The Finance Bill 2020 proposes to create an Alternate Tax Regime by way of new Section 115BAC to give benefit of lower tax rates to individual and HUF tax payers. Advocate Narayan Jain has analyzed the proposal in detail. He has explained the precise implications with the aid of case studies and advised on the circumstances in which the taxpayers should opt for the new regime

The Finance Bill 2020 proposes to create an Alternate Tax Regime by way of new Section 115BAC to give benefit of lower tax rates to individual and HUF tax payers. Advocate Narayan Jain has analyzed the proposal in detail. He has explained the precise implications with the aid of case studies and advised on the circumstances in which the taxpayers should opt for the new regime

Some taxpayers were hoping the exemptions and deductions would be increased. They were also expecting the income tax slabs to be widened. Everybody wanted the tax structure to be simplified and their tax burden to come down.

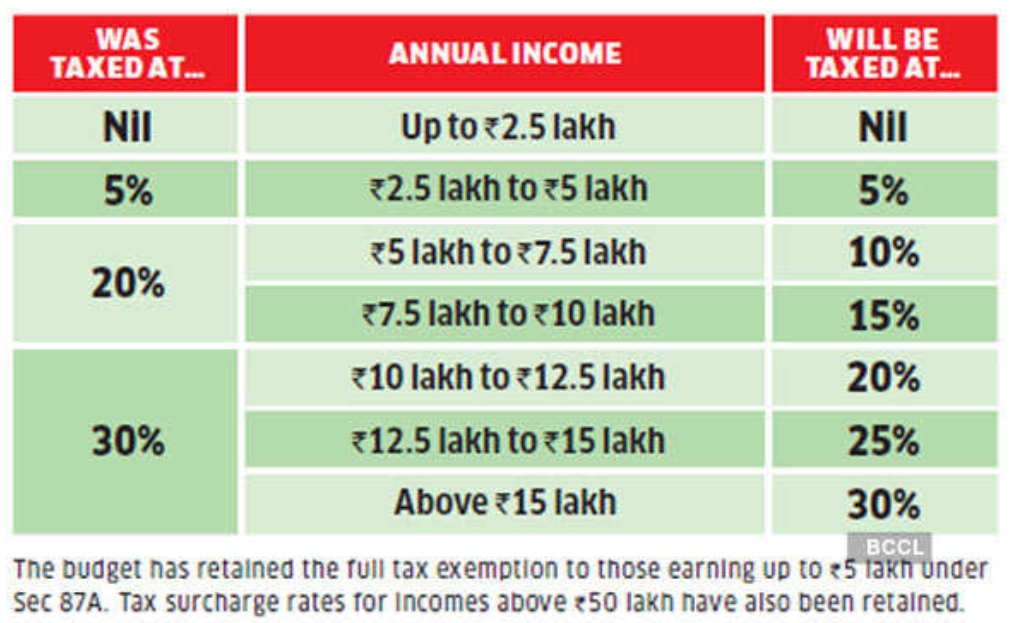

Finance Minister Mrs. Nirmala Sitharaman, in her second Budget, has proposed an alternate tax regime giving benefit of lower tax rates to individual tax payers as well as Hindu Undivided Families. She has claimed it as a step towards simplification of taxation. Exemption limit has been retained at Rs.2,50,000 but the slabs have been reoriented as an option. However, Individuals having income up to Rs. 5 Lakh will not be required to pay any income tax as they will continue to get tax rebate of Rs.12,500 under section 87A.

Alternate Tax Regime : The Finance Minister has proposed an Alternate Tax Regime by way of new Section 115BAC and the same will apply in relation to the assessment year 2021-22 and subsequent assessment years. The Salient features are discussed here below :

1. Seven Tax Slabs under optional tax regime :

On compliance of prescribed conditions, an individual or HUF shall, from assessment

year2021-22 onwards, have the option to pay tax in respect of the total income at

following rates:

Total Income and Slab Rate under the alternate tax regime:

Upto Rs,2,50,000 Nil

From 2,50,001 to 5,00,000 5 per cent.

From 5,00,001 to 7,50,000 10 per cent.

From 7,50,001 to 10,00,000 15 per cent.

From 10,00,001 to 12,50,000 20 per cent.

