1961 which reads as under;

"books or books of account" includes ledgers, day-books, cash books, account-books and other books, whether kept in the written form or as print-outs of data stored in a floppy, disc, tape or any other form of electro-magnetic data storage device;

Though the books of account has been defined under the act, it is now fairly settled that Bank Account Statement of assessee is considered as Books of Accounts.

The Apex Court in case of C.B.I. v/s V.C. Shukla And others [1998] 3 SCC 410 held that; ’Book’ ordinarily means a collection of sheets of paper or other material, blank, written, or printed, fastened or bound together so as to form a material whole. Loose sheets or scraps of paper cannot be termed as ’book’ for they can be easily detached and replaced. Books to be construed as Books of Accounts, it should be regularly kept in the course of business. Loose notings without any day to day transaction will not be considered as Books of Accounts.

4. False Entry or omission of any entry which is relevant for computation of total income, to evade tax liability: –

False Entry is defined in an inclusive manner which further opens scope of any other entries being construed as False Entry.

False entry in the books of accounts shall include entry on the basis of-

a) Forged or Falsified documents or False piece of documentary evidence. Any evidence which in the discretionary opinion of the Assessing officer is not bona fide, runs the risk of being considered as falsified piece of documentary evidence.

b) Invoices where actual supply of Goods or Service has not taken place. Whether actual supply of Goods has taken place or not can be corroborated by other documentary evidences viz., E-Way Bill, Consignment Note/Lorry Receipt, Factory Gate Goods In/Out Register, Stock Register, further Supply of inward Goods etc., However, it is quite impossible to substantiate whether Services have been supplied or not. Hence, it leaves a scope for arbitrary action by Assessing officer.

c) Supply of Goods or Services from Inexistent Person: Person has been defined u/s 2(31) of the Act to include Actual Living Persons as well as Incorporated/ Unincorporated Entities/Associations. While undergoing the transaction, if the person is existing person, however, during the time of assessment proceedings, such person has closed down the business then bona fide transactions may be included by Assessing officer under the purview of such penalty provision as a simple unserved notice u/s 133(6) of the Act raises flag of ingenuity in the eyes of AO.

Omission of Entry: Any entry recorded in books of accounts is omitted by taxpayer in computation of income with the purpose of evasion of tax liability then penalty u/s 271AAD can be levied. Hence, it will be incumbent upon the Assessing officer to prove that there was a deliberate attempt on part of the assessee to omit the entry with the purpose of evasion of tax liability.

Intention to use:

Explanation also covers scenarios of Intention to use Falsified Documents or impugned invoice. It appears to cover a situation where assessee intended to use falsified documents. However, in a situation where books of accounts are not drawn up to the date of Survey or Search and therefore, such falsified documents were not entered in books of accounts till date of such Survey or Search. Nonetheless, mere existence of fake invoice or falsified documents might be considered as intention to use the same and consequently a penalty u/s 271AAD could be imposed.

Interpretation–

Condition of applicability of section 271AAD (1) is that there should be ‘false entry’, or ‘omission of any entry which is relevant for computation of total income of such person to evade tax liability’.

There are some interesting features here. Though ‘false entry’ has been given inclusive meaning under the ‘Explanation’ to section 271AAD but other phrase ‘omission of any entry…’ has not been explained. But, the word ‘entry’ is appearing under both clauses (i) and (ii) of sub section (1).

Further, the phrase ‘to evade tax liability’ seems to qualify ‘an omission of any entry’ clause alone and does not govern the first clause i.e. clause (i) to sub section (1) of section 271AAD viz. ‘false entry’. This is so as the legislature has put semicolon immediately after ‘false entry’ followed by the word ‘or’ thus disjointing clause (i) and (ii) completely. Interpretation in such a situation seems to be that if the case is that of false entry, penalty is still imposable even if it may not be ‘to evade tax liability’. This seems to be in consonance with the purport and object of insertion of section 271AAD appearing in Memorandum, which seeks to penalize the practice of issuing and entering fake invoices. This interpretation seems to be in line with the Memorandum which also speaks of claiming fraudulent input tax credit under GST regime and modus operandi adopted in such cases and illustrated therein. Thus, for instance, if a person enters ‘fake invoices’ by way of its sales, it may not be evading any income tax liability but the fact is that such person has made ‘false entry’ in his books of accounts, that should be sufficient to charge him with the penalty under section 271AAD.

