Dr. Raj K. Agarwal & Dr. Rakesh Gupta have dealt with the controversial question whether the deposit of unaccounted high denomination notes in the bank can attract penalty under section 270A of the Income-tax Act, 1961 even though the said deposit is offered to tax in the return of income. The experts have explained the entire controversy in the proper perspective

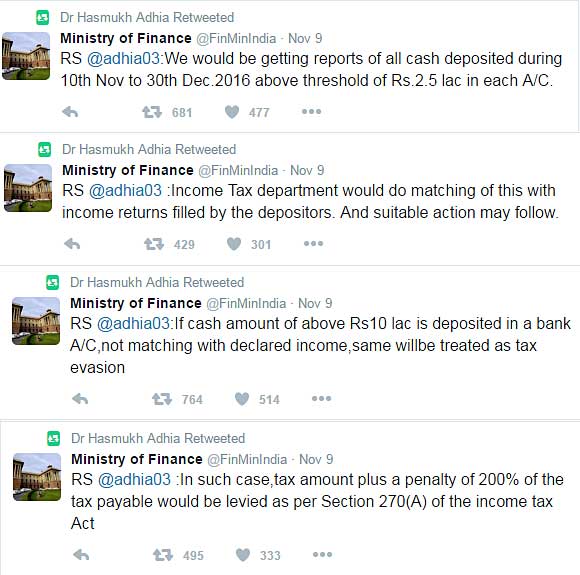

Recently introduced Demonetization whereby currency notes of Rs. 500 and Rs. 1000/- have been declared as invalid legal tender with effect from 9.11.2016 is most likely to witness huge cash deposits in bank accounts within the window period expiring on 30.12.2016. Media reports have appeared attributed to Government sources that in case substantial amount of cash is deposited in banks declaring it as current year’s unaccounted income and applicable tax @30% plus surcharge etc. is paid, still penalty @200% of the tax can be imposed as per provisions of section 270A of the Income Tax Act, 1961.

Up to A.Y. 2016-17, penalty for concealment of income was leviable u/s 271(1)(c) of the Income Tax Act which provided for the levy of penalty for concealing the particulars of income or furnishing inaccurate particulars of income. Thus, penalty was there for concealing the particulars of income or furnishing inaccurate particulars of income even when taxes were paid on such cash deposit by showing it as income. However, from 01.04.2016 the penalty provision for concealment of income has been substituted by section 270A according to which penalty is leviable only when assessed income is more than the returned income. Under Section 270A, there is no concept of attraction of penalty for concealing the particulars of income or furnishing inaccurate particulars of income.

In a case when amount of cash deposit in bank is declared by the assessee in his return of income and applicable taxes are paid, there can be no penalty in our considered opinion under section 270A even if assessee is not able to substantiate source of earning such income since there is no tax evasion involved. Measure of penalty in case of under reporting or mis reporting is the difference between the returned income and assessed income. If such deposit in bank is declared as income in the return of income, obviously it would be assessed as such and in that scenario, there would not be any difference between the returned income and the assessed income. So where is the question of penalty being talked about?

Above interpretation of law may however not be accepted by the Government since it may defeat the objective of penalty provisions. It would also defeat the objective of Income Declaration Scheme wherein tax, interest and penalty on such cash deposit was required to be paid @45%. This situation may lead to intense litigation which may prohibit the citizens to make declaration of unaccounted income and payment of tax thereon, as the impact of 200% penalty would mean that the total tax and penalty would be more than 90% with additional fear of being prosecuted.

As per one estimate, total currency notes of Rs. 500 and Rs. 1000 in circulation was approximately of Rs. 14 lac Crores. Such currency notes are likely to be deposited by one or the other methods into the bank accounts by those holding them. In case legitimate method of declaring such amount as income and payment of taxes thereon is not available, people would tend to adopt dubious or undesirable methods and manners for deposit of such amount in the banks. In such a case, Government would not be able to collect its share of taxes and rather may find itself litigating with such kind of persons with no revenue collections.

Section 270A provides for the levy of penalty @200% in case of misreporting of income and @50% in case of under reporting of income. Therefore, to solve the above mentioned situation, it is suggested that Government may take a clear stand that such deposits would fall with in the meaning of under reporting requiring levy of penalty @50% of the tax amount. That would mean that Government may get tax, surcharge and penalty to the extent of around 50% of cash deposited/income declared. By doing so, there would not be any inconsistency with the scheme of Income Declaration Scheme where the tax, interest and penalty was 45%. It would create win-win situation for everybody. If such clarification comes from the side of the Government, people may be tempted to declare such deposited cash as income rather than adopting dubious methods. It would bring revenue collection to the Government and capital formation for the banks with the least possibility of litigation.

The department has powers U/s. 131(1) to call upon any material evidences….though it is definitely a harassment on paper

We have deposited only SBN’s Rs.9,90,000.00 out of total sum deposited Rs.98,00,000.00 during 9.11.2016 to 30.11.2016. Still I.T. has issued summons under 131(1) & R.W.S. 131 (1A) of the IT Act 1961 after we responded in earlier communication through SMS received from I.T.

In Sahara Birla case the Hon. SC has not considered the following provisions of the Income Tax Act which could have changed its conclusion:

Section 292C of the Income Tax Act, 1961 states the presumption regarding the assets, documents and books found in possession or control of any person in the course of a search *or survey operation [Inserted by Finance Act, 2008, w.r.e.f. 1/06/2002] that:

Such book of account, other documents, money, bullion, jewellery, other valuable article or thing belong or belongs to such person.

The contents of such books of account and other documents are true.

According to Section 34 of the Indian Evidence Act, 1872, “Entries in books of account, regularly kept in the course of business, are relevant whenever they refer to a matter into which the Court has to inquire, but such statements shall not alone be sufficient evidence to charge any person with liability”

Sharing few landmark ruling of SC, any takeaway

1. [TS-22-SC-2017]: Loose paper-sheets “irrelevant, inadmissible” evidence; Rejects investigation plea in Sahara/Birla case

2. [TS-5026-SC-1998-O] : Evidences that come under the ambit of the Section 34 of the Indian Evidence Act, 1872 can be considered as book

3. [TS-5002-SC-1997-O], holds unsatisfactory explanation does not automatically result in deeming the amount credited in the books as the income.

4. [TS-5090-HC-1982(Bombay)-O] / [TS-5680-ITAT-2007(Delhi)-O] : Pass Book/Bank Statement is not “books” – Additions made u/s. 68 on the basis of entries in the bank pass books are not sustainable.

Talking big alone cannot save economies of scale. All you need to walk the talk yourself in your life; you cannot expect poor and down trodden people cannot afford to meet all additional costs, like service charges, like ‘service taxes’; why the seller would meet your so called ‘service tax’ ; the service provider would not pay of his pocket as he cannot charge his income which is skewed such a way that he has to work with minimum after all he knows ‘who will patronise him if he charges all these ‘filthy’ taxes on the services taker?

govt need to know what is meaningful and practicable, taxes payer many a time cannot afford these luxuries what govt indulges thanks to law makers forcibly take from tax payers as some charges under so called ‘direct’ and ‘indirect taxes’ after all all these taxes just loot the very poor who is the about 90% in the scheme of things; every rich wisely takes some exemptions, but can a poor man do?

You can make pulpit talks but you can’t follow what you profess in your talk; as ‘none walk the talk’, more predominant among all politicians, see now Modi called some ‘economists’ to advice him , did he take advice when he did the so called ‘surgical strike of black money’ on November 8th.

