CA Pratik Sandbhor has dealt with the important questions (i) whether unabsorbed depreciation can be set off against any head of income and (ii) whether unabsorbed depreciation can be carried forward in perpetuity. He has answered the questions with reference to the statutory provisions, Circulars issued by the CBDT and the judgements on the point

With the decision of Hon’ble Supreme Court in case of Tasgaon Taluka SSK Ltd. – 412 ITR 420 holding that Excess Cane Price(ECP) contains element of profit distribution and the said profit element embedded in such ECP shall be disallowed, the SSK’s shall be facing huge tax demands. In such circumstances the SSK’s seek some sigh of relief form the set off losses carried forward over the years to reduce the mounting tax burden. Substantial portion of such losses includes Unabsorbed Depreciation which has popularity of being carried forward in perpetuity. But can it be actually carried forward perpetually and be set off against any head of income. Lets take a further dive to decipher the true position in respect of the following two issues:-

1. Whether unabsorbed depreciation can be set off against any head of income.

2. Whether unabsorbed depreciation can be carried forward in perpetuity

Section 32(1) of Income Tax Act 1961 states that in respect of assets (tangible & intangible) the assesse shall be eligible to claim depreciation at prescribed rates on meeting the following two conditions:-

i. The asset is owned (wholly or partly) by the assesse

ii. The assets is used for purpose of business & profession

Further Section 32(2) expounds on the terminology of Unabsorbed Depreciation. Section 32(2) has not been any indifferent to the amendments that the Income Tax Act 1961 has seen over the years. The said section has been amended by Finance Act 1996&the amendment by Finance Act 2001reverting to original position.

For the sake of brevity lets peruse the section as it exists today (since A.Y. 2002-03)

“32

(1)…….

(2) Where, in the assessment of the assessee, full effect cannot be given to any allowance under sub-section (1) in any previous year, owing to there being no profits or gains chargeable for that previous year, or owing to the profits or gains chargeable being less than the allowance, then, subject to the provisions of sub-section (2) of section 72 and sub-section (3) of section 73, the allowance or the part of the allowance to which effect has not been given, as the case may be, shall be added to the amount of the allowance for depreciation for the following previous year and deemed to be part of that allowance, or if there is no such allowance for that previous year, be deemed to be the allowance for that previous year, and so on for the succeeding previous years.”

On reading through the said section it can be gleaned that where full effect cannot be given to depreciation as computed u/s 32(1), in any previous year, owing to fact that the depreciation allowance for said year exceeds the profit or gains for said previous year then subject to section 72(2) & 73(3), the excess of such depreciation shall be added to the depreciation of following previous year and where there exists no depreciation for following previous year, such unabsorbed depreciation shall deemed to be the depreciation for that year.

In other words depreciation of a particular year just adds up to the depreciation of next year and attains the form of depreciation of that particular year. Thus such unutilized depreciation is termed as ‘unabsorbed depreciation’ and cannot be said to be a ‘carried forward loss’, it stands distinct.

As far as set off of depreciation is concerned it is pertinent to note the following points form the section 32(2):-

- Firstly, the phrase ‘profits or gains chargeable’ has a very wide import to include within its ambit income under all the heads of income . The said phrase does not constraint to profits or gains of Buinsess or professions only. Refer Virmani Industries P Ltd – Supreme Court – 216 ITR 607.

- Secondly, the fact that the depreciation carried forward to following previous year is deemed to be depreciation of current year puts such unabsorbed depreciation in the shoes of current year depreciation enabling the set off such carried forward depreciation against any head of income.

- Thirdly, if the legislature intended to put any restriction on set off of depreciation against other heads of income as it did by the amendment of 1996, the said restriction would not have been withdrawn in its entirety by the amendment of 2001.

Though there exists some restriction in respect of sequence in which set off is to be claimed and the same has been worded out in section72(2), which imposes restriction to extent that, where there exists carried forward business loss, same shall be set off first before setting off such unabsorbed depreciation. Similar restriction is imposed by section 73(2).

Further reference may also be made to decision of Mumbai ITAT in the case of Suresh Industries in ITA No. 5374/Mum/2011 for A.Y. 2007-08 dated 13/09/2012

Also, the Hon’ble Bombay High Court in the case of Parrys (Eastern) P Ltd. – 384 ITR 264 held as under

‘short-term capital gain arose on account of sale of depreciable assets that was held for a period to which long-term capital gain would apply, said gain would be set-off against brought forward long-term capital losses and unabsorbed depreciation’

So does this position exist throughout the subsistence of the Income Tax Act 1961.Well, there’s a catch to it, the amendments by Finance Act 1996 & 2001to the Income Tax Act 1961,as referred earlier creates a cloudy picture.

