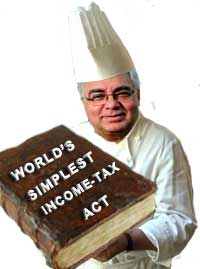

The appointment of Dr. Parthasarthy Shome as advisor to the Finance Minister augers well for tax payers in the Country because Dr. Shome is a man of wisdom and experience and is committed to creating a tax-payer friendly administration and simplified law and procedure, says the author. The author urges all tax payers & tax professionals to support Dr. Shome in his endeavor and starts off by listing 13 critical issues that need Dr. Shome’s immediate attention

Hon’ble Finance Minster speaking at the Delhi Economics Conclave on 14/12/2012 stated that “We have made it clear that our objective is to have clarity in tax laws, a stable tax regime, a non-adversarial tax administration, a fair mechanism for dispute resolution, and an independent judiciary.” I am of the opinion that by appointing Dr. Parthasrthy Shome as advisor to Hon’ble Finance Minister will achieve the goal of the Hon’ble Finance Minister. Dr. Parthasarthy Shome is a man of action, knowledge, integrity and has rich experience to understand the business laws of world.

Under the present system it takes more than 20 years to decide the prosecution matters relating to direct taxes. Hence the deterrent provision has not achieved the desired object due to delay in disposal of cases by magistrate Court

In the year 2007, when Federation has organized 14th National Convention at New Delhi I had the privilege of interacting with him, on some of the provisions of Direct taxes. He requested me to send suggestions in writing. In the meantime he relinquished his post, hence he had no opportunity to look into our suggestions. I thought of forwarding to him few suggestions which are on conceptual issues, for better administration of tax law, I am sure he will consider our suggestion either in this years Finance Bill or in the proposed Direct taxes code.

1. Introduction of Retrospective law to undo the judgments of Apex court, High Courts and Tribunal will shake the confidence of Investors:

Frequent amendments with retrospective effect make the Income–tax Act more complicated. It will not be possible to give any advice based on High Court or Apex Court decisions. There should not be any amendment in law to overrule the judgment which has been decided in favour of assessee. If Govt feels that, that was not the intention of the legislature, then the law may be amended prospectively. If at all any law has to be amended it may be amended retrospectively, only for granting reliefs and not for taking away the reliefs. This will help to gain the confidence of assessees and growth of industry.

2. Special court to deal with Prosecution in relation to Direct and Indirect taxes:

Under the present system it takes more than 20 years to decide the prosecution matters relating to direct taxes. Hence the deterrent provision has not achieved the desired object due to delay in disposal of cases by magistrate Court. Income-tax being a specialized subject, it is desirable that the matters may be heard by a specialized court, similar to Income-tax appellate Tribunal by two judges and thereafter direct appeal to High Court. It is for consideration whether the jurisdiction to deal with prosecution matters relating to Direct Taxes be granted to Income-tax Appellate Tribunal, Prosecution relating to Central Excise and customs to CESTAT and prosecution relating to VAT and Central Sales tax to Sales tax Tribunal .A bench of two members may be constituted to hear the prosecution matters .Appeal against the said order may be provided to High Court. This will help to speedy disposal of matters.

3. Direct appeal to Supreme Court on Interpretation of law which affects large number of assessees:

Section 257 of the Income –tax Act provided for direct reference to Supreme Court under old provision of reference. No such provision is incorporated after the insertion section 260A. The Income–tax Appellate Tribunal refers the matters to special Bench when there is a conflicting decisions of various Benches. In the mean time one of the High Court may have taken a contrary view. In such a case the decision of High Court will be binding. Though the Income-tax is all India statute, the Tribunal sitting in a particular State is bound by the decision of respective High Court of the particular State. This brings uncertainty in tax law. To avoid all these controversies the Tribunal may be given power to refer the matter directly to Supreme Court either of its own, or an application made by the assessee or of the department. If this process is followed there will be certainty in tax law will also help to reduce the pendency of cases before various High Courts.

4. All orders of Assessing Officer may be made appealable:

Under present Income-tax Act there are 35 sections for which appeals are provided. In proposed Direct taxes code Bill, 2010, the twenty first schedule refers to 24 Clauses. Law may be made simple by stating that any order passed by Income-tax authority i.e. Assessing Officer/Tax recovery Officer etc, which has the effect of adversely affecting an assessee may be made appealable before the Commissioner of Income tax (Appeals). This will help the assessee as well as department. When no appeal is provided the assessee has no option than to approach the High Court by way of writ jurisdiction. Proposed suggestion will help to reduce substantial litigation.