See Modi demonetization idea may be ideal thought but it lacks the nuances of balancing; as india is both a cash economy whereby every one contributes to ‘conversion of grey money’ into black as he buys goods and services without receipts provided by the traders; mostly no grocer provides any bill except a ‘cutcha’ bill to collect his cash, and you cannot file the ‘cutcha bill in tax returns, as the bill will not have the shops’ name and address; if you ask him to provide all such details he will not sell the goods or services to you is obvious, daily position in any one’s life in india;

how many people wish to pay extra costs for the goods and services provided; neither the provider nor the taker of the good or services, as every one cuts costs. So there can be none to be a taker of Modi’s idea, however ideal it is;

ideal just because it is not practical in life.

as cutting costs is a normal perception of every one; when banks charges for services as they do today, who will open savings bank account if his income is just barely meets his living expenses, sometimes he needs to borrow his daily living , that way ordinary farmers and poor people live, as ordinary farmer or poor man is not paid some allowances and salaries like some government servants under one pay commission or the other by these so called governments run by these so called worthies called ‘elected law makers’ as law makers themselves indulge in the very ‘illegal’ cost cutting activities, like not paying salaries, wages, to people or not even paying legitimate price to goods and services themselves but they want just the ‘tax payers’ to meet all such things, where is rationale please?

govt is equally accountable to tax payers too , government is run by elected representatives under democratic dispensation, that is, the defacto representatives as law makers cannot make all irrational statutes and affect the apply cart of governance, as also cannot affect dejure citizens under Art.5 as Art 51A of Part IVA of the constitution puts fundamental duty paradigm even on the law makers.

Law makers cannot escape wrongs committed by them by lop sided logic.

The Income tax Act is not qualifying to be a right law.

you have ‘other sources of income’ if loaded in ROI,u/s 270 A, you have not avoided, but you could not account just because a lot of transactions in cash economy, no receipts are issued but goods and services are sold, when you declare here when tax is paid, obviously you have not defaulted tax law as such in a right sense, as these are bound to occur in mixed economy like cash economy and accounted economy, so the tax payer cannot be penalized because ‘governance by govt failed’ therefore the existing tax system is full of ‘holes’, when you create your legal structure with conflicting provisions, conflicting laws or statutes, why blame the tax payer, so if govt blames tax payer, i would say ‘failure of governance system’ cannot take advantage of irrational laws and sections’, if taken by the govt, govt need be penalized under judicial review under art 266 r/w 267 writs as also art 32 applicable at the Supreme Court;

Besides the mental tension created by irrational tax laws the govt need to pay ‘liquidated damages’ to the affected tax payer .

If a certain amount is deposited in a bank account how on earth it could be called black money. The tax department is free to initiate inquiry as it deems fit. It seems we are not making legally sound comments but these are either politically or emotionally filled one.

I would say, all the moneys so far caught under unaccounted transactions cash be destroyed, even the union ministry shall not use that funds, then there may be some kind of solution is there though not real cats are not caught so far; else fresh unaccounted money will bulge into old unaccounted moneys; you know if you draw 2000 cash from ATM and buy goods ans]d services under no receipt basis you also promote ‘unaccounted transactions’ ; so obviously, even political parties give free bees in cash or kind do promote unaccounted moneys; so ED shall catch all those who got free bees, and from them locate who gave them and big fishes can be caught that is all politicians in the ensuing elections in the U P and other states.

then ED can really do some work or recovery much better than very Modi demonetzation trick.

this is no duplicate sir, unless you are yourself is some duplicate kind, think before your great comments friend.

I would say, all the moneys so far caught under unaccounted transactions cash be destroyed, even the union ministry shall not use that funds, then there may be some kind of solution is there though not real cats are not caught so far; else fresh unaccounted money will bulge into old unaccounted moneys; you know if you draw 2000 cash from ATM and buy goods ans]d services under no receipt basis you also promote ‘unaccounted transactions’ ; so obviously, even political parties give free bees in cash or kind do promote unaccounted moneys; so ED shall catch all those who got free bees, and from them locate who gave them and big fishes can be caught that is all politicians in the ensuing elections in the U P and other states.

then ED can really do some work or recovery much better than very Modi demonetzation trick.

In the wake of demonetization and ongoing assessments, Orange team have made an effort to compile and bring to our readers, latest case laws by various Courts including the Supreme Court on issues covering unexplained credit, unexplained expenditure, unexplained investments and topics alike.

1. [TS-5215-SC-2016-O]: Bogus company – unexplained Investment – Transaction of sale of shares of a company listed in BSE not genuine as the company was a ‘shell company’; incorporated for purpose of providing accommodation entries –

SC dismisses assessee’s SLP; Upholds HC order reported in [TS-5375-HC-2016(GUJARAT)-O] wherein HC had upheld re-assessment proceedings; The AO had reopened the case on the ground that the company of which assessee sold shares was a bogus company and hence, the LTCG claimed on sale of the said shares as exempt, had escaped tax

2. [TS-5195-SC-2016-O]: Share capital – unexplained Credit – Share capital bogus absent evidence to prove genuineness of share-holders – SC dismisses assessee’s SLP against HC order; HC upheld addition u/s.68 on account of alleged share capital treating it as undisclosed Income of the company; HC had upheld AO’s order who held that the assessee company had introduced its own money in the guise of share capital; HC observed that assessee company had failed to prove genuineness of the shareholders and source of fund; It had distinguished coordinate bench ruling relied on by assessee in the case of Hindusthan Tea Trading Co Ltd [TS-5219-HC-2003(Calcutta)-O]

3. [TS-6716-ITAT-2016(HYDERABAD)-O]: Peak credit &unexplained Credit – Only peak credit to be taxed u/s. 68, huge cash deposits in the savings bank account of assessee cannot be taxed – ITAT rules in favour of assessee; Holds that assessee having furnished the bank statement, AO could have verified and noticed that there were credits and corresponding debits which would give an indication that some amount has been recycled and that in such cases ordinarily, peak credit is to be taken into consideration for making an addition; Observes that AO made assessment as per Sec. 144 because assessee did not appear despite repeated reminders, however AO should keep in mind the normal turnover of the assessee, the expected profit in each year, based on the earlier year’s income declared and accepted and the material available to make the addition;

4. [TS-6684-ITAT-2016(Mumbai)-O]: Profit vs Cash deposits – Unexplained Credit – Only profit earned on sales constitutes income of assessee and not the amount of cash and cheques deposited in the bank account – ITAT holds partly in assessee’sfavour; Notes that assessee (a retail trader covered under presumptive taxation scheme u/s. 44AF) is required to declare its profit at 5% on gross sales; Thereby, restricts addition made u/s. 68 to 5% on total cash and cheque deposits including opening and closing balances (assuming them all to be on account of sales);

5. [TS-6726-ITAT-2016(MUMBAI)-O]: Share capital – Unexplained Credit – Taxpayer admits before ITAT of manipulating the accounts and making fictitious entries to inflate share capital; ITAT clarifies that only real income can be brought to tax and remits the matter for de-novo assessment and reconsider additions made u/s. 68 on account of unexplained credit in the form of increased share capital – ITAT rules in favour of assessee; AO had made additions u/s. 68 of increased share capital and share application money as unexplained credits in view of lack of credible explanation of source of introduction of such fresh share capital/share application; Assessee produced additional evidences before the ITAT conceding fictitious entries made to inflate share capital in order to avail bank loans; ITAT considers the additional evidences in the form of Affidavit of Promoter-Director, copies of revised audited accounts etc and remands the issue for de-novo assessment in order to identify and assess the real income of the assessee;

6. [TS-6730-ITAT-2016(KOLKATA)-O]: Cash Deposits – Unexplained Credits – Deposits in bank account received from clients towards making investment in shares, not unexplained, cannot be added to income; Cash deposits in bank account cannot be added to income when cash withdrawals are higher than the deposits; Addition of credit card payments towards reimbursement of official expenses sustained as assessee could not justify the same; Credit in bank account by way of housing loan cannot be added to assessee’s income as unexplained credit; Addition on account of investment from undisclosed sources deleted as investment was made by assessee out of its disclosed bank account; Revised return filed after issuance of intimation u/s 143(1) but before completion of assessment cannot be treated as invalid; – ITAT rules partly in favour of assessee (Associate VP of Religare Securities Ltd.); Deletes addition of cash received against sale of shares as the same was received from M/s Navratan Capital & Securities Ltd. and a certificate was provided by them to the effect that such payments were effected out of available cash balance with them; Further, deletes addition of cash deposits in bank account as withdrawals of cash were more than the amount of cash deposits, hence it is not unexplained cash deposits;

