Dr K. Shivaram, Senior Advocate, has lauded the Income tax Appellate Tribunal and the Tax Professionals for playing a proactive role during lock down by organising Webinars on several subjects which have helped tax practitioners to better their understanding on various issues. He has pointed out that this salutary practice has also helped them to do away with negative thoughts that set in as a result of the Lockdown

Dr K. Shivaram, Senior Advocate, has lauded the Income tax Appellate Tribunal and the Tax Professionals for playing a proactive role during lock down by organising Webinars on several subjects which have helped tax practitioners to better their understanding on various issues. He has pointed out that this salutary practice has also helped them to do away with negative thoughts that set in as a result of the Lockdown

There is no denying that the pandemic has changed the world forever, we as humans have undergone social and behaviour changes. From excessive use of hand sanitisers to the use of mask each time we step outside of our homes; the last few months have been spent in captivity in our homes as a precaution against a virus.

As most people sit at home, either finishing household chores (in absence of domestic help), or browsing for content on Netflix; tax professionals from the very beginning of the lockdown chose self-development. This is on account of the inherent habit of tax practitioners to keep updating themselves through attending lecture meetings, Study Circles and refresher programmes.

Leveraging the developments of the digital age, various associations of tax practitioners chose to conduct webinars for their fellow practitioners. Most of the webinars were held at free of cost, to ensure no reservation in attendance during these economically difficult times. The webinars were made accessible to the public, irrespective of their membership with the respective association.This commendable act deserves acknowledgement and appreciation.It reminds me of a Sanskrit shloka.

नचोरहार्यनचराजहार्यनभ्रातृभाज्यंनचभारकारि

व्ययेकृतेवर्धतएवनित्यंविद्याधनंसर्वधनात्प्रधानम

Which means, it cannot be stolen by thieves, nor can it be taken away by the kings. It cannot be divided amongst brothers, nor is it heavy to carry on one’s shoulders. If spent regularly, it always keeps growing. The wealth of knowledge is the most superior wealth of all.

The Chamber of Tax Consultants (CTC), All India Federation of tax Practitioners (AIFTP) the Bombay Chartered Accountants’ Society (BCAS) are some of the prominent associations that have held numerous webinars during the lockdown. Further, these associations also have a schedule of upcoming events on their website for the coming months. This has given young tax professionals to interact with some of the stalwarts of the profession and educate themselves about the trending issues in the profession. Hon’ble members of the Income tax Appellate Tribunal (ITAT), also rose to the occasion to educate people on certain topics and sharing their wisdom.

The Income- tax Act, 1961 is the only legislation of our Country which refers 116 Central Acts. Every year the Finance Act brings many amendments, further, there are various Notifications, Circulars etc, and of course the case laws of the Tribunal and Higher Courts. I have had the privilege of being associated with various professional organisations and journals for more than 40 years, and my considered opinion is that it is the continuous educational programmes conducted by the various professional organisations across the country helps the tax professionals upgrade their knowledge and help them make a better representation. From time to time the Hon’ble Supreme Court has always acknowledged that the Tax Bar as one of the best Bars in the country.