5. Orders of Commissioners may be made appealable to Tribunal in all cases to reduce the burden of High Courts:

At present, the assessee can file an appeal only against the order under section 263 passed by the Commissioner (Revision Order) and rejection order under section 12AA. There are number of other orders passed by the Commissioner for which no appeal is provided. Some of the orders of Commissioners which are creating hardships to assessees are –

(a) Order under section 179.

(b) Order under section 264.

(c)Order under section 273A.

(d) Not staying the Recovery when appeals are pending before first appellate authority.

(e) Order passed by the tax authority to auction the property.

(f) Issue of notice under section 148.

(g) Waiver of interest under section 234A, 234B & 234C.

To decide the issues relating to above matters, the authorities have to go into details about facts. The Income-tax Appellate Tribunal being a final fact finding authority under Direct Taxes, it is desirable that the appeal may be heard and disposed of by the Income-tax Appellate Tribunal and thereafter the aggrieved party may file an appeal before High Court on question of law. If such a provision is introduced stating that all orders passed by the commissioners are appealable to Tribunal, the precious time of various High Courts can be utilized for rendering justice to people at large.

6. Advance ruling for taxation – Scope may be extended:

The Assessing Officer makes huge additions for the sake of addition, when additions are made the assessee has to face the consequence of recovery, attachment and mental torture. When additions are deleted, getting refund of tax paid is very difficult

One of the very important provisions introduced in the Maharashtra VAT legislation is the provision for obtaining Advance ruling on the interpretations of any provision of the Act, Rules or Notification in respect of a transaction proposed to be undertaken by any registered dealer even though any question relating to the said provision has not arisen in any proceeding. The Advance ruling will be given by the Bench consisting of three members of Sales Tax Tribunal, Senior Practitioners nominated by the President of the Tribunal and Officer of Sales Tax Department not below the rank of Jt. Commissioner nominated by the Commissioner of Sales Tax. I am of the opinion that, if all states introduce such provision in their legislation and also to the Union of India to introduce such provision in Income-tax Act and Central Excise, Customs & Service Tax for all residents, which can reduce the litigation. I am of the opinion that the Income-tax Appellate Tribunal is more competent to decide the issues relating to Advance rulings. It is therefore suggested that in respect of residents the power of authority for Advance Rulings may be given to the Income-tax Appellate Tribunal.

7. Appointment of Members of ITAT as members of Authority for advance rulings:

The Authority for advance rulings has to decide very intricate issues of DTAA and International Taxation. By their experience and knowledge the members of the ITAT are most competent to be appointed as members of Authority for advance rulings. However, as on today the technical members are appointed from revenue department. Members of the ITAT through their President and Ministry of Law may formulate the system wherein some of the members may be considered as a candidate for authority for advance rulings. It may be possible that when litigation increases country may need more benches of Authority for advance rulings.

8. All pending appeals of the tax department before various High Courts, where the tax effect is less than 10 lakhs may be withdrawn:

As per the Instruction no. 3/2001. F.No 279/Misc.142 /2007 dt. 9th Feb. 2011 (2011) 332 ITR 1(ST) the department is not filing appeal before the High Court where the tax in dispute is less than 10 lakhs. However there are references which are filed earlier where the tax in dispute is less than 10 lakhs. Different High Courts have taken different view as to the applicability of the circulars to pending matters. It is desired that a circular may be issued stating that the said circular may be made applicable to all pending references and appeals. This will save substantial amount of Government and precious time of Court. Reason being as per the old provision for giving effect to the order of High Court , the matter has to be sent back to the Tribunal. After the order of Tribunal the Assessing Officer will give effect. At present there is no mechanism wherein one can find out whether orders of High Court or Order of Supreme Court has been given effect to or not.

9. Power to Tribunal to frame questions of law:

Order passed by the Income –tax Appellate Tribunal before 1-10-1998, are subject to reference to High Court under section 256(1) and if reference was rejected the application was to be filed under section 265(2) before the High Court to refer the questions of law. Only flaw in the earlier provision was procedural delay and for giving effect to the order of Tribunal the matter was required to be sent once again to Tribunal. The same provision may be reintroduced with the modification that once the order is passed by the High Court or Supreme Court the effect will be given by the Assessing Officer within prescribed period. This would save substantial time of High Court and would facilitate the Court to dispose the questions of law referred by Tribunal. If Tribunal refuses to grant reference, the appeal may be filed before the High Court and High court may admit the question of law or reject on the admission. I am of the opinion that the old procedure can be adopted by amending the section 260A. This will help the assessees, tax administration as well as High Courts to appreciate the questions of law, when question of law is framed by the Tribunal incorporating all in the statement of facts.

