Dr. Raj K. Agarwal & Dr. Rakesh Gupta have explained the salient terms of the Taxation Laws (Second Amendment) Bill, 2016 which sees to assess the deposit of unaccounted high denomination notes in the bank and also to levy penalty thereon. The experts have expressed concern that the terms of the proposed law may discourage those who want to come clean. They have suggested that the Government should adopt a constructive, pragmatic and forward looking approach rather than being punitive

Demonetization of high value currency with effect from 9.11.2016 flummoxed those who were hoarding such currency in abundance. Obviously, it was unaccounted cash. Caught by surprise, such persons thought of declaring such amount as current year’s income by paying tax @ 30% plus surcharge. But government made its intention clear that such declarations would attract penalty of 200%.

Opinions were expressed by the tax experts that as per the existing mechanism provided under section 270A of the Income Tax Act, 1961, no penalty on such declared amount would be possible as there would be no ‘under-reporting’ of income when such income is suo-moto declared in the Income Tax Return.

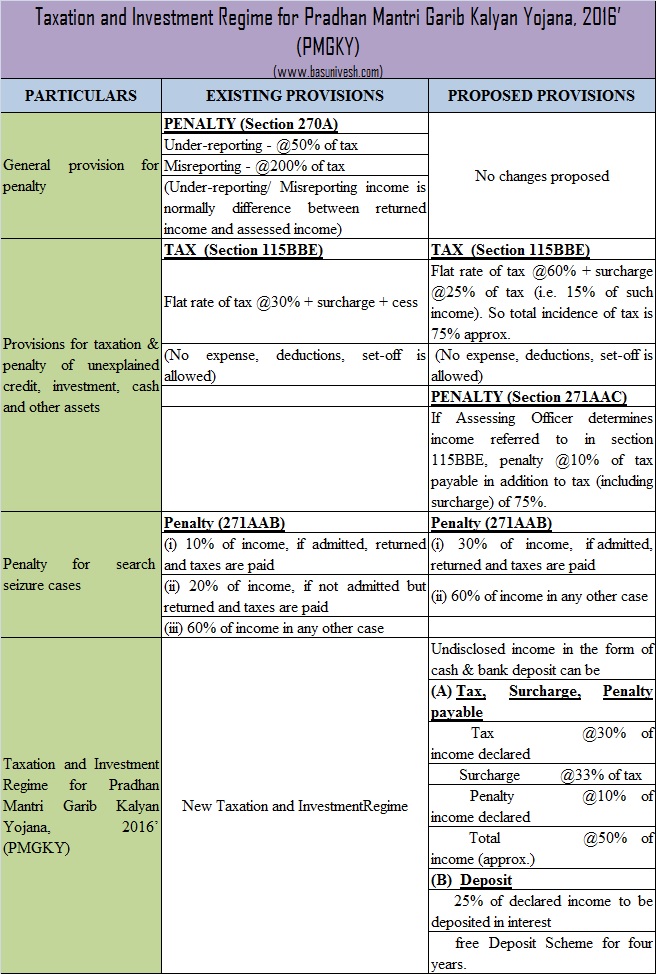

The Taxation Laws (Second Amendment) Bill, 2016 introduced in Lok Sabha by the Government on November 28th, 2016 seeks to address the above dichotomy. Government has given another opportunity to declare undisclosed income post demonetization decision. The Bill seeks to make, inter alia, the following two primary provisions:

1. New Chapter IX A, unveiling a Scheme has been introduced in the Bill titled as “Taxation And Investment Regime for Pradhan Mantri Garib Kalyan Yojana, 2016”. It is a variant of Income Declaration Scheme, 2016 according to which any person may make declaration in respect of any income in the form of cash or bank deposits made with the specified entity during the period of scheme. The undisclosed income so declared under the scheme shall be chargeable to tax, surcharge and penalty aggregating to 50% of the undisclosed income. Further, an amount of 25% of undisclosed income is required to be deposited in the Pradhan Mantri Garib Kalyan Deposit scheme, 2016 & such deposit shall be interest free having four years lock-in period.

2. Section 115BBE of the Income Tax Act, 1961 is proposed to be amended with effect from A.Y. 2017-18 to provide that any income falling within the ambit of section 68 and section 69 to 69D shall be liable to be taxed @ 60% along with surcharge @ 15% of such income. Such tax rate is there irrespective of the fact that such income is declared by the assessee in the return of income on his own or such income is determined by the assessing officer. Incomes falling u/s 68 and 69 to 69D are called “Deemed Income” in respect of which assessee is not able to prove the source of earning such income with evidence.

(Image credit: Basunivesh.com. Click for larger image)

Thus, the above amendment shall have the effect that any person having cash or deposits in an account maintained by such person with a specified entity of old currency notes after demonetization representing undisclosed income with respect to which he is not able to establish the source of earning income, would have to suffer the tax liability @ 75% of such income.

The amendment u/s 115BBE has been brought to plug the inconsistency existing under present penalty provisions of section 270A in respect of which opinion was being expressed that no penalty can be imposed when such income is declared by the assessee himself while filing return of income.