7. [TS-6729-ITAT-2016(JAIPUR)-O]: Cost of building, DVO report vs. Actual – Unexplained Investment – Addition u/s. 69 on adhoc basis of undisclosed investment in construction of building, based on DVO report, not valid when the assessee has produced supporting bills and vouchers; Statement made during the course of search cannot be made the sole basis for making addition; Repayment by company to assessee shareholder of amounts advanced earlier cannot be termed as deemed dividend u/s. 2(22)(e); Profit from sale of land held as investment by assessee, a real estate developer, can be taxed as capital gains; – ITAT rules in favour of assessee; Holds addition of undisclosed expenditure in construction is purely adhoc, to cover up for any possible leakages on surmises and conjectures and difference in value shown by assessee and that shown by the DVO;

8. [TS-6731-ITAT-2016(AHMEDABAD)-O]: Payers’ Identities – Unexplained Credit – No addition can be made as unexplained cash credit u/s 68 when assessee has proved the identities of people beyond doubt merely because the AO did not receive any confirmations from those people u/s 133 (6); Interest expenses allowable when interest free advances were made out of interest free funds available with the assessee – ITAT rules in favour of assessee; Holds that if the transaction is done by account payee cheque then the identity of the payer goes into oblivion because the money has flown from one identified bank account to another identified bank account; Deletes addition of unexplained cash credit u/s 68 made by AO.

confusion leads to confusion confounded situation; as all CAs would contribute!

Every one is contributing here to confound the confusion. Instead of fighting individually let there be an organised effort to set the law at rest.

you cannot go on contradictory notifications; if done Notifications lose its punch.

IDS and present Notifications are great mess in India; this mess would just apply sudden hydralic brakes to the taxation system; Modi economics is some strage economics; Modi has become a great joker of 2016; might get some UN award; courts would just dismiss revenue cases, for want of any principle of rule of law when weighed with Art 14 and Art 265, is my view;

Anyway tax payers are most harassed lot i see;

besides poor don’t get cash as they are used to handle cash not plastic cards or cheques.

Taxation law itself is a great mess;

CAs are one of the most confused advisers; Lawyers somewhat better in tax matters.

Contd.

Apropos of Previous comments:

Attention may be invited to yet another development from the Revenue’s side,wrt its strikingly queer interpretation of Sec 270 A; which has triggered the idea of an amendment.In one’s independent view, the idea is, for reasons set out below,disappointingly misconceived.

As shared on Facebook :

https://www.facebook.com/swaminathanv3?fref=nf

http://www.business-standard.com/article/economy-policy/now-bank-deposits-since-nov-8-may-attract-60-income-tax-116112401397_1.html#.WDf1paLtnZE.facebook

q

However, there were lacunae in this as black money holders can pay advance tax on their deposits and file it in their returns. In that case, penalty could not be levied in the strict sense as it was for misreported or under-reported income.

uq

The purport or import of the above selected observation, – that is, the mention of ‘lacunae’ (in sec 270A ?) , in one’s perspective, is not readily understood. Instead, makes for rendering the already obtaining confusion , worse ( more) confounded.

Further, that seems to convey , and proceed on the premise, wrongly so, that any unaccounted money, deposited with bank, post demonetization, could escape the consequence of penalty as provided for in sec 270A , by paying advance tax, and accounting for the income in the tax return, for the current previous year (assessment year 2017-18).

According to a study and an independent understanding of sec 270A, rtw sec 271, however, penalty, if at all otherwise validly leviable, cannot be avoided by any gimmick as envisaged.

That is so, should the entire scheme of the applicable sections of the Act in general, and both the sections, 270 A and 271, as warranted, in particular, are read together, as a single code, not each in isolation or a truncated manner.

Attention may be prudently invited to the viewpoints earlier shared, in brief, in the previous Post wrt > http://economictimes.indiatimes.com/wealth/tax/missed-the-tax-return-filing-deadline-heres-what-to-do/articleshow/53597715.cms

– (see the posted comment),reproduced below:

Q

1. Per dictionary, the word ‘mis’, used as a prefix, denotes ‘wrongly’. As such, income of an earlier year, if over- reported wrongly in current year, could be treated as an instance of ‘misreporting’; accordingly, entail all its consequences, even in the normal course.

2. Suggested possibility of any amendment of the law (in the forthcoming budget), if were to be resorted to, as visualized, could only lead to, as experience may bear out, muddling up further ; instead of easing of implementation.

UQ

Pithily stated: The monies deposited, unless really ‘unaccounted’ for taxation, would require to be explained, if and when queried, either as income of current year, or of any prior year (s). Should , factually, it be the income of the current year, the question of levy of a penalty u/s 270A will not arise. Should , however, that be the income of a prior year (s), sec 270 A will not apply; instead, application of sec 271 will arise. As such, to say that because of ‘lacunae’ in sec 270A, penalty on such income , could be avoided, does not make any sense whatsoever.

In this context, it needs to be borne in mind that, as per the settled position in law, income of a prior year cannot be assessed as income of he current year, or vice versa; for, each ‘previous year’ (i.e. the income year) is ‘separate’ and a ‘self-contained’ period. (read the expert commentary in text book and the plethora of case law cited).

Over to the EXPERTS at large, in field practice, suggesting to make a close study, and share own well-considered eminent views, if hold out any differently.

It is easier to render advice but the problem is who will bell the cat.

Government will lose their casein the court if rightly argued; you cannot make so called statutes bu]y so called notifications like; 200% penalty idea cannot be substantiated by the govt.

indeed futile statutes if the courts review under judicial reviews.

You can accept cash from your debtors ; but Debtors will face consequences for not complying with the provisions of sec.40A(3) of the IT Act.

The solutions offered here are fascinating but too good to be true.

Savings of Rs.15,00,000/- is more than the presumptive income + household/personal expenses + incometax paid + savings u/s.80C + other out-goings. He is inviting trouble. He should work out income and expenditure for the last 5 years and offer the excess as current income plus presumptive income for the current year. Advance tax should also be paid before 15-12-2016.

What I want to ask is a business man having its outstanding amount from his debtor as on 08.11.16 is Rs.1 cror..

Now due to demonetization all debtors are paying their dues in cash to that business man after 08-11-16..

Should that business man accept that recoveries from his debtor in cash ?

And if he accept what will be the impact …?

One business man has outstanding amount of Rs. 1 Cror in his books of account as in 08.11.16

He has disclosed income in respect of such outstanding in past three to four years in his UI income tax return..

Now due to bane of 500-1000 notes,he has recovered his outstanding in cash after 08-11-16.

Can he deposit this cash in his current account..?

What will be the implication if he deposit that cash in current account.

He has to explain about such cash receipt for entire year. Ont he basis of entire receipt if his income comes to more than minimum presumptive income, such income will be assessed in his hand instead of minimum presumptive income.

If Mr A is regularly filing his Return of Income. He owns 8 trucks and is engaged in the business of hiring and plying of goods carriage. His Return of Income has always been filed on presumptive basis as per Section 44AE of the Act. He has not maintained any books of accounts as he was not required under the Act. His freight collection for these 8 trucks per day is approximately Rs 40,000/- a day and he is in possession of Rs 15,00,000/- which represents receipts of last five days of freight collection. He has not deposited any cash in his bank account after 1st of November, 2016. How can he explain his cash on hand ?

The 8th line of para 2 in my post on November 19, 2016 at 5:14 pm may kindly be read as ‘However this by itself does “not” bar the taxpayer offering such deemed income in the return of income’.

An excellent thread for the lay-man – and to the expert too!

Rightly explained.

1. Some of the members in the forum are arguing that the taxpayers who had opted for IDS and paid 45% tax on undisclosed money/assets are worse-off than those who would now opt to pay 30% tax by disclosing the same as income in the current year. This is not entirely correct. The extra 15% tax paid by the taxpayers who have opted for IDS is something similar to paying insurance premium to cover the risk. The risk here is any subsequent action by the IT department like search/survey/enquiry in his/her own case or in case of any other person with whom such taxpayers has had the dealings resulting in unearthing of transactions that otherwise might have tax implications for the period covered under IDS ie. prior to AY 2017-18. Therefore, by paying the premium of 15% extra tax, the taxpayers who have declared their undisclosed assets under IDS-both movable and immovable- for the period prior to AY 2017-18 are fully insured against punitive action of penalty and prosecution .

