Dr. K. Shivaram, Senior Advocate, has made the fervent appeal, on the auspicious occasion of the 80th Foundation Day of the ITAT, that all stakeholders, namely, the Tax Bar, the Ld. Members, the CBDT etc, shoud collectively make an honest attempt to maintain and preserve the glory of the ITAT as one of the finest institutions of our country. The Ld. Advocate has systematically set out the precise expectations and obligations of each stakeholder

Dr. K. Shivaram, Senior Advocate, has made the fervent appeal, on the auspicious occasion of the 80th Foundation Day of the ITAT, that all stakeholders, namely, the Tax Bar, the Ld. Members, the CBDT etc, shoud collectively make an honest attempt to maintain and preserve the glory of the ITAT as one of the finest institutions of our country. The Ld. Advocate has systematically set out the precise expectations and obligations of each stakeholder

Income tax Appellate Tribunal (ITAT) – 80th Foundation Day – Vision 2022 – Celebrating 75 years of Independence of our great Nation

Expectation of the stake holders from Income-tax Appellate Tribunal on celebrating 80th Foundation Day – Vision 2022 – Celebrating 75 years of Independence of our great Nation

Introduction

On the occasion of the 79th anniversary of foundation of the Income Tax Appellate Tribunal (ITAT) on January 2, 2020, a two-day members conference was organised at Delhi. Under the leadership of Hon’ble Justice Mr P. P. Bhatt, President of the Appellate Tribunal. One of the subjects for a Panel discussion was “Expectation of the stake holders from the Income -tax Appellate Tribunal (ITAT)”.

For the purpose of discussion we have divided the subject of “Expectation of the stake holders from the Income-tax Appellate Tribunal (ITAT)”. in to seven parts, they are:

(1) From the Tax Bar;

(2) From the honourable members of the ITAT;

(3) From the Central Board of Direct taxes (CBDT);

(4) From the Ministry of Finance;

(5) From the Ministry of law and Justice;

(6) From the Judiciary and;

(7) Vision for 2022 – Celebrating 75 years of Independence of our great Nation

The Hon’ble ITAT was established on this holistic day of 25th of January 1941. Hon’ble ITAT is considered as the Mother of all other Tribunals and is one of the oldest temples of justice in our country. Over 80 years the Hon’ble ITAT has retained the glory as one of the finest institutions and role model to other institutions. This is mainly because of the following criteria adopted for function of the Appellate Tribunal:

Accessibility;

Cheapness;

Expedition;

Expert knowledge of taxation and Accountancy;

No technical formalities;

and the motto is to deliver: “Impartial, Easy and Speedy Justice” i.e. Nispakash Sulabh Satwar Nyay

We have made an attempt to pen down the expectations from all the stake holders. In the year 1989 total pendency before the ITAT was 3,00,597 and in Mumbai itself it was nearly 1 lakh. As on November 2020 total pendency before various Benches of the ITAT is approximately 90,000 appeals. This is the only institution where, despite the increase in the amount of litigation the pendency of cases has reduced. In some of the benches the matters are heard within one year of filing. Former Chief Justice of India Late Honorable Justice Mr. S. H. Kapadia while addressing the one of the conferences of the All India federation of tax Practitioners (AIFTP) stated that, when an appeal comes before the Hon’ble High Court, the question is always read first and thereafter the order of the Tribunal is read. His lordship stated that in 98% of the tax matters the Petitioners/Appellant never states that the order is perverse they only state the Tribunal erred in holding such an addition and that the addition is not justified. This shows the quality of the orders passed by the ITAT. This is the highest level of appreciation by the Judge of the apex court to the quality of the orders passed by the Honorable Members of ITAT.

On the Occasion of 40 years of the Appellate Tribunal (Four Decades) Shri N. A. Palkhivala, Senior Advocate in his Article titled “Forty Years of the Income Tax Appellate Tribunal” which was published in the souvenir of the Appellate Tribunal (1981) (at page No. 62-63) stated as under

“The Tribunal has shown great independence and courage in deciding cases according to law and in consonance with justice, regardless of the stakes involved. In short, it has fulfilled the purpose for which it was brought in to existence and fully justified the high expectations with which it was conceived”

On the occasion of 60th year of celebration of the Hon’ble ITAT, the then Honourable Prime Minster of India Late Shri A. B. Vajpayee in his message dated December 12, 2020 stated as under:

“As a quasi-judicial body, the Income Tax Appellate Tribunal has been fulfilling an important duty ever since it was set up in January, 1941. On this occasion, I urge everybody associated with the Income Tax Appellate Tribunal to dedicate themselves to their motto “Easy and Quick Justice”.

On the occasion of Platinum Jubilee celebration (75 years) the motto was enlarged as “Impartial, Easy and Speedy Justice” i.e. Nispakash Sulabh Satwar Nyay

On the occasion of inauguration of a new state-of-the-art office-cum-residential complex of the Hon’ble ITAT bench in Cuttack via video conferencing on November 11, 2020. The Honourable Prime Minster of India Shri Narendra Modi paid rich Tribute to Income tax Appellate Tribunal for rendering “Nispaksh Sulabh Satvar Nyay” to the stake holders and stated that the motto and vision of the Government is “Reform, Perform and Transform” – Tax system in India.

This has been made possible by the contribution of the Honorable Members of the ITAT, Bar members who are practicing before ITAT and Departmental representatives. In the year 2011, The International Tax Review has paid rich tribute to the Income Tax Appellate Tribunal calling it one of the 50 biggest influences in tax. The Tribute came on the strength of the recognition that the “ITAT has released countless rulings on the treatment of transfer pricing in India, with more than 100 rulings in transfer pricing this year alone”. It was a pleasant surprise to receive such a compliment from a prestigious journal. It stated, “The ITAT stands as a major influence in the approach to the practice, with tax payers all over the world using the numerous decisions as bench marks for their own documentation and transfer pricing strategy”.

The Hon’ble ITAT starts at sharp 10:30 AM every day. There could be few exceptions when there is strike, disturbance of public transport or heavy rains in Mumbai. Punctuality in court timings and discipline in taking the matters as per the serial number as a practice over the last 80 years deserves to be acknowledged and congratulated.

One must acknowledge that all the Hon’ble Presidents, Honorable Vice -Presidents and Hon’ble Members, Tax Bars and Departmental representatives have added to the growth of this mother Tribunal.

Since March, 2020, the Hon’ble Appellate Tribunal, at Mumbai and its other benches across the Nation have been constrained from conducting physical hearing. Good number of matters have been disposed by the Appellate Tribunal via virtual hearings. This has been made possible under the able leadership of the Hon’ble Justice Mr. P. P. BhattI, President of the Appellate Tribunal, ably assisted by the Hon’ble Vice Presidents, with the active involvement of the Hon’ble Members of the Appellate Tribunal. Tax Bars across the Country and the learned Departmental Representatives have been supportive and proactive regarding this process. We had made a humble submission in early September to initiate a combination of virtual & physical hearing. The Hon’ble Tribunal has been kind to consider our request and the same has been initiated.

1. Expectation from the Bar – Role of the Bar

The role of the Bar in the administration of justice is no less than that of the Bench: a good Bar makes for a good Bench. It is a partnership between equals.

The Bar and the Bench are like two sides of a coin. Both should have mutual respect and confidence in each other and only then can they play a proactive role to retain its distinctive quality as one of the finest institutions in this country and a model for other institutions to follow.

1.1. Code of ethics

ITAT Bar Association Mumbai, ITAT Bar Association Ahmedabad and All India Federation of Tax Practitioners have adopted the code of ethics to the members of their members which is part of the respective constitution. It is desired that all Tax Bar Associations which are representing before the ITAT can adopt the code of ethics adopted by the ITAT Bar Association Mumbai, which will guide the young professionals to follow the Standards-of-Professional-Conduct-and-Etiquette, which are practiced and followed by the senior members of the tax Bar.

1.2. Representation

It is desired that while making representation before the Hon’ble ITAT it would be advisable to follow the practical guide to appearing before the ITAT so that the precious time of the court time is not wasted. (Published in Publication of AIFTP -A fine balance, law practice, procedure and conventions – 2017 Edition P. 246). This will also aid young lawyers become successful in their careers and practice before various courts.