‘Explanation’ to section 271AAD which seeks to explain ‘false entry’ appears to go far beyond fake or false invoice as clause (a) of Explanation refers to ‘a false piece of documentary evidence’ also. But, reading all the clauses viz. clause (a), (b), (c) of ‘Explanation’ would show that the term ‘false entry’ refers to false invoice of goods or services, or invoices without actual supply of goods or services, or such invoices to or from a non-existent person. Therefore, the term ‘false entry’ should be read to convey falsity in and around the invoice only. Ejusdem Generis Rule of interpretation too dictates that where a class of things is followed by general wording that is not itself expansive, the general wording is usually restricted things of the same type as the listed items. “False piece of documentary evidence’ used in the clause (a) of Explanation would thus be read to have colour from the preceding part viz. ‘false invoice’, & from subsequent clause (b) and clause (c) of Explanation to section 271AAD which also speak about invoice without actual supply of goods or service or invoice from non-existent person.

Memorandum explaining the provision of Finance Bill also speaks about the menace of fake invoices and claim of fraudulent input tax credit under GST law. Therefore, no extended meaning can be assigned to the term ‘false piece of documentary evidence’ while understanding the meaning of the term ‘false entry’ for the purpose of section 271AAD. Thus, Menace of accommodation entry in respect of loan or capital, gift or such similar things does not appear to be caught within the meaning of ‘false entry’.

Coming to clause (ii) of sub section (1) of section 271AAD, it appears from its cursory reading as if legislature has overshot the object enshrined in the Memorandum while drafting the fine print of clause (ii) of sub section (1) of section 271AAD. But careful reading of that clause too would show that legislature has spoken about omission of entry in the context of fake/false invoices only. Section 271AAD may seem to have been drafted in such a manner that transcends well beyond the object of fake invoices so vociferously canvassed in Memorandum. But it is not so.

Clause (ii) of sub section (1) of section 271AAD which speaks of ‘an omission of any entry…..” would also have to be appreciated having regard to the Memorandum. In the matters of fake or false invoices of goods or services issued or obtained, there are situations where such invoices procured by or received from persons are not entered in books of account but in fact are omitted to be so entered. Fake or false invoices of goods or services in the real life world are taken or given either for the purpose of making entry in the books of account & claiming input tax credit, or are omitted to be entered while at the same time, claiming or enabling input tax credit under GST law. Hence, clause (ii) of section 271AAD (1) also is also introduced to encompass the situation envisaged in the Memorandum wherein it was highlighted “These invoices are found to be issued by racketeers who do not actually carry on any business or profession. They only issue invoices without actually supplying any goods or services…..” In practice also, these racketeers do not enter, rather omit to make entry in the books of account. This covers a situation where a person omits any entry of fake/false invoice which is relevant for the computation of income and which goes to evade tax. On the one hand, input tax credit is claimed/ enabled on the basis of such fake/false invoice but on the other hand, such invoices are altogether omitted or omitted in part even though such omitted entry had relevance for computation of total income of such person and seek to evade tax liability. Thus, according to literal & schematic interpretation of this clause (ii), if there is an omission of any entry of such invoices which has bearing on computation of total income to evade tax liability, it would lead to imposition of penalty under section 271AAD.

5. Quantum of Penalty:-

Sum equal to the aggregate amount of such false or omitted entry. i.e. irrespective of tax evaded, 100% of the value of the False Entry or Omitted Entry will be leviable as penalty under the section.

6. Any person Who Causes to make False Entry or omit entry:-

The words “ Any person” in the initial lines of the provision as well as “Any other person” covered under sub section (2), means any person who causes the first person to make false entry or caused him to omit entry or himself omitted the entry. Similar penalty will be imposed in the hands of the FACILITATOR of False Entry or Omission of Entry as well.

The provision is intended towards discouraging the practise of Accommodation Entry Providers, Racketeers or Facilitators.

In order to charge facilitator of the transaction, it must be proved with cogent corroborated evidences that he/she has caused a person to record a false entry or caused to omit an entry with an intention to evade tax.

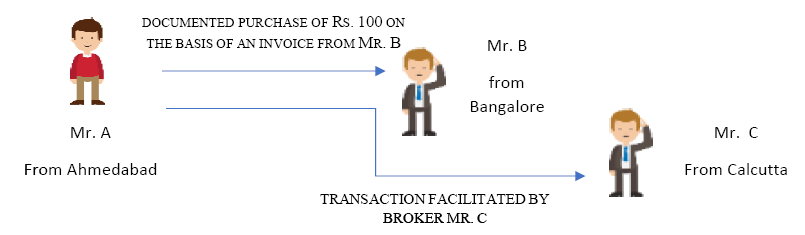

Illustrative example:

Now, during assessment proceedings of Mr A, such an invoice is alleged to be fake invoice by AO and accordingly penalty u/s 271AAD(1) of the Act is levied in hands of Mr A along with Mr B & Mr C u/s 271AAD(2) as seller & facilitator since they caused in providing the said False Entry

Controversial aspects of the Penal Provision:

1. Penalty can be levied without any proceedings under Income Tax Act:-

The major issue in that the conditions of the applicability of this penalty provision is that it should be found during ‘any proceeding’ under this Act which means under the Income Tax Act. The term ‘any proceeding’ is of wide amplitude & would cover all types of proceedings under the Income Tax Act. This term is not to be given restrictive meaning.