Whereas the taxpayer who has not subscribed to IDS does not have any risk coverage. He / She can no doubt deposit the old bills of Rs 500/1000 in the bank account, declare the said cash of earlier years as income of the current year and pay only 30% tax. But he/she is exposed to the risk of subsequent action by the department resulting in unearthing of actual facts relating to cash. If the department is able to prove that the money/cash deposited in the bank account in the current year was actually that of earlier years, the consequent punitive action would follow. This is particularly true in the case of high value cash deposits made in the bank account .So it is totally incorrect to say that taxpayers opting IDS are put to disadvantage or loss.

2. The other issue is whether the taxpayer can suo moto offer the cash deposit as income u/s 68/69A in the return of income. It is seen that the relevant sections itself provides that where the assessee offers no explanation about the nature and source of the money thereof the same may be charged to income-tax as the income of the assessee of that previous year . The income under section 68/69/69A/69B/69C/69D is deemed income and does not fall under any particular head of income in terms of section 14 of the IT act. However this by itself does bar the taxpayer offering such deemed income in the return of income. In this context it is important to note that column 1(f)(ii) of Schedule OS in ITR 4 dealing with the computation of income from other sources specifically provides for inclusion of “Any other income chargeable to tax at the rate specified under chapter XII/XII-A “. The deemed income u/s 68/69A is subjected to tax at the rate of 30% u/s 115BBE which is a part of Chapter XII. Hence it can be reasonably concluded that there is no bar on taxpayer suo moto offering income u/s 68/69A.

It is highly risky to offer a legal opinion on such skeleton information.

My suggestion in the interest of nation is that if someone has cash than please deposit it with bank and pay tax at 30%. In my opinion penalty cannot be levied. Department should also take liberal view. Otherwise peoples will convert old currency with new by paying commissions to agents and it will be great loss to nation. by paying tax we will support our nation and not agents.

You will be doing great injustice to the nation and the people who made declaration under IDS and paid tax @ 45%. हिन्दी में कहावत है फिसल पड़े तो हर गंगे। Had the government not given enough warning and opportunity. I surprise and how much one can get his illicit money converted by paying commission. All this will come to halt once the government machinery which has already come into motion.

All the comments and expert opinions are kites in the air and are sure to land the assessees into a legal trap. The reasoning given for no levy of penalty or levy of only 50% penalty on unexplained income has no legal or departmental backing.

Let me add my 2 cents

1. IDS is not applicable for AY 2017-18 in terms of section 183(1) of the Income Disclosure Scheme 2016.

2. As far as any deposit in the bank account in FY 2016-17 is concerned, the same may be taxed at normal rates if it is income under any head of income specified u/s 14 of the IT act or at the rate of 30% u/s 115BBE in case the source of the deposit is unexplained.

3. Alternatively, no tax liability would be attracted if the deposits made are in the nature of the following

i. Agriculture income

ii. Cash in hand that has already suffered tax

iii. Accruals from past/ household saving

iv. Redeposit of cash periodically withdrawn either from a loan/OD or any other account hitherto disclosed in the return of income.

4.Penalty u/s 270A is only for under reporting and misreporting of income. Under reported income is quantified by taking difference between Assessed income and Returned income. Say for example if Rs 5 lakhs is the Returned income and the same is accepted u/s 143(1)a and later assessed at Rs 8 lakhs by the assessing authorities then the under reported income is Rs 3 lakhs.

5. Now the situation becomes bit tricky when the given income is subject to different rates of taxation. Take for instance, the current demonetization drive because of which a taxpayer say ‘X’ deposits Rs 5 lakhs in currency of Rs 500/1000 in his bank account and later declares the same claiming it as income from business in his/her individual return of income for AY 2017-18.

6. If the claim of X is accepted by the ITO then it suffers normal tax rate of Rs 25 thousand. However, if the assessing authority on scrutiny clearly establishes that the deposit is not income from business but an unexplained deposit, then the tax liability is Rs 1.5 lakhs. In the latter situation, the under reported income for the purpose of section 270A is nil because the quantum of assessed income and returned income remains the same at Rs 5 lakhs. The additional tax liability of Rs 1.25 lakhs ( Rs 1.5 lakhs on assessed income- Rs 25 thousand on returned income) is only on account of differential tax rate on the same quantum of income. Under such circumstances, penalty provision may not get attracted notwithstanding that X has actually misreported the facts relating to the nature of deposit of Rs 5 lakhs in his/her account and paid less than the actual tax liability.

Sir, I agree with the views of Learned CAs that no penalty u/s 270A can be levied or any other action taken by the income tax department where cash deposits are made in current year income and advance tax paid on it. I remember an incident of similar nature when I was in Hubli Karnatka in the 1980s. A feisty old man running Kalburgi Distilleries had some extra cash which he declared in his own return of income, that of his wife , seven sons and seven daughters-in-law @ Rs . 5 Lakhs per year for several years and paid tax on it. Initially all returns were accepted by ITD . Then his cases went to Special Range and the officer in charge ( name withheld) after much questioning of all u/s 131 proceeded to send proposal u/s 263 to CIT, Bangalore for reopening the assessments made and assess the amounts in the hands of the Company. When the matter came up for hearing, Shri Laxminarayan, CIT, Bangalore just asked one question to the AO as to what proof he had that the amounts belong to the Company and not the individuals in whose hands it had been declared and tax paid. AO replied that he had strong suspicion that cash declared belonged to the Company. Observing that suspicion howsoever strong cannot take the place of proof, CIT dropped the poceedings u/s 263. As the law stands today no penalty can be levied on cash deposited and tax paid in current year. A retrospective amendment would not be a very desirable thing to do by a Govt which has publicly opposed retrospective amendments! Hon. RS/ CBDT can clarify.

Any amendment by the government cannot be termed as retrospective amendment. As any amendment which is brought in the finance Bill is effective from the next assessment year. Even in every finance bill 2 rates are prescribed, one which are meant for computation of advance tax and tds and other for computing the final income. So the government has a right even to prescribe the rates different from the rates those specified in the last year finance Act for advance tax.

Secondly, it is a unique situation where persons are claiming income of the current year as high as 5000%. There are number of options available to the government.

Yes agree with the views

Above clarification will apply only where income is declared after issue of notices u/ss.142/ 143(2)/ 148/ 153A/ 153C by the AO. Where income is declared voluntarily this clarification will not apply. Moreover it was for the purposes of IDS and it refers to the income accrued/ received prior to the commencement of the Scheme. Penalty u/s.270A cannot be worked out where there is no difference between the income returned and income assessed. The AO cannot exclude income declared in the Return and again bring it to tax u/s.69/69A. Even if he does so, there may not be any difference.

In that case person has to explain source and nature of income and If he.she able to explain to the extent of satisfactions of the A.O. it is well n Good than tax on normal rate can be paid.

If cash deposited is declared as Current Income for the AY 2017-18 and Advancetax thereon is paid, in my opinion, Normal Rates will apply and no penalty u/s.270A can be levied.

IT IS MY OPINION THAT EVERY ASSESSEE IS REQUIRED TO PROVE THAT CASH DEPOSITED AFTER 08.11.2016 IS RELATED TO CURRENT FINANCIAL YEAR. IT IS THE BURDEN ON THE ASSESSEE TO PROOF. OTHERWISE SEC. 270A IS APPLICABLE.

As per FAQ (Qtn. No. 8) of circular no. 17/2016, dtd. 20/05/2016( IDS Scheme, )

“Where any income has accrued /received out of income prior to the commencement of Scheme and no declaration is made under the Scheme (IDS), then such income shall be deemed to have been accrued, arisen or received in the year in which notice under section 142/143(2)/148 /153A /153C is issued by the A.O. and the provisions of the IT Act shall apply accordingly. So from my view payment of tax @45% on cash deposits is not resolve the litigation.”

So with above clarification A.O. will taxed such deposit @ 30% under section 68, 69, 69A etc.

