The author warns of a serious conflict of interest in permitting serving Commissioner (Appeals) to argue appeals on behalf of the Department before the ITAT. He argues that no person can be a judge and a lawyer at the same time.

The Hon’ble Apex Court in Anil Rai vs. State of Bihar (2001) 7 SCC 318 has observed that justice should not only be done, but also should appear to have been done.

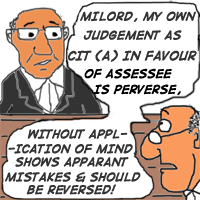

It has been observed that in Income Tax Appellate Tribunal, Mumbai, very often the Commissioner of Income Tax (Appeals) who has to adjudicate the appeals filed against the order passed by the Assessing Officer has been deputed to argue the matters before the Appellate Tribunal. It means in the morning he has to defend an issue on behalf of the department and afternoon when he functions as an appellate authority, he has to decide the same issue as an independent quasi-judicial authority. Can he do justice to the assessee as an independent quasi-judicial authority? By deputing the quasi-judicial authority to represent the matters before the Income Tax Appellate Tribunal the purpose of appointing the quasi judicial authority has been lost, howso ever impartial he may be. His function as a departmental representative has grave impact on his judicial function as an appellate authority. It may also be appreciated that when an officer represent the matter before the Income Tax Appellate Tribunal he has to defend the matter on behalf of the department, he has no authority to concede though personally he may of the opinion that the department has no case. Whereas when a lawyer represents the matter he has to assist the Court to arrive at a correct decision and he may withdraw certain grounds whereas such a power is not with the officers of the tax department when they represent the matter before the Income Tax Appellate Tribunal.

A judge when he is discharging his duties as a judge cannot be asked to represent the matter before the Court as a representative of the Government. Similarly a Commissioner of Income Tax (Appeals) should not be given the responsibility to represent the Department, when he functions as quasi-judicial authority.

It is the duty of the professional organizations to bring to the notice of the higher authorities that when a Commissioner of Income Tax (Appeals) functions as a quasi judicial authority he may not be deputed to represent the matters before the Tribunal.

We are of the considered view that if it is brought to the notice of CBDT it would certainly take an appropriate remedial measure.

We are sure that the tax administration will act positively and may not depute Commissioners of Income Tax (Appeals) to represent the matters before the Tribunal, which will help to get the deserved justice to the assessee from the Commissioner of Income Tax (Appeals).

It is desirable that all the officers, before they are promoted as quasi-judicial authority, must be posted at ITAT as departmental representative at least for six months, their experience as departmental representatives, may help them to discharge their responsibility more efficiently.

Members may send their view to the office of the Federation.

Dr. K. SHIVARAM

Editor-in-Chief AIFTP

(Reproduced with permission from the AIFTP Journal – November 2008 issue)

what is the harm if we have seperate officials for these two different assignments. after all, they are human beings and a human being is definately would be influenced by what he does in the morning to his work in afternoon. similar conflicts also are found in state commercial tax departments. there also joint commissioners (appeal) appear as departmental officials in state commercial tax tribunals.

Though I agree with the views of the ld. author, I would just add that there is a positive angle in deputing certain CIT(A)’s at ITAT. Having been on an arguing counsel’s chair they do learn some court manners. It also helps them in learning some law even however hard they try not to do so. Therefore, I think it should be made mandatory for every CIT(A) to serve as arguing counsel in the morning and then be a judge in the afternoon. They would also know what would happen to their order in the higher forum if passed in a flimsy manner.