Such proceeding under the Income Tax Act, 1961 may be, for instance, assessment proceeding, investigation proceeding e.g. under section 131, 131(1A), 132, 133(6), 133A; TDS proceeding, penalty proceeding and appellate proceeding. But, if the authority who has found such default during any of these proceeding before him is not the assessing officer, such authority would be required to refer the matter to the concerned assessing officer who would thereafter proceed to initiate & impose penalty under section 271AAD.

Memorandum explains the purpose of legislation as to discourage fraudulent claims of input tax credit.

Therefore, for example if proceeding is in progress before GST authority, and the default as prescribed under section 271AAD is found, that by itself would not empower assessing officer to initiate & impose penalty under section 271AAD since that proceeding is not under the Income tax Act. Can a AO directly levy penalty u/s 271AAD in absence of any assessment proceedings?

In such a situation, GST authority may bring the fact of the default having been committed by a person to the knowledge of the assessing officer of that person and thereafter, if the assessing officer of such person initiates any proceeding under the Income tax Act within the four corners of law & also finds such default having been committed by such person, such assessing officer may proceed to impose penalty under section 271AAD against such person.

Thus the AO has to first initiate assessment/reassessment proceedings under Income Tax Act as envisaged u/s 148, 148 r.w.s 133A, 153A, etc. to arrive at his finding to the effect. Only during the course of such proceedings, if he concurs that assessee’s books of accounts contain false entry or omitted entry with a view to evade tax, a penalty could be imposed u/s 271AAD.

Opponents of this view may tend to argue that such interpretation cannot be given as penalty provision being quasi-criminal in nature should be construed strictly and any proceeding before any other authority under some other enactment should not empower assessing officer under the Act to initiate action under section 271AAD.

In our considered view, there does not seem to be any warrant to give such restrictive meaning and interpretation to this situation. In any case, sharing of information based on facts & evidence by one authority under one enactment to the income tax authority is the order of the day & cannot be shut out. Assessing officer having been supplied such information by other authority under different enactment, may initiate action of investigation under the Income Tax Act, 1961 and may come across himself such violations as are envisaged under section 271AAD. And only then the AO initiate penalty provision under section 271AAD. If the above mentioned course of action is followed and no fault can be found in it.

2. Books of Accounts are not maintained

The second issue is regarding the default envisaged under section 271AAD ‘found’ ‘in the books of accounts maintained’. False entry or omission of any entry as contemplated under this section should be found in the books of account maintained by a person.

Situation-1 If books of account are not maintained, there is no applicability of section 271AAD (1).

There may be requirement of maintaining books of accounts under the provisions of the Act and yet if that person is not maintaining books of accounts, he may be liable to penalty for non-maintenance of books of accounts but cannot be penalized under section 271AAD (1), as the finding of false entry or omission of entry should be found in the books of accounts maintained.

Alternatively, when books of accounts are not maintained, such penal provision cannot be triggered as the section mandates pre-existence of books of accounts through words “it is found that in the books of account maintained by any person there is (i) False Entry or (ii) Omission of Entry..”)

An existing analogous penalty provision u/s 271A exists which provides penalty for non-maintenance of books of accounts. Further, a Penalty u/s 271B of the Act for not Auditing Books of Accounts is also simultaneously prescribed under the Act. Courts of law have in plethora of judgements held that, Penalty u/s 271B shall not be levied if the Books of Accounts are not maintained.

Courts have held that When a person commits an offence by not maintaining the books of accounts as contemplated under section 44AA, the offence is complete and after that, there can be no possibility of any offence as contemplated under section 44AB and therefore, the imposition of penalty under section 271B is not permissible. Further courts have held that, It is clearly a case of impossibility of performance where it is expected that the assessee should get her books of accounts audited when it is a known and admitted fact that there are no regular books of accounts which have been maintained at first place.