From my mind Person has to disclose such deposit in his books/return and to pay tax @ 30% on such amount. Penalty is any way litigated issue. Penalty may be levied if it is found to be under-reporting / misreporting.

In my personal view after payment of tax at applicable rate on amount deposited in bank account, is not amount to under-reporting / misreporting.

The provision of sec 270AA granting immunity from penalty and prosecution shall come to a shelter since AO is obligated to drop the penalty u/s 270AA if entire assessed tax with interest is paid and no appeal of quantum addition is filed

simple

Since you are senior citizen, you are having savings then, deposit the cash in your account safely. And use the same whenever is required.

I am a senior citizen. I have saved some money (in excess of ₹2.5 lakh) from my tax paid income and retained it in cash during past several years, to combat any emergency for my wife/me.

I am a regular tax payer. My s143(1) assessment is over Upto a/y 2016-17.

What should be the most cost effective method to deal with the above money? Litigation is least preferred.

If you can substantiate your savings with your drawings in the past, there will not be much of problem.

they may treat it income of earlier year i.e, A.Y 2016-17 and may start proceedings u/s. 143(3)/147. can levy penalty, since the assessee fails to explain how ur turnover is suddenly rise ?

Please also do not forget the consequences of indirect taxes particularly the Service Tax as now everything what you receive is chargeable to service tax unless it falls in negative list or exempt category.

If you can able to satisfy tax authorities about the genuineness of transaction and prove that such money in fact not earned during the current year, same cannot be taxed in current year. Tax authorities did not require to prove that income is current year income as there are presuming provisions under Income Tax Act, 1961.

I am sure that the senior citizen and the Jeweler who purchased his gold in cash would invite the attention of the tax sleuths and the attending investigation.

I have a query, There is an assessee who is senior citizen, His father died in year 2000, leaving a will for him where he gave him 25 Lakhs Cash, he is having that will with him, the assessee invested the same in the gold & deposited the same in the bank locker now in this year he has sold all the Gold at the present market rate, He is having that cash with him now, whether such assesee can deposit such cash in the bank account, whether he will be still liable to be penalized under Section 270.

!.If your client is able to positively establish the receipt of cash in the year 2000 along with the will then the source of Rs 25 lakhs is identified.In any case the department cannot reopen the case for the year 2000-01 to probe the source as the limitation period of 6 years from the end of the relevant AY 2001-02 has expired.

2.The receipts for purchase of gold worth Rs 25 lakhs and subsequent sale receipt for sum ‘X’are required for explaining the transaction in the event of which only the profit/gain on sale of gold would be subjected to normal rate of taxation in the current year. In absence of any receipt, the profit /gain would be taxed u/s115BBE at 30%

Dear Sir,

No courts can take a different interpretation (even on the grounds of public benefit) if the language of the statute is unambiguous. If the simple reading of the statute gives a clear meaning, then no other interpretation can be applied by a court.

Thus 270A (which may have been drafted with a particular intent) upon its simple reading, unambiguously states that penalty is leviable only in case of under-reporting or misreporting income.

In my opinion the wordings in Section 270 A are over simplified. Any amount of wealth un earthed in a raid by IT Department can be explained by the assessee as Income of that financial year for which there will always be time to file the IT return.

My simple querry is that, we all keep some cash with us out of our savings over a period of time, out of the income duly taxed or in case where yearly income is below taxable limit. This cash is kept handy for any emergencies, and in most of the cases, it is this amount which one is going to deposit.

Why in all the discussions it is being presumed that this cash deposit is income ( current year / previous year ) , when in actual, it is our little savings out of cash withdrawals of current and earlier year ( already taxed ) which may amount to few lakhs.

Any observations pls. share.

Sir,

If assessee has explanation about the cash deposited in account, no tax will imposed on such deposition.

But merely explanation that cash deposit is out of earlier income is not enough. One must prove that saving is out of income disclosed in earlier years. Income disclosed, leaving standard and other investment to be considered.

As far as any deposit in the bank account in FY 2016-17 is concerned, the same may be taxed at normal rates if it is income under any head of income specified u/s 14 of the IT act or at the rate of 30% u/s 115BBE in case the source of the deposit is unexplained.

Alternatively, no tax liability would be attracted if the deposits made are in the nature of the following

i. Agriculture income

ii. Cash in hand that has already suffered tax

iii. Accruals from past/ household saving

iv. Redeposit of cash periodically withdrawn either from a loan/OD or any other account hitherto disclosed in the return of income.

AS per RBI notification & PM Speech on 08 Nov-2016, legal tender of the Rs 500 and Rs 1000 has been withdrawn from 12 pm and these are now only a piece of paper.

My Question is then under which section the Income tax departmentor Police seizing such piece of papers (old note of Rs 500 and Rs 1000). Whether keeping raddi papers or say piece of papers is crime.

Such notes, though not legal tenders, would, I believe serve the purpose of evidence.

Please consider relevant notification:

language is

“in exercise of the powers conferred by sub-section (2) of section 26 of the Reserve Bank of India Act, 1934 (2 of 1934) (hereinafter referred to as the said Act), the Central Government hereby declares that the specified bank notes shall cease to be legal tender with effect from the 9th November, 2016 to the extent specified below, namely..”

Till 30th December 2016, old notes of 500 and 1000 are not piece of paper and valuable. It is correct that after that date same will be of no value more than a piece of paper.

Thanks for the experts for sharing their views,agreed with the experts view of penalty under sec.270A. Whether the Prevention of Money Laundering Act (PMLA) can be invoked in case of Deposit of Demonetised High Denomination Currency Notes beyond explainable limit.

For larger cash deposits, Suspicious Transactions reported by banks under PML Act, could invite show cause or such notices to explain the source of such deposits. This could lead to long drawn out process if source can not be shown. Even if 270A penalty can not be invoked, my suggestion is that proceedings under PML Act should not be ignored by large amount depositors.

There is no doubt that proceeding under other statutory provisions can be initiated and income tax department as well as banking system should communicate deposition of cash to other statutory bodies.

One must accept the position that it is not an declaration scheme launched by government in which normally there is provision of secrecy.

In addition to this I want to say that statutory provision of money laundering act are attracted only in case of proceeds of crime as specified under schedule to such act and as I aware Income Tax Defaults not specified in schedule of such act, therefore merely on assessment of unexplained money/ investment as income of assessee did not attract automatically proceeding under money laundering act.

While I totally agree with Mr. Baid on the implications of PML Act, “that statutory provision of money laundering act are attracted only in case of proceeds of crime as specified under schedule to such act”

I only wish to emphasise that if and when the process of reporting Suspicious Transactions Reporting is initiated by the Banks, as required to be initiated under PMLA, the end of the process leading to the proof that no criminality is involved can be extremely cumbersome.

Initiation of inquiry cannot be avoided in case income declared now and not declared in IDS.

Though I am not expert on the subject, as I understand, action under PML Act may be taken only when crime/ default etc. determined by the respective authorities and not before that action.

In present situation if a person regularly involved in a business or any other regular occupation, deposited substantial cash in bank, there is higher probability that legislative authority considered same as income earned from business and not disclosed to revenue authorities.

But for other person in-depth investigation shall be initiated by the concerned authorities, particularly in case of persons who have criminal record.

In case of penalty imposed for Misreporting of income, immunity u/s 270AA not available.

In the addition made by AO for cash deposition, it is probable that penalty will be imposed for Misreporting of income.

Agreed with experts opinions and answers. The Finance Ministry and CBDT for reasons best known to them, with or without knowledge of PM are creating panic in public mind. One has to wait and see as to what happen. In case entire deposit is not admitted as income claiming as cash balance and the AO adds it also, if the tax payers accept and pay tax within 30 days without filing appeal, they can seek immunity as provided in 270AA. Unless the Government brings in an amendment in the FA.2017 with retrospective effect, I do not see any threat and the statements of the Fin.Ministry and CBDT are only to thwart attempts by people to bring in money into circulation.

General consensus here seems to be hovering around just one of the Acts, Income tax Act. It may not be out of place here to add that under Prevention of Money Laundering Act, the Banks are required to furnish “Suspicious Transactions Report” whether or not made in cash. It is anybody’s guess whether or not notices under PML Act, to the reported entities may be sent by the Authorities, to explain and prove the source.