The Principles of Good Representation in taxation matters before Appellate Tribunal (2017) ‘Income Tax Appellate Tribunal – A Fine Balance, law, Practice, procedure and Conventions’ (at page No. 279) dedicated to Padma Vibhushan Late Dr. N. A. Palkhivala, Senior Advocate, can be used as a guideline.

Honourable Chief Justice of the Tripura High Court, Justice Akil Khureshi in his lecture on the subject of “What does a judge expect from Junior Advocates” in which honourable Judge has offered several valuable insights, which is equally applicable to making representation before the Appellate Tribunal. It is desired that the young professionals must read and listen to the video of the Honourable Justice Mr. Akil Khureshi.

1.3. Culture of chamber practice is diminishing – Great loss to the development of the Bar

While addressing the legal fraternity on the occasion of 150 years of the Bombay Bar Association, our Chief Justice of India Hon’ble Mr. Justice Sharad A. Bobde, then as judge of the Hon’ble Supreme Court, stated that the Chamber culture in the Hon’ble High Courts and the Hon’ble Supreme Courts is diminishing. While working in Chambers, the advocates could learn how to mention cases before the bench, defend the independence of the judiciary and all the essential skills of the profession. He encouraged the practicing advocates to train juniors and help them learn the nuances of law.

1.4. Independency of the ITAT

For maintaining the independency of this Institution, Contribution of the Tax Bar especially ITAT Bar Association Mumbai and then Hon’ble President of the ITAT Late Hon’ble Shri T. V Rajagoplala Rao deserves to be written in golden words. In the case of V.K Agarwal v. ITAT (1999) 235 ITR 175 (SC), For interfering the judicial function of the ITAT then law Secretary was held liable for contempt proceedings. In view of the PIL of the ITAT Bar Association Mumbai and AP Tax Bar Association the transfer and guidelines are laid down by the Apex Court for posting and transfer of Hon’ble Members of the ITAT. [ Ajay Gandhi v B. Singh (2004) 265 ITR 451 (SC) ]

1.5. Additional Benches

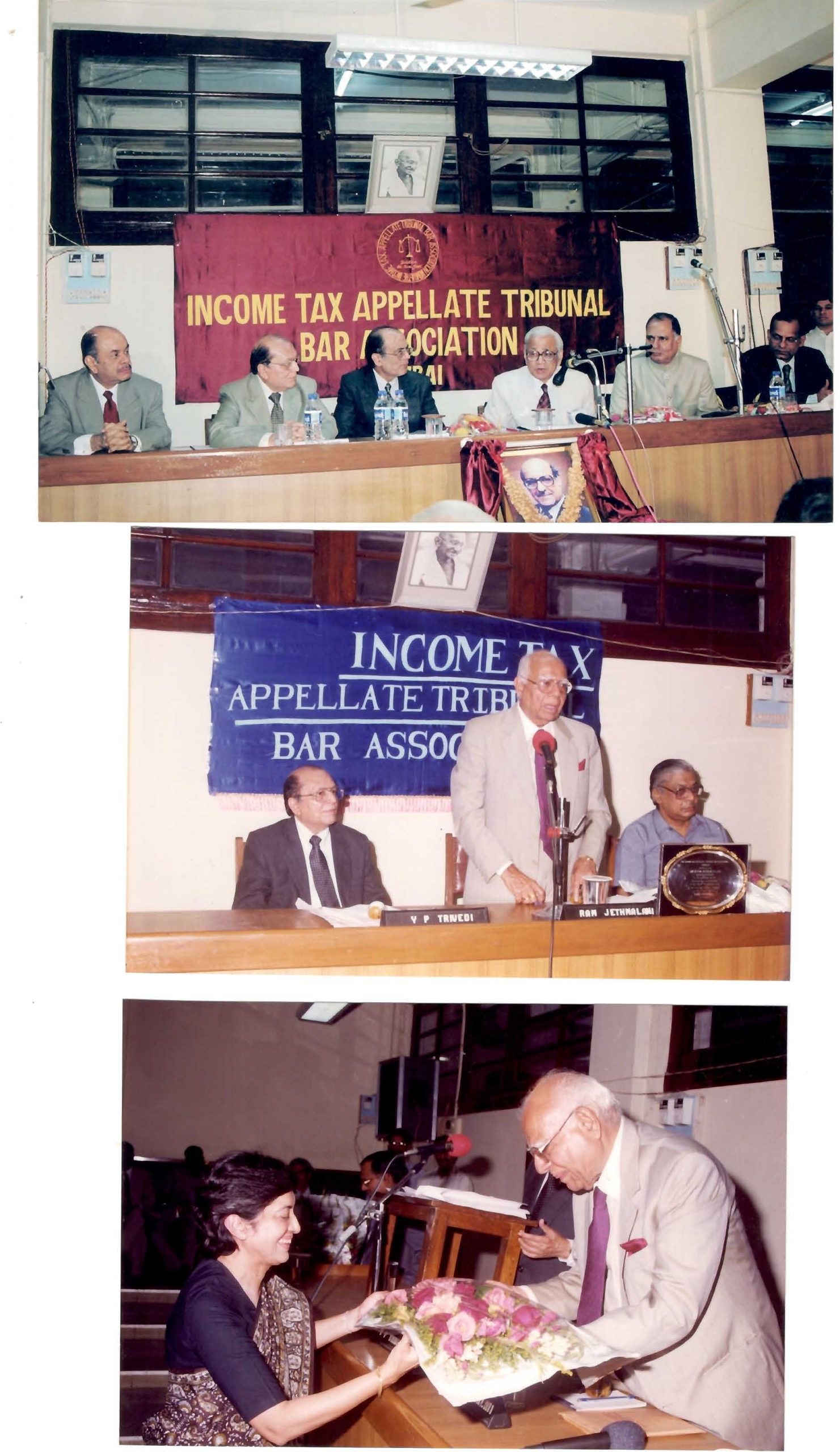

There was a move to have five additional Benches at New Mumbai. The ITAT Bar Association Mumbai has made representation before the Central Govt to allot the additional space in the same premises which was occupied by the ALL India Radio as they were not fully utilised by them. The representation was supported by the other professional organisations and also Indian Merchant Chamber. The then Urban Minister Shri Ram Jethmalani on the request of the ITAT Bar Association Mumbai had visited the premises of the ITAT on September 16, 1998 and was appreciated the need of allotment of additional premises to the ITAT.

From Left to Right: Mr. Y. P. Trivedi, Senior Advocate, President ITAT Bar Association Mumbai Honourable Mr. Ram Jethmalani, Union Minister of Urban Development Union of India , and Honourable Mr. T. V. Rajagopala Rao, President ITAT

However, in spite of recommendation of the Hon’ble Minster the Cabinet of Ministers have not agreed to the proposal of allowing addition space to the Income tax Appellate Tribunal. Having no other alternative, the ITAT Bar Association has filed a PIL before the Hon’ble Bombay High Court, due to which the additional space was allotted to ITAT Mumbai, which has helped the institution assesses as well as the tax professionals. ITAT Bar Association v UOI WP 624 of 1999 dt. 28-6-2000 (SLP no 15549/2000 dt. 18-2-2002). SLP was dismissed. The new premise was inaugurated on 16-2-2001 by then Hon’ble Law Minster Shri Arun Jaitley and Late Hon’ble Justice Mr. S. H. Kapadia then as Judge of the Hon’ble Bombay High Court.

1.6. Visit of the Chief Justice of India to ITAT Premises at Mumbai

It is for the first time in the history of the ITAT for unveiling the portrait of Late Shri N. A. Palkihvala, then Chief Justice of India Honourable Chief Justice B. N. Khare visited the ITAT premises on January 16, 2004 and unveiled the portrait at court room no. 1, wherein more than five judges of the Hon’ble Supreme Court, Chief Justice of the Hon’ble Bombay High Court, Honourable Justice Thakkar and many judges of the Hon’ble Bombay High Court were present.

A commemorative stamp in memory of Padma Vibhushan Late Dr. N. A. Palkhivala, Senior Advocate, President of the ITAT Bar Association of Mumbai, was released by the then Honourable Prime Minister of India Late Shri Atal Bihari Vajapayee.