Ø Surajmal Parsuram Todi Vs. CIT, 222 ITR 691 (Gah) Gauhati High Court

Ø Commissioner of Income- tax v. Bisauli Tractors, 299 ITR 219 (All.) Allahabad High Court

Ø CIT Vs. S.K. Gupta and Co. [2010] 322 ITR 86 (All.) Allahabad High Court

Ø Udayshankar Narendraprasad v ITO, Ward-9(1) ITO. ITA No.223/Ahd/2013 (ITAT, Ahmedabad)

Ø Shri Tarun D. Karia Vs. DCIT, in ITA No.3541 to 3545/Ahd/2000 (ITAT, Ahmedabad)

Ø Naveen Kumar Kaparthy Vs ITO (ITAT Hyderabad) ITA No. 1659 & 1660/H/17

Ø ACIT vs. Ashok Kumar Mohallal Kothari and others in ITANo.166 and 167/Nag/1997(I.T.A.T. Nagpur)

Ø Brij Lal Goyal vs. ACIT (I.T.A.T., Del) 88 ITD 413 (2004)

Ø Shri Satya Prakash Mundra vs. ITO Kishangarh ITA No. 754/JP/2016 (I.T.A.T. Jaipur)

Ø Shri Nirmal Kumar Joshi vs. ITO Kishangarh ITA No.73/JP/2018 (I.T.A.T. Jaipur)

Ø Shri Rajeshbhai Hirabhai Patel,, … vs The Income Tax Officer (ITAT RAJKOT) ITA Nos. 359 & 455/Rjt/2014

Analogous interpretation could be applied in case where Books of Accounts are not maintained and it is claimed by AO that there is False Entry or Omission of entry which is relevant for computation of income has been committed to evade tax.

Situation 2- If a person is not required to maintain books of accounts as he is opting for presumptive scheme of assessment

Presumptive taxation gives leeway from preparation and maintenance of books of accounts to the assessee. If an assessee who has indulged in supply or receipt of fake invoice can be penalized under this section in absence of any books of accounts?

Even if a person has not prepared books of accounts, he would have maintained minimal records to identify their Turnover, Gross Profit, Expenses and Net Profit as required under the Act. Such minimal records if maintained in the regular course of business can be construed as books of accounts under the wider inclusive definition u/s 2(12) of the Act and accordingly a penalty u/s 271AAD could be levied.

There is no reason as to why penalty under section 271AAD be not imposed on such person in such a situation. He may not be maintaining comprehensive books of accounts as envisaged under section 2(12A) but the fact of the matter is that for computing his turnover, there may be some record being maintained by him which can be taken/treated to be books of accounts for this purpose & penalty under section 271AAD may be imposed. It goes without saying that ‘books of account’ have been defined inclusively & not exhaustively under section 2(12A).

Situation 3- If though books of accounts are maintained, fake invoices are also found but these are not found entered in the books of accounts.

Such situation would ordinarily emerge when such invoices would be found during the course of survey or search. These invoices even if not used/entered on the date investigation, would nonetheless constitute ‘false entry’ as there was ‘intention to use’ of such invoices, in the books of accounts maintained. This is so in view of opening language of Explanation to section 271AAD. Accordingly, a penalty u/s 271AAD could be levied.

Situation-4 If despite the fake invoices found and/or omission of an entry to evade tax, in the books of accounts maintained such books of accounts are not rejected under section 145 while passing the assessment order.

Usually books of accounts are rejected in such a situation & there can be no better case than this situation where books of account should be rejected, yet mere fact that these have not be rejected would not take away the case from the levy of penalty under section 271AAD if on the facts it is found that there were fake invoices or omission of entry

Situation-5- If a person is issuing only fake invoices and is not maintaining books of accounts and no documents are found vindicating him on his person

The said person may still be liable to be penalised under sub section (2) of section 271AAD as he falls within the ambit of ‘any other person’ causing the first mentioned person referred in sub section (1) to make false entry.

3. Onus to prove:

Section 271AAD is penal provision and hence, burden to prove the fact that the default as envisaged under sub section (1) or (2) of this section has been committed by any person, would rest on the shoulders of the Revenue. This section contemplates ‘false entry’ or ‘omission of entry’. Both require the Revenue to establish existence of the fact situation either of false entry or of omission. It would be for the assessing officer to lead evidence in support of the allegation of the default & existence of the conditions and confront the person so as to elicit his response. It would thereafter be possible for the assessing officer to reach a conclusion either way. There is no presumption under the law as to mental culpability or as to the existence of the conditions envisaged under section 271AAD. It goes without saying that the question whether there is ‘false entry’ and/or ‘omission of entry’ ‘to evade tax liability’ is essentially a question of fact which needs to be established with evidences the burden to prove of which would lie on the shoulders of the assessing officer.