If a lady saves Rs 5 lakhs after her marraige in form of cash which she received from relatives, gifts in form of cash on child birth, mundan ceremany and various other occasions. She also collected some money by giving tutions. All the money was saved by her as there was no burden of expenditure on her (all household expenses met by her husband). Can she now deposit all this in bank. Earlier year returns not filed. This 5 lakhs is not the income of current year, so why would she pay tax on this income? Suppose for 10 yrs she saved Rs 50000 per year.

What is the tax implication on this?

If this interpretation is accepted as correct then it would mean that the government has perpetuated the VDIS through the law itself. Instead of speculating let us ask the CBDT to issue a clarificatory circular.

Is there any remedy left with a person who honestly wants to pay tax now?

If there is honesty,need to deposit huge cash would not have arisen!!

As per today’s news reports, the government may take action much before the due date for filing of return and proceed to levy penalty @ 200%. In this context, we shall discuss the various options available to the government and the assesses. e.g. If the department issues summon to record statement for heavy deposit of cash in account and asks for source.

Sir with due respect i want to ask one thing whether we should wait for some time & lets whether the government come with any notification in regards to that or we should suggest the person to deposit the unaccounted cash & pay the advance tax on it.

I think CBDT should come out with a circular clerifying Government stand on applicabulity of penal provisions u/ s 270A.This would help to reduce litigatiins.

Very Well explained by our Tax Experts

Do you not feel that CBDT should come out a clear directive to deal such situation for the benefit of general public and field officers.

sir I am strong opinion that provision of section 270a is at all not applicable if any person needed advise mail to me or contact me 2419001 Udaipur

Legal position has been rightly stated be Dr. Raj and Dr. Rakesh. Solution suggested is also good that government should clarify it’s position in order to avoid litigation and doubt. Further suggestion of payment of tax with penalty of 50% is also good suggestion and will be in the interest of every body and will bring desired results.

Very useful deliberations. Learnt a lot. Thanks to all.

I HAVE NOT FILED THE RETURN FOR PREVIOUS TWO YEARS NOW I DEPOSITED CASH ON 11-11-2016 IS RS.30 LAKHS TO MY ACCOUNT

I DECLARED 2.5 LAKH NET INCOME IN F Y 2013-14. NOW I WANT TO FILE THE RETURN OF F Y 2014-15 & F Y 2015-16. IS THEIR ANY POSSIBILITY TO DECLAREE MY INCOME 10 lAKH FOR TWO YEARS AND CAN I SHOW 10 LAKH CASH BALANCE IN MY ACCOUNT

Answer is Big NO . Your intention is malafide and you are inviting big trouble. Not only you will be penalised u/s.270A, but you will be prosecuted for untrue verification and abatement of offences. You must remember that this Scheme is not for converting Black-money into White. Declare entire Rs.25 lakhs as income of the Current Year and pay Advancetax thereon before the due date. My request to the Investigation Wing of the Incometax Department to search this Ravindran u/s.132 of the Incometax Act.

One is amused with the suggestion of the learned authors “that Government may take a clear stand that such deposits would fall within the meaning of under reporting requiring levy of penalty @50% of the tax amount”. The intention of the authors to find a meeting point is laudable but such a clarification would be clearly ultra vires and not binding on the assessee.

Only For the purpose of minimising penalty in search cases, under s271 AAB, an assessee is required to disclose n substantiate the manner of earning undisclosed income . If assessed income is equivalent to returned income ,in any case case ,there can not be any penalty under s. 270A…CA. Anil Garg, Indore 9827020779

Yes Tejinder, you are correct. Meaningless discussion is going on ; and these learned Experts are confusing the laymen. You may be taxed at Normal rates on the cash declared under “Other Source” and no penalty will be attracted. However pay Advancetax by due date on such income.

In My view, Prosecution Provision for willful attempt to evade Penalty may also applicable in cases where Cash deposited in More Than 25 Lacs.

In furtherance of previous comments, if cash deposited in bank is offered in ITR u/s 56 without jusifying/declaring source and due taxes paid, but in assessment, since source not available, AO assessed it u/s 68 instead of s.56, then can dept invoke 270A on the ground that chapter VI containing s.68,69,69A/B/C etc are for making additions by AO and not by assessee and since addition made, 270A attracted ?

Needs comments from learned authors / members.

I am not a tax expert. So please let me know.

Can any body revise his return for AY 2016-17 and offer the cash deposited as his “income from undisclosed sources” in that return and now pay the tax and interest.

**Up to A.Y. 2016-17, penalty for concealment of income was leviable u/s 271(1)(c) of the Income Tax Act which provided for the levy of penalty for concealing the particulars of income or furnishing inaccurate particulars of income. Thus, penalty was there for concealing the particulars of income or furnishing inaccurate particulars of income even when taxes were paid on such cash deposit by showing it as income.**

Penalty under u/s 271(1)(c) will kick in only after Returns/ Revised Returns are submitted or not submitted within stipulated time-limits. If deposited Cash is claimed as income for fy 2016-17 {and tax paid} for returns to be filed in ay 2017-18, then 271(1)(c) becomes infructuous.

Similarly, s270AA as explained by authors in such cases would yield no Penalty-Revenue as there would no difference between Returned Income and Assessed Income.

However, if Assessee is unable to prove any bonafide source of income for Deposited Cash, then it could be presumptuously held under relevant statutes that such income has accrued from Illegal activities such as Smuggling, Extortion, Drugs Trade etc. and Confiscated/ assessee Criminally prosecuted as provided by law.

Is there such provision for “presumptive” imputation in relevant laws by shifting to assessee the onus of proving that the source of income is bonafide?

Hon’ble Gujrat High Court in the case of Fakir Mohd Haji Hasan (247 ITR 290)2001 has held that if source of income is unknown, it can not be determined as to under which head (out of 5 as mentioned in s.14), it can be taxed & hence such income can not be classified even as income from other sources, for want of source The judgement was rendered on the ground of set off of B/f losses against income added u/s 68.

Now, in current scenario, if assessee declared cash so deposited u/s 56(1) without establishing exact source of income and pays tax thereon, whether it would be assesseable u/s 56(1) (chp IV) or as deemed income u/s 68(chp VI) and if it is assessed under chapter VI as deemed income, whether 270A would be invoked.

i am also agree with the opinion of the learned author but the issue is what we can do now? If any of the assessee is having huge unaccounted cash with him for past many years & now he wants to pay tax at the flat rate of 30%.

Whether he should do this or not? As the government is very serious towards the more & more serious actions in the upcoming future?

I fully agree with the view of CA Gautam Baid. There is no case of any penalty. May be the AO imposes the same and we have to fight, but it would be cleared at Appeal or at the best at ITAT.

I totally agree with the opinion of the learned author that the penalty u/s 270A will not be applicable on deposits in Banks where the same is reflected in the Return of Income.

Section 2(c)- “property” means property of any kind, whether movable or immovable, tangible or intangible, and includes any right or interest in such property.

& as per my understanding it includes money deposited in bank account as well.

You are giving the old definition. Now the definition is enlarged in section 2(26). The definition is “property” means assets of any kind, whether movable or immovable, tangible or intangible, corporeal or incorporeal and includes any right or interest or legal documents or instruments evidencing title to or interest in the property and where the property is capable of conversion into some other form, then the property in the converted form and also includes the proceeds from the property.

whether, the Courts can lift the veil to go in the root of true nature of transaction during this period.

root/purpose of the cash deposit made during this period, to know the true nature of the transactions.

ADD-on

Speculation has been rife both in knowledgeable and other quarters over the penal consequence and possible quantum, the bank deposits of old notes are potent with.

However, a conscious note deserves to be made of the following:

The quantum of 200 % penalty is, needs to be specially noted, is the maximum amount as provided for in the newly substituted sec 270 A , in place of the old sec 271(1)(c). Further, In terms of the new section, penalty has to be levied, provided there has been an ‘under-reporting’ or ‘misreporting’ of income as envisaged, so also defined, therein.