It is a great honour that for release of commemorative stamp in memory of Padma Vibhushan Late Dr. N. A. Palkhivala, Senior Advocate, President of the ITAT Bar Association of Mumbai, then Honourable Prime Minister of India Late Shri Atal Bihari Vajapayee on January 16, 2004 at Mumbai in his address honourable Prime Minster of India Stated as under:

“In those dark days, the battle for democracy was fought by many people in many different ways. Many of us in politics under the leadership of Shri Jayaprakash Narayan fought in prisons. But I have no doubt that one of the finest battles was fought in the court rooms that fighter was Nani Palkhivala”

1.7. Public interest petitions by the Tax Professional originations

It is to be acknowledged the Contribution of the tax Bar for the better administration and functioning of the ITAT by filing PIL are as under:

► All India Federation of Tax Practitioners v UOI Income Tax Review Page 4 Vol. XXIII April 1997

Residential Accommodation to members of the ITAT – Govt agreed to provide.

► All India Federation of Tax Practitioners jointly with Rajasthan Tax Consultants association v. UOI (1998) 97 Taxman 48 (Raj) (HC) Residential Accommodation to members of the ITAT, High court has directed the Govt to provide residential Accommodation to members of the ITAT

► UOI v All Gujarat Federation of tax Practitioners (2004) AIFTPJ -April-P34 – Residential Accommodation to members of the ITAT and also telephone, newspaper library, car, secretarial assistance etc. to members of the ITAT.

► All India Federation of Tax Practitioners with ITAT Bar Association WP No 2166 of 2002

Discrimination while allotting the residential accommodation to the members of the ITAT, Court directed to make representation. Govt accepted the recommendation petition became infructuous order dated November 27, 2002

► All India Federation of Tax Practitioners v UOI WP NO 13 of 2015 and Supreme Court Advocates on Association v UOI (2016) 5 SCC 1 Appointment of the Judges collegium -Consider the suggestion of the AIFTP- Elevation of members of the ITAT

► ITAT Bar Association of Mumbai v. UOI 2350 of 1996 Income tax Review April 1997 Vol XXX111 No 1 – law Secretary intervene in the Judicial function of the ITAT. High Court stared the order of law Secretary. In the said matter the Law Secretary is held liable for contempt proceedings. Tribunal held to be Court. Guidelines prescribed for transfer of Members. Ajay Gandhi v B.Singh ( 2004) 265 ITR 451 (SC) .) ITAT v V.K Agarwal (1999) 235 ITR 175 (SC) Law secretary was held liable for contempt proceedings.

► ITAT Bar Association v UOI WP 624 of 1999 dated June 28, 2000

Additional Premises were allotted to the ITAT Mumbai. SLP no 15549/2000 dated February 18, 2002. SLP was dismissed, Matter is pending before the Bombay High Court.

► All India Federation of Tax Practitioners v. UOI WP No. 2873 of 2018 dated 27-8-2019

Departmental promotion (DPC), the Hon’ble High Court directed the ITAT to follow up the proposals to fil up the posts of Assistant Registrars at the earliest.

► All India Federation of Tax Practitioners v. UOI (WP No.868 of 2020, pending for admission)

Appointment of Hon’ble Members of the Appellate Tribunal New Rules 2020 on short tenure basis.

1.8. Publications

To better equip the tax professionals who are practicing before the Hon’ble ITAT, The ITAT Bar Association in association Mumbai, jointly with AIFTP have published three memorable publications, they are:

1. (2012) ‘Digest of case laws Direct taxes, including Allied laws – A tax Companion (2003-2011) to commemorate the 150th anniversary of the Hon’ble Bombay High Court;

2. (2016) ‘Interpretation of Taxing Statutes-Frequently asked questions’ Dedicated to Hon’ble Mr. Justice S.H. Kapadia, former Chief Justice of India;

3. (2017) ‘Income Tax Appellate Tribunal – A Fine Balance, law, Practice, procedure and Conventions’ Dedicated to Padma Vibhushan Late Dr. N. A. Palkhivala, Senior Advocate.

4. (2020) ‘151 Land mark Judgements of the Honourable Supreme Court of India ( Direct taxes ,Indirect taxes and Allied laws ) -151 Years of Mahatma Gandhi’ ( Publication of AIFTP released on 2 -10 -2020)

1.9. Development of the tax Bar – National Tax Moot court competition

For the development of the Tax Bar, ITAT Bar Association Mumbai in association with AIFTP and Government law College Mumbai have initiated Nani A. Palkhivala, Memorial Tax Moot Competition. First Moot Court competition was organized from 16th to 18th December, 2004. The Moot Court competition was continuously held for a decade. Interestingly the moot courts competition was held at the premises of the ITAT Mumbai and semifinals were judged by the sitting Hon’ble members of the ITAT and final round was judged by the sitting judges of the Bombay High Court this was made possible because of the Hon’ble President and Hon’ble members of the ITAT. Because of initiation of tax Bar now similar moot courts are held in Mumbai, Rajasthan, Kolkata etc.

1.10. Continuous education program

To better equip the tax professionals the ITAT Bar Association Mumbai started their website in the year 2008 namely www.itatonline.org. The website is very vibrant and provides information about latest case laws of the Apex Court, various High Courts, Income tax Appellate Tribunals, Authority for Advance Ruling etc. it also publishes articles written by professionals across the country and various other information. Case laws digested from 2003 to 2019 is available in the website which can be downloaded. Weekly update of the gist of the case laws are published under the head “Digest”. There is an interactive forum where in the professionals can interact and share their views. Very recently they have introduced a mechanism where one can upload the article and also important case laws on direct taxes, indirect taxes as well as Allied laws. The website also publishes gist of speeches and also provides link to important video which are hosted.

Possibly this is one of the greatest contributions of the tax Bar for the development of the tax profession and for better representations before the appellate Tribunal and various Appellate authorities.

Late Honourable Mr. Justice S.H. Kapadia, former Chief Justice of India, while addressing the National convention of AIFTP at Mumbai stated that “Every wrong advises given by the Tax Professionals have economic consequences. It is the duty of the Tax Professionals not to encourage tax evasion in the garb of tax planning. There is a very thin line between legitimate tax litigation and illegitimate tax evasion. Your Federation has prescribed a Code of Conduct in which they have laid down the duties of tax lawyers to their clients, to their opponents and to the Court. I recommend one more clause – ‘Duty to the Country’”.

We hope the tax professionals will respect the vision of Late Honourable Mr. Justice S. H. Kapadia and follow his advice.

2. Expectation from the Honorable Members of the ITAT.

It is noteworthy that the ITAT is the only institution where the Honorable members though governed by the service Rules have adopted the Code of ethics adopted by the Honorable Judges of the Hon’ble Supreme Court and High Courts.

The code of ethics and conventions is also published in the publication Income tax Appellate Tribunal – (2017) A fine balance, law Practice procedure and conventions dedicated to Padma Vibhushan Late Dr. N.A Palkhivala. ITAT also published the conventions to be followed by the hon’ble members in the Bench and also off the Bench. (at Page nos 258 & 267)

The Tax Bar and assesses are having high expectations form the ITAT. On occasions we hear from the assesses that CITs(A) is of the view that they cannot give the relief but a relief can be claimed from the Tribunal. Members of the Tribunal may have to consider that, in hearing the appeals, they are not merely adjudicating on the issues before them but they are deciding on the fortune of the assesses. Hence the members of the Tribunal have a greater responsibility towards the tax payers of our country and also maintain the honor and dignity which this institution built over the last 80 years of its existence.

Judges are remembered by the quality of the judgements delivered by them. Few instances are;

Mr. R. J. Kolah was arguing before Supreme Court Bench headed by Honorable Mr. Justice J. C. Shah. It was the departmental appeal and after hearing the other side Honorable Justice Mr. J. C. Shah told Mr. Kolah “Mr. Kolah, we have read the judgement and Mr. Desai has also read the judgment. There is no need for you to read it again”. To this, Mr. Kolah replied “My Lords, your Lordships have read the judgement in your way and my learned friend has read it in the way it suits him. Your lordships will now read the judgment with me in my way” and the Hon’ble Judges allowed him to continue and they have decided in favour of the assessee. (A Tribute to the Stalwarts of the Tax Bar i.e. Late Shri R.J. Kolah, late Shri N. A. Palkhivala and Late Shri S. P. Mehta – AIFTPJ August 2003.)