10. Transparency in appointment of members of settlement commission and Appointment of professionals as members of settlement commission:

At present, the appointment of members of Settlement Commission is done not by way of interview, it is on ad-hoc basis whereas for appointment of members of Income-tax Appellate Tribunal, there is complete transparency, interview is taken by Senior most Judge of Supreme Court, Law Secretary, Member of Law Commission and President of ITAT. Federation suggests that the procedure laid down for appointment of members of ITAT may be followed for appointment of members of Settlement Commission. The Income-tax Act provides that a person who is man of integrity and knowledge can be appointed as member of Settlement Commission. However, though more than 40 years have passed over 125 members are appointed, the Government has not appointed a single professional as member of Settlement Commission. An ideal Settlement Commission could be having one from the Department, one from the profession of law and one from the Accountancy profession.

11. Transparency of Instructions:

All instructions may be made available in the website of the CBDT. CBDT may be requested to publish the list of judgments of High Courts accepted and SLP filed and admitted for final hearing . The same may be up dated every financial year . This will help the tax administration as well as assessee. It was noticed that many time the department files appeal to the High Court on the ground that the SLP is filed and is pending, without realizing that the SLP was already disposed by the Supreme Court.

12. Accountability and transparency in tax administration:

Dr. Raja Chelliah in his report (1992) 197 ITR 177 (St.) (Para 5.9 Pg. 257) suggested that there has to be Accountability in tax administration. The Assessing Officer makes huge additions for the sake of addition, when additions are made the assessee has to face the consequence of recovery, attachment and mental torture. When additions are deleted, getting refund of tax paid is very difficult. Federation suggested for introduction of Accountability provision in the proposed Direct Taxes Code. When refund due to the assessee has not been paid within the time the Officer concerned may be personally held liable to pay interest. At present the interest is paid from the Government treasury, why tax payers money should be spent for paying interest, due to inaction on the part of officers concerned.

13. Aadhaar and Permanent Account Number (PAN) may be linked:

Aadhaar introduced by the Government is a very good concept. It can be linked with PAN. The Aadhaar form may also contain the details of PAN. It may help to increase the number of tax payers. Payments by cheque or card may be encouraged which will help to curtail unaccounted transactions.

Jai hind

![]()

Dr. K. Shivaram

Editor-in-Chief

Reproduced with permission from the AIFTP Journal, December 2012

@vswami

The comment/observations, for that matter,it requires to be realised,would equally obtain/hold good , besides for income under the head of, – salaries and other sources, for ‘capital gains’, as well.

The write-up has made to focus on certain areas which have, for long, been of commonly worrisome concern to that section, however limited that be, of the people who could rightly claim and be virtuously categorised as honest/not dishonest tax payers. It comprises significantly those having income from sources on which the law mandates TDS; that is, salaries, besides interest income from bank deposits, and the like.

As none can afford to be unaware, even so, there could be instances in which, howsoever honest he be, tax payer may still, as lawfully considered, or advised by his consultant, put up a genuine claim for excluding a particular item in computing his taxable income. For example, that could be anything which is clearly not in the nature of a ‘perquisite’, or not in the nature of a ‘revenue’ receipt, or excess interest adjusted and withdrawn in a later year hence not received,- such as on premature encashment of a long-term bank deposit, so on.

Also, none can prudently remain unaware that, however, in the prescribed tax return forms (Form 2 or Form 1), having been mandated to be a paper-less form, a tax payer has no way or scope for him to disclose, at least in a brief manner, or furnish his explanation/ the reasons for any such claim.

But, then, for no fault of his, taxpayer could be alleged to have failed to make a proper disclosure, and in the result be confronted with the same hardship the penal provisions of the Act entail; albeit, those are intended to apply to the basically recalcitrant, if not basically dishonest. Obviously, though left untouched, unwittingly or otherwise, that is an area which requires to be seriously looked into/reviewed and suitable remedial steps taken; better late than never.

I think barring first issue about retrospective amendments and last 2 issues, all other issues crop up at high level of tax practice. If those issues, if at all resolved, I don’t think the Income Tax Law will be free from complications so far as general tax practice is concerned.

Sir,

I totally agree with the suggestions made. I also feel that the procedure presently followed by the assessing officers dealing with the first level assessment needs a lot to be changed to reduce the harassment of asessees.

Dear Sir,

Excellent work.

But, unfortunately, plight of Tax payers, sufferring with unwarranted Tax Demand arrears which remains unsolved for over a year(possibly due to mistakes of Dept & CPC) has not been touched upon.