“Higher wisdom has to prevail over better wisdom” is the mantra judges mumble when they are forced to follow a precedent that they don’t quite agree with. However, judges do find ways of getting out of having to follow a judgement of a higher court. The latest salvo on this front is the Third Member judgement in Kanel Oil which shows that a High Court judgement, though superior in status to the Tribunal, may have to yield to the latter. In this case, the Bench was faced with a piquant situation. It had to decide whether an assessee liable to pay Minimum Alternate Tax (“MAT”) under section 115JA of the Act was also liable to pay advance tax under sections 234B and 234C for default in paying advance tax. The issue as such was covered against the assessee by the decision of the Special Bench in Ashima Syntex 117 ITD 1 but the assessee must have been very smug during the hearing because there was a subsequent judgement of the Bombay High Court in Snowcem India 313 ITR 170 which held, following the judgement of the Supreme Court in Kwality Biscuits 284 ITR 434, that assessees paying tax on book profits u/s 115JA were not liable to pay advance tax. The Judicial Member did oblige and decided in favour of the assessee by following the judgement of the Bombay High Court. However, the Accountant Member wrote a detailed dissenting judgement and followed the judgement of the Special Bench. This is how the matter landed up before the Third Member.

Read more ›

A MATter of interest!

Depreciation Dreams Dashed

The twin losses in quick succession on the depreciation front have put depreciation – aficionados in a sense of gloom. First, in Techno Shares & Stocks, they were told in no uncertain terms that their esoteric arguments on the intangible assets front was far fetched. Second, in Plastiblends, they were told that their gambit to extract maximum deduction u/s 80-IA while postponing the claim for depreciation for later years when the s. 80-IA relief would run out was not going to work.

To be fair to the aficionados, on the first part, the Legislature did lead them up the garden path by promising depreciation on virtually everything under the sun. The draftsman, probably having a moment of “goodwill” towards the taxpayers, drafted the term “intangible assets” to include not only all the known intangible assets like “knowhow, patents, copyrights, trademarks, licences and franchises” but also “any other business or commercial rights of similar nature”. Enthused by the seemingly unlimited scope of the definition, the aficionados set off a flurry of claims – on goodwill, non-compete fees, stock exchange card – there was no stopping them – if it looked intangible, it was depreciable!

The aficionados also displayed a remarkable sense of alacrity. When their argument that a stock exchange card is not a capital asset for purposes of wealth-tax and capital gains was successively thrown out by the Special Bench in Jagan Nath Sanyal 72 ITD 1 (Del) (SB) and R. M. Valliappan 103 ITD 63 (Che) (SB), they quickly recovered their wits and used the same arguments that had been used to decide against them to urge that they were entitled to depreciation. After all, if a stock exchange card is an “asset” liable to wealth-tax and is also a “capital asset” liable for capital gains, then surely it is also an “intangible asset” for purposes of depreciation, they argued.

Death of a Circular

Circular No. 23 dated 23rd July 1969 held the fort valiantly for 40 years but in the end met an unceremonious death.

The Circular, issued in an era where fair play was still respected, was a masterful analysis of section 9 which provided a tax liability on non-residents from income accruing or arising through or from business connection in India.

The Circular was essentially a series of illustrative instances and guidelines designed to guide befuddled taxpayers from the labyrinth of tax laws. Written in a simple and easy-to-understand style, it told you in clear terms whether your transaction was taxable or not and the reasons for the same.

The Circular had its share of admirers. Picked up for scrutiny … minutely examined … dissected … on a number of occasions …. by the finest legal brains … it still held up and came up on top! There is a long list of judgements which endorsed the correctness of the interpretation of section 9 made in the Circular … Morgan Stanley 292 ITR 416 (SC), SET Satellite (Singapore) 11 DTR 313 (Bom) / 173 TM 475, Gulf Oil (Great Britain) Ltd. 108 ITR 874 (Bom.) and Amadeus Global 113 TTJ 767 (Del.) … the list goes on.