Mr. V. H. Patil was arguing a matter before the Hon’ble Bombay High Court on an issue relating to taxation of Partnership, Honorable Justice Mr. S. K. Desai in the beginning commented that tax counsels think they know everything but this is issue relating to partnership, and that there is no case and he has read the order of Tribunal. My senior requested the lordship to let him read the relevant provisions of the partnership Act, and then lordship may decide accordingly. When my senior completed the argument, Honorable Justice Mr. S. K. Deasi remarked that Mr. Patil was right and that he wrong, and apologized for his harsh words. The matter was decided in favour of the assessee.

When one of our bar’s members was arguing miscellaneous petition before the ITAT, the judicial member asked the counsel to file an affidavit. Shri S. P. Mehta was present in the Court and addressed the Bench stating that when a counsel makes statement in the open court, it has to be believed, and that they will not file the Affidavit of the counsel. Ultimately, the matter was heard without the affidavit of the counsel.

2.1. Case laws which can be useful to new members to be appointed in due course of time and Judicial precedents on expectations from the Hon’ble members are while deciding the matters:

► Lakhmi Mewal Das v ITO (1972) 84 ITR 649 (Cal) (HC) (659)

K.L Roy J. 6-3-1970: After I dictated my judgement in this matter Dr Pal requested for an opportunity to argue the case on only one point, viz, on the decision of the Supreme Court in ITO v. Bachu Lal Kaproo (1966) 60 ITR 74 (SC), a passage from which had been quoted and relied on in my judgement and which, not having been cited before me in the course of arguments, Dr. Pal has an opportunity of making his submissions on the on the afore said decision of the Supreme Court. Dr. PAL Submitted, and in my opinion correctly, that the facts before the Supreme Court were different from the facts in the present case and I agree with Dr. Pal in that case notice was served under section 34 of the 1922 Act within four years and Supreme Court had no occasion to consider Section 147(a) of the Act which is in the present case.

► PCIT v. M. J. Export Pvt. Ltd. (Bom)(HC), www.itatonline.org

The Tribunal should not make general observations that there are "contrary decisions"- Tribunal to be specific about the decisions and make a mention of the citation in the order and not make general observations.

► Ritha Sabapathy (Smt) v. Dy.CIT (2019) 416 ITR 191/ 308 CTR 417 / 263 Taxman 84/177 DTR 178 (Mad) (HC)

Even if the assessee could not appear, the Tribunal could have decided the appeal on merits. Court also directed to send the copy of the Judgement to the President of the Tribunal as well as Law Secretary in the Ministry of law and Justice so that the same may be brought to the notice of all the Members of the Tribunal. (Referred Balaji Steel Re. Rolling Mills v. CCE&C (2014) 29GSTR 502 (SC) / (2015) AIRSCW 426. (Ratio in CIT v. S. Chenniappa Mudaliar (1969) 74 ITR 41 (SC))

► Shirpur Gold Refinery Ltd v Dy.CIT (2019) 262 Taxman 390 (Bom) (HC)

Non speaking orders- The CIT(A) allowed the claim of expenditure and depreciation after verification of merits- Tribunal was not right in in law reversing the said conclusion without examination.

► Co-Operative Centrale Reiffeisen-Boereleenbank B. A. v. Dy.CIT (2018) 170 DTR 41 / (2019) 411 ITR 699 (Bom.)(HC)

Court held that Tribunal could have summoned all records and thereafter should have arrived at categorical conclusion whether First Appellate Authority was right or AO. It failed to discharge it duties.

► CIT v. Dr. K. Kannagi and Dr. N. Rajkumar (2020) 424 ITR 470 (Mad) (HC)

Even in affirming the findings of the authorities below, the burden was heavier for the higher appellate authority when it decided to reverse the findings of the authorities below.

► PCIT v. Montage Enterprises Pvt. Ltd. (2018) 409 ITR 185 / 305 CTR 444 / 171 ITR 70 (Delhi)(HC)

Reversal of findings of fact of Assessing Officer by Tribunal without recording reasons and also not deciding the cross appeal filed by the department. Matter remanded to Tribunal for fresh adjudication.

► Cheryl J. Patel v. ACIT (Bom.) (HC) ITA 424 & 643 of 2016 (Bom) (HC)

The Appellate Tribunal should give an independent reason showing consideration of the submissions made on behalf of the assessee.

► CIT v. Tara Ripu Dhamanpal Trust (2018) 409 ITR 102 (P&H) (HC)

Reasoned speaking order which is the mandate as laid down by the Supreme Court in Kranti Associates Pvt. Ltd. v. Masood Ahmed Khan (2010) 9 SCC 496 and Canara Bank v. V. K. Awasthy (2005) SC 2090

► DSP Investment Pvt Ltd v. Add. CIT ITA No 2342 of 2013 dt 8-03 2016 (Bom) (HC)

Tribunal is not justified in referring the Judgment not dealing with, considered as non-speaking order violation of natural justice, order was set aside.

► Reliance Infrastructure Ltd vs. Dy.CIT ITA No.701of 2014 dt.29-11-2016 (Bom) (HC)

Referring the judgment in favour of assessee and not dealing with the case would make the order suspect. Ex facie, it is a breach of principle of natural justice. Order of Tribunal is set aside.

► Shivsagar Veg.Restaurant v ACIT. (2009) 317 ITR 433 (Bom) (HC)

Order passed by Tribunal after more than four months from date of hearing without assigning reasons and dealing with propositions and case law relied upon by assessee, suffered from non-application of mind and, thus, is to be quashed.

► Dattani and Co v. ITO ITA No. 847 of 2013 dt 21-10 2013 (Guj) (HC)

Decision relied not considered; order of the Tribunal is remanded.

► Lakhmi Mewal Das v ITO (1972) 84 ITR 649 (Cal) (HC) (659)

After dictation a passage from the judgment of the supreme Court was quoted, which was not cited in the Course of hearing. Counsel said give me an opportunity to address, which was granted and judges recorded that the passage recorded by them were not applicable to the facts of the case.

► Bhavya Construction Co. v. ACIT (Bom)(HC) ITA 1009 of 2017 dated January 30, 2020 (Bom) (HC)

Relying on the case laws not cited by both the parties and not dealing with the case law cited by the representative of the assessee. Matter remanded to the Tribunal to pass the fresh order

► Kranti Associates Pvt Ltd v Masood Ahamed Khan & ors (2010) 9 SCC 496

Order passed by a quasi-Judicial authority or even an administrative authority, affecting the rights of parties must be a speaking order supported with reasons. Summarized in (para 5.1)

(a) In India the judicial trend has always been to record reasons, even in administrative decisions, if such decisions affect anyone prejudicially.

(b) A quasi-judicial authority must record reasons in support of its conclusions.

(c) Insistence on recording of reasons is meant to serve the wider principle of justice that justice must not only be done it must also appear to be done as well.

(d) Recording of reasons also operates as a valid restraint on any possible arbitrary exercise of judicial and quasi-judicial or even administrative power.

(e) Reasons reassure that discretion has been exercised by the decision maker on relevant grounds and by disregarding extraneous considerations.

(f) Reasons have virtually become as indispensable a component of a decision-making process as observing principles of natural justice by judicial, quasi-judicial and even by administrative bodies.

(g) Reasons facilitate the process of judicial review by superior courts.

(h) The ongoing judicial trend in all countries committed to rule of law and constitutional governance is in favor of reasoned decisions based on relevant facts. This is virtually the life blood of judicial decision making justifying the principle that reason is the soul of justice.

(i) Judicial or even quasi-judicial opinions these days can be as different as the judges and authorities who deliver them. All these decisions serve one common purpose which is to demonstrate by reason that the relevant factors have been objectively considered. This is important for sustaining the litigant’s faith in the justice delivery system.

(j) Insistence on reason is a requirement for both judicial accountability and transparency.

(k) If a judge or a quasi-judicial authority is not candid enough about his/her decision-making process then it is impossible to know whether the person deciding is faithfully to the doctrine of precedent or to principles of incrementalism.

(l) Reasons in support of decisions must be cogent, clear and succinct. A pretence of reasons or rubber stamp reasons is not to be equated with a valid decision-making process.

