Dr. K. Shivaram, Senior Advocate, has lauded the recent philosophy of the Income-tax Dept of “Honouring the Honest“. He has described it as a “Game Changing Fiscal Policy“. He has advised that the tax administration has to make sincere efforts to satisfy at least 10 expectations of high tax payers. He has opined that this will be a way forward to eliminate the so-called “Trust Deficit” between the Tax Department and the Asseessees

Dr. K. Shivaram, Senior Advocate, has lauded the recent philosophy of the Income-tax Dept of “Honouring the Honest“. He has described it as a “Game Changing Fiscal Policy“. He has advised that the tax administration has to make sincere efforts to satisfy at least 10 expectations of high tax payers. He has opined that this will be a way forward to eliminate the so-called “Trust Deficit” between the Tax Department and the Asseessees

The Hon’ble Prime Minister on August 13, 2020 launched the “Transparent Taxation – Honouring the Honest” platform. The intention of the Government is to enhance Transparency, Efficiency and Accountability and. With a view to achieve its objective it has proposed three areas of work viz. i. Faceless Assessment, ii. Faceless Appeals and iii. A Citizens Charter.

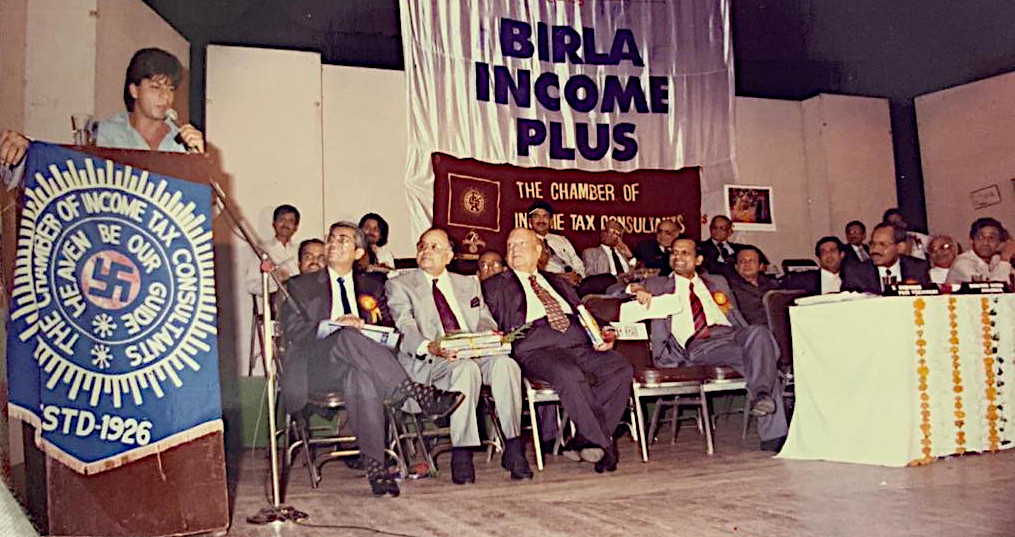

Superstar Amitabh Bachchan and other eminent personalities listen attentively to Late Shri D. M. Harish during a function conducted by CTC in 1995 to honour high taxpayers of Mumbai

The Scheme for Faceless Assessment been notified by the Central Board for Direct taxes (CBDT) vide Notification dated August 13, 2020 bearing Notification no. 60 of 2020 & 61 of 2020. This comes as an update to the E – Assessment Scheme, 2019 (2019) 417 ITR (St.) 12which was announced by the vide Notification dated September 12, 2019 bearing Notification no. 61 of 2019 & 62 of 2019.

Superstar Shah Rukh Khan addresses the distinguished audience and articulates the expectations of taxpayers

Further, The Finance Bill, 2020 (2020) 420 ITR145/ 221 (St) vide amendment in section 250 and section 274 of the Income tax Act, 1961 (Act) proposed to expand the scope of e-assessment to include e-appeals and e-penalty respectively. The provision for e-penalty has been included in the Scheme for Faceless Assessment. The Scheme for Faceless Appeals is awaited and is expected to be launched by September 25, 2020.