Therefore, when the tax regime and penalty provision for declaring undisclosed income have been made so stringent, another opportunity has been given under the scheme to declare the undisclosed income by paying taxes @ 50%.

Government had earlier introduced Income Declaration Scheme, 2016 between the period 01.06.2016 to 30.09.2016, wherein, the amount of tax, surcharge and penalty required to be paid was @ 45% of undisclosed income. The effective rate of tax under Income Declaration Scheme, 2016 was further reduced in a way to around 41% by allowing deferment of taxes up to one year i.e. 30.09.2017.

Under the newly introduced scheme, tax, surcharge & penalty rate in aggregate is 50% and the payment of taxes is to be made in advance before filing declaration of undisclosed income. Thus, the effective rate of tax is already high in the new scheme. Apart from tax etc. @ 50%, it is also required under the new scheme to make interest free deposit equal to 25% of undisclosed income having four years lock-in period. It would imply that a person declaring such income would be left with only 25% of the funds for use by him.

One of the objectives of demonetization is to curb black money and motivate persons carrying on business to shift from parallel economy or black economy to regularized business, wherein all transactions are fully recorded with no tax evasion. To achieve the above objectives two things are significant:

1. Availability of white capital to start regularized business

2. Business friendly infrastructure having ease of doing business.

Government has undoubtedly taken several steps during last two years to create ease of doing business and further steps are in offing in this direction. But, if we want to achieve the objective that parallel economy is shifted to regularized business, government, in our considered opinion, should allow the people carrying on business to retain @ 50% liquidity by paying 50% taxes as proposed. Any further requirement of making deposit of 25% of undisclosed income having four years lock-in period in our considered opinion would come in the way of achieving above objective and should therefore be shunned or dispensed with. Availability of only 25% liquidity with people carrying on the business may not be sufficient to fulfill need of capital required for doing the business in regularized way.

It can not be ignored that in case persons do not adopt the above scheme, the old currency notes may be prone to be exchanged through dubious means which may lead to the spurt of disputes inter-se between the persons and litigation with the authorities. The economic activity that generates huge employment may dip which in turn may have negative impact on the overall economic development of the country. Also, Government may not have its share of collection of taxes if people don’t opt for the above scheme. In our considered opinion, the approach of the government should be constructive, pragmatic and forward looking rather being punitive.

Moreover, there is fear that in case too much discretionary powers are given to the authorities to investigate the past transactions as it appears too to be reality, it may lead to harassment and corruption. Serious attempt should be made to strike a balance by bringing the concept of accountability so that the discretionary powers are not misused.

| Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. Neither the author nor itatonline.org and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission of itatonline.org |

The amendment bill 2016 as passed by Lok Sabha has proposed retrospective amendments in Tax rates as transactions already effected by the tax payers before this bill has been introduced , shall also attract higher taxes and penalties. In my humble opinion , it is not valid due to judicial precedents of Supreme Court . Please enlighten us, if i am wrong. Rajesh Jain FCA, LL.B

whether relevant forms / dates of operation etc are prescribed ?

Tax amnesty schemes are morally defunct and unethical. There is no justification whatsoever for new amnesty schemes. Each such scheme provides incentive to keep income untaxed and it is only under compelling circumstances that tax is paid in the next amnesty scheme. Such schemes penalizes honest tax payers and at the same time encourage errant tax evaders. The government had to give an undertaking to the Supreme Court that the VDIS-1997 was the last of its kind, and the government would not bring any such schemes in the future. The Comptroller and Auditor General of India condemned the scheme in his report as abusive and a fraud on the genuine taxpayers of the country. The then Finance Minister Chidambaram once said the government would not be able to announce any more amnesty schemes for the next 20 years, due to, inter alia, curbs imposed by the Supreme Court. In spite of this the present government declared Income Declaration Scheme 2016 in complete contravention of the SC ruling on a domestic tax amnesty scheme. As is very well known, the composite rate of tax was 45% under IDS 2016 Scheme. The PM had stated that after the closure of the IDS-16, the life of defaulters would be made like hell. What happened ? Within 1 and half month he has again come with a new scheme for the defaulters, this time by asking the defaulters to pay 4.90% more (i.e. 49.90% total) than the IDS-16 rate of 45%.

Perceived under this back ground I , respectfully do not agree with the views of the Ld. Authors that “if we want to achieve the objective that parallel economy is shifted to regularized business, government, in our considered opinion, should allow the people carrying on business to retain @ 50% liquidity by paying 50% taxes as proposed. Any further requirement of making deposit of 25% of undisclosed income having four years lock-in period in our considered opinion would come in the way of achieving above objective and should therefore be shunned or dispensed with. Availability of only 25% liquidity with people carrying on the business may not be sufficient to fulfill need of capital required for doing the business in regularized way.”

In the first instance, why should such defaulters be allowed to escape with the payment of only 49.90% of the tax. Why should they be given the right to retain the proposed 25% interest free deposit ? Had they paid the taxes regularly then this 25% would not have remained with them. Why to penalize honest in order to accommodate wilful defaulters ?. The untaxed income has not come up suddenly but accumulated over a long period of time. The government has lost interest on the unpaid tax during the accumulation period. The defaulters are now stating that the cost of declaration is higher than 49.90% if the loss of interest on the interest free deposit of 25% for 4 years is considered in the calculation.