(m) It cannot be doubted that transparency is the sine qua non of restraint on abuse of judicial powers. Transparency in decision making not only makes the judges and decision makers less prone to errors but also makes them subject to broader scrutiny (See David Shapiro in Defence of Judicial Candor (1987) 100 Harvard Law Review 731-737).

(n) Since the requirement to record reasons emanates from the broad doctrine of fairness in decision making, the said requirement is now virtually a component of human rights and was considered part of Strasbourg Jurisprudence. See (1994) 19 EHRR 553, at 562 para 29 and Anya v. University of Oxford 2001 EWCA Civ 405, wherein the court referred to Article 6 of European Convention of Human Rights which requires, “adequate and intelligent reasons must be given for judicial decisions”.

(o) In all common law jurisdictions judgements play a vital role in setting up precedents for the future. Therefore, for development of law, requirement of giving reasons for the decision is of the essence and is virtually a part of “due process.”

► Canara Bank v V.K. Awasthy (2005) 6 SCC 321

One essential requirement is that Tribunal should be impartial and have no personal interest in the controversy, and further that it should give ‘a full and fair opportunity ‘to every party being heard

2.2. Thoughts for consideration

One of the Commissioner was selected as member of the ITAT at that time he was Commissioner DR in settlement commission. After the hearing he called me in his chamber and told me that he was told that I am one of the Counsels who regularly appears before the ITAT, he wished to know as to how the Bar judges a member as a good member and what are the qualities that he should possess. Some of the thoughts shared that day are as under:

►When the honourable member presides over the Bench as a member, they have to forget that earlier you were tax administrator they have to decide the cases as per the law follow the mandate of the Constitution of India Article 265, “No tax shall be levied or collected except by authority of law”

► On Bench honourable member should be courteous and fair whether the appearance is by Senior or Junior

► On the Bench, if the Honourable has any doubt arises, try to get the clarification from the representatives at the time of hearing

► On the Bench, honourable member should not try to convince the representatives that he is wrong

► First try to understand the facts.

► Give an opportunity to develop the arguments on first principle and there after case laws

► Don’t go by the Trial by media or paper reporting

►While dictating the order honourable member may come cross a judgment whether favour or against are relevant the Honourable member should give an opportunity to the parties concerned.

► Order should contain arguments of both the sides and reasons in the order for rejecting or accepting the submission

► The decision-making process must be transparent.

►While giving adjournment one need not be so strict be liberal at least for three adjournments thereafter be strict.

After joining the Bench, the Learned Accountant member served in Mumbai, on his superannuation a rich tribute was paid by the ITAT Bar Association Mumbai by holding a full court reference in his favour.

For instance, on retirement of one of the Accountant Members, Honourable Shri N. R. Prahbu, the ITAT Bar Association Mumbai had full court reference and a large number of members attended, and everybody prised for honourable members qualitative judgments. Honourable member openly acknowledged that when he was in department, he was under the wrong impression that the ITAT is only for the assessee they are deciding the favour of assessee and not revenue. That it is an assessees Tribunal. When Honourable member started hearing the appeals honourable member realised that the ITAT is doing justice it is the revenue which creates huge demand without any supporting reasons.

It is desired that all new members who are likely to be appointed must read the article written By Mr S. E. Dastur, Sr. Advocate, “My Ideal Tribunal Member” (A reflection by S. E. Dastur) It is published in the year 2001 P. No 162 on the occasion of 60 years of celebration. (75th years Souvenir P. 216) www.itatonline.org. Some of its salient features are as under:

It is also worth acknowledging the Letter dated 11-12-2007 by then President of the ITAT on how to pass the orders.

2.3. Amicus curiae

Where an important issue is involved and if it is affecting large number of assesses. When as assessee is not represented before the Tribunal or in case if represented if not getting proper assistance it may be desirable for the Bench to request the Bar Members to assist the Bench as amicus curiae. Normally High Courts and Supreme Court follows this procedure. Once the judgement is delivered the it is binding on all the Tribunal till it reversed by the higher forum.

3. Expectation from the Central Board of Direct taxes (CBDT)

3.1. Acceptance of orders of High Courts

Earlier, whenever the Department would accept a decision of a particular High Court on interpretation of law, the Central Board of Direct taxes used to issue a circular stating that interpretation has been accepted. This practice seems to have been discontinued now. If this process is adopted and instructions /circular are published, the litigation will be reduced considerably. Hon’ble Bombay High Court in CIT v. TCL Ltd. (2016) 241 Taxman 138 (Bom.)(HC) has passed a detailed order asking the Chief Commissioner of Income tax to host details of the matters admitted before the Bombay High Court, matters accepted by the Revenue, etc. online. Though the assurance was given by filing an affidavit, however, no action seems to have been taken by the tax administrative authorities in this regard.

3.2. Yearly publication of list of cases pending before various High Courts and Apex Court.

In taxation matters the department is party either as petitioner or respondent. In each state one of the officers of the department may be deputed to prepare the list of cases filed before the Hon’ble High Court questions of law and sections involved. Questions admitted or rejected. This can be published yearly basis in the website of the CBDT. Which can be up dated day to day basis. This will help the tax payers, tax administration as well as judiciary. Highest pendency of 10,000 appeals are in Mumbai and other High Courts put together it may not be more than another 15,000 matters. Same systems may be worked for writ petitions and matters pending before Supreme Court.

3.3. Mechanism to discuss and take action on suggestions made by the Apex Court, High Courts and other Judicial authorities

It has been observed that various High Courts make several recommendations to CBDT to look into certain matters and take appropriate measures. However, it appears, there is no mechanism to find out whether the issue is actually brought to the notice of the Ministry concerned and what action has been taken. It is therefore, advisable to put up such suggestions on their website for public domain and after considering various suggestions, appropriate action can be taken. This will bring transparency in the functioning of the Ministry and will also bring accountability.

In the AIFTPJ – April, 2016 at page no. 5. We have referred about 16 Judgements where in Courts have passed strictures against the department for failure to follow the due process of law. We have also recommended that if directions are followed, it may be communicated by press release or by way of Circular. Judiciary can pass the orders to address the grievances to improve the administration, there is no mechanism by which the judiciary is able to overseas the implementation of its orders. We feel it is the duty of the Bar to ensure proper implementation of the orders by making representation or by the Help of Right of Information.

► Arun Ganesh Jadav v UOI (Bom) (HC) www.itatonline.org

High Court directed the department to follow direction of Delhi High Court in court on its own motion v CIT (2013) 352 ITR 273 (Delhi) (HC). Department was also directed to set up a self -auditing vigilance cell to redress tax payers’ grievances

► Shakari Khand Udyog Madan Lal v ACIT (2015) 370 ITR 107 (Guj) (HC)

Guidelines to streamline the procedure for reopening of assessment in state of Gujarat. It is desired that CBDT should direct all Assessing Officers to follow the guidelines.

► CIT v State Bank of India (2015) 375 ITR 20 (Bom) (HC)

Department cannot arbitrarily pick and choose which orders of the ITAT should be challenged in the High Court. Special Bench order is not challenged, order decided in favour relying on the special Bench is challenged

► Piramal Fund Management pvt. Ltd v DCIT WP 526 of 2016 dated March 17, 2016 (Bom) (HC)

Strictures were passed against high-handed and un fair approach of the AO in refusing to give an acknowledgement of stay application. The Chief CIT was directed to ensure that such behavior is not repeated. Department was directed to nominate another AO to hear stay application.

► A.T. Kearmey India Pvt Ltd v ITO (2014) 363 ITR 172 (Delhi) (HC)

The honorable High Court warned the Assessing Officer of contempt action for seeking to overreach ITAT’s stay order and directed the revenue to lift the attachment and ensure that the amounts recovered are deposited bank account of the assessee. A copy of the order was also sent to the CBDT Chairman.

► CIT v. Reliance Infrastructure Ltd (Bom) (HC) ITA 803 of 2012 dated October 10, 2014 (Bom)(HC)

High Court summoned the senior Officials of the department and strictures were passed for “irresponsible conduct” of filing an appeal on a point which was admittedly covered against the department by a judgement of Supreme Court.

► CIT v Harinagar Sugar Mills Ltd (2014) 226 Taxman 190 (Bom) (HC)

the High Court did not condone the delay of 117 in filing appeal and 1248 days in filing review petition. A copy of the order was forwarded to the Chief Commissioner of Income tax and Secretary, Finance Government of India for remedial action.