Primary onus is on Assessing officer to prove that the documents are forged or falsified documents or supply or receipt of goods/ service has not taken place. Or Supply or receipt of goods is from a non-existent person.

Burden to prove that the ‘other person’ has caused to make false entry, or caused to omit entry, or omitted the entry would also be on Revenue, which can be discharged by leading direct, documentary or circumstantial evidence.

Apex Court has in case of CIT versus Daulat Ram Rawat Mull, (1973) 87 ITR 349, held that onus of proving what was apparent is not real is on the party who claims it to be so.

Hence, once the assessee has substantiated supply or receipt of goods or service from existing person with supporting documentary evidences, it is the duty of Assessing officer to prove otherwise to levy penalty under referred section.

4. Who is the Assessing office for the “any other person”?

Can assessing officer of a person referred u/s 271AAD(1) levy penalty to a person referred u/s 271AAD(2) even when such other person does not pertain to their jurisdiction ?

Who is competent to impose penalty on ‘any other person’ contemplated under sub section (2). Assessing officer who is envisaged under sub section (1) is also the assessing officer under sub section (2) who would be competent to impose penalty on other person. This is clear from the expression ‘the’ before the words ‘Assessing officer’ which would mean the same assessing officer who has been referred earlier.

Of course, the assessing officer would impose penalty on such other person after affording him the opportunity of hearing & after confronting him the material in support of the allegation of default, as envisaged under section 274(1) and thereafter such assessing officer shall send a copy of such order to the assessing officer of such other person as envisaged under sub section (3) of section 274.

Section 274(3) provides for such a situation where penalty is levied by income tax authority who is not AO of the assessee.

(3) An income-tax authority on making an order under this Chapter imposing a penalty, unless he is himself the Assessing Officer, shall forthwith send a copy of such order to the Assessing Officer.

However, such a clause intended to cover only those cases where penalty is levied by jurisdictional Commissioner (Appeals) or the Principal Commissioner or Commissioner where they would send a copy of penalty order to AO for administrative convenience of recovery of demand, etc. In our example above, if Mr A of Ahmedabad has purchased goods from Mr B of Bangalore, can penalty be levied by AO situated at Ahmedabad to assessee situated at Bangalore & Calcutta ?

As per principles of natural justice, an opportunity of being heard shall be mandatorily provided by AO to such Bangalore & Calcutta based assessee. It cannot be the intention of legislature to make Bangalore & Calcutta based assessee’s to come to Ahmedabad to avail the said opportunity of being heard every time during the course of penalty proceedings. Further, such jurisdiction to levy penalty cannot be transferred without following proper procedure of law u/s 127 of the Act.

5. Where assessment of such other person is completed without any adverse findings and subsequently a penalty is levied on a person u/s 271AAD(1), then can a similar penalty be levied on other person u/s 271AAD(2) in case of completed assessment ?

In that situation the AO needs to invoke the relevant provisions under the Act to assume the jurisdiction and thereafter he can levy the penalty u/s 271AAD(2) on such other person.

6. Penalty is levied on person and other person who causes false entry or omission of entry and consequently, a person succeeds in Appeal and penalty u/s 271AAD(1) is quashed. Whether similarly, based on outcome of appeal of person, such other person will be given instant relief?

A provision to that effect is contained under section 275(1A) of the Act.

(1A) In a case where the relevant assessment or other order is the subject-matter of an appeal to the Commissioner (Appeals) under section 246 or section 246A or an appeal to the Appellate Tribunal under section 253 or an appeal to the High Court under section 260A or an appeal to the Supreme Court under section 261 or revision under section 263 or section 264 and an order imposing or enhancing or reducing or cancelling penalty or dropping the proceedings for the imposition of penalty is passed before the order of the Commissioner (Appeals) or the Appellate Tribunal or the High Court or the Supreme Court is received by the Principal Chief Commissioner or Chief Commissioner or the Principal Commissioner or Commissioner or the order of revision under section 263 or section 264 is passed, an order imposing or enhancing or reducing or cancelling penalty or dropping the proceedings for the imposition of penalty may be passed on the basis of assessment as revised by giving effect to such order of the Commissioner (Appeals) or, the Appellate Tribunal or the High Court, or the Supreme Court or order of revision under section 263 or section 264:

However, can scope of such section be extended to include appellate order passed in case of a person referred u/s 271AAD(1) to apply to penalty order passed in case of a person referred u/s 271AAD(2) ?