From 12,50,001 to 15,00,000 25 per cent.

Above 15,00,000 30 per cent.

2. Option to be exercised :

a) The option shall be exercised for every previous year where the individual or the HUF has no business income, and in other cases the option once exercised for a previous year shall be valid for that previous year and all subsequent years.

b) The option shall become invalid for a previous year or previous years, as the case may be, if the Individual or HUF fails to satisfy the conditions and other provisions of the Act shall apply;

c) the concessional rate shall not apply unless option is exercised by the individual or HUF in the form and manner as may be prescribed,-

i) where such individual or HUF has no business income, along with the return of income to be furnished undersection 139 (1); and

ii) in any other case, on or before the due date specified under sub-section (1) of section 139 of the Act for furnishing the return of income for any previous year relevant to the assessment year commencing on or after 1st April, 2021 and such option once exercised shall apply to subsequent assessment years;

d) Limited Option in case of taxpayers having business income: Option can be withdrawn only once where it was exercised by the individual or HUF having business income for a previous year other than the year in which it was exercised and thereafter, the individual or HUF shall never be eligible to exercise option under this section, except where such individual or HUF ceases to have any business income in which case, option shall be available as in case of taxpayers having no business income.

3. Individual or HUF opting for concessional rate not eligible for various exemptions/ deductions as part of conditions for concessional rate :

According to the condition listed in section 115BAC, means that the individual or HUF opting for taxation under the newly inserted section 115BAC of the Act shall not be entitled to the following exemptions/ deductions:

Leave travel concession as contained in clause (5) of section 10;

House rent allowance as contained in clause (13A) of section 10;

Some of the allowance as contained in clause (14) of section 10;

Allowances to MPs/MLAs as contained in clause (17) of section 10;

Allowance for income of minor as contained in clause (32) of section 10;

Exemption for SEZ unit contained in section 10AA;

In case of Salaries persons Standard deduction, deduction for entertainment allowance and employment/professional tax as contained in section 16;

Interest on housing loan under section 24 in respect of self-occupied or vacant property referred to in sub-section (2) of section 23. (Loss under the head income from house property for rented house shall not be allowed to be set off under any other head and would be allowed to be carried forward as per extant law);

Additional deprecation under clause (iia) of sub-section (1) of section 32;

Deductions for Investment in new plant or machinery in notified backward areas under section 32AD; Deduction for amount deposited in Tea/ Coffee/ Rubber deployment account under section 33AB; deduction for amount deposited in Site Restoration Fund under section 33ABA;

Various deduction for donation for or expenditure on Scientific Research contained in section 35(1)(ii) or (iia) or(iii) or section 35(2AA);

Deduction in respect of expenditure on specified business under section 35AD or Deduction in respect of agricultural extension project under section 35CCC;

Deduction from family pension under clause (iia) of section 57;

Any deduction under chapter VIA (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc). However, deduction under sub-section (2) of section 80CCD (employer contribution on account of employee in notified pension scheme) and section 80JJAA (for new employment) can be claimed.

4. Some allowances to be allowed under section 10(14):

As many allowances have been provided through notification of rules, it has been proposed to carry out amendment of the Income-tax Rules, 1962 subsequently, so as to allow only following allowances notified under section 10(14) of the Act to the Individual or HUF exercising option under the proposed section 115BAC:

(a) Transport Allowance granted to a divyang employee to meet expenditure for the purpose of commuting between place of residence and place of duty;

(b) Conveyance Allowance granted to meet the expenditure on conveyance in performance of duties of an office;

(c) Any Allowance granted to meet the cost of travel on tour or on transfer;

(d) Daily Allowance to meet the ordinary daily charges incurred by an employee on account of absence from his normal place of duty.

5. Some allowances NOT to be allowed under section 10(14):

It has also been proposed to amend Rule 3, so as to remove exemption in respect of free food and beverage through vouchers provided to the employee, being the person exercising option under the proposed section, by the employer.