Temporary reprieve from Daga Capital

The decision of the President of the ITAT to stay hearing of appeals involving Daga Capital 119 TTJ 289 (Mum) (SB) has provided temporary reprieve to beleaguered assesses reeling under the twin losses of Daga Capital and Cheminvest. In Daga Capital, it was held that Rule 8D though inserted vide notification No. 45/2008 dated 24th March 2008 would apply to pending matters as well. Though the Special Bench was not concerned with the mechanics of Rule 8D, its ruling cast a gloom because Rule 8D, if literally applied, can result in the quantum of disallowance exceeding the quantum of exempt income! Of course, the correct interpretation, according to some experts, is that Rule 8D is meant as a measure of last resort only; i.e., when it is not possible to work out the disallowance correctly having regard to the accounts.

Daga Capital came close to being referred to a 5 Member Bench for reconsideration. In GE Capital, the Bench fairly acknowledged that at the time of hearing, its initial impression was to write a reference to the President for constituting a larger Bench though it stopped itself because an appeal had already been filed in the Bombay and Delhi High Courts against Daga Capital and as per the decision of the President in Star India a reference to a larger Bench cannot be made when the High Court is seized of the issue. It, however, was considerate enough to direct that the appeals be blocked for 6 months or till the disposal of appeal by the Bombay High Court in Daga Capital whichever was earlier.

Cheminvest added to the pall of gloom by holding that the disallowance under section 14A has to be made even if assessee has no tax-free income in the year.

A Code Full Of Problems!

The author is chillingly polite when he says that even the draftsmen of the Direct Taxes Code have not realized the far reaching consequences that their proposals will have. He identifies ten conceptual problems with the Code and warns that unless these are addressed, the Direct Taxes Code will become a draconian piece of legislation. He also implores tax professionals to rise to the occasion and come forward with objective suggestions which will help simplify and rationalize tax laws and procedures

Direct Taxes Code – 2009, may not achieve the desired object of simplification of the Direct Taxes. Tax Professionals must come forward with objective suggestions which will help to simplify and rationalise the tax laws and procedures.

In the 62nd year of independence, the Government has proposed the Direct Taxes Code. Tax professionals, have already started debating on the proposed Direct Taxes Code. We are of the considered opinion that if Government considers the various suggestions put forward by the professionals and professional organisations and thereafter the amended bill is introduced, it will bring stability in the tax laws. Hence the professionals concerned must send objective suggestions without any fear or favour. There are provisions of far reaching consequences in the proposed Code and the objectives may not be realised by the team which has drafted the Direct Taxes Code. It is therefore, desirable to refer the matter to the Select Committee of the Parliament before the Bill becomes an Act.

Psst …. Phir se settlement karne ka hai …??

The author slams the Government for trying to scuttle a settlement mechanism, designed to reform astray-taxpayers. He lauds the Bombay High Court for reading down the ill-conceived amendments and exhorts the Government to accept the same in the right spirit. The author also uses his rich experience to set out a road map for speedy disposal of settlement applications.

Income Tax Settlement Commission (ITSC) was formed on recommendation of Wanchoo Committee in the year 1976 for settlement of income tax cases. Having created an institution for reform of tax payer who has gone astray, constant effort of the executive was to scuttle its working. May be the idea, to settle rather than to dispute, was before its time in the year 1976; by Finance (No. 2) Act, 2009, provisions have been exacted for constitution of Dispute Resolution Panel.

By Finance Act 2007, a final death blow was dealt to the institution of ITSC by providing that in respect of applications filed before 1-6-2007, if an order of final settlement under section 245D(4) is not passed before 31-3-2008, than the proceedings before the ITSC shall abate and departmental officer shall dispose off the case.

No funds for the temple of justice …

The author is aghast that while the Finance Minister has been generous in providing funds to the other sections of society, he has totally overlooked the judiciary. He implores the Government not to ignore the judiciary and warns that unless financial independence is given to the judiciary, judicial reforms are not possible.

While preparing the budget for our country the Hon’ble Finance Minister made a sincere attempt to satisfy all sections of society, for which he deserves to be congratulated. However, two important areas, which escaped the attention of Hon’ble Finance Minister is allocation of fund to judicial reforms and accountability on implementation of budget allocation.