In our opinion, suitable amendment should have been carried out in provisions of the Act to avoid multiplicity of appeals and save time of judiciary in deciding futile appeals.

7. How successfully such other person can challenge the validity of penalty u/s 271AAD(2) when person has surrendered and has paid penalty u/s 271AAD(1) to avoid litigation?

8. Question arises whether Penalty u/s 271AAD can be triggered in case of-

Ø Unsubstantiated claim of expenditure

Ø If Confirmation has not been provided by Creditor u/s 133(6), then can it be considered that Supplier doesnot exist?

Period of Limitation:

Section 275 of the Act provides for Bar of Limitation in imposing penalties. It provides that No order imposing a penalty under Chapter XXI shall be passed— (c) in any other case, after the expiry of the financial year in which the proceedings, in the course of which action for the imposition of penalty has been initiated, are completed, or six months from the end of the month in which action for imposition of penalty is initiated, whichever period expires later.

Reasonable Cause (273B):

Another important point to be noted is that section 273B does not seek to cover the defaults under section 271AAD. It may be recalled that section 273B provides that no penalty under the specified sections shall be imposable if assessee proves that there was reasonable cause for the failures/ defaults envisaged under the prescribed penalty provisions.

Section 273B grants immunity from levy of penalty for failure in compliance of any provision, if assessee proves that there was a reasonable cause. However, corresponding amendment of introduction of Section 271AAD in Section 273B has not been made. Accordingly, even if for reasonable cause, if any False Entry is made or any Entry is omitted, then assessee cannot take shelter u/s 273B of the Act. Since the word “may” has been used in the section, the AO has the follow the Principle of Natural Justice before levying the penalty.

Is it limited to Fake Invoice under GST only?

Stated intention of the legislature as explained in Memorandum to Finance Bill, 2020 is to discourage fraudulent practice of availing input tax credit under Goods and Service Tax Act without actual supply of goods. However, section 271AAD does not restrict it’s scope only towards such GST Invoices. Therefore, it appears that penalty u/s 271AAD can be levied for non-GST false entry or omitted entry as well. Can the assessee argue that scope of section 271AAD cannot be widened to include non-GST invoices considering the intention of the legislature demonstrated in Memorandum to Finance Bill, 2020?

Assessee shall be aided by a judgement of Apex Court in case of K.P. Varghese v. Income-tax Officer [1981] 7 Taxman 13 (SC) wherein their Lordships have held that Rule of Construction of Statute mandates to know the intention of the legislators in enactment of law and hence, intention of legislators shall play a pivotal role in interpreting a stature.

The speech made by the mover of the Bill explaining the reason for the introduction of the Bill can certainly be referred to for the purpose of ascertaining the mischief sought to be remedied by the legislation and the object and purpose for which the legislation is enacted. This is an accord with the recent trend in juristic thought not only in western countries but also in India that interpretation of a statute being an exercise in the ascertainment of meaning, everything which is logically relevant should be admissible. In fact there are at least three decisions of this Court, one in Sole Trustee, Loka Shikshana Trust v. CIT [1975] 101 ITR 234, the other in Indian Chamber of Commerce v. CIT [1975] 101 ITR 796 and the third in Addl. CIT v. Swat Art Silk Cloth Manufacturers Association [1980] 121 ITR l/[1980] 2 Taxman 501, where the speech made by the Finance Minister, while introducing the exclusionary clause in section 2(15) of the Act, was relied upon by the Court for the purpose of ascertaining what was the reason for introducing that clause.

Whether Penalty order passed u/s 271AAD Appealable?

Section 246A of the Act contains a provision where every penalty order passed under chapter XXI of the Act is an appealable order.

246A. (1) Any assessee or any deductor or any collector aggrieved by any of the following orders (whether made before or after the appointed day) may appeal to the Commissioner (Appeals) against—

(q) an order imposing a penalty under Chapter XXI;

Can penalty be waived by Settlement Commission:

Power of Settlement Commission to grant immunity from prosecution and penalty.

245H. (1) The Settlement Commission may, if it is satisfied that any person who made the application for settlement under section 245C has co-operated with the Settlement Commission in the proceedings before it and has made a full and true disclosure of his income and the manner in which such income has been derived, grant to such person, subject to such conditions as it may think fit to impose for the reasons to be recorded in writing, immunity from prosecution for any offence under this Act or under the Indian Penal Code (45 of 1860) or under any other Central Act for the time being in force and also (either wholly or in part) from the imposition of any penalty under this Act, with respect to the case covered by the settlement :

Therefore, settlement commission has the powers to grant immunity from imposition of any penalty leviable under the Income Tax Act and accordingly immunity from penalty u/s 271AAD may be granted by Settlement Commission subject to the conditions mentioned u/s 245H of the Act. Further, if proceedings for settlement have abated u/s 245HA, then pursuant to provisions of Section 273AA of the Act, immunity from imposition of penalty can be granted by Principal Commissioner or Commissioner.