The new Scheme of Faceless Assessment, is not devoid of challenged, however, they are not incapable of being addressed. It is the need of the hour to tackle the issues from the regarding the launching and implementation of the New Scheme, as operation of the New Scheme will pose new challenges in the times to come. The Hon’ble Chairman (CBDT), Members of the Board, and the high-ranked officers are patiently attending virtual conferences to clear any ambiguity or query in the minds of the tax practitioners.

There will be certain inherent limitation in the inception years of the New Scheme. However, in the years to come, with constant improvement and updates, the New Scheme would be a game changer for its stake holders. Tax payers and tax professionals should cooperate with the initiative of our Government.

The New Challenge is a welcoming initiative by the tax payers, taxman and tax professionals. It is important to be updated with technology and to leverage technology to the benefit of mankind. Further, in the past issues arising out of transparency, accountability and efficiency have been faced by the tax payers and their representative. The All India Federation of Tax Practitioners (AIFTP) from time to time have an appeal to the government to bring Accountability provision in the income tax Act , as suggested by Dr. Raja J. Chelliah in his committee report (1992) 197 ITR 99 (St) (112).The tax Practitioners are pleased to note that Finance Bill, 2020 (Supra), a new section 119A of the Act “Taxpayers’s Charter”, wherein the CBDT was empowered to adopt and declare a charter and issue such orders, instructions, directions or guidelines to the income tax authorities for the administration of such Charter. It is pertinent to understand that a “Citizen’s Charter” was published on the income tax website on April 29, 2014, which briefly explains the mission and vision of the department and explains its expectations and duties towards a tax payer. However, the Charter lacked a legislative sanction. Not only is the New Charter legally binding, it also has a redressal mechanism for any non-compliance under the it. The enforcement of the New Charter is yet to be understood. Considering its intention, it is definitely a welcoming piece of legislation, it will play a significant role in improving the taxman-taxpayer relationship. Both domestic and international tax payers would be benefitted by this Charter. This will also help in improving the ease of doing business in India.

This new proposed relationship will change the perspective of the tax payer towards the department. The Department would be looked as “tax facilitator” rather than a “tax collector”.

For the first time in the history of taxation, a function was held to appreciate hard work, enterprises and to encourage tax compliance. On November 27, 1991 the Chamber of Income tax Consultants (CTC), Mumbai had taken the initiative for honouring high tax payers of Mumbai. A grand function was organized at Birla Mathurshri Sabhagriha to felicitate high Tax payers of Mumbai, which included Shri Amitabh Bachchan, Late Shri Ashok H. Desai, Late Shri D.M. Harish and many more. Former Attorney General of India, Shri Ashok H. Desai who was one of the highest tax payers of our Country for many years, stated “I wish the state could follow the advice of Kautilya who says that king must tax like Sun, who takes the moisture gently from the sea but returns it manifold as bountiful rain.” According to us the tax administration should adhere to this philosophy.

CTC once again honoured the high tax payers of Mumbai in the year 1995, where in included Shri Shahrukh Khan, Late Shri Dinesh Vyas, Shri Rakesh Jhunjunwala and many more, and the Chairman of CBDT was also present. In the vision 2000 tax law and tax Administration which was published in the year September 1996, views of high tax payers were published, based on their suggestions. Ten important expectations are as under:

- The law as it stands need to be fairer, reasonable, simple and enforceable.

- In the admiration of law, sense of justice needs to be upgraded.

- The goal of any tax law should be to collect not the budgeted amount but the right amount in accordance with law.

- Some of the provisions of the income-tax law are very complicated. These provisions are difficult to understand, difficult to interpret and consequently difficult to administer.

- Lack of accountability has driven out the sense of justice from tax administration and this has assumed dangerous proportions.

- Tax payer’s money is to be used effectively, without wastage.

- Maximum tax rate should not be more than 20 to 25 per cent.

- As regards incentive or pension scheme to tax payers on the basis of taxes paid, when a tax payer is not able to earn the tax payer have nothing to fall back on, some sort of Social Security system. Government is a partner only in profits not otherwise.