To pin point: The view floated around to the effect that the Officer has power to ‘slap’ a penalty, the maximum at that, and that too on the ground of ‘ income mismatch’, as most media reports are seen to have cautioned about, unwittingly so, is, to say in the least offensive manner, rather misleading.

Now, on the implications of, and the numerous difficulties, the new section itself, is potent with, in its implementation, the eminent critique of a leading tax lawyer,based on his analytical study of the new enactment, is open to be viewed / heard @ http://live.abstream.tv/bcasonline_budget2016/?b=bcasonline_budget2016

It is by and large established that in case huge unexplained cash is deposited , and the same is offered to tax @ 30% in terms of 115BBE in the return of income, there is no chance of initiating penalty u/s. 270A for misreporting. The learned and experienced professionals are however, requested to explain, how far the Courts can take cognizance of unethical and opportunistic behavior of the assesse, when the action of depositing and declaring unexplained income is clearly a fallout of demonetization and not honesty.

a lot of deliberate confusion is being created among genuine traders who are in a fix to deposit their day to day sales proceeds by restricting to Rs.2.5 lacs. the problem arises , have they to stop their daily sales and purchases till end of December 2016. In my humble opinion the problem is in case of ordinary savings bank account which is not normally being disclosed by the assesses in their IT return. for a regular business account there should be no problem at all. let a business continue and deposit as much as cash they can generate but keeping in view the restrictions put by section 40A 3 of I Tax act. the traders can receive checks, electronic transfers, e wallet payments, drafts and any other allowed mode. if some has put his money beyond 2.5 lacks in a savings bank account then he / she must file an IT return disclosing therein the cashflow, so that nothing is left to chance.

Situation-1

Unless and until return of income is filed under section 139 the question of section 270A will never arise.

Situation-2

Suppose you have not filed your return of income though you have deposited substantial cash into bank account from 9 November 2016 to 31 March 2017.You will receive notice u/s 131 you will land in trouble tax, interest, penalty, prosecution will follow under respective sections.

Situation-3

You filed your return of income assessed income and return income is the same so no question of section 270A.However AO will call for bank statement to check cash deposits from 9 November 2017 to 31March 2017.I don’t think that the AO can take preconceived view that “cash deposits” are out of unaccounted income in the past. It may be appreciated those cash deposits are part of income of F.Y.2016-17. So the AO cannot tax cash deposits as well as income as per return both at the same time. Therefore even in respect of “cash deposits” there is no scope for invoking penalty u/s 270A.

IF THE PERSON DOES NOT MAINTAINED BOOKS OF ACS AND FILE HIS RETURN EARLIER YEARS UNDER U/S:44 AD AND ALSO HUGE CASH DEPOSIT, WHAT IS THE EFFECT ON PENALTY UNDER VARIOUS SECTION IN INCOME TAX ?

In my opinion if income disclosed u/s 68 or 69A, tax paid u/s 115BBE, properly disclosed in return of income, as per present provision of section 270A no penalty can be imposed.

Section 68 or Section 69A is for the Dept. to invoke. Assessee cannot offer income under these sections

Your interpretation does not appear to be correct. Assessee can furnish Return of Income invoking sec. 68/ 69A voluntarily.

What will happen if the Returned Income including cash deposited in the Bank is below taxable limit of Rs.250000/300000 for the AY 2017-18 ? Will there be any tax or penalty or both ?

According to me, if the cash is deposited within the time provided and the same is offered as income in the ROI for Ay 207-18, there will not be any question of penalty as provisions of section 270A are not triggered.

If amendment comes to pay 50% tax – this would amount to be a permanent disclosure scheme.

May be so. But the penalty is to be levied on difference between the returned income and assessed income. This will be zero, hence, how the penalty will be computed. However, if the assessing officer can make out or substantiate that it is income of earlier year and assess in that year, the penalty will get imposed.

We need to look at from the angle of The Benami Transactions (Prohibition) Amendment Act, 2016 which was enacted 8 days before withdrawal of high denomination notes.

In this way even if someone is not liable for tax on his deposit, but still he may be liable in terms of this Act.

The Benami Transactions (Prohibition) Amendment Act, 2016 and original act regulate only matter with reference to property only and not with reference to money.

Benami Property Act will get attracted only when the deposit is money is being held for the benefit of someone else.

OFFHAND (not to oversight but keep in focus the sequence of relevant events):

The event of demonetisation has taken place in November, 2016; to be exact, through an official announcement over the media late in the evening on 9th November.

The source of the monies on hand in the old -now declared- bad- currency notes , that are consequently obliged to be deposited between 10th November, and 31st December, 2016, could be, -as is readily visualised, in one’s straight forward thinking will be, out of income, –

(A) either duly reported, or not so reported , for the financial year that ended on march 31, 2016 or any preceding year, in the tax return filed for the assessment year 2016-17 or a preceding assessment year, as the case may be;

(B) or reportable for the current year commencing April 1, 2016 and ending March 31, 2017, in the tax return due to be filed for the assessment year 2017-18, later in 2017.

As such, in one’s independent view, the scheme of voluntary declaration of income (IDS) would have, in terms, been strictly applicable , calling for compliance, only to cases falling under (A) above; and, only to the extent there has been concealment / non-reporting or underreporting, for the assessment year 2016-17, or any preceding assessment year.

On that premise, the question of levy of any penalty, either under the old sec 271 (1)(c) or new section 270 A, providing for such a levy, should not arise, even remotely, in cases in which the taxable income for the assessment year 2016-17 or any preceding year have been duly reported; and, if were to be questioned, could be proved by taxpayer to the satisfaction of the AO to that effect.

Pithily stated: So long as the source of the deposits made in banks, of now -bad –notes, could be satisfactorily explained and proved, – that is, cannot be rightly considered to be not commensurate with the known or declared sources of income , for the aseessment year 2016-17 or before, there appears to be no scope for levy of a penalty.

According to a close reading of the IDS , that came to be announced much earlier to the event of demonetisation, not in anticipation thereof.And in the normal course, that was intended to apply only to income that ought to have been reported , but not done, in the tax return for the assessment year 2016-17 or any preceding assessment year; not for the current assessment year 2017-18. If so, some of the observations in the write-up which seem to offer suggestions -as personally understood,- to the effect that, tax payer may have to be allowed the benefit for the current year , having regard to the differential in tax and penalty under the IDS, to say the least, does not appear to be persuasive enough for the Revenue to take a liberal view. Any way, thus far, the Revenue does not seem to have in contemplation any such leniency; except to the contrary.

Over to the learned tax experts, who have authored the write-up, presumably active in practice hence expected to know better; with a request for enlightenment of tax payers in proper light, should there be any scope at all for the Revenue to take a different view on any of the points, contrary to the position as sought to be personally explained herein above.

Section 270A will be attracted in this case because you will not be able to substantiate the source of income which amounts to ‘misreporting of income’ & consequently 200% penalty will be levied.

Section 270A attract if

income assessed is greater than the income determined in the return processed under clause (a) of sub-section (1) of section 143

Under which clause of 270A, such income will be covered.

Offering any income without substantiating the source may fall under the purview of Section 270A(9)(a) – Misrepresentation of facts which will attract 200% penalty

If you unable to disclose the source , penalty provisions are attracted, moreover you may invite penalty. So far suggestion of 50% is concerned, this is a far fetched thinking and would defeat the whole purpose.

Read PENALTY as PROSECUTOR in 4th line

Under which provision penalty for non explanation of source will be leived, if income disclosed in return u/s 69A and paid tax u/s 115BBE.

Theoretically and legally, the interpretation of learned authors are very correct. But, in my view, the department will take various steps in such cases viz. (i) to find the ways to held that it belongs to earlier years and not to the current year and may open the assessment of earlier years (ii) will give cause for initiating search and survey; and (iii) investigation by ED and FIT under PMLA etc.

What will be the implication of section 270A(9) which, inter alia, includes “recording of false entry in books of account”? Does this cover the cash deposits even in cases where “books of account” are not maintained / not required to be maintained?