Can Penalty u/s 271AAD and u/s 270A(9) be levied simultaneously ?

270A Penalty for under-reporting and misreporting of income.

270(8) provides that where any person has under-reported income in consequence of any misreporting thereof, such person shall be liable to pay penalty of two hundred per cent of the amount of tax payable on under-reported income.

270A(9) provides exhaustive list of cases where under-reported income shall be construed as being committed due to misreporting thereof.

(a) misrepresentation or suppression of facts;

(b) failure to record investments in the books of account;

(c) claim of expenditure not substantiated by any evidence;

(d) recording of any false entry in the books of account;

(e) failure to record any receipt in books of account having a bearing on total income; and

(f) failure to report any international transaction or any transaction deemed to be an international transaction or any specified domestic transaction, to which the provisions of Chapter X apply.

On perusal of clauses (d) & (e) of section 270A(9) of the Act, it is clear that such clauses also provide for similar penalty as envisaged under clauses (i) & (ii) of section 271AAD(1) viz., False Entry in the books of accounts or omission of any entry relevant for computation of total income of such person, to evade tax liability. Since section 271AAD begins with the expression “Without Prejudice to any other provisions of the Act” it appears that penalty can be levied under both the sections simultaneously.

However we think this will lead to litigation in the sense that the provisions of section 271AAD are specific and have been made to tackle the fraudulent claims of ITC under the GST Act,2017.

It is fairly well settled in law that general provisions do not override specific provisions, as aptly described by the maxim ‘generalia specialibus non derogant’. A special provision normally excludes the operation of a general provision. In the case of South India Corpn. (P.) Ltd. v. Secretary, Board of Revenue (AIR 1964 SC 207, at page 215), Hon’ble Supreme Court had an occasion to consider whether article 277 or article 372 of the Constitution of India should govern the situation involved therein. Their Lordships then pointed out that "a special provision should be given effect to the extent of its scope, leaving the general provision to control cases where specific provisions do not apply." In the light of these discussions, it is clear to that to the extent a default is covered by the specific provisions u/s 271AAD, such a default cannot be subject-matter of penalty under section 270A(9) of the Act.

Said principle has been upheld by Supreme Court in case of CIT v. Shahzada Nand and Sons 60 ITR 392 (SC) UOI v. Indian Fisheries (P.) Ltd. AIR 1966 SC 35.

An interesting situation emerges in the new penalty regime of section 271AAD. For example, if an assessee does not have an invoice for claim of expenditure (unsubstantiated expenditure) then he shall be liable for penalty for misrepresentation at the rate of 200% of the Tax Evaded. So, in a case where a company is taxed at 22% (under new tax regime u/s 115BAA), then it will be liable for penalty at 44% of the expenditure claimed. Contrastingly, when the assessee is available with the invoice, but such invoices is a falsified document in the eyes of the A.O., then assessee shall be liable to pay 100% of the Expenditure as penalty.

Penalty u/s 271AAD and other penalties such as u/s 270A(9), 271AAC cannot be levied simultaneously for single offence based upon same facts:-

Ø The Double Jeopardy principle existed in India prior to the enforcement of the Constitution of India. It was enacted under in section 26 of The General Clauses Act, 1897. Section 26 states that “provision as to offences punishable under two or more enactments,- where an act or omission constitutes an offence under two or more enactments, then the offender shall be liable to be prosecuted or punished under either or any of those enactments, but shall not be liable to be punished twice for the same offence.

Ø Article 20(1) provides: “No person shall be convicted of any offence except for violation of a law in force at the time of the commission of the act charged as an offence, nor be subjected to a penalty greater than that which might have been inflicted under the law in force at the time of the commission of the offence.”. [Prohibits retrospective application of penalty provisions]

Article 20 (2) of the Constitution mandates that a person cannot be prosecuted or punished twice for the same offence.

Ø Principles of “autrefois convict” or Double jeopardy which means that person must not be punished twice for the offence is embodied in English common law’s maxim ‘nemo debet bis vexari, si constat curice quod sit pro una iti eadem causa” (no man shall be punished twice, if it appears to the court that it is for one and the same cause). The maxim audi altermn partum rule i.e. a person cannot be punished twice for the same offence is kept at higher pedestal.