► Thermax Babcock & Wilcock Ltd v CIT (Bom) (HC) ITA 17 of 2002 March 04, 2014

The High Court laid down Zero tolerance policy over adjournments. It was held that appeals may be dismissed, heard ex -parte and / or costs imposed if counsels are not prepared. The Copy of the order was forwarded to Joint Secretary, Department of law & Judiciary, Government of India.

► CIT v. Kirloskar Oil Engineers Ltd (2014) 364 ITR 88 (Bom) (HC)

The Department was given last opportunity and warned of heavy cost for wasting judicial time by filing appeals on covered matters.

► BBC World News Ltd v ADIT (2014) 362 ITR 577 (Delhi) (HC)

Proceedings of original records were not found. The High Court expressed alarm at the shoddy record keeping by the Department. Adverse remark was made because papers / documents on record were not serially numbered and indexed. Direction were given to keep proper records.

► UTI Mutual Fund v ITO (2012) 345 ITR 71 (Bom) (HC)

Referring the judgements in KEC International v. B.R. Balakrishnan (2001) 251 ITR 158 (Bom) (HC), the Court laid down the guidelines on how stay application should be dealt with

► Rajasthaani Sammelan, Balika Vidyalaya and ors v ADIT (2013) 350 ITR 349 (Bom) (HC)

High Court cautioned the Department and directed it to follow the settled guidelines for recovery of tax.

► Milestone Real Estate Funds v. ACIT (2019) 415 ITR 467

Stay – Strictures- Recovery proceedings were stayed- Revenue was directed to re deposit the amount with drawn from the Bank – Order set aside -Court also expressed dismay at the conduct of the Officers of the Revenue- The desire to collect more revenue cannot be at the expense of Rule of law-Revenue to pay cost of Rs. 50,000 to the Petitioner for the unnecessary harassment

► Sanjay Jain v. Nu Tech Corporate Service Ltd. (SC), SLP(C) D. No. 48031 of 2018 dated March 1, 2019

Editorial: Nu-Tech Corporates Ltd v. ITO (2018) 259 Taxman 183 (Bom) (HC)

Illegal Recovery – Strictures against DCIT- Adjustment of refund -High Court was not justified in its remarks against the DCIT and in issuing directions that (i) ‘deadwood’ should be weeded out (ii) personal costs of Rs. 1.5 lakh should be imposed (iii) adverse entry should be made in the Annual Confidential Report (iv) Denial of promotion etc. The directions were wholly unnecessary to the lis before the Court & are expunged

► ITO v. Rayoman Carriers Pvt. Ltd (2019) 167 DTR 393 /199 TTJ 912(SMC) (Mum)(Trib)

Rectification of mistake apparent from the record –Strictures- The insinuation of the Dept that ITAT passes order in a state of oblivion displays a totally irresponsible and cavalier approach on the cusp of contempt and deserving exemplary cost to purge the same. Referring in a deriding manner that the ITAT started with the grounds of appeal, displays the naiveté of revenue authority purporting to be critical examiner of ITAT verdict, which is uncalled for- I express deep anguish at this approach of the department and hope that revenue will disband this cavalier and naïve approach while insinuating about the functioning of the ITAT without verifying their record.

► PCIT v. JWC Logistics Park Pvt. Ltd. (2018) 404 ITR 310 (Bom.)(HC)

Strictures passed against Dept’s Advocate for “most unreasonable attitude” of seeking to reargue settled concluded issues and not following the judicial discipline and law of precedents.

► Zuari Foods and farms Pvt. Ltd. v. ACIT (2018) 408 ITR 279 (Bom.)(HC)

Court directed the Counsel to furnish the compilation of judgments on reassessment proceedings to the Commissioner to study the same. Even for reopening the assessment with in four years there are certain jurisdictional requirements that must exist before the power of reassessment is exercised. Strictures passed against the AO for making comments which are highly objectionable and bordering on contempt and for being oblivious to law

► Sicom Ltd. v. DCIT (Bom.)(HC), WP 2460 OF 2018 dated October 1, 2018 (Bom)(HC)

Strictures – The Dept should bring some order and discipline to the aspect of granting refunds. All pending refund applications should be processed in the order in which they are received. It is the bounden duty of the Revenue to grant refunds generated on account of orders of higher forums and disburse the amount expeditiously. In the absence of a clear policy, the Courts may impose interest on the quantum of refund at such rates determined by the Court – Registrar of High Court is directed to forward copy of the order to the PCIT and the Chairperson – Central Board of Direct Taxes.

► XL Health Corporation India Pvt. Ltd. v. UOI WP No. 37514/2017 October 22, 2018 (Karn.)(HC)

Strictures – The total callous, negligent and disrespectful behaviour shown by the Departmental authorities in this Court should not be tolerated at all. It is this kind of lack of judicial discipline which if it goes unpunished, will lead to more litigation and chaos and such public servants are actually a threat to the society. Commissioner Service tax (Appeals) should pay cost of Rs. 1 lakh from his personal funds.

► ITO v. Randhir Singh (2018) 163 DTR 10 / 192 TTJ 64 (SMC) (Chd.)(Trib.)

Remand report – Strictures – Once the AO was satisfied in the remand proceedings and did not oppose not controverted the documents filed by the assessee, he cannot be said to be aggrieved by the Order passed by the CIT(A) considering his own remand report – Merely on account of change of the AO, presumably the incumbent cannot be allowed to file appeals willy nilly. Such rampant careless behaviour shakes the public trust and faith reposed in the authority of the AO to act fairly and impartially.

► ITO (E) v. Chandigarh Lawn Tennis Association (2018) 193 TTJ 256 / 163 DTR 113 / 66 ITR 14 (SN) (Chd.) (Trib.)

Interim stay – Contempt – Strictures passed against the Department for confronting, showing resentment and displeasure to the Tribunal for granting interim stay against recovery of demand. Petition of revenue was dismissed with costs of Rs. 20,000/- to be deposited in Prime Minister’s Relief fund within 15 days of receipt of the copy of this order.

► PCIT v. Bank Note Paper Mill India (P.) Ltd. (2018) 256 Taxman 429 / (2019) 412 ITR 415 (Karn.)(HC)

Strictures – The Court deprecated the tendency of the Revenue to file appeals even though the issues were ex facie covered by the decisions of the jurisdictional High Courts or even the Supreme Court of India – Copy of order forwarded to Chief Commissioner, CBDT, Ministry of Finance, Department of revenue for need full action

► PCIT v. Radan Multimedia Ltd. ITA 1320 of 2018 dated September 26, 2018 (Bom.)(HC),

Strictures – Subsequent event was not brought to the notice of High Court by revenue – Court held that there is no discipline in the manner the Dept conducts matters. The Dept should not take legal matters casually and lightly. There should be a dedicated legal team in the department. Lack of preparation is affecting the performance of the advocates. They do not have full records & do not have the assistance of officials who can give instructions. The Commissioner of income tax should devote more time to their work rather than attending some administrative meetings and thereafter boasting about revenue collection in Mumbai.

► PCIT v. Starflex Sealing India Pvt. Ltd. ITA 130 of 2016 dated August 2, 2018 (Bom.)(HC)

Strictures passed, passed against the revenue for not following the assurance given earlier – Court observed that “We are pained at this attitude on the part of the State to obtain orders of admission on pure questions of law by not pointing out that an identical question was considered by this Court earlier and dismissed by speaking order. Revenue has not carried out the assurance which was made earlier. Revenue should give proper explanation why assurance given earlier is not being followed. It is time responsibility is fixed and the casual approach of the Revenue in prosecuting its appeals is stopped”

► CIT v. Hapur Pilkhuwa Development Authority (2018) 304 CTR 337 / 169 DTR 281 / 258 Taxman 125 (SC)

Strictures – Delay of 596 days – Misleading statement about pendency of similar appeal – Petition was dismissed – Awarded cost of Rs. 10 lakhs to be paid to the Supreme Court Legal Services Committee.