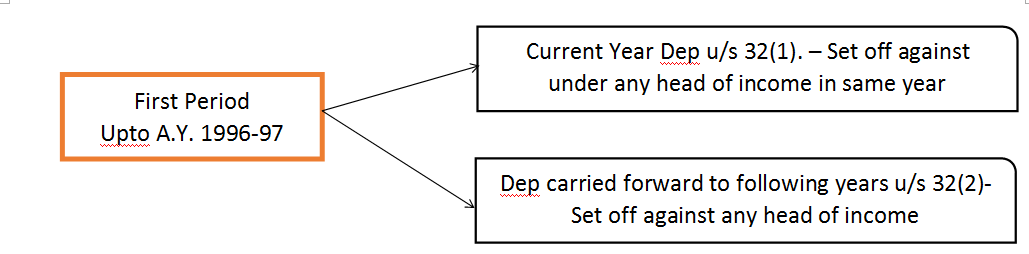

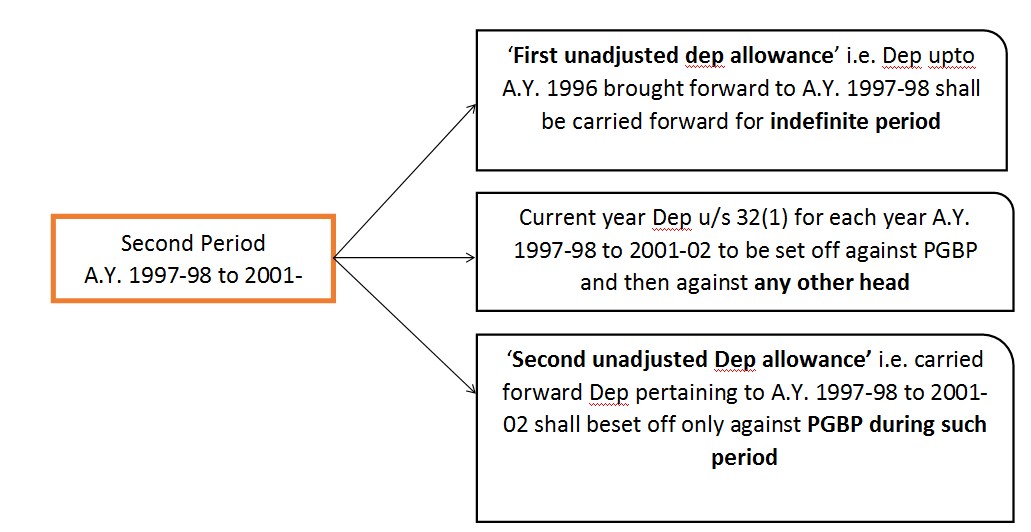

As far as the position of section 32(2) prior to the First Amendment i.e. the one in 1996 is concerned, it was the similar to what we discussed above. The said amendment stretched the section 32(2) by enumerating certain condition to the effect that:-

a. Carried forward Unabsorbed Depreciation can be set off only against PGBP

b. Unabsorbed depreciation can be carried forward for 8 years only form the year for which it is first computed.

c. And the unabsorbed depreciation shall be carried forward and sett off only if such business is continued.

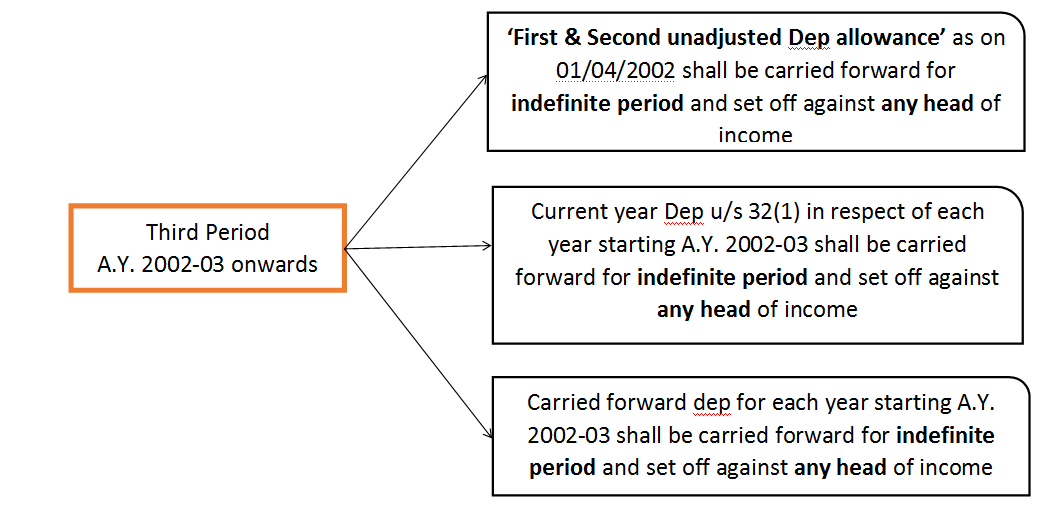

The subsequent amendment of Finance Act 2001 restored the position as it existed prior to amendment of 1996 by removing the restrictions