Ø The State Of Maharashtra & Anr. v/s Sayyed Hassan Sayyed Subhan & Ors. [Criminal Appeal No.1195 of 2018] Hon’ble Supreme Court of India.

o 7. There is no bar to a trial or conviction of an offender under two different enactments, but the bar is only to the punishment of the offender twice for the offence. Where an act or an omission constitutes an offence under two enactments, the offender may be prosecuted and punished under either or both enactments but shall not be liable to be punished twice for the same offence.

Ø Section 300 of Criminal Procedure Code,1973

(1) A person who has once been tried by a Court of competent jurisdiction for an offence and convicted or acquitted of such offence shall, while such conviction or acquittal remains in force, not be liable to be tried again for the same offence, nor on the same facts for any other offence for which a different charge from the one made against him might have been made under sub- section (1) of section 221, or for which he might have been convicted under sub- section (2) thereof.

The Enormity of Penalties:

It is to be highlighted here that, if the addition or disallowance has been made u/s 68, 69, 69A, 69B, 69C, 69D, then penalty will be imposed u/s 271AAC.

Further, Section 122(1) of CGST Act, 2017 provided for levy of penalty for the offences which include issuing an invoice when there is no supply, making a supply without an invoice or on the basis of a false invoice. Finance Act, 2020 has inserted subsection (1A) after subsection (1) in section 122, the penalty for the above transactions would extend to beneficiaries in such transactions and to the person at whose instance such transactions are conducted.

To understand the grave cascading effect of above penal provisions, consider following example:

Say Mr. A has shown Sales of Rs. 100. However, assessing officer is not satisfied with explanations offered by Mr. A for the Sales and considers it to be without actual supply of goods or services and consequently alleges the consideration (Sales Receipt) against such sales as unexplained cash credits u/s 68. Now, AO will add Rs. 100 in total income of Mr. A u/s 68. Net outflow in monetary terms will be as follows:

| Sr. No |

Particulars |

Amount (incl SC & Cess) |

|

|

1 |

Tax u/s 115BBE of Income Tax Act |

78 |

|

|

2 |

Penalty u/s 271AAC of Income Tax Act |

7.8 |

|

|

3 |

Penalty u/s 271AAD of Income Tax Act |

100 |

|

|

4 |

Penalty u/s 122(1) of CGST Act |

18 |

|

|

Total outflow |

203.8 | ||

Conclusion- Potentially A Draconian Penalty Provision:

While the intention of the legislature in enacting such provision is good to curb malpractice of fraudulent input tax credits, it is feared that Assessing Officer’s will use this penal provision as a Rule of Thumb for levying the penalty. Historically, higher tax rate (115BBE) and higher penal provision (Misreporting as against underreporting) have become easy tools in the hands of Assessing officers for meeting the unrealistic collection targets. The vesting of unbridled power with the AOs under section 271AAD is fraught with dangers of its rampant misuse by them.

| Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. Neither the author nor itatonline.org and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission of itatonline.org |

One of the best Article on Tax Subject , I have come acrossed. Well researched and each possible area has been thoroughly examined. Thanks Ms. Nidhi Surana.

THE NEW SECTION HAS BEEN ELABORATELY AND CLEARLY EXPLAINED & ARTICLE IS OF GREAT KNOWLEDGE

What if you don’t maintain books of account, then applicability of 271AAD cannot be invoked since section specifically says any false entry found in the books of account ….

I read the article of CA Nidhi Surana titled as “Section 271AAD: The newly introduced controversial penalty provision”. However, it came to my notice that several paragraphs are verbatim word by word and seem to have been lifted from the article published by TIOL on 07.04.2020 titled as “Penalty u/s 271AAD- Facets and Fallout” and link of this article is https://taxindiaonline.com/RC2/inside2.php3?filename=bnews_detail.php3&newsid=38360

The article authored by CA Nidhi Surana is of great knowledge and helpful, however i believe the same has been marjorly copied from the article authored by Dr Rakesh Gupta, Ex ITAT Member and CA Somil Agarwal which is published on TIOL on 07.04.2020. it is requested to itatonline that they must ensure that the article that has been published should be free from plagiarism.

quite informative

it is really good article containing detailed information on provisions sec 271AAD and other relevant provisions. From CA Pradeep Agrawal

The newly section has been decently elaborated. naturally it vanish so many doubts in regard of this section. The section would naturally discourage to make false entry in the books of account.

The critical analysis of this penal provision has exposed the lacunae in drafting an otherwise well intended action. In the name of simplifying the law it is made more complex and prone to misuse.

Very elaborately explained.