► Kalyani Motors Pvt. Ltd. v. Deputy Commissioner (Audit) VAT WP Nos.60480/2016 dated September 24, 2018 (Karn.)(HC)

Court is pained by the manner in which the authority has passed the order just ignoring the applicable Notification and throwing it to winds. The said order is nothing less than suffering from malice-in-facts as well as malice-in-law. The responsible officer deserves to pay the exemplary costs of Rs. 50,000/- for passing such whimsical order from her personal resources or by deduction from salary

► UOI v. Pirthwi Singh (SC) Diary No. 4893 of 2018, dated 24-4-2018

National Litigation Policy – Burdening the Court with frivolous litigation – Strictures passed – Union of India has created a huge financial liability by engaging so many lawyers for an appeal whose fate can easily imagined on the basis of existing orders in similar cases. Yet the Union of India is increasing its liability and asking the tax payers to bear an avoidable financial burden for the misadventures. Appeal was dismissed with cost of Rs. 1,00,000/-.

► Digipro Import & Export Pvt.Ltd. v. UOI Appeal No. 3070 of 2017, dated 15-5-2017 (Delhi) (HC)

Severe strictures passed to condemn the illegal practice of the Dept of collecting undated cheques from taxpayers after search/survey without even quantifying the extent of duty evasion. Attempt of the unscrupulous officers is to ‘negotiate’ the evaded duty by threats and coercion. It is not rule of law but anarchy unleashed by holders of public office. It is an abuse of law which has to be stopped-Central Vigilance Commissioner (CVC) is directed to issue the guide lines.

► CIT v. Parle Biisleri Ltd. (Bom) (HC); (NM. No.1672 of 2017 in ITA No. 448 of 2014, dt. 28.08.2017.)

Delay of 1128 in filing the appeal was not condoned and Severe strictures passed against the department for filing a ‘patently false’ affidavit

► PCIT v. Diana Builders & Contractors Pvt. Ltd. ITA 934 of 2016 dated April 17, 2017 (Delhi) (HC)

Delay of 448 days in filing of appeal was not condoned and strictures passed regarding the "standard excuses" of the department for delay in filing appeals, namely, budgetary constraints, lack of infrastructure to make soft copies, change of standing counsel etc.

► CIT v. Krishan K. Agarwal SLP(C) 871 of 2017 January 16, 2017 (SC)

We are extremely unhappy with the delay of 3381 days in refiling the special leave petition but make no other comment. The concerned authorities need to wake up. The special leave petition is dismissed both on the ground of delay as also on merits

► Clarion Power Corp v. Commissioner of Customs (CESTAT) (Trib.) Appeal No. C/126/2007-DB dated January 17, 2017

Advocate – Strictures passed against Advocate for making frivolous arguments without having the file and wasting the valuable time of the Court. Costs imposed of Rs 1000.

► State of Jharkhand v. Lalu Prasad Yadav (SC) Cr A No.394 of 2017dated May 8, 2017

Severe strictures passed against the High Court for "inconsistent decision-making" and passing orders which are "palpably illegal, faulty and contrary to the basic principles of law" and by ignoring "large number of binding decisions of the Supreme Court" and giving "impermissible benefit to accused". Law on condonation of delay explained. CBI directed to implement mechanism to ensure that all appeals are filed in time

► Sushila Devi v. CIT (2017) 292 CTR 116 (Delhi)(HC)

Department’s recalcitrance to release the assessee’s seized jewellery, even though it is so small as to constitute "stridhan" and even though no addition was sustained in the assessee’s hands, is not "mere inaction" but is one of "deliberate harassment. The respondents shall also pay costs quantified at Rs. 30,000/- to the petitioner, within four weeks, directly.

► Piramal Fund Management (P.) Ltd. v. Dy. CIT (2016) 383 ITR 581 / 133 DTR 250 / 286 CTR 175 (Bom.)(HC)

Stay Petition – Strictures passed against unfair conduct of AO – AO acknowledges the application for stay of penalty but refuses to acknowledge the stay application filed – Chief CIT is directed to ensure such behavior is not repeated. High Court disposed the petition directing the Revenue to nominate another AO to hear the stay application.

► CIT v. TCL India Holding Pvt. Ltd. (2016) / 138 DTR 319 / 288 CTR 34 (Bom.)(HC)

Strictures passed against department for casual and careless representation despite huge revenue implications. Dept directed to take remedial measures such as updating the website, appointment of meritorious advocates, proper evaluation of work done by the advocates, ensuring even distribution of work amongst advocates etc. Prevailing practice of evaluating competence of advocates on basis of "cases won or lost" deplored. The Registry is directed to send a copy of this order on the Chairman, Central Board of Direct Taxes (CBDT) and the Principal Commissioner of Income Tax

► Overseas Enterprises v. UOI (Patna)(HC) (Civil WP. No. 13382 of 2014, dt. 30.11.2015)

Strictures – Customs officials directed to pay costs of Rs. 14 lakh + interest @ 9% p.a. from personal account and to face disciplinary action for “high-handedness”, arbitrariness” and seeking to “hoodwink” Court

► DIT v. Credit Agricole Indosuez (No.1) (2015) 377 ITR 102 / 280 CTR 491 (Bom.)(HC)

Strictures passed regarding the “casual and callous” and “frivolous” manner in which senior officers of the dept. authorize filing of appeals. Strictures also passed against counsel for acting as a “mouthpiece” of the Dept. in persisting with unmeritorious appeals. CBDT directed to take appropriate action – Question decided by Tribunal based on concession by Department or on agreed position that questions covered by decision of Court – Appeals not to be filed in such matters. Registry is directed to forward the copy of the judgment to CBDT for necessary action and to provide an in-house committee of senior Officers of the revenue to review decisions taken in respect of appeals already filed and pending.

► Vijay Prakash Agrawal v. CIT (2013) 355 ITR 114 / 87 DTR 4 / 261 CTR 602 (All.)(HC)

Refunds – Non-grant of refunds-Search and seizure – Refund of seized amount with interest – Strictures passed against Dept for harassing honest taxpayers.

► Sak Industries Pvt. Ltd. v. Dy. CIT (2012) 71 DTR 98 (Delhi)(HC)

Stricture -Cost on department – Undesirable haste in passing assessment order results in miscarriage of justice – Awarded cost on department – Reassessment order was quashed

► CIT v. DSLD Software Ltd. (Karn.)(HC) [2013] 351 ITR 385 (Karnataka)

Frivolous appeal – Cost – High Court awarded the cost of Rs. 1 lakh on officer who had file the appeal – High Court held that only way to prevent department from filing frivolous appeals is by imposing heavy costs

► Directorate of Revenue v Uttamcahnd (2016) (333) E.LT 80 (Delhi) (HC)

Stricture were passed against the revenue for condemnable lethargic attitude in pursing the prosecution matters. Where the petition was filed after eight months of order of the Trial Court, no reason was given as to why the Trial was protracted at the Trial stage for more than 24 years.

► CBDT instruction for passing the orders of rectification with in prescribed time limit (2016) 382 ITR 16/ 17 (St)

► CBDT Circular No 14 (XL) 11-04 -1955 guided Assessing officers as regards their duty to assist tax payers in every reasonable way, particularly in the matter of claiming and securing reliefs.

3.4. Instructions and statements

All Instructions may be made available to the public. As soon as statement of an assessee is taken in course of search and survey, a copy thereof may be made available to the deponent. In search cases, the appraisal report may also be made available to the assesses. This will bring more transparency and also accountability.

Very recently the CBDT released the Tax payer’s charter and new scheme of faceless assessment and faceless appeals. We, hope the all earlier grievances may not survive. While inaugurating the two days virtual National Tax conference of the AIFTP on 6th November 2020, Hon’ble Finance Minister Mrs. Nirmala Sitaraman, Union Finance Minister said that AIFTP is a catalyst to make tax compliance easy and effortless for many assesses and their role is critical for a growing economy like India. We hope the CBDT will play a very proactive role in the years to come to gain the tax payers confidence, compliance and developing the culture of tax service instead of tax collection.

4. Expectation form the Ministry of finance

Power of Advance Ruling (AAR) to the Members of the ITAT

It is urged that the Hon’ble Ministry of Finance to consider ITAT members for the position of members of the AAR, as they are better equipped with day to day issues that arise in the sphere of international taxation.

For commercial arbitration the person having the knowledge of tax law and accountancy has many advantages, it is for the consideration that services of the some of the retired members of the ITAT may be taken into consideration by the Ministry of Finance and Ministry of law.