It seems it is not the intention of the government to eradicate the black money it seems it has intention to take revenge/vengeance against the middle class, business class and the salary class who saved their hard earned money on which they had evaded tax due to corruption and ugh rate of tax. Did Modi and BJP won without spending the black money? Why so vengeance?

Anyone can write articles for pro or con of a thought; fact here is whether Modi approach is a well reasoned one; that aspect seems failed; we need to note India is a Democracy, it is indeed a cult of incompetence, why it is accepted by people just because, effective and efficient rulers just took the people for granted, that situation and circumstances led to democratic ideas;so in India , Modi is elected by inefficient an ineffective voters, just accepting some ‘party’ as might it could provide better administration than s one, on the basis of some political speeches made by the party ‘demagaouges’ or some road side ‘orators’ not backed by great knowledge of facts or experience of these persons; naturally what people face today is on account of their own low knowledge on things;

Knowledge builds of experience, as to how things turn out over time; that is the so called education we tout and package and sell some great degrees…PhD, D.Phil…so on;

If we have really understand or predict things better, if that were to be true, naturally we might not face so many ‘ifs and buts’.

We still play with our so called unsystemised knowledge base; but we sell that knowledge at exorbitant prices in theso called universities as if we have reached the end but we are happy to cheat ourselves, like we buy a flat with so many luxuries, as if real, we are willing to pay any price for such flats or education.

that way we developed a parliament where every one talks as if he is fully knowledgeable,but that is indeed self cheating mechanics.

that is the philosophy of knowledge we play always time immemorial.

None knows what is correct knowledge, but simply groupe in the great darkness.

The whole world is governed by two elements one is attraction & greed AND other is Fear & Terror. A person living with right thought and approach always take care of Morality, Social pressure or and fear of law. The balance between Greed and Fear maintain and keep the world in order. Today the corruption has been pervaded in all sphere of life in the whole world because the balance between these two elements has been disturbed. Today the greed and attraction have been got much weight-age on the fear of law. Today there is no fear of law in the society, so the crime and corruption is on its hike. So therefore the stringent law has now become a ‘MUST’ and steps taken by my Great PM in last two years is very necessary to weaken / root out the crime and corruption. The steps is very very necessary and INDISPENSABLE to restore the fear of law in the society. The honest and a Nationalist person has no any things to controvert.

Great scope for misuse of Sec.68/69 etc by AO, and resultant corruption. The DNA of bureaucrats do not under go any change by demonetization step. They would try to recoup their own loss due to demonetization at the earliest.

Modi has gone mad

Apparently the intention of the Govt is to extract money by any means, as is not keen to directly attack the persons involved in dubious means, evading tax. The result is to extract from honest and innocent persons due to their human error, lethargy, negligence, lack of seriousness etc. Lot is emphasized on declared / explained source. While their were no such detailed column in the forms of Return and more the persons are restrained to make any written note / explanation with the Return of income.

Modi’s intentions are good to track black moneys; but implementation is a great nightmare for any; that issue was severally discussed by several RBI governors; besides same problems arose all over the globe; if you do not know the right art of implementation, naturally you will run into a loop line with high speed and face serious accident; that is what is happening today in the demonetization; actually nothing can be achievable unless well planned, planning can be in a very high secret manner is possible; see how terrorists manage their plans; when terrorists can why a govt cannot is a million $ question;

the root of black money is high taxation ; see Sweden is willing to pay 55% by way of direct taxes , so too several European countries; if the tax payers are well accounted how their moneys are utilized by the government; in india tax revenue is obviously misused by law makers, every one knows; when so , would you like to pay high taxes to be used by law makers for their private interests.

Again, you may note no currency is black ; so you can never locate; ‘you may say unaccounted cash, if the govt doesn’t account on tax revenue collection would you not call the tax revenue so highly collected is misused and not accounted to the people properly would you not call the law makers unaccounted revenue too is a ‘black revenue collections’ since misused;

Therefore , only calling tax payers excess cash you call ‘black moneys, if he had not filed ROI for AY concerned;

what is the ‘raison etre’ one position is black , the other position is not ‘black’;

why the law makers cannot be brought to book for justice, under very Art 14 r/w Art32 or 226, a question arises in the mind of ‘dejure ‘ citizens; the law makers are just ‘defacto power holders ‘ only is it not?

tax payer works and earns; while revenue collected government doesn’t earn by hard work as such, but simply shouting at Lok sabha or the rajya sabha only, without meaningful substance.

we have to think in this direction too ,, that situation led to Magna carta, ‘bloodless revolution’ or glorious revolutions that is the political history besides ‘french revolution’;

one needs to think;

simple pulpit talk never serves th critical thinkers, for that purpose we have a constitution and the judiciary as such; you cannot bypass just because you are ‘some ‘ government, is it not, think a little sirs. if you think then’checks and balances’ are needed on both sides of the spectrum.