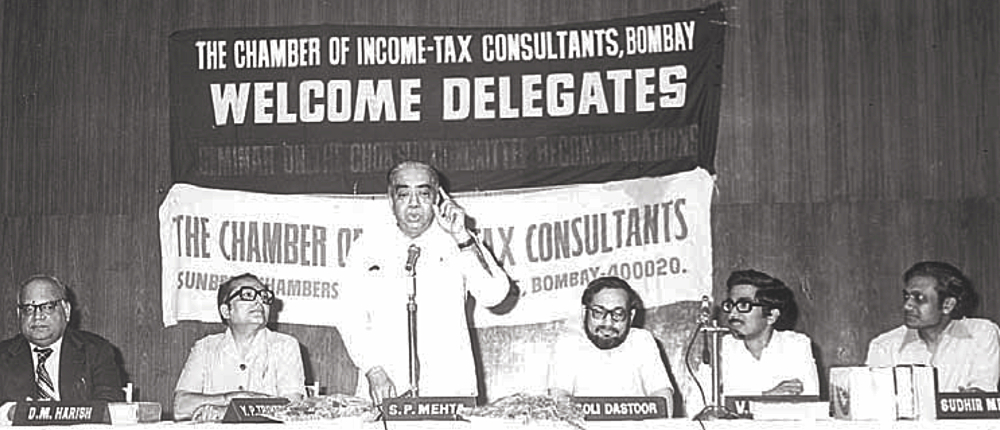

The ITAT Bar Association of Mumbai is very fortunate that Padma Vibhushan Late Dr. N. A. Palkhivala, Senior Advocate, who was the President of the Association for the period (1967-2002). Thereafter it was led by Dr. Y.P. Trivedi, Senior Advocate, with his extraordinary multifaceted personality and great oratory skills (2003-06), followed by Shri S. E. Dastur, Senior Advocate (2007-08). Hon’ble Justice Mr Kureshi, Chief Justice of the Tripura High Court on the occasion of the farewell function by the Tax Bars on November 16, 2019 stated that, “You are an outstanding Bar having excellent seniors, very good middle level advocates and also very talented juniors. Mumbai is the commercial capital of our country and we have the tax bar which is one of the premiere bars of our country and High Court is called the Premiere High Court of the Country.” Honourable Justice also appreciated the contribution of Shri S. E Dastur Senior Advocate who has trained more than 21 juniors from his chamber. Late Shri Dinesh Vyas, Senior Advocate and a well-known as corporate lawyer has led the association (2009-10).It is also worth acknowledging that Late Shri S.P. Mehta, advocate was one of the most respected lawyers from the field of taxation and has also trained more than 10 lawyers from his chamber. Shri V.H. Patil, advocate another well-known tax counsel has trained more than 15 juniors from his chamber. The ITAT Bar Association of Mumbai is very fortunate to have the guidance from the legends of the Tax Bar who are known for their knowledge, integrity and ethics.

Senior Advocates Dr. Y. P. Trivedi and Mr. S. E. Dastur during a function to felicitate them for 50 years of practice

It may be worth acknowledging that the under the guidance of Honourable Justice Mr. P.P. Bhat, Honourable President of the ITAT with the help of Vice-Presidents of the ITAT have played a very proactive role, in updating the knowledge of the Honourable members of the ITAT and also the professionals who appear regularly before them through various webinars on important technical subjects viz. Vivad Se Vishwas Scheme, Judicial precedents, Concept of real income etc. Further, beyond the subject of tax, webinar sessions were arranged with Gurudev Sri Sri Ravi Shankar, Art of living Foundation on the topic “How to remain happy while discharging our duties in office with family and Society”, and a lecture by sister BK. Shivani on the subject of “Sankalp se Srishti”. The Honourable President and Hon’ble Vice-Presidents from different Zones have interacted with various ITAT Bar Associations and other stake holders to get the feedback on how to go ahead after lifting of lockdown, implementation virtual courts, safety of staff & tax professionals post lock down etc. Suggestions made by the representatives of the various professional organisations have been acknowledged.

Further, as per the information given by the Honourable Law Minister Shri Ravi Shankar Prasad on March 11, 2020, pending cases in the Supreme Court is around 60,653 as on March 3, 2020. The number cases in High Courts is 46.15 lakhs and it is 3.19 crore cases in district and subordinate Courts. One may be worth appreciating that the pendency before ITAT as on March 31, 2020 was 94,000 appeals, whereas the total pendency of appeal before the ITAT in the year 1998-99 was 3,00,597. It is heartening to note thatthis is the perhaps only institution of our country, where in spite of the fact that the filing of appeals has increased the pendency has reduced without compromising on the quality of the orders/decisions. This was possible due to the efficient administration, discharge of duties by the Honourable members, and able assistance by the tax professionals and departmental representatives. I have that the privilege of being associated with the ITAT for more than four-decades. I salute this great institution, which is rightly referred as mother Tribunal of all other Tribunals; the Honourable Members, the Bar and Departmental Representatives have built the glory of this practice. This has been possible only because of constantly updating one’s knowledge on the subject.

These webinars have helped tax professionals not only to sharpen their skills but also escape the lethargy that sets in because of the lockdown. It has provided tax professionals with an opportunity to learn a new set of skills; something that would take a considerable amount of time and would not have been possible given the monotonous-hectic lifestyles led by tax professions where the calendars are preoccupied with due dates and deliverables. It is heartening to note that, many experts have utilised their time for writing articles on various subjects, and more than 50 articles are published on www.itatonline.org. Further, to clarifying doubts for the tax professionals and tax payers on the subject of Direct tax Vivad se Vishwas Scheme, senior members of the tax profession have answered more than 250 queries pertaining to the Scheme. Further, for the benefit of tax professionals the www.itatonline.org is preparing a section wise digest of case laws which are published in various journals, magazines and online. The case laws are updated regularly in the digest column the website. All the educational activates are possible due to very supportive approach from the talented young professional members of the ITAT Bar Association and research team of the journal committee of the AIFTP.

All these activities will result in improving their services to their Clients. As Abraham Lincoln’s famous quote, “Give me six hours to chop down a tree and I will spend the first four sharpening the axe.” These webinars and online interaction will prove to be useful in delivering more effective and efficient services to their Clients. Also, these activities have certainly helped to do away from the negative thoughts that may arise on account of the lockdown. The day the lockdown is lifted and normalcy is restored, it would not only be the world that has changed; tax professional would be smarter and sharper.

Further, the tax professionals across the country have contributed food and other facilities to the needy citizens who have affected by lockdown. It is worth appreciating that the AIFTP has received more than 10 lakhs of contribution from their members for contributing to Prime Minister’s Care Fund.

