The CBDT has issued a Central Action Plan 2018-19 in which it is inter alia stated that there are 3,21,843 appeals pending before the CsIT(A) as on 01.04.2018. The demand involved in these appeals is a whopping Rs. 6.38 lakh crore.

In order to reduce the number of appeals pending before the CIT(A), the CBDT has issued a clear-cut action plan in which specific targets for disposal of appeals have been assigned. The CBDT has also offered incentives to CsIT(A) for passing “quality” orders. Incentives are offered where the CIT(A) enhances the assessment, strenghtens the stand of the AO or levies penalty u/s 271(1)(c) of the Act.

The AOs have been directed to make proper representation before the CIT(A) either by attending personally or by filing written submissions.

PCsIT and CCsIT have also been assigned responsibilities to ensure that the CsIT(A) and AOs discharge their duties in the manner envisaged by the CBDT.

LITIGATION MANAGEMENT

“The rising litigation with the taxpayers and the quantum of revenue locked up in appeals is a matter of serious concern that requires attention.” – Vision 2020

Litigation is not only a cost on the credibility of a tax administration system but also an indicator of the robustness and fairness of a system of taxation. Litigation has been rising over the years and has now assumed grave proportions, as is evident from the following data:

No. of appeals pending with CsIT (A) as on 01.04.2017 3,28,173

No. of appeals disposed of by CsIT (A) during FY 2017-18 1,23,480

No. of appeals pending with CsIT (A) as on 01.04.2018 3,21,843Demand involved in appeals with CsIT (A) as on 01.04.2018 Rs.6.38 lakh crore

Demand stayed by ITAT/Courts as on 01.04.2018 Rs.87,035 crore

Such high volume of litigation has resulted in rendering a huge amount of tax as uncollectible. Besides, it is a major impediment towards creating an environment of tax certainty for the taxpayers. It also involves infructuous costs on account of efforts to realize taxes blocked in these appeals. The substantial progress made last year is required to be continued with renewed vigour so as to bring down the quantum of litigation and unblock the revenue involved.

PART A – TARGETS FOR CIT (APPEALS)

2. The pendency of appeals with CsIT (A) and demand locked therein has been increasing over the years. Analysis of the work done last year reveals the following:

Revenue involved Pending On Disposals New filings Pending On 01.04.2017 01.04.2018 A1 more than 50 crores 1295 1033 579 841 A2 1 to 50 Cr 34488 9813 11694 36369 A3 10 L to 1 cr 76771 23723 35701 88749 B Less than 10 Lakhs 215619 86205 1743 131157 C Current Less than 10 L 0 2706 67433 64727 328173 123480 117150 321843 (a) Total appeals pending where demand is less than 10 Lakh are 1,95,884 as on 01.04.2018, which shows a decline of about 9% from the corresponding figure as on 01.04.2017. However, the pendency is still very large, and includes 1,15,706 appeals where demand is less than Rs. 2 lakhs. A special focus is required on such cases during the current year.

(b) In regard to high demand appeals, there is a decline of 35% in A1 category but an increase in pendency of A2 and A3 categories of 5 % and 16% respectively.

(c) The appeals pending as on 01.04.2018 include 22256 appeals that are more than 5 years old.

3. The results of last year‟s action plan strategy in litigation management at the level of CIT(A) are encouraging. There has been a reduction in overall litigation, particularly in cases involving very high quantum of demand, as also in cases with tax demand of less than Rs.10 lakhs which have a wide-spread impact on taxpayers. It is therefore reasonable to continue with a similar action strategy for the current fiscal, to meet the core objectives of budget collection, reduction in outstanding demand and litigation management. Accordingly, a two-pronged strategy as in last year, with slight modifications to deepen the impact, shall be adopted this year, too, having proportionate focus on optimizing disposal in terms of numbers and on maximizing disposal of appeals involving high quantum of demand.

3.1 It is seen that the appeals pending in different categories are not evenly distributed amongst PCCIT regions, as also within each PCCIT region. Hence the targets for disposal are being set at the level of PCCIT regions, and at micro level there shall be norms for disposal of appeals by individual CITs(A). In order to ensure optimum distribution of work and maximum disposals, the PCCIT/CCITs may redistribute the cases in such a manner as to attain/exceed the targeted disposals. The allocations of pending appeals may also be reviewed periodically to ensure that each CIT(A) delivers results in accordance with the norms laid down hereunder. Further, the PCCITs/CCITs shall endeavor to ensure disposal of older appeals on priority, particularly appeals that have been pending for more than 5 years.