- A high tax payer does no favour to any one including Government when he pays a high tax, for he simply performs his duty and nothing more. However, if conferring honour on high tax payers can stimulate others to reach greater levels of compliance, one can support the recommendations of the tax consultants that the Government should honour the tax payers.

- Tax administration should treat the tax payers as respected citizens and not as Tax Evaders.

Financial express dt 22-9 – 2020 stated that only 1 percent of the Indian population pays income tax and declares earnings above the non-taxable income. Only 5.78 crore income tax returns were filed by individual tax payers for the financial year 2018-19 till February 2020. Out of this only 1.46 crores individual tax payers fled returns declaring above Rs 5 lakhs.

In the case of Mukul Kumar Singh v CIT (Pat) (HC) (WP No 12528 of 2009 dated September 7,2020), the Honourable High Court observed that“The Trust deficit between the Department and the Asseessee, perhaps has led to the litigation being prolonged for more than a decade and a half. Every public body and institution have a duty not only to build goodwill and defend its reputation but also to install faith in the mind of public with regard to its functionality. There are times when the Institution has to show magnanimity, even in existence of a bonafide error and not unnecessary embroil a party to litigation and prolong his agony”

Indian citizens have heritage of ‘High-Character’. There are number of obligations which the tax payers have to undergo, they have to deduct tax, deposit with in stipulated time, file the TDS return, if there is delay fee or penalty of Rs. 200/- for every delay, delay in payment of tax or delay in depositing the tax at source attracts interest, disallowance, penalty and prosecutions. Large number of prosecutions matters are on account of technical defaults. The Compounding fees are so high it may be difficult to most of the assessees to pay such a high fee. There is no provision under the Income tax Act, where in an assssee may realise certain mistake in the return and later desires to settle voluntarily by paying the tax. The taxpayer cannot file the return voluntarily after beyond period of limitation unless the notice is received from the tax administration. There has to be one-time settlement provision to deal with such technical and bonafide mistake of the tax payers.

We appreciate our Prime Minister’s initiatives on this front. This is a proactive step taken by the Honourable Prime Minster of India we hope when India celebrates 75 years of independence there will be double the number of tax payers who will contribute to the development of the Country.

There could be number of issues which the tax professionals can help the tax administration to bring more assessees under tax net. One must appreciate that in a recent Webinar organised by the AIFTP on September 12, 2020 the subject of “Faceless Assessment- Chartinga Road Road map for a Painless Tax Regime & Seamless Tax Compliance” Honourable Chairman CBDT, Mr. P. C. Mody shared his vision and the Tax Officials Dr. Pushpinder Puniha, Principle Chief Commissioner of Income-tax National e-Assessment Centre and Shri Kamlesh Varshaney, Joint Secretary TPL, Central Board of Direct taxes in a panel discussion with Mr Mukesh M. Patel Advocate Ahmadabad Shri Ganesh Purohit, Senior Advocate, Jabalur, and Mr Samir Jani, Advocate, Secretary General AIFTP, have clarified the number of issues. Further the CBDT issued directions to its officers vide letter dated September 18, 2020 clarifying the number of issues. This shows proactive role played by the CBDT, we hope they will continue to have dialogue with the tax consultants from time to time for better administration of justice.

Jai Hind!

Dr. K. Shivaram,

Senior Advocate

September 20, 2020

Reproduced with permission from the AIFTPJ -September , 2020

I fully endorse the view of the learned Senior Advocate. Year 2020 is very difficult to all tax payers , hence the tax administration has to make all the resources to build tax payers confidence .

Suggestions made by the learned Senior Advocate can be considered by the CBDT while preparing the budgets in the proposed Finance Bill, 2021

The CBDT is on its part is proactive in issuing beneficial circulars in last decades and settling many issues .The same is helping in vexed issues being settled .

However the government felt let down in 2016 etc disclosures scheme and garib yojana.

After demonetisation ,GST,e assessments and now faceless appeals the govt is moving in a DETERMINED MODE.

It is more than clear that since short time is allowed in recent days to file response the skilled practitioners with grasp of issues and extraordinary writing skills of submissions shall be SOUGHT AFTER.

However the normal can compensate by bringing new assessees and filers to their fold but doubling the assessees in few years is unlikely but for own survival endeavours be made.