6. Set off of Loss or depreciation not permitted:

a) The income of such taxpayer is to be computed without set off of any loss carried forward or depreciation from any earlier assessment year if such loss or depreciation is attributable to any of the deductions referred to in para (3) above. Likewise the income of such taxpayer is to be computed in case of loss under the head house property without any set off of such loss with any other head of income.

b) The loss or depreciation shall be deemed to have been given full effect to and no further deduction for such loss or depreciation shall be allowed for any subsequent year so however, that where there is a depreciation allowance in respect of a block of asset which has not been given full effect to prior to the assessment year beginning on 1st April, 2021, corresponding adjustment shall be made to the written down value of such block of assets as on 1st April, 2020 in the prescribed manner, if the option is exercised for a previous year relevant to the assessment year beginning on 1st April, 2021;

7. Unit in the International Financial Services Centre:

If the individual or HUF has a Unit in the International Financial Services Centre [section 2 (zc) of the Special Economic Zones Act, 2005], as referred to in section 80LA(1A), the deduction under section 80LA shall be available to such Unit subject to fulfilment of the conditions contained in that section; and

8. AMT shall not apply:

It has been proposed to amend section 115JC so as to provide that the provisions relating to Alternate Minimum Tax (AMT) shall not apply to such individual or HUF having business income.

Carry forward and set off of AMT credit not permitted: It has also been proposed to amend section 115JD so as to provide that the provisions relating to carry forward and set off of AMT credit, if any, shall not apply to such individual or HUF having business income.

9. The comparison of tax burden between existing tax rates and new alternate tax regime:

a) Case Study 1: If a taxpayer having income of Rs. 15 Lakhs would have claimed benefit of Standard Deduction from salary for Rs.50,000; deduction for Rs.1,50,000 under section 80C, and for Interest on housing loan for Rs. 2 Lakhs under section 24, his taxable income will come to Rs. 11 Lakhs (after aforesaid deductions) and his tax liability under the existing regime will be Rs.1,48,200, whereas under the new regime tax liability on Rs. 15 lakhs comes to Rs. 195,000. Thus in such a case new tax rates are not advisable.

b) Case Study 2: An individual taxpayer with gross salary up to Rs. 12.5 lakh claiming only deductions under section 80C (Rs. 1.5 lakh), 80D (Rs. 25,000) and Standard deduction of Rs 50,000 from Salary will pay more tax under the new personal income tax regime. Lower the gross salary, higher the additional tax payable by individuals in the new tax regime claiming only the above three deductions in the old tax regime.

c) Case Study 3: An individual with gross salary of Rs. 12.5 lakh claiming only deductions under section 80C (Rs 1.5 lakh), 80D (Rs 25,000) and standard deduction from Salary of Rs 50,000 will pay tax of Rs.120,000 on taxable income of Rs.10,25,000. He will pay tax of Rs.1,25,000 which comers to Rs.5000 more tax under the new personal income tax regime.

d) Case Study 4: Salaried individual not claiming any exemptions or deductions

Assuming no tax deductions or exemption are claimed in the existing personal tax regime, the individual with gross salary of Rs 7.5 lakh is paying tax of Rs.52,500 (if Standard deduction from Salary is considered) and he would pay tax of Rs.37,500 and thus save tax of Rs 15,000 if he/she opts for the new personal tax regime.

d) Case Study 5 : Assuming no tax deductions or exemption are claimed (except standard deduction from Salary) in the existing personal tax regime, the individual with gross salary of Rs 10 lakh is paying tax of Rs.1,02,500 (if Standard deduction from Salary is considered) and he would pay tax of Rs.75,000 under the new tax regime and thus save tax of Rs 27,500 if he/she opts for the new personal tax regime.

Thus the taxpayers need to check their tax liability under the existing regime and new optional regime and should carefully decide whether to go for new tax regime. An individual who is currently availing more deductions and exemption may choose to avail them and continue to pay tax as per the old regime.

10. Comparative Tax Slabs at a glance :

On its part, the Finance Ministry expects four out of five taxpayers to move to the new tax regime. It analysed the income and investment data of 57.8 million taxpayers and found that 69% would save on tax under the new system. Another 20% might want to switch to avoid the hassles and paperwork involved in tax planning. It is advisable to consider all aspects and decide on the exercise of option!

(Narayan Jain is former Secretary General of AIFTP and author of the books “How to Handle Income Tax Problems” and “Income Tax Pleading & Practice”

| Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. Neither the author nor itatonline.org and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission of itatonline.org |