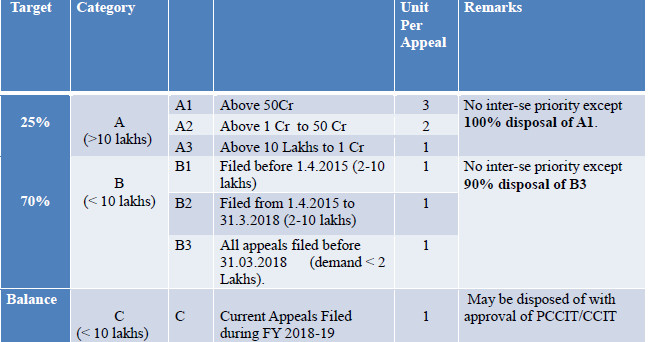

3.2 Accordingly, the targets and norms for FY 2018-19 in respect of disposal of appeals pending with CsIT (A) in each PCCIT Region are set out as under:

A. Each PCCIT Region shall ensure:

a. Disposal of at least 25% of appeals that involve demand of Rs.10 lakhs or more in categories A2, and A3 and 100% of appeals pending as on 01.04.2018 that involve demand of Rs.50 crore and above (category A1);

b. Disposal of at least 90% of appeals that involve demand of less than Rs.2 lakhs (new category B3);

c. Disposal of at least 70% of appeals that involve demand of less than Rs.10 lakhs, inclusive of the targeted disposal in B3 (less than 2 lakh demand) category.

B. Each individual CIT (A) shall be expected to dispose of a minimum of 550 appeals, or achieve a minimum of 700 units during the year. In PCCIT regions where the average number of Category B3 appeals pending with CITs(A) is more than 500, each individual CIT(A) shall be expected to achieve a minimum of 800 units during the year.

C. In Regions where the targeted disposal as at A above translates into numbers of units that fall short of the norms for individual CITs(A) stated at B above, the PCCITs concerned shall scale-up the targets stated at A above so as to ensure satisfaction of the norms. Such scaling-up shall be done, as far as possible, in respect of Category A2 appeals followed by Category A3 appeals.

D. Correspondingly, in Regions where the targeted disposal as at A above translates into numbers of units that are significantly higher than the norms for individual CITs(A) stated at

B above, the PCCITs concerned may scale-down the targets stated at A above, in consultation with the Member (A&J). Such scaling-down shall be done, to the extent possible, only in respect of Category B appeals.

3.3 The above targets, along with demarcation of units, are represented by the following Table:

TABLE 4

3.4 For the purpose of evaluation of performance of an individual officer holding additional appellate charge(s) during the year/part-year, the aggregate disposal including in the additional charge(s) held, shall be considered.

3.5 The individual norm of 550 appeals or 700 units stated above may also be varied by the PCCIT concerned in respect of CITs (A) within his jurisdiction, having regard to the number and categories of appeals pending for disposal with the CITs(A), so as to attain maximum output and optimum work allocation. However, each PCCIT Region as a whole must achieve the targets of disposal of 25% of appeals involving demand exceeding Rs.10 lakhs and above, 90% of appeals involving demand less than Rs.2 lakhs and 70% overall in Category B appeals.

3.6. The above targets should cumulatively result in a significant increase in disposal of appeals with CITs(A) and substantially reduce the pending appeals carried forward, as well as unlock the demand locked therein of about Rs.4.5 lakh crore.

ACTION ITEMS:

(1) Category A appeals involving demand above Rs. 50 Crore and pending as on 01.04.2018 shall be disposed of by 31.12.2018.

(2) The priority for disposal of appeals in different Categories shall be as under:

(i) Higher priority shall be given to appeals involving demand of less than Rs.2 lakhs and filed up to 31.03.2018 (Category B3). There shall be no inter-se priority within the Category.

(ii) The next priority shall be given to disposal of appeals involving demand of Rs.10 lakhs and above (Category A), irrespective of the year in which the appeals are filed. There shall be no inter-se priority within the Category, except that appeals involving demand of Rs.50 crore and above shall be disposed of by 31.12.2018. Different sub-categories shall earn 1, 2 or 3 units respectively as indicated in Table 4 above.

