CA Shivangi Samdhani has argued that the extension of the due date of the Vivad se Vishwas Act, 2020, brought by the Finance Minister through Press Conference held on 13th May 2020, does not serve the purpose in true spirit and is also unfair to those who have already filed the declaration forms. She has suggested that, in order to make parity, assessees should be allowed to pay tax arrears till December, 2020 irrespective of the date of filing of Declaration. This, she says, will result in a win-win situation for all

CA Shivangi Samdhani has argued that the extension of the due date of the Vivad se Vishwas Act, 2020, brought by the Finance Minister through Press Conference held on 13th May 2020, does not serve the purpose in true spirit and is also unfair to those who have already filed the declaration forms. She has suggested that, in order to make parity, assessees should be allowed to pay tax arrears till December, 2020 irrespective of the date of filing of Declaration. This, she says, will result in a win-win situation for all

In the series of relaxations brought under various statues because of COVID19, the date of making payment without any additional charge under “Vivad se Vishwas Act” has been further extended to 31st December, 2020 from 30th June, 2020 which was originally set out at 31st March, 2020.

However, the extension in my wisdom will not serve the purpose in true spirit and is also unfair to those who have already filed declaration forms.

For better understanding and analysis attention is invited to the following provisions:

1. Section 3 of the DTVSV Act, 2020:

“3. Subject to the provisions of this Act, where a declarant files under the provisions of this Act on or before the last date, a declaration to the designated authority in accordance with the provisions of section 4 in respect of tax arrear, then, notwithstanding anything contained in the Income-tax Act or any other law for the time being in force, the amount payable by the declarant under this Act shall be as under, namely:—

| Sl. No | Nature of tax arrear | Amount payable under this Act on or before the 31st day of March, 2020 | Amount payable under this Act on or after the 1st day of April, 2020 but on or before the last date….” |

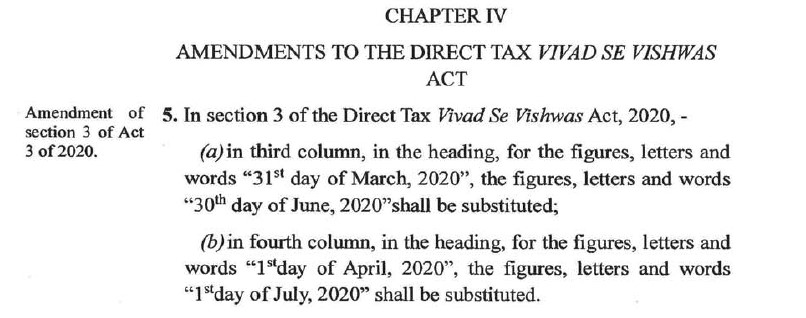

2. Amendment brought by way of Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020 dated 31st March, 2020:

3. Further amendment announced by Hon’ble Finance Minister on 13th May, 2020 in her Press conference:

“…Now without any additional amount which is to be paid, in total the whole Vivad se Vishwas Scheme is getting extended upto 31st December, 2020 and for this extension no extra payment is being asked…”

4. Section 5 of DTVSV Act, 2020 which has been never amended:

“5. (1) The designated authority shall, within a period of fifteen days from the date of receipt of the declaration, by order, determine the amount payable by the declarant in accordance with the provisions of this Act and grant a certificate to the declarant containing particulars of the tax arrear and the amount payable after such determination, in such form as may be prescribed.

(2) The declarant shall pay the amount determined under sub-section (1) within fifteen days of the date of receipt of the certificate and intimate the details of such payment to the designated authority in the prescribed form and thereupon the designated authority shall pass an order stating that the declarant has paid the amount…”

The collective reading of the above provisions reveal that an assessee, without any burden of additional charge, can file declaration till 31st December, 2020. However, whenever he files a declaration, tax has to be paid within 15 days from the date of receipt of Certificate from Designated Authority.

The above situation can be understood with the help of following example:

When Assessee filed Declaration on 1st June, 2020, he will receive Certificate of Designated Authority on or before 16th June, 2020 (As per section 5(1) Designated Authority, within 15 days, will have to determine the amount payable and grant certificate) and the assessee will then be bound to pay the entire tax arrears by 1st July, 2020 (as per section 5(2) within 15 days from receipt of certificate the declarant will have to make payment of tax arrears).

Since, the date has been extended to 31st December, 2020, assessees will defer filing of Declarations till December, 2020. However, the ones who have already filed declaration will have to face a lot of hardship as they will be bound to make payment long before 31st December, 2020 as no amendment has been made in section 5 of DTVSV Act, 2020.

It is to be borne in mind that the working of Income Tax Department has been started. Soon Lockdown 4.0 will also start wherein more relaxation with regard to functioning of various departments is expected. As a result working of Commissioner (Appeals), Income Tax Appellate Tribunal, High Court and Supreme Court will commence in a few weeks and will definitely be long before 31st December, 2020.

Since the assessees will wait till December, 2020 to file declaration forms they will be seeking adjournments till December, 2020 and the entire working of the Department and Judiciary will get hampered. Not only this when the majority of the Declarations will be filed in the month of December, 2020 the Designated Authorities will have a huge pressure of granting Certificates within the stipulated time.

In view of this Ministry of Finance in order to make parity should come out with a clarification or suitable amendment to allow assessees to pay tax arrears till December, 2020 irrespective of the date of filing of Declaration.

This will result in a win-win situation all – Assessee, Department, Judiciary as well as Counsels. The assessee will file Declarations at the earliest and the Department/ Judiciary can mark the appeal as non-maintainable because of DTVSV Act, 2020 much before 31st December, 2020 and work accordingly.

| Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. Neither the author nor itatonline.org and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission of itatonline.org |

But on income tax e filing portal last date coming is 30 June only

Where is the notification for Vivad se Vishwas Scheme for getting it extended upto 31st December, 2020 without burden of interest?

Atleast some additional tax ought to have been payable by the applicants intending to avail the extended due date under vivad se Vishwas scheme