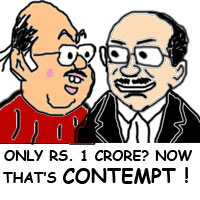

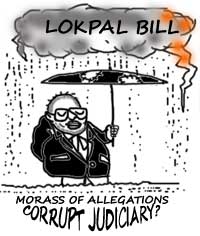

The author adds his voice of reason to the strident debate on the pros and cons of the Lokpal bill. The author argues that while the proposal to bring the judiciary under the scrutiny of the Lokpal is well-intentioned, it will adversely affect the fearlessness and independence of the judiciary and have disastrous consequences. Instead, the author suggests measures to curb corruption in the judiciary.

In India common citizens have full faith in the Judiciary, but their objection is against the Judiciary is delay in justice delivery system. Therefore, one need to take remedial measures to reduce the pendency of cases before various Courts. Mere introduction of Lokpal Bill may not have much impact on the present system. According to me, the legislature alone is responsible for delay in justice delivery system, because they have not increased the strength of judges and have also not been filling up the vacancy of Judges.