Thus the position in respect of depreciation during and for the period A.Y. 1997-98 to 2001-02 is upset by the said amendments. The question that arises is that, whether the restrictions imposed by Finance Act 1996 apply to unabsorbed depreciation brought forward to A.Y. 2002-03 from period

i. Prior to A.Y. 1997-98

ii. During A.Y. 1997-98 to A.Y. 2001-02

The Mumbai Special Bench in the case of Times Guaranty Limited – 40 SOT 14 held that the depreciation as on 01/04/1997 shall be carried forward only for 8 years and depreciation pertaining to period A.Y. 1997-98 to 2001-02 shall be carried forward and set off only against PGBP for period of 8 years from the year in which the depreciation is first computed. This position has been overruled by various High Court decisions subsequently.

The Gujarat High Court in the case of General Motors Ltd. – 354 ITR 244 took cognizance of the CBDT Circular No. 14 of 2001 and held as under

The CBDT Circular clarifies the intent of the amendment that it is for enabling the industry to conserve sufficient funds to replace plant and machinery and accordingly the amendment dispenses with the restriction of 8 years for carry forward and set off of unabsorbed depreciation. The amendment is applicable from assessment year 2002-03 and subsequent years. This means that any unabsorbed depreciation available to an assessee on 1st day of April, 2002 (A.Y. 2002-03) will be dealt with in accordance with the provisions of section 32(2) as amended by Finance Act, 2001 and not by the provisions of section 32(2) as it stood before the said amendment. Had the intention of the Legislature been to allow the unabsorbed depreciation allowance worked out in A.Y. 1997-98 only for eight subsequent assessment years even after the amendment of section 32(2) by Finance Act, 2001 it would have incorporated a provision to that effect. However, it does not contain any such provision. Hence keeping in view the purpose of amendment of section 32(2) of the Act, a purposive and harmonious interpretation has to be taken

The said decision has been further followed by Hon’ble Bombay High Court in the case of Bajaj Hindustan Ltd. – 394 ITR 73. And the SLP against the same has been dismissed by Hon’ble Supreme Court in 261 Taxman 558 (2019)

Therefore it may be summarized to say that the unabsorbed depreciation standing as on 01/04/2002 shall be eligible to be carried forward perpetually and set off against any head of income.

Conclusion:-

For the sake of brevity and easy perusal the position in respect of unabsorbed depreciation could be summarized and tabulated as follows:

| Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. Neither the author nor itatonline.org and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission of itatonline.org |

Currently , is there any requirement that , for offsetting the accu. depreciation , the assets on which the depn. was claimed in the past year , are required to be retained and should not be disposed off ; In my view , this is not there since the assets out of the block of assets would get disposed off in the normal course after their useful life irrespective of whether the accu. depn. is fully off set or not .

SIR

You have explained very well.

And, Some doubts are there in my mind, that is,

In case of Late Filing ITR for a year, Can We forward the Unabsorbed Depreciation to the next 8 financial years?

And also Capital loss can be carried forwarded in case of late filing of ITR?

kindly guide us please

As per my view, depreciation allowable for current year is worked out u/s 32.1 at applicable rates on WDV or cost as the case may be.

B/f depreciation of all earlier years is to be added and form part of current depreciation.

Allowable Depreciation is to allowed to the extent of chargeable income, if any. If chargeable income is less, balance un-allowed depreciation will again form part of current depreciation of next year.

On reading of S. 32 we find that “Chargeable income” should be considered as income on which tax is payable that is , after allowing all deductions including deductions under chapter VIA and after all permissible set offs of current losses and b/f losses.

Only after all such deductions, and set offs, if there remains any income, that can be called “chargeable income”, in context of S.32 and tax on income.

Current depreciation ( including b/f depreciation) should be allowed against such chargeable income to the extent of chargeable income and balance will again form part of current depreciation of next year and so on.

Therefore, current depreciation can be allowed against any chargeable income including income u/h salaries.

Readers can refer to my detailed article

[1996] 86 Taxman 184 – Article

“Chargeable profits and gains in context of depreciation allowance”.

The article’s premise of 412 ITR 420 is wrong. There varied interpretations.

The law that brought forward depreciation can be carried forward till it is absorbed as it forms part of current depreciation is well established. However, issue was for the intermediate years when its C/F was restricted to 8 years. Which seems to have been set at rest.