Tax professionals are debating whether the virtual hearing will be future litigation practice of our country. One school of thought is virtual hearing cannot be the effective alternative for actual court hearings. Honourable Justice Mr. B. N. Srikrishna former Judge Supreme Court of India at the inaugural speech during one of the seminars addressing the AIFTP has stated that technology will help the lawyers to make better representation, a lawyer develops his reputation by appearing before courts over the years which cannot be substituted by the technology. Honourable Justice Dr. D. Y. Chandrachud, Judge Supreme Court of India addressing the laws students in an Webinar organised by the Nayana forum of legal studies and research Hyderabad on the topic ‘Future of Virtual Courts and access to Justice in India’ on 24thMay, 2020 stated that “I want to dissuade people from idea that virtual court hearing are some sort of a panacea . They will not be able to replace court hearings.”

One will appreciate that the young lawyers learn the value, ethics and conventions of the profession by attending the courts and watching performance of the Seniors who argue before the Courts and Tribunals. It may not be possible in virtual courts. Accordingly, we are of the strong view the virtual courts may not be substitute for actual court hearings.

One may appreciate that it is ITAT which has developed the concept of E-Benches of the Tribunal which is well thought concept and working satisfactorily. According to us before one start virtual hearing one may consider the following proposals:

- As more than 50 per cent of appeal before the ITAT is from the Revenue Department. The revenue may be instructed to file all their appeal by electronic mode and the Rules may be amended accordingly. Announcement made by the Honourable President dt 1-06 2020 of E. filing Portal is a welcome move .

- It may be necessary to suitably amendment the Rules requiring that when an appeal is taken up for hearing before the Tribunal, the entire appeal papers before the CIT (A) and assessment records may be forwarded to the respective Bench in the digital format. If Bench desires to grant access the file to either parties, the same can be done by giving the other side an opportunity to be heard.

- Amendment may be made in the Rules that the paper book can be filed by email and the Court cases which the party’s desires acknowledgement of filing may also be sent by e-mail.

- ITAT Rule 18 state that the grounds of appeal should be very brief and should not be narrative. One may consider amending the Rules and also adding the Sections involved and Issue involved. E.g. S.271(1)(c), Concealment penalty, etc.

- Every month the heard quarter of ITAT receives the information from various Benches the number of appeals is filed and number of appeals disposed of. If sections and issues are mentioned in the grounds of appeal at a given point of time the Head office may be able to find out types of litigations pending before various Benches. If on a particular issue large number of matters are pending it can be grouped or as soon as the issue is decided by the Apex Court such matters can be taken out of turn hearings.

These are the some of the suggestions for virtual hearing before the ITAT. Readers may send their objective suggestions which will help the institution as well as tax consultants and smoothen the tax administration process.

Very inspirational article by the learned author. I joined the legal profession only this year. It is very encouraging to know about the contribution made by the seniors of the tax profession . It is desirable to have more articles on the tax professionals who have contributed to the development of tax profession.

I had the fortune of interacting with all the professionals referred in the article of learned Author . For the benefit of the young professionals I desire to refer one of the greatest contribution of Shri V.H .Patil Advocate he is the person who has given life to the Chamber of Income tax consultants Mumbai . Though the chamber was established in the year 1926 it was defunct till 1976 .In the years 1976 -78 Shri V.H.Patil became the President . He who introduced the Residential Refresher Course in the year 1978 . He used to encourage young lawyers and Chartered accountants to write papers . I am also one of the beneficiary who has given an opportunity to write the paper. Because of him many leading professionals have accepted to became president of the Chamber , such as Shri Y.P. Trivedi sr Advoacte , Shri S.E .Dastur sr Advoacte , Shri D. M.Harish Advocate , Shri Narayan Varma Chartered Accountant Dr ,K..Shivaram Senior Advoacte , Shri S.N.Inamdar Senior Advoacte and many more .

Contribution of late Shri S.P.Mehta Shri Y. P .Trivedi ,Shri S.E .Dastur and Shri V.H Patil for development of tax profession and producing more than 50 leading tax professionals is rightly acknowledged by the learned author. It is Nice to see the photograph wherein all stalwarts sharing their vision .

Sur, Tax Friends jointly with Tax Practitioners Association, Thane and four other Associations from across the country have held 36 Webinars and are scheduled to hold more and sir you gave chaired one hand of them

Five Suggestions made by the learned author for e.portal is worth considering by the ITAT

Respected Sir,

I Thank you very much for recognising the webinars organised by the AIFTP through Chairmen of respective Zones and by which professionals across the country benefited. AIFTP so far organised more than 60 webinars. I am pleased to state that in one of webinar which was addressed by Gurudev Sri Sri Ravi Shanker through YouTube more than 4400 people participated. Many more webinars are scheduled for the month of June, 2020.

Sir, your article is very inspirational to tax professionals. I request the subscribers of the itatonline.org to attend the webinars of the AIFTP.

Mr. M. S. Rao

Dy. President, AIFTP