The CBDT is not content with enhancing the monetary limits for maintainability of appeals of the department. All Principal CsIT have been directed to ‘personally ensure’ that all appeals falling below the specified limits are withdrawn by 20th August 2018. The PCsIT have been directed to send a report giving details of their compliance.

GOVERNMENT OF INDIA

MINISTRY OF FINANCE / DEPARTMENT OF REVENUE

CENTRAL BOARD OF DIRECT TAXES

NORTH BLOCK, NEW DELHI-110001 Tele : 011-23093621 Fax : 011-23093340SHABRI BHATTASALI Special Secretary & Member

F.No.279/Misc.M-73/2018-ITJ New Delhi 16th July, 2018

Subject: Withdrawal of appeals in consequent to Circular No.3/2018 dated 11.07.2018 issued by the Board — reg.

Dear Principal Chief Commissioner of Income Tax,

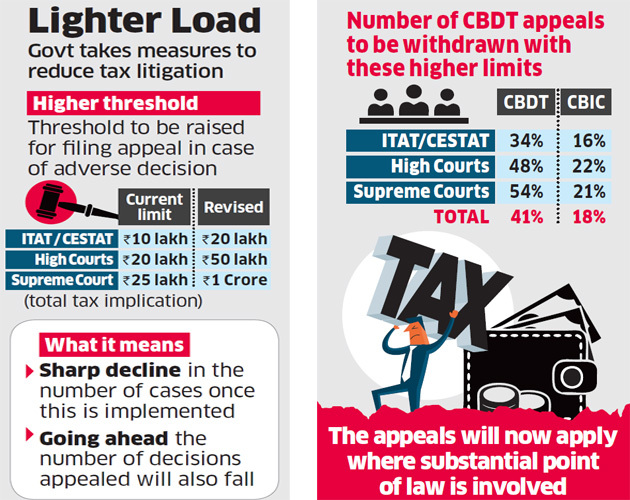

As you are aware, Board has issued Circular No. 3/2018 dated 11.07.2018 enhancing the monetary limits for filing SLPs/appeals before Supreme Court, High Courts and ITAT.

Consequently, SLPs/appeals pending before these fora which are covered by the said Circular are required to be withdrawn/not pressed on priority so that the Department can focus on high value litigations.

2 I, therefore, request you to personally ensure that the exercise of withdrawing/not pressing such appeals is concluded latest by 20.08.2018. A report stating that all such appeals have been withdrawn/not pressed may be sent to the Board in the following format:

Sr. No. Forum No. of appeals pending below the Monetary limit specified in the Circular Tax effect involved in the said appeals

(in crores)No. of

appeals withdrawnTax effect involved in the said appeals

(in crores)1 ITAT 2 HC Total With

Shabri Bhattasali)

To

All the Pr. Chief Commissioners of Income Tax

(Image Credit: ET)

In order to reduce the long pending grievances of taxpayers & to minimise litigations pertaining to tax matters & to facilitate the Ease of Doing Business, the Govt of India has decided to increase the threshold monetary limits for filing Departmental Appeals at various levels.

— Ministry of Finance (@FinMinIndia) July 11, 2018

Excellent move by the CBDT & CBIC…Good to trust those who pay taxes. pic.twitter.com/vg47DRDoWz

— Arun Jaitley (@arunjaitley) July 11, 2018

Government's decision of withdrawing cases and increasing the threshold limit for filing appeals in various courts will improve Ease of Doing Business and Ease of Living. The move will also help in reducing tax litigation. pic.twitter.com/QcTWOLLmMQ

— Piyush Goyal (@PiyushGoyal) July 12, 2018

OFFHAND

This is seen to make it clear beyond any shadow of doubt- contrary to feeling of some – see http://itatonline.org/info/cbdt-cracks-whip-specifies-time-limit-for-withdrawal-of-low-tax-effect-appeals-pcsit-directed-to-personally-ensure-compliance-send-report/

Still any ‘doubting Thomas’ – around?!

Sir, this is an appreciable effort by CBDT to ensure compliance with its circular. It may also be considered by CBDT to call details of such cases online from the taxpayers concerned . This will expedite the process of weeding out low tax effect appeals.