Section 270A will trigger only when there is difference in returned income and assessed income as the penalty is to be levied on as a percentage of tax amount payable of under-reported income or under-reporting as a consequence of misreporting. Sub-section (3) defines under reported income as difference between the returned income and assessed income. Sub-section (9) gives instances where the under-reporting will be termed as a consequence of misreporting.

agreed too

Can section 276c also triggers when assessee doesn’t provide the source of income and claim under section 68?

If a lady saves Rs 5 lakhs after her marraige in form of cash which she received from relatives, gifts in form of cash on child birth, mundan ceremany and various other occasions. She also collected some money by giving tutions. All the money was saved by her as there was no burden of expenditure on her (all household expenses met by her husband). Can she now deposit all this in bank. Earlier year returns not filed. This 5 lakhs is not the income of current year, so why would she pay tax on this income? Suppose for 10 yrs she saved Rs 50000 per year.

What is the tax implication on this?

yes the views of CA. Pankaj sir is correct it may be so.

Sir then in such case if a person is having unaccounted cash, is there any remedy rests with him except paying advances tax & wait for the income tax letter

If huge cash is deposited and there is no explanation for the source. Whether the assessee will be under scanner of Prevention of Money Laundring Act etc..?

Yes, it can be. There is risk of investigation under Prevention of Money Laundering Act.

But it may pertinent to mention that under Prevention of Money Laundering Act only proceeds of crime and projecting it as untainted property shall be guilty of offence of money-laundering.

What about Provisions of section 277 if source of income is not substantiated. will it amount to wrong verification of return and may invite rigours of Section 277(ii) i.e. RI of 3 months to 2 yrs an with fine ?

What about service tax component?

When a person declares income u/s 69A and paid tax u/s 115BBE and disclose such facts in return (In return specific space provided for declaration of such income), how verification of such return can be held as False Verification.

You are correct. Assessees are allowed to declare income under the Head “INCOME FROM OTHER SOURCES”. So long as this Head is there, assessees are free to declare excess cash under this Head. In my opinion threats of Sec. 115BBE and Sec.270A are unfounded and meaningless. If the Govt. wants the asseessees to come clean and also wants to collect substantial Revenue, also avoiding unnecessary litigation, CDBT should issue clarification to the effect the such cash can be declared under the Head OTHER SOURCES provided the assessee pays Advance tax thereon as the applicable Slab for the AY 2017-18.

In my view Provisions of Sec 115BBE apply only when the assessing officer feels that the explanation is not proper in respect of any amount of credit etc under 69A and the same is not the prerogative of the assessee to apply suo-moto. I stand corrected please and state why I am wrong.

Section 69A reads as under:

Where in any financial year the assessee is found to be the owner of any money, bullion, jewellery or other valuable article and such money, bullion, jewellery or valuable article is not recorded in the books of account, if any, maintained by him for any source of income, “and the assessee offers no explanation about the nature and source of acquisition of the money, bullion, jewellery or other valuable article”, or the explanation offered by him is not, in the opinion of the Assessing Officer, satisfactory, “the money and the value of the bullion, jewellery or other valuable article may be deemed to be the income of the assessee for such financial year”.

In the section it is no where provided that presumptive provision can only be applied on invocation of same by AO. Presumptive provision is statutory provision and in the given circumstances such presumption ought to be invoked by assessee at the filing of return. In case presumptive provision applicable but assessee did not invoked same then AO has all statutory provision to invoke same.

Saying that only AO has power to invoke such presumptive provision and assessee cannot file return declaring income invoking such presumptive provision it not supported by the language of the provision.

Can section 276c also be imposed when assessee don’t provide the source of income ??

If income got assessed by the AO in the year in which assessee declares the same, it cannot be said that income got evaded. When no income got evaded there is no question of willful evasion of income and in such case provision of section 276C cannot be invoked.

Very true….Prosecution for Willful Attempt to evade Penalty will Attract.

When there is no attempt for evasion of tax, on what basis it will amount to willful attempt to evade penalty.

Any currency destroyed or not returned to the banks is a benefit for the govt..

you would ask how…. ?

the underlying gold reserves will be free for the govt for the un-deposited amount and it can print new currency

Penalty is for “Under Reporting” of Income. Under Reporting of income will be, when there is a difference between the income assessed and income determined in the Income Tax Return. When department is not able to prove under reporting, question of misreporting will not come into picture. The penalty should not be levied when there is no gap between Returned Income and Assessed Income and Maximum Marginal Tax is paid. If Maximum Marginal Tax is paid section 115BBE will also not come into play.

Cant such deposits be covered under “mis-reporting” of income?

If assessee declare same as unexplained income under appropriate provisions and paid appropriate tax (section 115BBE) AO cannot be treated same as mis reporting in absence of any such presumptive provision in section 270A.

what for section 115BBC of income tax ,where undisclosed income has already shown in ITR under Schedule SPI_SI_IF with higher tax rate and advance tax paid on it. Then how it will be treated as underreporting or misreporting of income u/s 270A

In my view no penalty will attract for cash deposits provided it is admitted as Income and taxes are paid @30.9% including surcharge.

Income Declaraion scheme applied to earlier assessment years. AY 2017-18 is seperate.

The wording of income declaration includes income for ay 2017 _18 aswell

Excerpts on ids

183 . (1) Subject to the provisions of this Scheme, any person may make, on or after the date of commencement of this Scheme but before a date to be notified by the Central Government in the Official Gazette, a declaration in respect of any income chargeable to tax under the Income-tax Act for any assessment year prior to the assessment year beginning on the 1st day of April, 2017

When its not applicable under ids. The person who comes under ids is considered worser than a person who not did it in ids and considering the income now. Wld it not be dis incentivise person who have gone on ids.

It is always the honesh people who are disincentivised by bringing such schemes.The law enforcing agencies should go after the black money hoarders instead of comming out with such schemes. Actually the hoarding of black money is being made easier by the introduction of Rs.2000/- notes

Is there any provision under IDS that if income not disclosed in IDS, same cannot be assessed afterword.

When there is specific presumptive provisions under income tax act (section 68, 69, 69A etc.) under which specified sum considered as income of the year in which respective incidence appears. If cash deposited in bank account considered income of the financial year 2016-17 (AY 2017-18) and AO bound to assess same as current year income (in absence of any evidence (explanation) that such income is not current year income and therefore cannot be assessed in the year in which assessee offered same for taxation), it cannot be said that assessee take any undue benefit of legislative provision.

In case same income is assessable under two different provisions and assessee opt for one provision which appeared to him as beneficial it can not be said that he cheated other person who paid more tax then him.

If opting for one provision is not legislative permitted than legislative consequence will apply.

Your opinion is correct. IDS intended to the undisclosed income and assets. Where as the cash deposit of old currency and its income chargeability pertains to the current financial year. If source is not explained, only section 115BBE comes into effect, which mandates 30% tax only. When the deposit of cash is offered as income, no penalty leviable as per section 270A. Fraternity! Please respond.

Let me add my 2 cents

1. IDS is not applicable for AY 2017-18 in terms of section 183(1) of the Income Disclosure Scheme 2016.

2. As far as any deposit in the bank account in FY 2016-17 is concerned, the same may be taxed at normal rates if it is income under any head of income specified u/s 14 of the IT act or at the rate of 30% u/s 115BBE in case the source of the deposit is unexplained.

3. Alternatively, no tax liability would be attracted if the deposits made are in the nature of the following

i. Agriculture income

ii. Cash in hand that has already suffered tax

iii. Accruals from past/ household saving

iv. Redeposit of cash periodically withdrawn either from a loan/OD or any other account hitherto disclosed in the return of income.

4.Penalty u/s 270A is only for under reporting and misreporting of income. Under reported income is quantified by taking difference between Assessed income and Returned income. Say for example if Rs 5 lakhs is the Returned income and the same is accepted u/s 143(1)a and later assessed at Rs 8 lakhs by the assessing authorities then the under reported income is Rs 3 lakhs.

5. Now the situation becomes bit tricky when the given income is subject to different rates of taxation. Take for instance, the current demonetization drive because of which a taxpayer say ‘X’ deposits Rs 5 lakhs in currency of Rs 500/1000 in his bank account and later declares the same claiming it as income from business in his/her individual return of income for AY 2017-18.