(iii) Lowest priority shall be given to appeals involving demand of less than Rs.10 lakhs and filed during the current FY 2018-19 (Category C). Such appeals can be disposed of, with approval of the CCIT concerned, if there is inadequate number of appeals of Category A or B pending with him. The CIT (A) may also dispose of any such appeal on priority, if so directed by the PCCIT/CCIT concerned.

(iv) Appeals of the same assessee relating to different years involving substantially similar issue(s) or inter related issue(s) may be disposed of irrespective of the Category to which they belong, if one of the appeals falls for priority disposal. In respect of group search & seizure cases, the CIT (A) may dispose of appeals of group cases irrespective of the category to which they belong if one of the appeals falls for priority disposal.

(v) Appeals pending for more than 5 years shall be given priority within each Category. PCCITs shall 14ndeavor to liquidate the pendency of such appeals during the year.

(vi) Cases set aside and restored to the CIT (A) by Courts/ITAT are to be disposed of on priority. These shall get points as per regular category.

(vii) Appeals involving Transfer Pricing issues shall earn 1 unit in addition to the normal number of units specified against the relevant category in Table 4.

(viii) Appeals in cases where returned losses have been reduced or converted into income in assessment will be entitled to normal units specified in Table 4, on the basis of notional tax on the amount of disputed additions

(3) Incentive for quality orders:

(i) With a view to encourage quality work by CITs(A), additional credit of 2 units shall be allowed for each quality appellate order passed. The CIT (A) may claim such credit by reporting such orders in their monthly DO letter to the CCIT concerned. Quality cases would include cases where-

(a) enhancement has been made,

(b) order has been strengthened, in the opinion of the CCIT, or

(c) penalty u/s 271(1)I has been levied by the CIT(A).(ii) The concerned CCIT shall examine any such appellate orders referred to him by the CIT(A), decide whether any of the cases reported deserve the additional credit and convey the same through a DO letter to the CIT(A), which can be relied upon while claiming the credit at the year end.

(4) Action on part of Pr. CCIT /CcsIT:

(i) To ensure a rational distribution of workload, especially of A and B category appeals amongst CsIT (A), Pr. CCIT/CCITs shall carry out intra-city and inter-city reallocation of workload, which may be reviewed at the end of every quarter. The re-distributing and re-allocating the workload shall be done in such a way that all the CsIT(A) in the respective Region have, as far as possible, sufficient number and distribution of appeals of various categories required to meet the above mentioned targets. The exercise should be completed by 31thJuly, 2018.

(ii) After redistribution of workload, targets for each CIT (A) may be communicated to the Member (A&J), CBDT before 15thAugust, 2018 with a copy to the Zonal Member.

(iii) PCCITs/CCITs should take necessary steps to ensure that necessary resources and infrastructure, including secretarial support, are provided to CITs(A) so as to enable them to discharge their duties efficiently and meet Action Plan Targets. A suitable mechanism should also be devised to ensure that remand reports are sent to the CIT (A) in time.

(iv) CCITs should monitor the working of the CITs(A) on quarterly basis including by conducting regular Inspections as per the targets assigned.

(5) Evaluation of performance of a Region and of individual CITs(A) would be done by the Zonal Members on the basis of achievements of overall targets as well as targets in respective categories. The performance evaluation would be on the basis of disposal uploaded on the Appeal module of ITBA.

PART B: REPRESENTATION BEFORE CIT(A)

4. Proper representation before CIT(A) is essential for quick disposal of appeals as well as for improving the quality of appellate orders. Timely submission of remand reports and proper representation before CIT(A) in appropriate cases is therefore of utmost importance.

4.1. The AO shall submit all remand reports pending as on 30.06.2018 latest by 30.09.2018 and henceforth the AO shall submit remand report within 30 days from date of receipt of the remand order of the CIT(A). The Range heads shall closely monitor this work.

4.2. Further, each AO shall identify the top 20 cases of quality assessments and shall make proper representation in these cases before CIT(A), either personally or by filing written submissions. The Joint/Addl. CIT Range will identify top 20 cases of the Range and will personally monitor proper representation in these cases before the CIT(A).

it is all against the law and violates the rights of the assesee. The CIT(A) will black mail the assesee. There are lot of law points to be disposed off for which the CIT(A) are not fully educate the law. The appeal work should be transfer to the Judaical courts.The CBDT should not give such directions to the CIT(A). This is a quasi judicial body. The CIT(A) will not be able to do justice with the assesee.

CBDT encouraging CITs to enhance. Slow clap.