1. Judicial Reforms

Judiciary is guardian of our democracy. The common man has faith in the temple of justice. Only one criticism against the judiciary is that there is delay in disposing of the matters. Delay in disposal of matters are not on account of judges fault, it is only due to shortage of judges and lack of infrastructure. When world is becoming one global village, the judiciary also requires to keep pace with modern technology. The judiciary is neither having any political lobby to take up the cause of judiciary with the government when the allocation of fund is required to be made for modernisation and innovation nor they can make representation to Government. Therefore, it is very essential for the Government to allocate in each years budget a specific amount for the research in law and modernisation of judiciary.

Dear Finance Minister, this Budget, I want ….

The author puts on his thinking cap and conjures up a 10-point wish-list of conceptual changes that need to brought about in the tax policy to ensure effective compliance. He also uses his vast experience in the field of tax laws to identify specific loop holes and suggests measures to plug the same.

Every year the Hon’ble Finance Minister interacts with representatives of industries. Representative of each industry appeals to the Hon’ble Finance Minister to give concession in rate of tax and incentive to their industry. However, we are not aware of any representation from any industry to raise the tax base, simplify the tax law and humanise the tax administration. My experience shows that it is the tax professionals, who make the representation objectively without any favour or fear. Earlier the Member Legislation of Central Board of Direct Taxes used to visit Mumbai before the Finance Bill and after introduction of Finance Bill and discuss with the professional organisations to ascertain their views on various issues and provisions. We hope this tradition of interacting with voluntary organisations will be resumed to common good. One of the duties of the tax professionals is to make representation for better tax law and responsive administration. The suggestions herein, therefore, are made in three parts and deal with the issues that engage us viz.

(A) Conceptual (B) Specific and (C) Increase of Tax Base.

Lamb (Tax payer) vs. Wolf (corrupt official)!

The author does some soul-searching to discover the reasons why fellow-Indians do not pay their taxes honestly even though they know it is their constitutional duty to do so. He argues that the poor policies of the tax administration, which puts defense-less taxpayers at the mercy of corrupt officials, are responsible for this sorry state of affairs and suggests a few solutions to set things right.

1. Article 51A of the Constitution of India refers to various fundamental duties of every citizen of our country. One of the duties referred in the said Article is “to strive towards excellence in all spheres of individual and collective activity, so that the nation constantly rises to higher levels of endeavour and achievement”. The fundamental duties are not enforceable by mandamus or any other legal remedy but it has to be cultivated by the citizens and requires to be taught to the children from the beginning. Paying tax rightfully due to the State is also the duty of the citizens. However, people are reluctant to pay the taxes. Four main reasons why people of our country are not paying the taxes are:-

(a) When an assessee files the return he will be subject to harassment by the tax administration, if the matter is selected for scrutiny. Returned income may be only Rs. 2 lakhs, assessed income may be of Rs. 50 lakhs. Assessee may succeed in appeal, however, no question will be asked to the assessing officer why such huge additions were made.

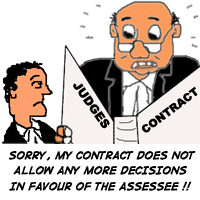

Judges on Contract!

The author is severely critical of the proposal of the Government to appoint Members of the Tribunal on contract basis for 5 years subject to renewal at the discretion of the Government. He warns that making the Members insecure about their position in the Tribunal will undermine the independence and judicial functioning of the Tribunal. He implores all stake holders to strongly oppose the Government’s move.

1. The Income Tax Appellate Tribunal is in existence since 1941. Over the years it has served as role model for other similar institutions. The members are selected by a high powered selection committee chaired by Senior Judge of Supreme Court. There is complete transparency in the process of appointment. It is because of this high tradition that we have witnessed many talented professionals joining the institution and many have been elevated to the High Courts. The present system of appointment of members of ITAT till the superannuation is working very satisfactorily and there is absolutely no need to amend the service rules for appointment of members of ITAT. Earlier there was a move to appoint retired members of ITAT on ad-hoc, contract basis for two years. All the Tax Bar Associations have strongly opposed the move, which was then dropped.

2. It has been given to understand that, there is a move to amend the service rule for appointment of Members and Government is proposing to appoint Members of the Income Tax Appellate Tribunal on contract basis for five years and thereafter, their tenure will be renewed every five years at the discretion of Government.