5. Expectation from the Ministry of law and justice.

5.1. Elevation of members to High Court – Institutionalization of the process of elevation of Members to the High Court

India’s Income Tax Appellate Tribunal was set up on 25 January 1941, and it was the first experiment in Tribunalization in the history of India. It is considered to be a very successful experiment in Tribunalization and is often cited to justify more steps in this direction. However, till date very few Members of the ITAT have been elevated to the High Courts. Deserving Members of the ITAT due to their specialised knowledge and experience in ‘taxation’ and ‘commercial transactions’, would be able to understand and decide the issues involving both the subjects in a better manner. The speed of disposal would also increase. This will also attract young bright lawyers to join the Income Tax Tribunal. Not only members be elevated to the High Court but also this process be institutionalised, to be more systematic and transparent in elevating the Members. Sir, though the resolutions was passed in the Chief Justice’s Conference which was held on September 2002 as well as April 2016, not much progress has taken place till date.

6. Expectation form the judiciary

6.1. Elevation of members to High Court – Institutionalization of the process of elevation of Members to the High Court

ITAT has good number of judicial members who deserves to be elevated to the High Court. Once you practice in Direct taxes you will be able to practice any branch of law. Income tax Act is the only Act which refers 98 Central Acts and various State legislations If one analyzes the development of the commercial law it is due to interpretation of taxation law. e.g. Hindu law, law of partnership Act, transfer of property Act, Company law etc.Deserving Members of the ITAT due to their specialised knowledge and experience in ‘taxation’ and ‘commercial transactions’, would be able to understand and decide the issues involving both the subjects in a better manner. The speed of disposal would also increase. This will also attract young bright lawyers to join the Income Tax Tribunal. Not only members be elevated to the High Court but also this process be institutionalised, to be more systematic and transparent in elevating the Members. My Lord, though the resolutions was passed in the Chief Justice’s Conference which was held on September 2002 as well as April 2016, not much progress has taken place till date.

6.2. Tax Benches in High Courts

The pendency before ITAT is only 90,000 appeals and the matters are heard within two years of filing of appeals and in some of the Benches within six months of filing of appeals. However, in some of the High Court’s due to shortage of judges the tax matters are not heard within reasonable time. In cities like Mumbai for admission it takes around two to three years and where as if admitted for final hearing it takes another 10 years. Bombay High court around 5,200 matters are pending for admission and around 5600 matters which are admitted are pending for final disposal. It is desired that a court should have a continuous and dedicated tax bench where the tax litigation. If revenue prepares the list of pending cases which are admitted and to be admitted and the question of law involved, it may help quick disposal of pending matters before various Courts and also Apex Court. In tax matters it is the department which is always a party either as petitioner or respondent hence, it may be easy to prepare the list. Once the list is prepared it can be published in the website which can also help the assesses as well as the department. This project can be done with the Co–operation of the tax Bar of the respective State. All India Federation of Tax Practitioners, will be ready to help the tax administration if an opportunity is given to them.

6.3. E-bench of Supreme Court

The Income-tax Appellate Tribunal has started the e-Court at Mumbai through which the matters of Nagpur are heard by members sitting at Mumbai. The experience has been very satisfactory and both the tax payers and the Department have found the functioning of this bench satisfactory. The e-Bench of Supreme Court may initially be started with SLP, relating to direct and indirect tax matters. One Court room from respective High Court may be converted in to an E-Court.

6.4. Court of Appeals

Hon’ble Shri Venugopal, Attorney General of India speaking on the occasion of Constitution day on November 26, 2020 has strongly suggested for four Court of appeals between the High Courts and the Hon’ble Supreme Court. It is worth noting that the AIFTP has been making representation from time to time constitute a regional Benches of the Supreme Court.

7. Vision – 2022

Our great nation will be celebrating 75 years of Independence, in the year 2022. contribution of the mother Tribunal in the nation building process deserves to be acknowledged by all stake holders. Few thoughts for considerations are;

- ITAT can consider approaching a reputed IT Company for developing a state-of-the-art facility for filing of e-Appeals before the Tribunal and conducting the hearing. This will also help in accurately analysing the pending appeals before the Tribunal at the time of filing itself.

- The Appeal Forms may be suitably amended to facilitate e-filing.

- The Tribunal Rules, may be suitable amended to as to facilitate e-hearings.

- All pending appeals grounds of appeal may be analysed and list may be prepared on the section wise and issue wise. This may help to quick disposal matters as soon as the delivery of judgement by Apex Court or Jurisdictional High Court.

- The Appellate Tribunal Rules may be amended so that the grounds of appeal may also mention the relevant sections and subjects.

- As soon as the appeal is filed by the Department or the assesses, they may be requested to e-mail to grounds to designated e-mail account of respective Zones along with Name of assessee, Appeal No., Assessment Year. The Computer should able to segregate the appeal on the various parameters i.e. section wise, issue wise etc.

- The Entire computerization process can be done within a span of six months.

- At present all the appeals before Commissioner (Appeals) are filed electronically and the submission are also made online. A system should be in place such that when appeals are heard before the Appellate Tribunal, the Hon’ble Members of the Appellate Tribunal should be able access the file of the Commissioner (Appeals) and Assessing Officer at the click of button.

- All the information relating to the Appellate Tribunal must be made available on the website i.e. www.itatnic.in; such as matters pending before the Special Benches, third-member cases, various circulars, notifications, relevant provisions of the Act, Appellate Tribunal Rules, Pendency of appeal before the various Benches, minutes recorded etc., All orders of the Appellate Tribunal must be uploaded as soon as they are signed.

- All souvenirs of the Appellate Tribunal such as 25 years celebration, 50 years celebration etc. may be hosted on the website, they contain scholarly articles and give insights about the history of Appellate Tribunal.

- A Combination of Virtual and Physical hearing by maintaining the parameters laid down by the Government could be considered for the disposal of matters before the Hon’ble Appellate Tribunal.

- There could be in house research committee of the ITAT to get the suggestions from stake holders and to have continuous innovation to get the speedy justice from the final fact-finding authority.

In the year 2022 when we celebrate 75 years of our Independency day. the Total pendency before the ITAT may be less than 50,000. The day may not be far, file the appeal get the date for hearing. Quick and qualitative judgements form the final fact-finding authority will defiantly contribute to the development of the Country. We all have the greater responsibility to preserve and maintain the honour and dignity of the ITAT as one of the Finest institutions of our Country. The tax Bar across the country is fortunate to have great legacy of seniors whom we consider as role models. We are also fortunate to have good number of young professionals who are following the value and ethics of the profession. Hon’ble chief Justice Mr. Akil Kurshi on the occasion of his transfer from Mumbai to Tripura on November 16, 2019 during his farewell function organized by the Tax Bars, stated as under “You are an outstanding Bar having excellent seniors, very good middle level advocates and also very talented juniors”

Let all of us collectively make an honest attempt to maintain and preserve the glory of the Income tax Appellate Tribunal as one of the finest institutions of our country and it gives an honour to be associated with the institution.

We hope when the ITAT celebrates 80th years of foundation day on January 24, 2021, the conference or event may be combination of physical and virtual, the suggestions made before us can be considered and debated.

Readers may send their objective suggestions to the afitp@yahoo.com, so that the ITAT Bar Association’s Co-ordination committee can take up the suggestions with respective forums.

Please update this with latest Madras Bar Judgment of Apex Court. National Tribunal Commission has been ordered. Qualification of members has been reduced from 25 years to 10 years. We don’t know if CG will repeat its mistakes or not as in last 10 years, 4 times, CG has been hammered by SC on same topic.

Have a little courage to talk about apathy from central government which has kept more than 50% vacancy in many tribunals including this one, especially when recommendations were made long ago.

SUGGESTIONS ARE EXTREMELY PROPER AND TIMELY. I ENDORSE THE SAME. I ADD LITTLE THAT EVERY stakeholder SHOULD HONESTLY START IMMEDIATELY TO FOLLOW THE SAM

On behalf of the Federation, we fully endorse the view expressed by the learned author.

Our Federation has participated in the 75th year of celebration as well as 79th year of celebration.

The Federation will wholeheartedly join the 80th years of the celebration of Income Tax Appellate Tribunal.

I endorse the various suggestions made by the learned Senior Advocate .We have to celebrate 80 th year of the ITAT which is the mother Tribunal of our country